These AI Stocks Have Survived Recent Turmoil, Outpacing Nvidia with Steady Upswings

On Wednesday, $NVIDIA (NVDA.US)$ once again single-handedly rescued the sluggish market, overshadowing the impact of the U.S. August CPI data released on the same day. Jensen Huang's statement about the strong demand for AI chips leading to a strained relationship with customers, powerfully guided a V-shaped reversal in the U.S. stock market. The $Nasdaq Composite Index (.IXIC.US)$ halted its decline and surged over 2%, the $PHLX Semiconductor Index (.SOX.US)$ rose by 4.9%, and both the $S&P 500 Index (.SPX.US)$ and the $NASDAQ 100 Index (.NDX.US)$ indices completely erased intraday declines of at least 1.5% for the first time in nearly two years.

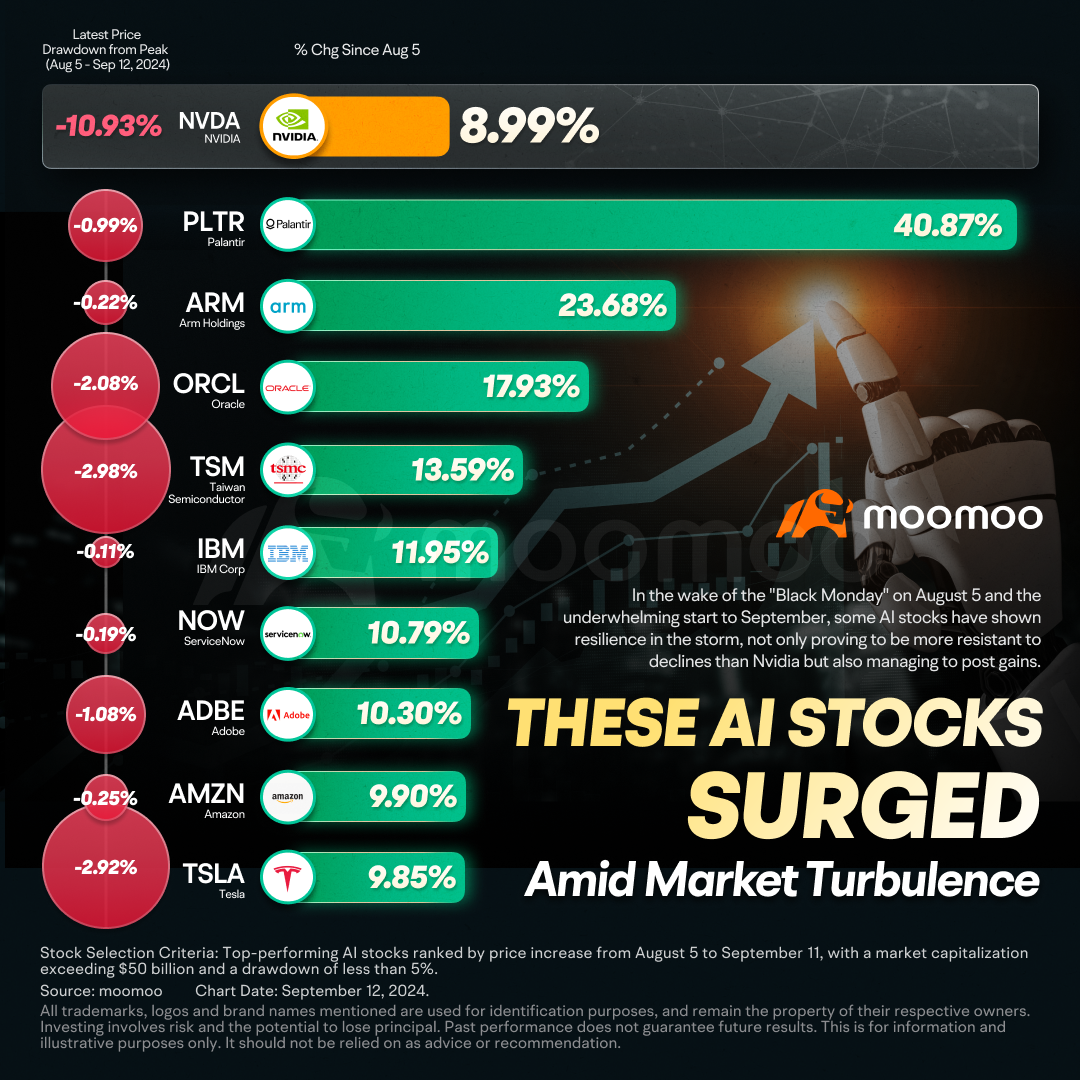

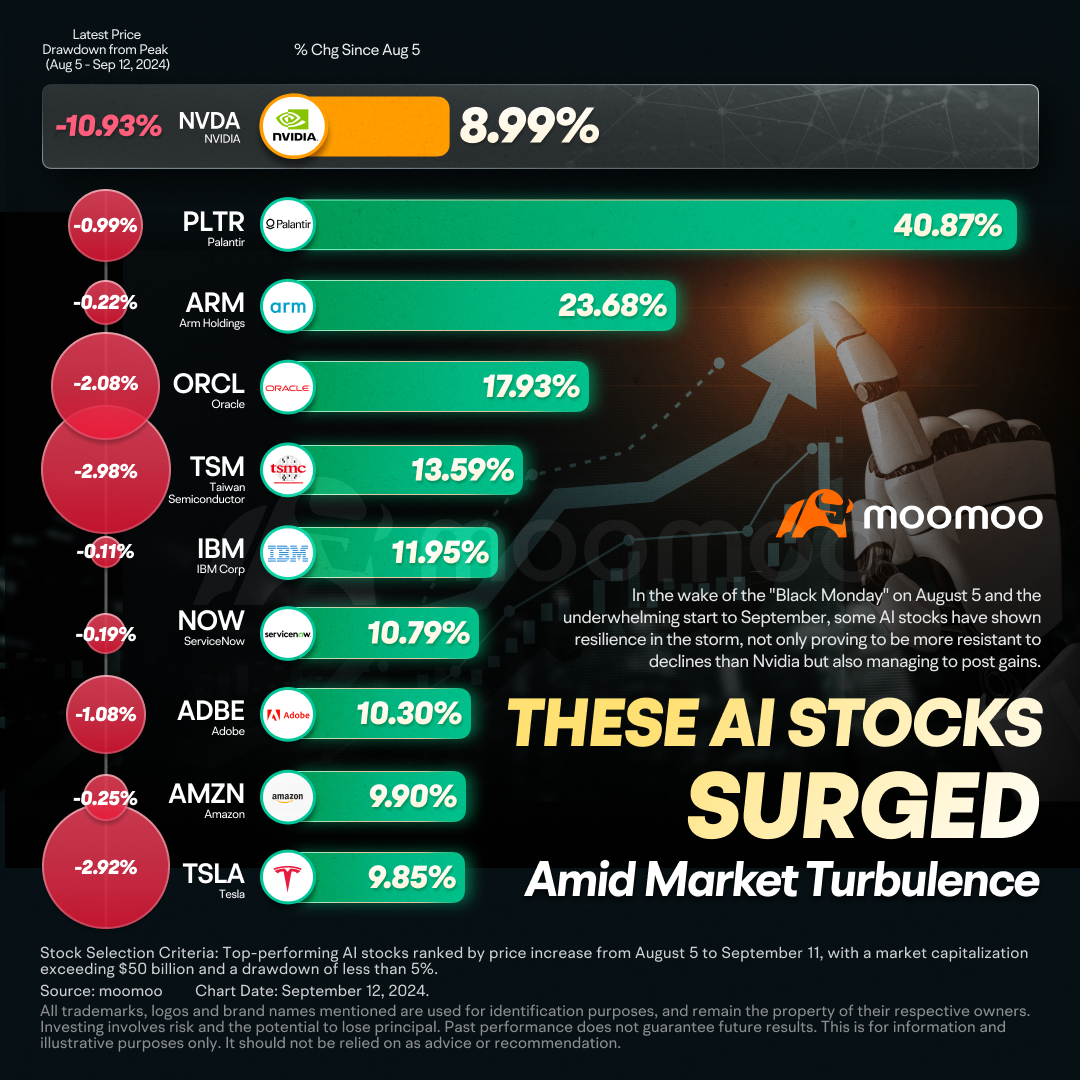

Just as the market was exuberant about the potential return of confidence in AI, some investors are delving into AI stocks that have shown strong performance in the late summer storm. These stocks not only demonstrated stability with slight retracements amidst market turbulence but also achieved strong upward momentum. $Palantir (PLTR.US)$, which was just announced to be included in the S&P 500 last week, has surged over 40% since the Black Monday on August 5th, with the current price retracting by less than 1% from the peak during this period. $Oracle (ORCL.US)$, with a year-to-date increase of over 50%, also defied the odds by rising nearly 18% after two rounds of market pullbacks, retracing about 2%, significantly lower than NVIDIA, the darling of AI, which retraced almost 11%. $IBM Corp (IBM.US)$ , the "blue giant" steadily advancing into the AI business, has quietly staged a comeback, rising 12% during the turbulent period.

Below are the AI stocks that have stood out since August 5th in terms of stock price performance and retracement magnitude.

The "AI faith" in the U.S. stock market faced multiple challenges in late summer this year. On the one hand, the lackluster performance of several large tech companies' financial reports has starkly contrasted with the massive AI capital expenditure and sluggish growth in core business, raising doubts once again about the justification of high valuations. Concerns about the uncertain monetization capability of AI, the slowdown in demand for AI, and the potential bursting of the AI bubble have intensified. These worries have quickly spread to the upstream AI industry chain, as there are fears that if customers of companies like Nvidia are unable to generate sufficient revenue from AI or are affected by the economic slowdown, their massive investments in GPUs and other AI hardware may not be sustainable. What's worse is that these AI stocks have carried too much hope in the early stage, raising the threshold for investors to be satisfied with their financial and performance results, and amplifying all flaws.

From a macroeconomic perspective, frequent geopolitical risks, intermittent fears of recession, uncertainties surrounding the U.S. elections, and the Bank of Japan's hawkish monetary policy stance have all contributed to pressure on risk assets.

Given these factors, it may take time for the market to digest the implications, suggesting that AI stocks with robust fundamentals and higher margins of safety could represent more attractive trading opportunities.

Palantir:

AI software pioneer $Palantir (PLTR.US)$ announced its inclusion in the S&P 500 last week. This acknowledgment is backed by the firm's robust profitability and the proven monetization capabilities of its artificial intelligence solutions.

Palantir has garnered increased optimism from analysts following its impressive second-quarter results. Argus analysts noted Palantir's historic service to the U.S. defense and intelligence sectors while also recognizing its expansion into the commercial arena with robust data management and analytics solutions. Wedbush also raised its price target to $38 from $35 and maintaining an Outperform rating. The firm reported "strong beats" on both revenue and earnings per share, driven by unprecedented demand for Palantir's artificial intelligence solutions across commercial and government sectors. Additionally, Wedbush pointed out a significant 50% year-over-year increase in deals exceeding $10 million, with the U.S. commercial deal count nearly doubling, underscoring the effectiveness of Palantir's bootcamp-led go-to-market strategy.

Bank of America believes that Palantir's unique capabilities and technology are often misunderstood and its inclusion in the S&P 500 will prompt institutional investors to reassess their views on the firm. Notably, BofA highlighted Palantir's unconventional sales strategy, which emphasizes the role of engineers in the sales process, as a critical differentiator that bolsters profitability compared to other software companies.

Oracle:

The latest financial report released by $Oracle (ORCL.US)$ this week has showcased its robust profit-making ability, with its recent stock performance significantly outperforming its peers in the software industry. As of the first quarter of the 2025 fiscal year ending in August, the revenue surged by 7% compared to the same period last year, surpassing expectations. The revenue from the highly anticipated Oracle Cloud Infrastructure (OCI) also exceeded Wall Street's expectations. The revenue guidance for the second quarter indicates a growth range with a median value 8.72% higher than analysts' forecasts.

Jefferies increased its target from $150 to $170 post earnings, maintaining a Buy rating and highlighting the accelerating growth in remaining performance obligations, despite a significant 18% drop in capital expenditures. Barclays noted that the strong performance obligations suggest promising times ahead for Oracle. BofA lifted its price target from $155 to $175 while keeping a Neutral rating, citing continuous acceleration in cloud growth, although it acknowledged a mixed outlook regarding future targets. Meanwhile, JPMorgan's Mark Murphy reported that Oracle's revenue growth exceeded expectations, fueled by positive trends in its cloud business and a new multi-cloud partnership with AWS, Microsoft Azure, and Google GCP.

Despite these promising developments, JPMorgan maintained a Neutral rating with a price target of $120, indicating no immediate upward revisions to consensus estimates.

IBM:

$IBM Corp (IBM.US)$ hit a historic high on Wednesday for the first time in 11 years. The long-established tech giant is striving to keep up with the AI trend by shifting its focus to the software sector, proved by acquisitions of Red Hat and Apptio.

IBM's second-quarter financial report revealed a significant surge in orders for its AI business, driving revenue growth beyond analysts' expectations. CEO Arvind Krishna noted that about three-quarters of the AI orders are from consulting, with the remainder coming from software. Over time, the revenue share of software may increase.

While IBM may not match the growth pace of popular AI stocks like NVIDIA, it demonstrates lower stock price volatility and a more prominent safety margin. With a price-to-earnings ratio of less than 20, IBM is valued lower than the approximately 24 times of the Nasdaq 100 index.

Pagliara from Capwealth believes that IBM's stability and predictability make it a suitable choice for long-term investors with a horizon of 15 to 20 years or those seeking dividend income. However, some cautious analysts feel that finding additional drivers to support IBM's stock price upside may not be easy.

Furthermore, other winners include chip stocks $Arm Holdings (ARM.US)$ and $Taiwan Semiconductor (TSM.US)$, cloud computing service provider $ServiceNow (NOW.US)$, software company $Adobe (ADBE.US)$, and two members of the MAG7: $Amazon (AMZN.US)$ and $Tesla (TSLA.US)$.

Source: the Fly, Bloomberg, CNBC

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment