The difference between profit models and individual stock gambling.

Using pure technical analysis or pure fundamental analysis to trade individual stocks is gambling. There is no statistical data or excellent game logic support, so it's hard to say how to evaluate it after operation. Winning and losing are all luck; whatever you do next is gambling. The correct direction of investment transactions is not gambling; it is probability; you already know what the results will be before you do it. This is the difference between profit models and individual stock gambling.

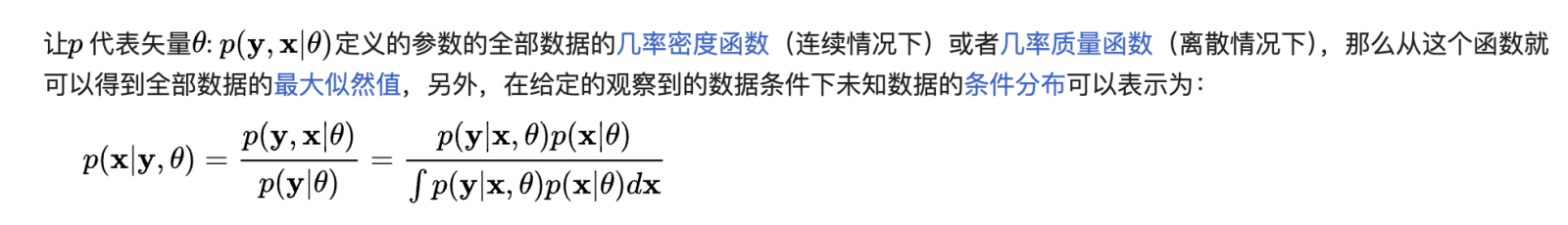

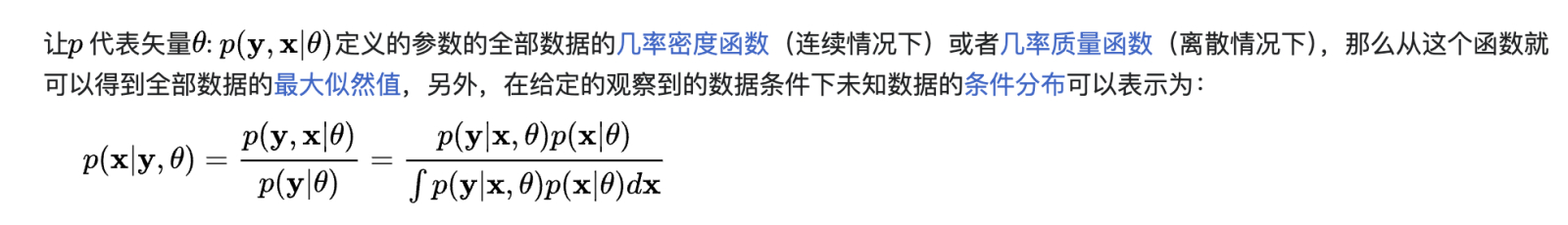

Why will Tesla's stock price continue to rise and fall, continue to move back and forth in the form of a long-term trend and rapid recovery, and fluctuate in the range? The most fundamental reason is:

1. The fundamentals of the economic situation are poor, and Tesla shares are growing short and short. Although some Wall Street agencies acknowledge the extraordinary potential of driverless FSDs, they are still afraid to take big positions in Tesla shares. Since Tesla's price-earnings ratio in FY2024 has reached 90 times, earnings expectations for the 2024 and 2025 fiscal years have continued to decline.

2. Considering that driverless FSD will soon become a reality within the next 6-12 months, many Wolf-level hedge funds on Wall Street that prefer long and short two-way speculative arbitrage and don't dare to rashly undersell Tesla.

Ready to wait for changes in fundamentals.

The rise and the loss are bound to be unsuccessful in the US stock market.

The human stock market is very vicissitudes! The proper path for US stocks is to give money out of the blue rather than the icing on the cake.

1.60% of Tesla's stock positions will lock in Tesla's long-term trends and main trend goals and directions for value investment and long-term holdings.

2.40% of Tesla positions are used to invest and trade against Tesla's secondary trends, short-term trends, and short-term trends.

3. Set up Tesla's Special Funds for Deep-Fall Re-Buy (Special Fund with Deep Drop and Repurchase): When Tesla's stock price enters the 211.700-182.000 range, there are plans and steps, divided into gradients, batches, discrete random variables, and position opening layout. Above 211.700, no new long positions will be considered.

4. Keep in mind that the stock price enters the 211.700-182.000 range before firing again. Taking the initiative to buy packages also requires looking at the current situation, situation, and environment. There must be room for capital in investment transactions, and there is room for fault tolerance. There is no need to fully attack and defend, let alone operate at full capacity, and lose the ability to strike back twice, three, four times.

5. There is a type of “scoundrel” like this: they are very demanding of others; they must clearly explain their bullish and bearish opinions, and can predict all the points and requirements; otherwise, they won't be able to see it at all. As for themselves, they are like this: if stocks don't rise, they won't buy them? Do you like to go after the best and buy the best at a high price? Is it uncomfortable if stocks and funds aren't locked in? Feeling uncomfortable when you don't have to run out of investment and trading capital? If you are not satisfied with warehouse operation, is it uncomfortable? Then when do you expect the package to be lifted?

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment