The latest updates on some of Singapore's stock movers

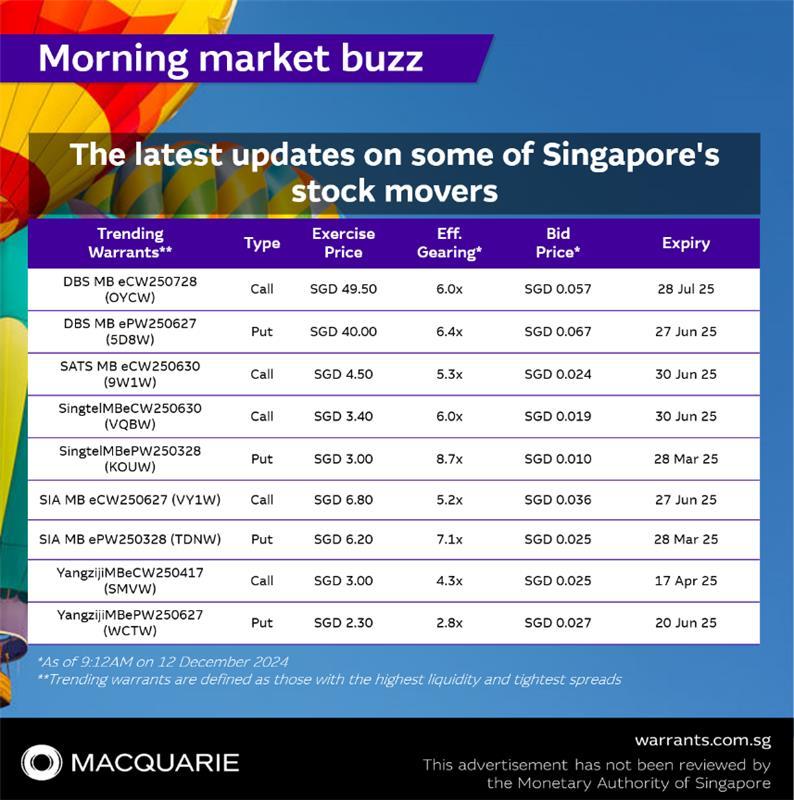

Macquarie has new call warrants tracking DBS, SATS, SingTel, SIA and a put warrant over Yangzijiang newly listed this morning. We have summarised the latest stories surrounding these stocks:

– DBS: After breaking into new record high territory this month, the stock continues to hover near last week's high of $44.26. With the stock up 2.9% month to date to yesterday's close at SGD 43.68, Macquarie's trending DBS call warrant $DBS MB eCW250627 (VODW.SG)$ (https://warrants.com.sg/tools/warrantterms/VODW) is up 7 times more, +20.8% to SGD 0.093. Trending DBS put warrant $DBS MB ePW250627 (5D8W.SG)$ (https://warrants.com.sg/tools/warrantterms/5D8W) on the other hand is down 20.7% to SGD 0.065. Bloomberg reported on 10 December that the bank, alongside other Asian banks such as Mitsubishi UFJ and Sumitomo Mitsui are among potential suitors for the Jakarta-listed PT Bank Pan Indonesia

– SATS: The stock currently ranks third on the year-to-date best performing index stock on the STI (behind Yangzijiang and DBS), helped by better than expected earnings, but appears to be hitting a road block around the $4 level. The share price has pulled back 7.5% over the past month from the $4 level to yesterday's close at $3.71. Two weeks ago, SATS announced that Avilog will acquire a 49% stake in SATS Saudi Arabia, resulting in a partnership to accelerate growth in Saudi Arabia’s aviation and logistics sector

– SingTel: Market watchers believe that there could be potential consolidation within the telecoms sector in 2025, where Singapore's 4-player market may consolidate into three, due to the deferral of payment by M1 and Starhub for its 700-megahertz (MHz) spectrum to somewhere between November 2024 and end-June 2025. If so, this could lead to potential share price volatility for the telcos.

– SIA: Since tumbling 15.6% in August after reporting a 50% fall in net profit in its first half April to September period, the stock has recouped half of those losses over the past four months. Could its share price fate increase as we head into 2025 where the demand outlook for air travel is expected to remain robust? The International Air Transport Association (IATA) said yesterday that they expect net profit in 2025 to come in around USD36.6bil, higher than the USD31.5bil net profit in 2024.

– Yangzijiang: The stock finished at a new record high of $2.75 yesterday, and is up 14% month to date to further cement its place as the top performing index stock (with gains of 85% year to date). The stock is riding on a wave of positive momentum following last Monday's announcement of another USD 2.63 billion contract win

– Investors keen to trade the moves in any of the above stocks may wish to consider using this morning's newly listed warrants to do so, for their ability to magnify the stock's move whilst costing a fraction of the underlying share price

– See how the new warrants move alongside their underlyings on the Live Matrix!

DBS call $DBS MB eCW250728 (OYCW.SG)$: https://warrants.com.sg/tools/livematrix/OYCW

SATS call $SATS MB eCW250630 (9W1W.SG)$: https://warrants.com.sg/tools/livematrix/9W1W

SIA call $SIA MB eCW250627 (VY1W.SG)$ : https://warrants.com.sg/tools/livematrix/VY1W

SingTel call $SingtelMBeCW250630 (VQBW.SG)$ : https://warrants.com.sg/tools/livematrix/VQBW

Yangzijiang put $YangzijiMBePW250627 (WCTW.SG)$ : https://warrants.com.sg/tools/livematrix/WCTW

DBS call $DBS MB eCW250728 (OYCW.SG)$: https://warrants.com.sg/tools/livematrix/OYCW

SATS call $SATS MB eCW250630 (9W1W.SG)$: https://warrants.com.sg/tools/livematrix/9W1W

SIA call $SIA MB eCW250627 (VY1W.SG)$ : https://warrants.com.sg/tools/livematrix/VY1W

SingTel call $SingtelMBeCW250630 (VQBW.SG)$ : https://warrants.com.sg/tools/livematrix/VQBW

Yangzijiang put $YangzijiMBePW250627 (WCTW.SG)$ : https://warrants.com.sg/tools/livematrix/WCTW

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment