Those who are afraid to open positions when they fall when they are low can't be held up when times are high and high.

Whoever is alive can see it: 271.000-278.980-299.290-314.800-515.000 (I'm afraid I won't be able to withstand the temptation and hold the chips in my hands.)

Tesla and Nvidia are listed companies with different potential and different styles. Why convergence? If you like Nvidia, open a position with Nvidia. Being happy and tired of falling is bound to be unable to obtain a large amount of cheap, high-quality chips that can obtain high profits. If you lose the opportunities brought by the decline in vain, you will not be able to achieve great results in the US stock market. Whether Elon Musk or Donald John Trump talked about Tesla shares in the previous interview, they said sincerely: regardless of whether the stock is covered or not, it is necessary to survive the difficult period of decline, not just focus on short-term trends or even short-term trends. The potential of Tesla stock can be seen if you believe it: only first, not second. If they hate Tesla that much, they close their positions and leave. Don't worry about major contradictions; ignore secondary contradictions. There are no perfect stocks; if there is such a stock, this kind of stock has no growth potential. The most important thing is that I'm afraid I can't buy it; the most important thing is that there are no such stocks at all.

Elias=Jerome knows that an influencer analyst who was once very optimistic about Tesla has sold all Tesla shares and bought Tesla forward call options contracts instead.

Elias=Jerome also saw that Capital Group (Capital Group), which manages more than 2.6 trillion dollars of financial assets, is selling and reducing its holdings of Tesla shares, and is the protagonist of a very large single-tier capital sell-off, but the shares sold by Capital Group only operated about $3.5 trillion in capital, made up for it by increasing and expanding the stock positions of State Street Global Advisors, SSGA (State Street Global Investment Management). The bulk of the sell-off now is retail capital. Institutions are generally increasing their holdings and expanding their shares. In particular, The Vanguard Group (Pioneer Pilot Group), the actual trader of the American 401K pension account, worked hard in the midst of the decline, and built a large number of positions. Also operating in this way are JPMorgan (Xiaomo), Morgan Stanley (Damo), Bank of America (Bank of America), UBS Group AG (UBS Group), ARK Investment Management LLC (Ark Investment Management Co., Ltd.), and Baron Capital (Barron Capital).

Please hand over to me those low-level chips you're tired, poor, and huddled up and hungry for relief (high-ranking chips, if you want to cut meat, you still need Tesla's market maker, the actual trader of the American 401K pension account, The Vanguard Group Pioneer Leader, and Citadel Fortress, the world's largest options maker. Here, I would like to criticize BlackRock Inc. BlackRock Inc., which are passionate about cryptocurrencies and markets other than Wall Street, and their investment in Tesla's key technology points is out of step with the reputation of the so-called federal reserve system's prime traders; they are too scarce — shabby.) Those on the other side where you chase high for strength and wealth (Beijing-Tianjin-Shanghai? Pearl River Delta? The Yangtze River Delta? (Claiming that wealth scares the US and the West, and that they have money to invest in the Belt and Road Initiative to support Asia, Africa, and Latin America, they just don't have the financial resources to develop a sound and strong social security, pension, and medical system covering the whole society.) Throw away the chips and give them to me. I'm here at 515.000 and greet them with a light.

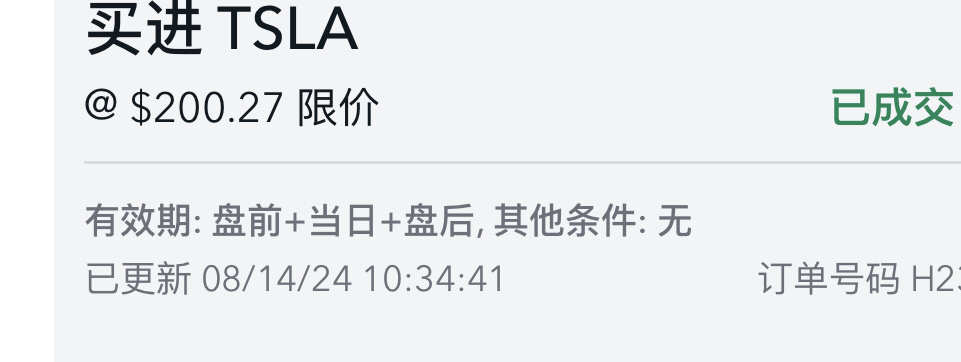

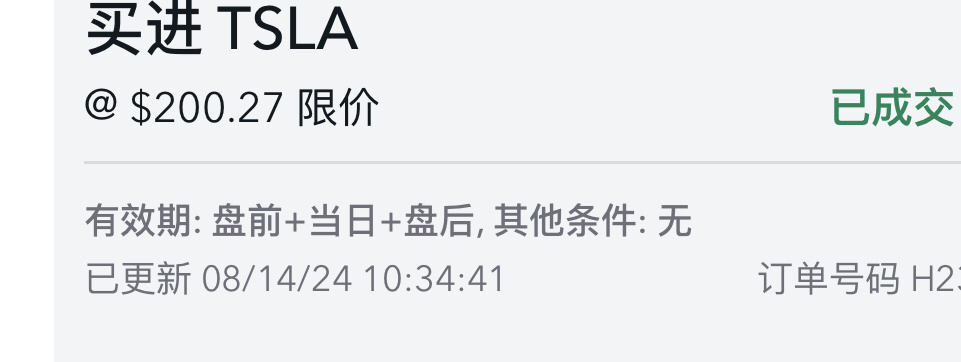

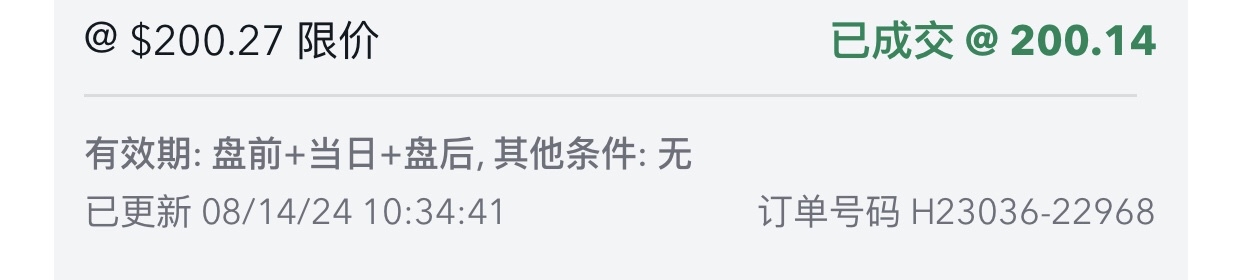

Core Tip: The rebound in stock prices was heavily suppressed by backpressure. If you want to find future leading stocks in the AI field that are still in the gross margin stage, you need to change your current profit mindset, standards, and methods, be based on the long term, and have enough vision and patience. If you can't do this, it's better to buy mature high-tech blue-chip stocks when there is a sharp drop, such as buying Tesla and the like near the 200-day EMA (I just believe you can open a position on Nvidia now).

1. If none of the fundamentals of listed companies can match the main forces in the market to trigger an increase in stock prices to achieve arbitrage, they will do the opposite, which is to curb the rise in stock prices, lock up more relatively high chips, force out more low chips, and save enough strong rebound energy to launch an upward market in the future.

2. Frustration is something God is helping you plan for the longer term, but I just can't tell you right now. Doing what you love to do the most is where your true talent lies.

3. Apathy and indifference are the strongest counterattacks against people and things you don't like. Crazy is a child playing the best games in the garden of reason. As long as one person is warm and intelligent enough, they are likely to ignite another person.

4. Generally, an important medium- to long-term potential sector requires losing at least five groups of strategic investors before starting. Today, the first batch, second batch, and third batch of strategic investors have lost confidence, and they still need to lose another batch. In actual operation, it is important to have a plan and moderation. Sometimes people are very forgetful, especially when profit makes them lose their wisdom. Therefore, it is particularly important to remind:

Tesla: Starting at $1.13 per share in 2010, loss, unprofit,..., hovering at a low price for a long time, more than 90% of the original participants sold cheap Tesla shares with a sense of depression and extreme frustration. Tesla was only able to soar to a peak of $371 a few years later.

That's almost a 33,000% increase...

That's enough to turn every $5,000 into $1.6 million.

However, compared to artificial intelligence technology, this is probably just a trifle thing...

Investment guru Peter Lynch said, “There have been 40 stock market crashes in the past 70 years. Even if I had predicted 39 of them in advance and sold all of my stocks before the crash, I would regret it a lot in the end. Because, even in the biggest stock crash, the stock price will eventually rise back up and rise higher than before.”

Excellent companies will continue to reach record highs, and they can overcome bulls and bears. For excellent companies, the bear market is only temporary; the bull market is eternal.

Tesla's starting price of $1.13 per share on June 29, 2010, loss, no profit,... It has been hovering at low stock prices for a long time, and more than 90% of the original participants sold cheap Tesla shares with a sense of despondency and extreme frustration. It wasn't until August 26, 2018, that is, about 8 years later, that Tesla was able to soar to a peak of $371.

Is it difficult to hold shares for 6-8 years? (Do what you like or should do.)

That's almost a 33,000% increase...

Turn every $5,000 into $1.6 million. In the face of such results, it was enough to overshadow the average annual return of 71.8% for the Medallion Fund (Medallion Fund) world profit champion, led by the world's great mathematician, investor, and philanthropist James Harris Simons (James Harris Simons).

A truly top-level trading order that makes a lot of money is not only the absolute value at a relatively low price, but also quantity. The most important and core one is that in the midst of large fluctuations, especially in large downward fluctuations, they have overcome and transcended the pain of time and space with unwavering belief.

This is how the rich and feudal Rothschild family and stock god Warren Buffett walked through. James Harris Simons, the world's top mathematician, philanthropist, and god of speculation worth over 23 billion dollars, has fully demonstrated the great value and power of mathematics and theoretical physics. Medallion Fund has almost taken them to the extreme.

Excellent companies will continue to reach record highs, and they can overcome bulls and bears. For excellent companies, the bear market is only temporary; the bull market is eternal.

Tesla's starting price of $1.13 per share on June 29, 2010, loss, no profit,... It has been hovering at low stock prices for a long time, and more than 90% of the original participants sold cheap Tesla shares with a sense of despondency and extreme frustration. It wasn't until August 26, 2018, that is, about 8 years later, that Tesla was able to soar to a peak of $371.

Is it difficult to hold shares for 6-8 years? (Do what you like or should do.)

That's almost a 33,000% increase...

Turn every $5,000 into $1.6 million. In the face of such results, it was enough to overshadow the average annual return of 71.8% for the Medallion Fund (Medallion Fund) world profit champion, led by the world's great mathematician, investor, and philanthropist James Harris Simons (James Harris Simons).

A truly top-level trading order that makes a lot of money is not only the absolute value at a relatively low price, but also quantity. The most important and core one is that in the midst of large fluctuations, especially in large downward fluctuations, they have overcome and transcended the pain of time and space with unwavering belief.

This is how the rich and feudal Rothschild family and stock god Warren Buffett walked through. James Harris Simons, the world's top mathematician, philanthropist, and god of speculation worth over 23 billion dollars, has fully demonstrated the great value and power of mathematics and theoretical physics. Medallion Fund has almost taken them to the extreme.

How to make an enemy country rich

So-called “empty messages” cannot stop the bull run, and even a world war, and vice versa. The only thing traders have to do is assess the potential.

A good trading strategy requires room for error; an accurate buy and sell point also requires room for error.

No one of us knows where the bottom zone is; only God has this power. On the other hand, there are too many self-righteous people who are struggling to pursue such abilities, and are also acting recklessly and arrogant.

When you invest in stocks, what ultimately makes you make a lot of money depends on a firm belief in the midst of big fluctuations and a continuous belief in saving money in the snow, rather than icing on the cake. This statement is actually very, very important; making big money requires a firm belief.

A good top-notch money-making trading order list covers the coming of the space-age, not only the absolute value of the low price, but also the number of issues, the most important of which is also covering the sedimentation of the time years. Shock, courage, will, vigor,...

Because you can't take advantage of avoiding all falls. You and I are neither Creator nor God. Only those who can master the fall can finally get those upward swings. This is very, very important, very, very worth the money.

So, you have to endure some of your own unforeseen spins, which is really difficult and difficult to achieve. If you and I have done it all, then you and I can get those upward spins too.

Stock speculation is much more than simply analyzing charts. The bearish movement in the bull market, the bearish movement at the end of the bear market, the bearish market decline during the bull transition period, and the persistence of the bullish momentum are crucial, and this is the main focus.

A sharp fall in the stock market means that gold falls from the sky, freaking you up and driving others away. It also requires excessive boldiness, which most people probably don't have. There are different ways to succeed; don't accept your uninertial approach.

If someone bought shares in Berkshire Hathaway (Berkshire Hathaway) in 1965 and kept them, they made an excellent investment—and their stockbrokers would starve to death. Most pension funds probably didn't buy Berkshire shares in 1965 and have held them ever since. If they actually did that, they would have far fewer problems today. Berkshire's stock price at the time was $22. Today, its share price is close to $0.133 million.

Elias=Jerome, if I tell you now, this opportunity has come again. What would you think? How to deal with it?

So-called “empty messages” cannot stop the bull run, and even a world war, and vice versa. The only thing traders have to do is assess the potential.

A good trading strategy requires room for error; an accurate buy and sell point also requires room for error.

No one of us knows where the bottom zone is; only God has this power. On the other hand, there are too many self-righteous people who are struggling to pursue such abilities, and are also acting recklessly and arrogant.

When you invest in stocks, what ultimately makes you make a lot of money depends on a firm belief in the midst of big fluctuations and a continuous belief in saving money in the snow, rather than icing on the cake. This statement is actually very, very important; making big money requires a firm belief.

A good top-notch money-making trading order list covers the coming of the space-age, not only the absolute value of the low price, but also the number of issues, the most important of which is also covering the sedimentation of the time years. Shock, courage, will, vigor,...

Because you can't take advantage of avoiding all falls. You and I are neither Creator nor God. Only those who can master the fall can finally get those upward swings. This is very, very important, very, very worth the money.

So, you have to endure some of your own unforeseen spins, which is really difficult and difficult to achieve. If you and I have done it all, then you and I can get those upward spins too.

Stock speculation is much more than simply analyzing charts. The bearish movement in the bull market, the bearish movement at the end of the bear market, the bearish market decline during the bull transition period, and the persistence of the bullish momentum are crucial, and this is the main focus.

A sharp fall in the stock market means that gold falls from the sky, freaking you up and driving others away. It also requires excessive boldiness, which most people probably don't have. There are different ways to succeed; don't accept your uninertial approach.

If someone bought shares in Berkshire Hathaway (Berkshire Hathaway) in 1965 and kept them, they made an excellent investment—and their stockbrokers would starve to death. Most pension funds probably didn't buy Berkshire shares in 1965 and have held them ever since. If they actually did that, they would have far fewer problems today. Berkshire's stock price at the time was $22. Today, its share price is close to $0.133 million.

Elias=Jerome, if I tell you now, this opportunity has come again. What would you think? How to deal with it?

Why do the bitter and mean people think Tesla, led by Musk, is drawing big cakes and opening a bakery (they are targeting GM and Ford companies $23-14, and categorically deny that Tesla is an AI-type high-tech innovator); while the world's top investment banks Morgan Stanley and JPMorgan see Tesla as an excellent investment target and opportunity ($310, accepting and approving Tesla as a high-tech enterprise for deep AI development and application)?

Tesla is currently the only publicly traded company with great prospects that can change the fate of wealth by trusting it and holding it for a long time.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment