The so-called advantage and success is the ability to constantly bypass pitfalls. The advantage is never the ability to run into traps, but the ability to bypass them. The most important advantage is that it's not that you intentionally bypass the trap, but that some of your abilities have nothing to do with this trap.

Looking at the major cycles in the history of the US index, US stocks are long and short. In particular, blue-chip stocks with excellent US technology performance.

What the so-called “God of the Sky” is best at: making false statements and making alarmist remarks. The wave theory is an act of pretending to be fooled in the face of applied mathematics.

The sharp and mean idiots are the best at it: icing on the cake and falling off the ground.

Tesla Bear said: Elon Musk's electric car company “could go bankrupt” as shares could plummet 91% amid disappointing first-quarter results. A well-known bear market at Tesla is a dire warning about the company's future. Hedge fund manager Per Lekander (Per Lekander), who has been shorting Tesla since 2020, predicted that the electric vehicle (EV) maker could “go bankrupt” and that its stock could plummet to $14.

Rykander, managing partner at the investment management company Clean Energy Transition, described the first quarter results as “the beginning of the end of the Tesla bubble.” “I actually think the company might go bankrupt,” he said. He said the company's business model, which relies on strong revenue growth, vertical integration, and direct-to-consumer sales, could falter if sales decline. He asserted that his assessment was based on a forecast of the company's earnings of $1.40 per share for the full year.

Rykander believes Tesla should be viewed as a “no growth” stock valued at 10 times forward earnings, while its current valuation is about 58 times forward earnings. Forward earnings are a key metric used by traders to evaluate the value of a stock. He also pointed out that Tesla's problems in the first quarter were not just caused by the company's alleged supply chain disruptions, but “demand issues.”

Lekander is skeptical about the company's future, especially since its two main models, the Model 3 and Model Y, won't be updated until 2025.

“Given that these models are out of date and the economy isn't growing rapidly, I don't see any reason to see any recovery in the next two years,” Lekander said. Why it matters: Rykander's comments come at a time when Tesla faced a series of challenges. The company's delivery numbers for the first quarter were disappointing. This prompted analysts to adjust their predictions, and some even questioned Tesla's valuation.

Earning money means continuous self-cultivation; making money means continuous learning; making money means continuous growth; making money means continuous enlightenment; making money means continuous progress. The more money you make, the more you read, the more thorough you read. If you make money with physical strength, be honest; if you make money with mental strength, be smart; if you use money to make money, be moderate; if you use resources to make money, you can be smooth; if you use people to make money, you can be open-minded.

Sometimes being denied good intentions hurts as much as receiving bad intentions. The building materials required for the most bizarre ideals are mediocre and tedious endeavors. Now, I'm 20 years old, and my youth is reflected in my face: in the future, I will still be 20 years old, and youth will live in my heart. Don't try to understand everything; sometimes we don't need to understand; we just accept it. The most capable people aren't the ones who get good cards, but the ones who know when to leave the table.

We need to be a doer in a speculative family, and a speculator in a practical family. Always be alert to yourself - the root cause of all mistakes in market trading is nothing more than the word “greed” and the word “anxious.”

If you keep your money and firepower, you're not afraid to go wild and arbitrage without the right opportunity.

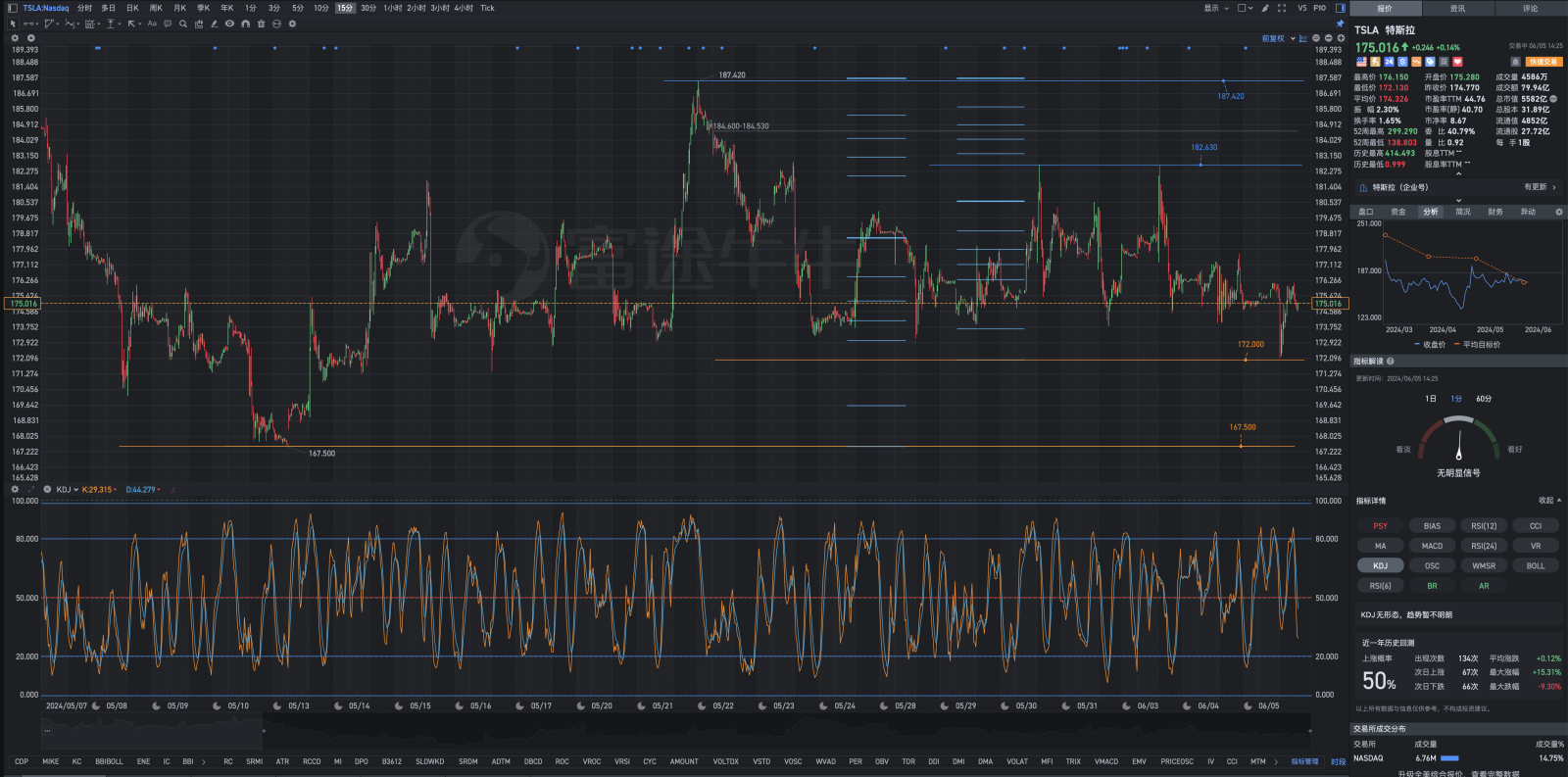

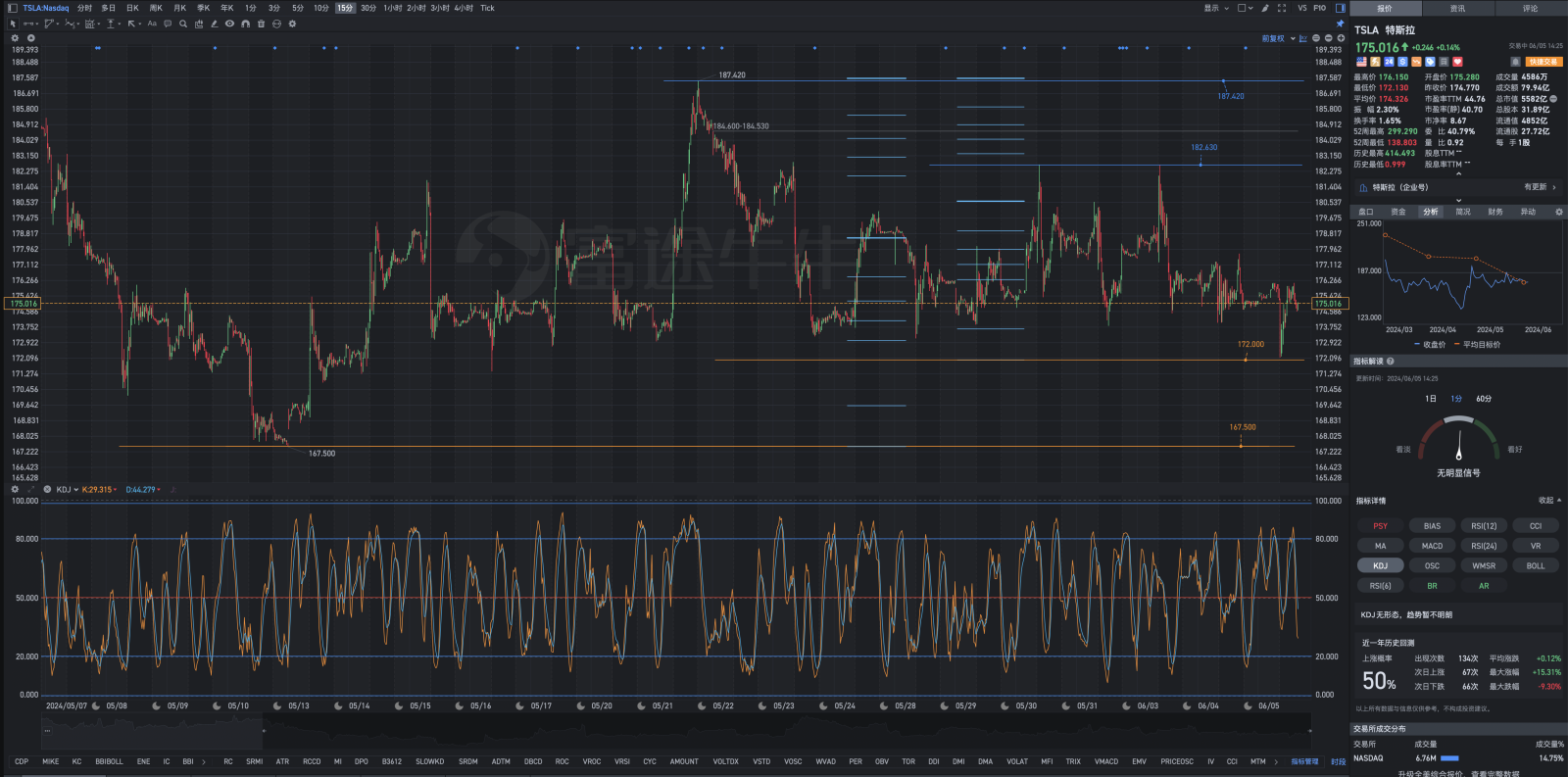

Now that the stock price hasn't even entered the Air Defense Identification Zone, why start arbitrage?

When you can live peacefully with uncertainty, endless possibilities unfold in your life. In fact, getting rich is a bastard's choice, but today's society isn't as good as being a bastard if they aren't rich. You can't get rich by doing what you love; you can only be rich by doing what others don't want to do. The extra effort will definitely be exchanged for unexpected gains, and will gradually turn into a belief that one must win, a spirit of perseverance. These will become inexhaustible and inexhaustible intangible assets in the investment process. If you want to get results that are different from normal people, you must invest in the efforts of ordinary people. Ordinary people will never understand this, because normal people are naturally not capable of losing money. Ordinary people think this way and talk and act according to this way of thinking. At the same time, there is bound to be no profit. Low-level desires can be obtained through indulgence; superior desires can only be obtained through self-discipline; top-level desires can only be obtained through suffering. Some people can't teach you how to do it. Other than intelligence, courage, and the basics of mathematics, physics, and chemistry, the most important thing is that they don't trust you. But that's right, we've never met, why should you trust me. If you don't know how to “send charcoal in the snow” and are only good at “icing on the cake,” you're bound not to eat good fruit for a period of time. Stocks are also spiritual.

On a deeper level, have you carefully tasted and interpreted the meaning of K-line graphics? Have you tried to find the curve formula and function nature of the technical indicators you use. Have you solved the domain of this function and the value range of the value range? Otherwise, how can you implement accurate transactions? It is not enough to find the accuracy of so-called support levels and pressure levels based on experience and brokers' own analysis systems.

Professional traders need to incorporate thinking into their blood: “Compared to investment technology, investment thinking is more important. Investment thinking is a strategic direction, and skilled use of investment technology is to achieve investment thinking. The investment mentality of professional investors is: 1. General principle thinking; 2. Position control thinking; 3. Main contradictory thinking; 4. Investment purpose thinking; 5. Profit model thinking; 6. Thinking at a critical moment.”

The greatest brilliance in life is not that it never falls, but that it always rises again after falling.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment