To increase wealth, why isn't everyone following Warren Buffett's blueprint?

Because it is impossible for ordinary investors to replicate. I'm not saying "difficult"... I mean itIn fact, it is not possible。

First of all - this pointVery...Important - Never forget that Berkshire Hathaway is an insurance company. A key factor in Buffett's success is the investment of his insurance float. Buffett invests billions of dollars of insurance float funds every year.

I don't know about your situation, but I don't have that much cash flowing in at any time. This means Buffett can make up for mistimed or minor (if 'minor' refers to billions of dollars) buying decisions and still make a profit.

The key point is, a key factor in Buffett's long-term success is the investment of insurance float funds. Don't get me wrong - he still needs to make good investments - but after investing billions of dollars every year, investing becomes a bit easier.

Secondly, some of Buffett's most profitable investments are ones you can't even dream of making. For example, in 2011, Buffett negotiated with Bank of America to purchase preferred shares with a 6% dividend yield and the right to purchase 0.7 billion shares of common stock before September 2021 at a price of $7.14 per share...

Let me translate this sentence into English... Buffettinventedan investment, but this investment does not exist because Bank of America was in dire straits at the time and Buffett had billions of dollars in cash on hand (remember Point 1 above?). You and I simply can't do this. Oh... Berkshire Hathaway made a profit of $14.2 billion from this investment in about six years.

This is one of his most profitable investments.

Now, do not misunderstand me. Buffett is a miracle. He is absolutely the best. Do you know those "economic moats" that Buffett often talks about? Those "competitive advantages" he likes to buy? Buffett created them in the financial market. Buffett's return is his "economic moat".His"Economic moat." This is no small matter!!

But, dear readers, youwill neverbe able to achieve the same record as him with his strategy. This is not because you lack skills (although that's very likely). You can't do it because his strategy is actually not replicable by you.

However, I do hope you can prove me wrong.

My favorite 10 investment quotes from Warren Buffett.

Most people do the exact opposite.

When they get opposite results, they are very surprised.

1. "When others are greedy, I am fearful. When others are fearful, I am greedy."Most investors buy when excited and sell when discouraged. When they incur losses, they are very surprised. Buffett buys when everyone is selling and sells when everyone is buying. He never feels surprised.

2. "For investors, the most important quality is character rather than intelligence."Most investors act on intuition. Then they present the data to prove this point. And bear the consequences. Buffett can remain calm even in terrible markets. And surprise everyone.

3. "I don't want to jump over a seven-foot fence. I look for a one-foot fence to step over."Most investors want to hit a home run. Get rich quick. And strike out. Many times. Buffett has hit many singles. Easier to hit. And he has won many games.

4. "Price is what you pay, value is what you get. I like buying quality merchandise when it is on sale."Most investors buy when all commodities are rising, and flee when all commodities are on sale. Buffett does the exact opposite. And gets the exact opposite.

5. "Successful investment requires time, discipline, and patience. No matter how much talent or effort, some things just need time."Investors attempting to get rich quickly rarely succeed. Buffett has been investing all his life. Even his reasonable returns have translated into wealth.

6. "If you are not willing to hold a stock for ten years, then don't even think about holding it for ten minutes."Most investors seek quick profits in booming investments. Their investments usually end up losing money. Buffett buys quality investments. After many years, wealth will show.

7. "In the short term, the market is a popularity contest. In the long term, the market is a weighing machine."Most investors chase popular trends. Then when the market unpredictably changes and ruins their investments, they are surprised. Buffett evaluates value, and over time, his wealth increases.

8. "Opportunities don't come easy. When it rains gold, take out a bucket, not a thimble."Most investors hope for good luck. They are still waiting. Buffett learned about investing, studied investments. So when opportunities arise, he can recognize them. And then have good luck.

9. "The key to investing is not evaluating how much an industry will grow, but determining any company's competitive advantage."Most investors will say when discussing a company: "But it represents the future." But later they will find out that's not the case. Buffett chooses companies that will be part of the future.

10. "What we learn from history is that people do not learn from history."Most investors chase the latest trends. New shiny investments. And make the same mistakes as their predecessors. Buffett learns lessons from history and experience. Rarely makes the same mistakes.

You can learn from successful people. Or make all the mistakes yourself. You choose.

Although Warren Buffett's investment strategy has been successful for him and many others, there are several reasons why not everyone follows his wealth growth blueprint:

1. Understanding and Knowledge: Buffett's approach relies on a deep understanding of value investing, including analyzing companies, fundamental aspects of companies, and market conditions. Many people lack financial knowledge or the willingness to learn these complex concepts.

2. Risk Tolerance: Buffett emphasizes long-term investments in fundamentally strong companies. Not everyone has the same risk tolerance or patience to hold investments for many years, especially during market fluctuations.

3. Resource Access: Buffett has abundant resources, including a network of financial experts and proprietary information. Most individual investors cannot access the same level of resources.

4. Behavioral Factors: Emotions and psychological factors, such as fear of loss or desire for quick profits, may lead investors to make impulsive decisions, deviating from Buffett's disciplined approach.

5. Market Conditions: The investment environment evolves over time. Buffett's effective strategies in earlier years may not yield the same results in different economic environments, and some investors may not be able to adjust accordingly.

6. Time Commitment: Buffett spends a significant amount of time researching and analyzing investments. Many people may not have the time or be willing to dedicate to such an intensive process.

7. Investment Horizon: Buffett's philosophy revolves around long-term investment horizons. Many investors focus more on short-term gains, which may lead them to adopt different strategies.

8. Diversification vs. Concentration of Investments: Buffett often heavily invests in a few companies he is bullish on, contrary to the common advice of diversification. This concentrated investment approach carries high risks and may not be suitable for everyone.

9. Personal Goals and Values: Individuals have different financial goals and values, which may lead them to prioritize investments that align with personal beliefs or urgent needs rather than following Buffett's method.

In conclusion, while Buffett's strategies may be effective, they require a specific mindset, knowledge base, and environment, which not everyone possesses.

Requirements:

1: The ability to buy stocks during an economic recession.

2: The ability to hold stocks during an economic recession.

Hidden assumptions:

1: During an economic recession, when you are unemployed, you have enough money to sustain your current lifestyle and buy stocks. You can do this during a possible two-year economic recession.

2: In the long run, the stock market you invest in will rise. However, this is not the case for all stock markets and all periods. 'Long term' may also mean decades. In the 20 years after the Great Depression, the U.S. stock market did not rise.

3. Your life is long. Your vision is long. Life always changes, and you may not be able to invest continuously for decades. In fact, your stock investment portfolio is your retirement fund, and you must withdraw it before an economic recession occurs, otherwise you will lose half of its value, taking 3-5 years to recover.

4: You are very patient, can endure a 20-30% decline in your net assets, and it takes 3 years to recover.

Issue:

60% of Americans do not have $1000 to pay for unexpected expenses. It can be imagined how many people have enough savings to weather an economic recession without selling their stock investment portfolios.

Humans are very loss-averse. That's why it's difficult for you to buy stocks when you know the stock market will depreciate and may continue to do so in the next 6-7 months.

Contrarian investing, bravely moving forward when others are fearful. I believe the days of limited information are coming to an end. Stock value declines often have sufficient reasons. You must believe that the company can survive this difficult period. Sometimes it does, and you can make big money; sometimes it doesn't, and that's the end of your investment.

Patience is hard to maintain. When you have suffered massive losses for many years and only now start to profit, patience becomes even harder to maintain. Your instinct is to sell immediately and take the profit.

One day, Jeff Bezos asked Warren Buffett why no one could replicate his strategy, because it's very simple, but well known.

Warren Buffett's answer was very simple:

"Because no one is willing to get rich slowly".

Nowadays, everyone wants to get rich quickly. However, success in the stock market is built up slowly. You must be patient, but also stick to your choices. For Warren Buffett, 99% of people are unable to replicate his strategy simply due to lack of patience.

Warren Buffett's lifelong strategy was inherited from his mentor Benjamin Graham, who detailed it in his favorite book 'The Intelligent Investor'.

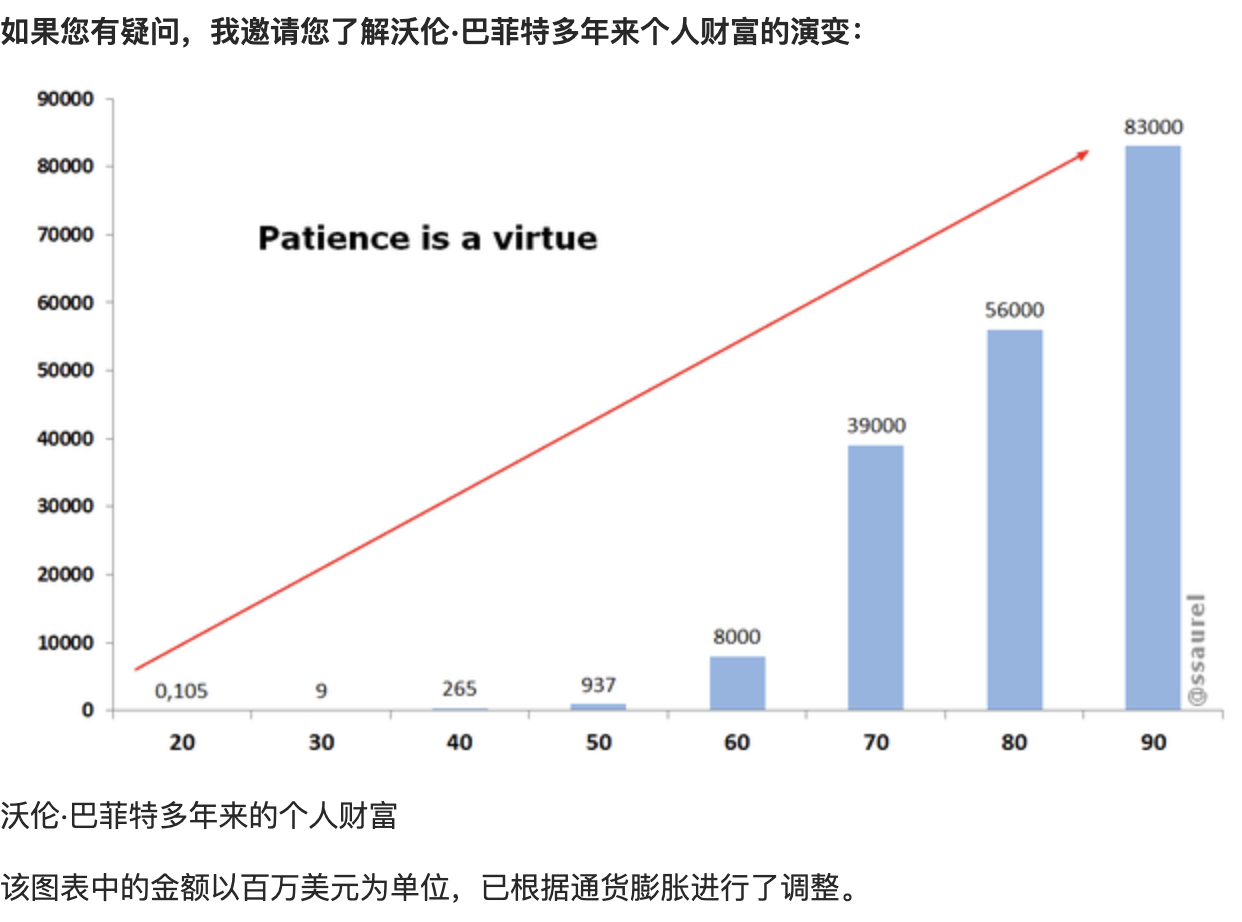

Warren Buffett's personal wealth over the years.

The amounts in this chart are in millions of US dollars and have been adjusted for inflation.

Warren Buffett had a fortune of 0.105 million US dollars at the age of 20. By the age of 30, this fortune had reached 9 million US dollars. Ten years later, his fortune reached 0.265 billion US dollars. Warren Buffett's progress was slow but steady.

To apply such a strategy, Warren Buffett must have patience. This is the secret to Warren Buffett's success in the investment world.

Warren Buffett was not yet a billionaire at the age of 50. This happened when he was just over 50. For him, the pace of developments accelerated significantly, as between the ages of 60 and 90, his wealth rose from 8 billion US dollars to today's 83 billion US dollars.

If you want to be a successful stock market investor like Warren Buffett, you need to develop patience as a fundamental quality. Those who do so will reap huge rewards, as Warren Buffett's statement reveals: "The stock market is designed to transfer funds from the active to the patient."

Therefore, to make money in the stock market, one must have patience.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment