Today's Morning Movers and Top Ratings: ORCL, CVNA, MSTR, AAL and More

Morning Movers

Gapping up

$Oracle (ORCL.US)$ The information technology company saw its stock climb 13.3% due to strong per-share earnings, with adjusted earnings per share of $1.41 surpassing the consensus estimate.

$Kohl's Corp (KSS.US)$ The retailer's shares increased by 2.2% after reporting earnings and revenue that exceeded expectations for the fourth quarter.

$Coinbase (COIN.US)$ The cryptocurrency trading platform's shares grew by 2.1% following an upgrade from Raymond James to market perform from underperform.

$Bitdeer Technologies (BTDR.US)$ The crypto company's stock jumped 4.6% after B. Riley initiated coverage with a buy rating, citing its diverse business model and access to low-cost power.

$Ventyx Biosciences (VTYX.US)$ Shares of the biopharmaceutical company rose 7.1% after positive clinical update assessments from Wall Street, with upgrades from Wells Fargo and Oppenheimer.

$MicroStrategy (MSTR.US)$ Shares of the bitcoin developer surged 6.2% amid optimistic commentary from Wall Street analysts and raised price targets from Canaccord Genuity and TD Cowen.

Gapping down

$American Airlines (AAL.US)$ Shares of American Airlines slipped more than 3% in premarket trading Tuesday after the carrier provided investors with updated financial and operational guidance for the first quarter of 2024. For the first quarter, the airline forecasts an adjusted loss per share to be at the lower end of its previous forecast range of 15 cents to 35 cents, compared to consensus estimates of a 23 cent loss per share.

$On Holding (ONON.US)$ The shoemaker's shares dropped more than 14% after quarterly results fell short of investor expectations, with a reported loss and revenue missing consensus estimates.

$Asana (ASAN.US)$ The work management platform's stock decreased by 2.3% following the release of weak full-year revenue guidance, overshadowing its better-than-expected earnings report for the fourth quarter.

$Southwest Airlines (LUV.US)$ The airline's shares fell by 7% after the company announced it was reevaluating its full-year 2024 guidance, including capital spending expectations, and reported weaker than expected leisure bookings for the first quarter.

Source: CNBC; Investing.com

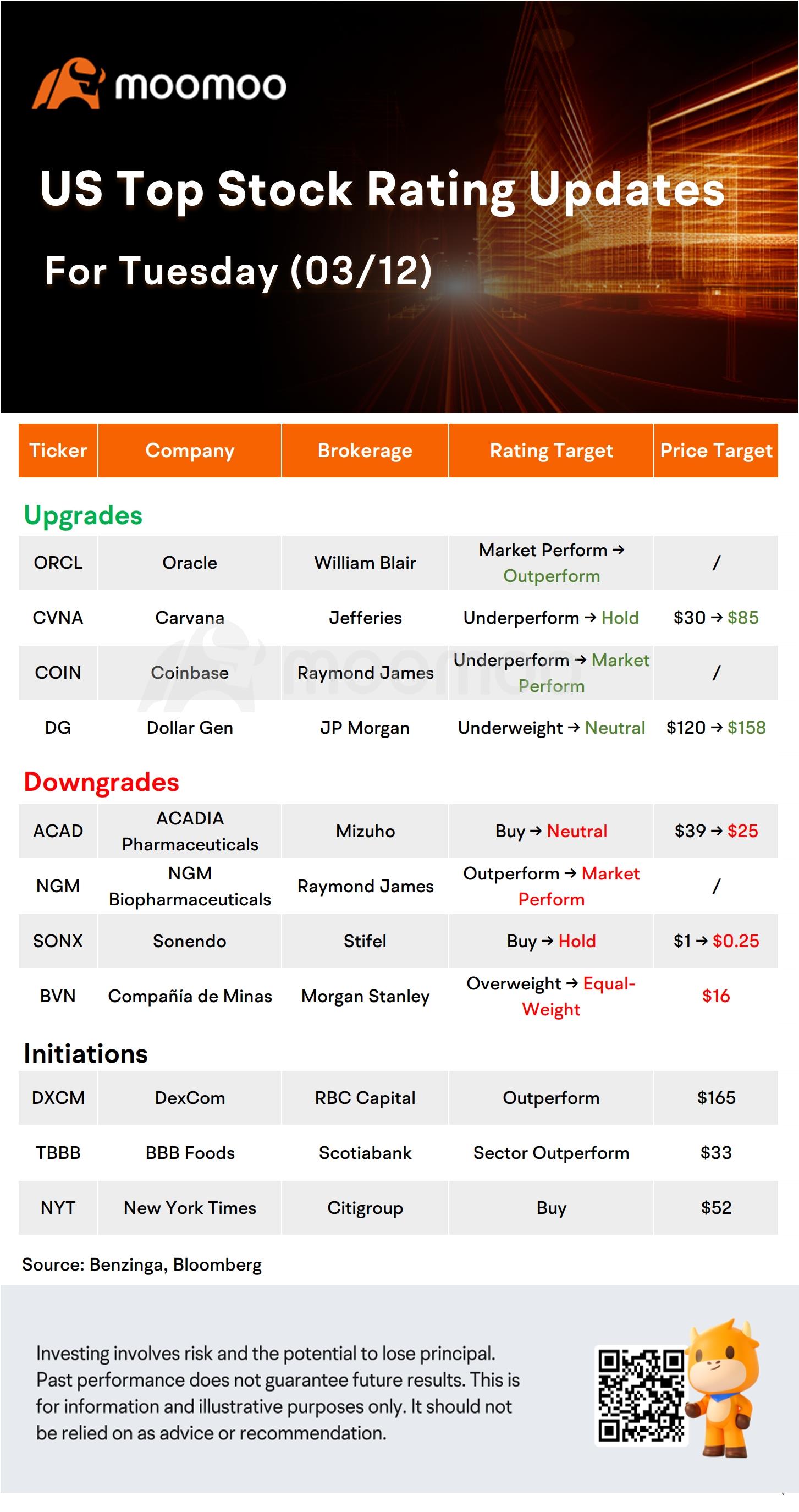

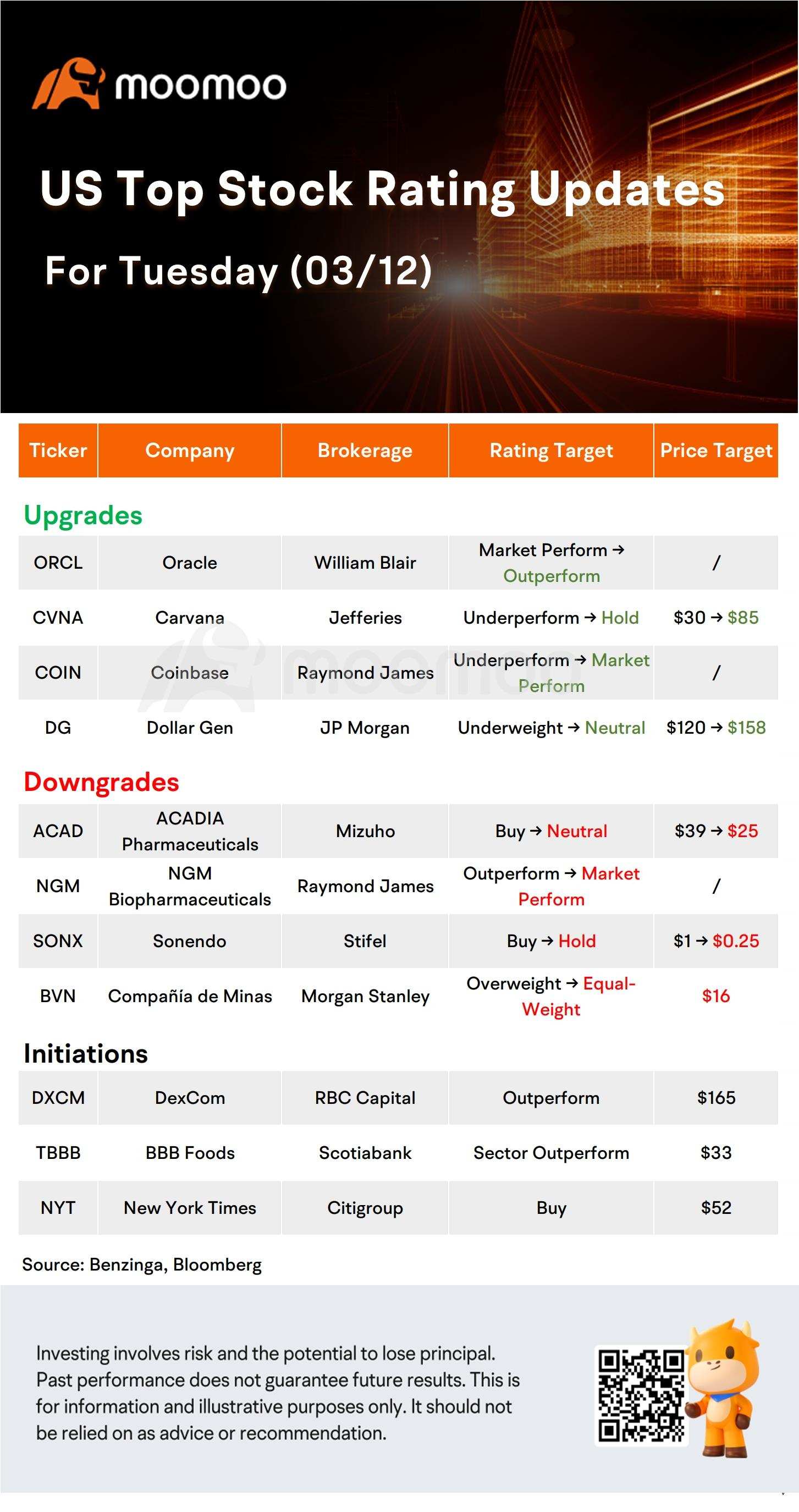

US Top Rating Updates on 03/12

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

74379264 : $SPDR S&P 500 ETF (SPY.US)$ $BITCOIN FD (QBTC.CA)$20.00

Ronglua : What's going on with TSLA!?

Dman444 Ronglua : Rotation to other stocks. It will comee back .