Tesla Expeditionary Force follows the command of the Supreme Command Headquarters and crosses the English Channel to land in Normandy.

Mutual Fund successfully implements strategic deception, through dispersed funds entrusted to various brokers, has long controlled the market. Despite the net outflow of funds, the stock price has risen sharply, which is a recent phenomenon in Tesla's stock market.

Both daily and hourly technical indicators are overbought, but this can be used as a cover for main traders to catch the market off guard, go with the trend, go against the technical indicators, go against human nature, and fill the gap of the previous gap-down opening, laying a solid foundation for building a skyscraper.

整日沉迷于看跌卖空能快速套利而乐此不疲的“全日空”之流,要改弦更张,变换城头大王旗,否则后果自负,咎由自取。

Please Free

JC family trading iron rules (it is not excessive to emphasize repetition):

Win in a bear market; win in volatility; win with courage; win with wisdom; win with openness; win with learning; win with change; win with adaptability; win with mathematics; win with physics; win with models; win with functions; win with vibrations; win with quantification; win with frameworks; win with moderation; win with probabilities; win with technology; win with psychology; win with agility; win with flexibility; win with oscillations; win with long-term; win with investment: win with mindset; win with tolerance.

Lose in closed-mindedness; lose in self; lose in ossification; lose in self-abandonment; lose in self-deception; lose in chasing highs; lose in chasing strength; lose in chasing highs; lose in stagnant growth; lose in one-sidedness; lose in gambling; lose in protecting positions; lose in full positions; lose in financing; lose in elimination; lose in perpetual motion; lose in gambling; lose in complaining; lose in making excuses; lose in cursing; lose in daydreaming; lose in planning; lose in forecasting; lose in short-term; lose in impatience; lose in greed; lose in mindset.

98% of people will never be able to overcome their biases towards bullishness, aversion to bearishness, and predictions, and without various contingency plans backed by a certain proportion of protective capital, so 98% of people can only end up in failure. Trading is for a living, not for being enslaved by stocks, not for engaging in battles of viewpoints (JC does not participate in battles of viewpoints, no interest), but for winning in investment and trading.

Warning bell: The first and last chapters of the book of wisdom both say, "There's no such thing as a free lunch." Don't expect to make money without working hard. Here, at this moment, all of JC's posts are personal expressions of thoughts before, during, and after trading, exploring and researching. There is no engagement in battles of viewpoints, stock recommendations, or inspirational sentences. They cannot be used as the basis for trading, and any trading gains or losses must be borne by oneself.

We didn't know each other to begin with, let alone in the financial world where, even if you are capable, it's easy to be seen as a swindler. Therefore, JC will never use research results as a vehicle for giving away money for free, because there is no need for it. Where are the so-called true friends in the financial market? Each follows their own path, each does their own thing, disinterested and firm. JC is not concerned about your meal, or anything else; JC is not influenced by your attitude. JC is not afraid of anyone except Jesus Christ (who is actually God, the Holy Trinity of the Father, Son, and Holy Spirit).

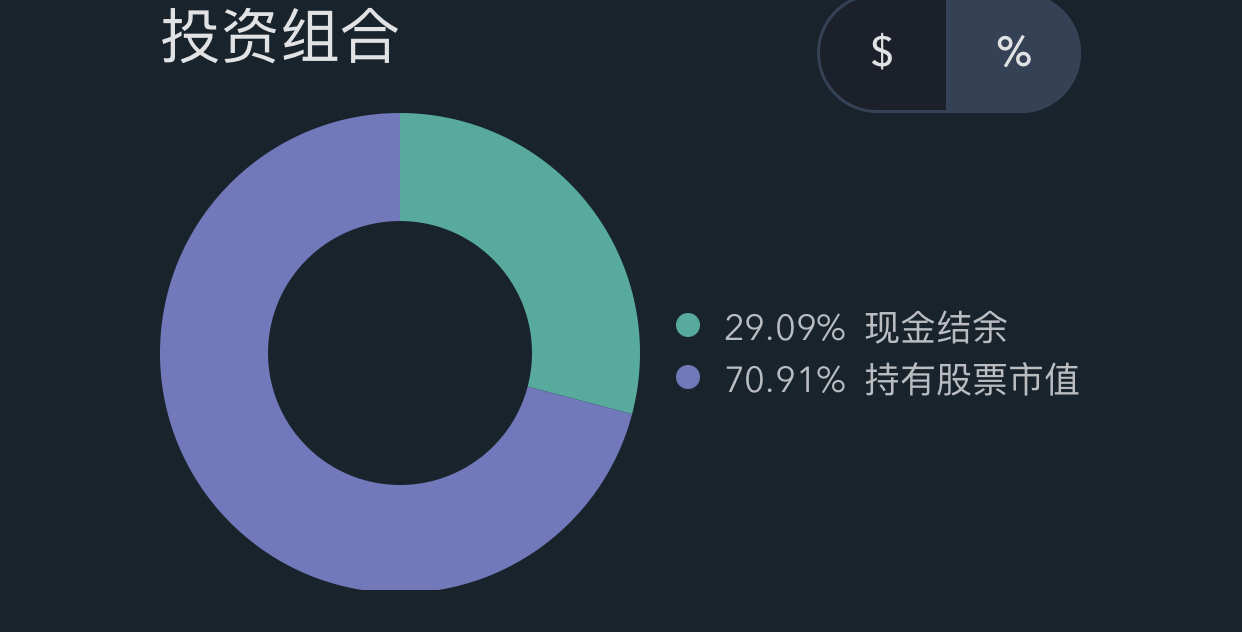

Disclaimer: There are many crazy people in the stock market, so it is better to make it clear. This article is a personal trading diary, not an opinion or stock recommendation. This is the well-regulated US securities market, not the **** A-share securities market. The blogger has a long-term operating style. However, in special circumstances, such as when the market is particularly good and the proportion of profit chips exceeds 80-90% for a long time, the blogger will choose to sell and close the position to realize the floating profit. When the market and individual stocks are not good, especially when they are extremely bad, such as when the proportion of profit chips is less than 21-7%, JC will choose to gradually and batch-by-batch build a discrete random variable portfolio, so ordinary traders cannot imitate this operation.

Win in a bear market; win in volatility; win with courage; win with wisdom; win with openness; win with learning; win with change; win with adaptability; win with mathematics; win with physics; win with models; win with functions; win with vibrations; win with quantification; win with frameworks; win with moderation; win with probabilities; win with technology; win with psychology; win with agility; win with flexibility; win with oscillations; win with long-term; win with investment: win with mindset; win with tolerance.

Lose in closed-mindedness; lose in self; lose in ossification; lose in self-abandonment; lose in self-deception; lose in chasing highs; lose in chasing strength; lose in chasing highs; lose in stagnant growth; lose in one-sidedness; lose in gambling; lose in protecting positions; lose in full positions; lose in financing; lose in elimination; lose in perpetual motion; lose in gambling; lose in complaining; lose in making excuses; lose in cursing; lose in daydreaming; lose in planning; lose in forecasting; lose in short-term; lose in impatience; lose in greed; lose in mindset.

98% of people will never be able to overcome their biases towards bullishness, aversion to bearishness, and predictions, and without various contingency plans backed by a certain proportion of protective capital, so 98% of people can only end up in failure. Trading is for a living, not for being enslaved by stocks, not for engaging in battles of viewpoints (JC does not participate in battles of viewpoints, no interest), but for winning in investment and trading.

Warning bell: The first and last chapters of the book of wisdom both say, "There's no such thing as a free lunch." Don't expect to make money without working hard. Here, at this moment, all of JC's posts are personal expressions of thoughts before, during, and after trading, exploring and researching. There is no engagement in battles of viewpoints, stock recommendations, or inspirational sentences. They cannot be used as the basis for trading, and any trading gains or losses must be borne by oneself.

We didn't know each other to begin with, let alone in the financial world where, even if you are capable, it's easy to be seen as a swindler. Therefore, JC will never use research results as a vehicle for giving away money for free, because there is no need for it. Where are the so-called true friends in the financial market? Each follows their own path, each does their own thing, disinterested and firm. JC is not concerned about your meal, or anything else; JC is not influenced by your attitude. JC is not afraid of anyone except Jesus Christ (who is actually God, the Holy Trinity of the Father, Son, and Holy Spirit).

Disclaimer: There are many crazy people in the stock market, so it is better to make it clear. This article is a personal trading diary, not an opinion or stock recommendation. This is the well-regulated US securities market, not the **** A-share securities market. The blogger has a long-term operating style. However, in special circumstances, such as when the market is particularly good and the proportion of profit chips exceeds 80-90% for a long time, the blogger will choose to sell and close the position to realize the floating profit. When the market and individual stocks are not good, especially when they are extremely bad, such as when the proportion of profit chips is less than 21-7%, JC will choose to gradually and batch-by-batch build a discrete random variable portfolio, so ordinary traders cannot imitate this operation.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment