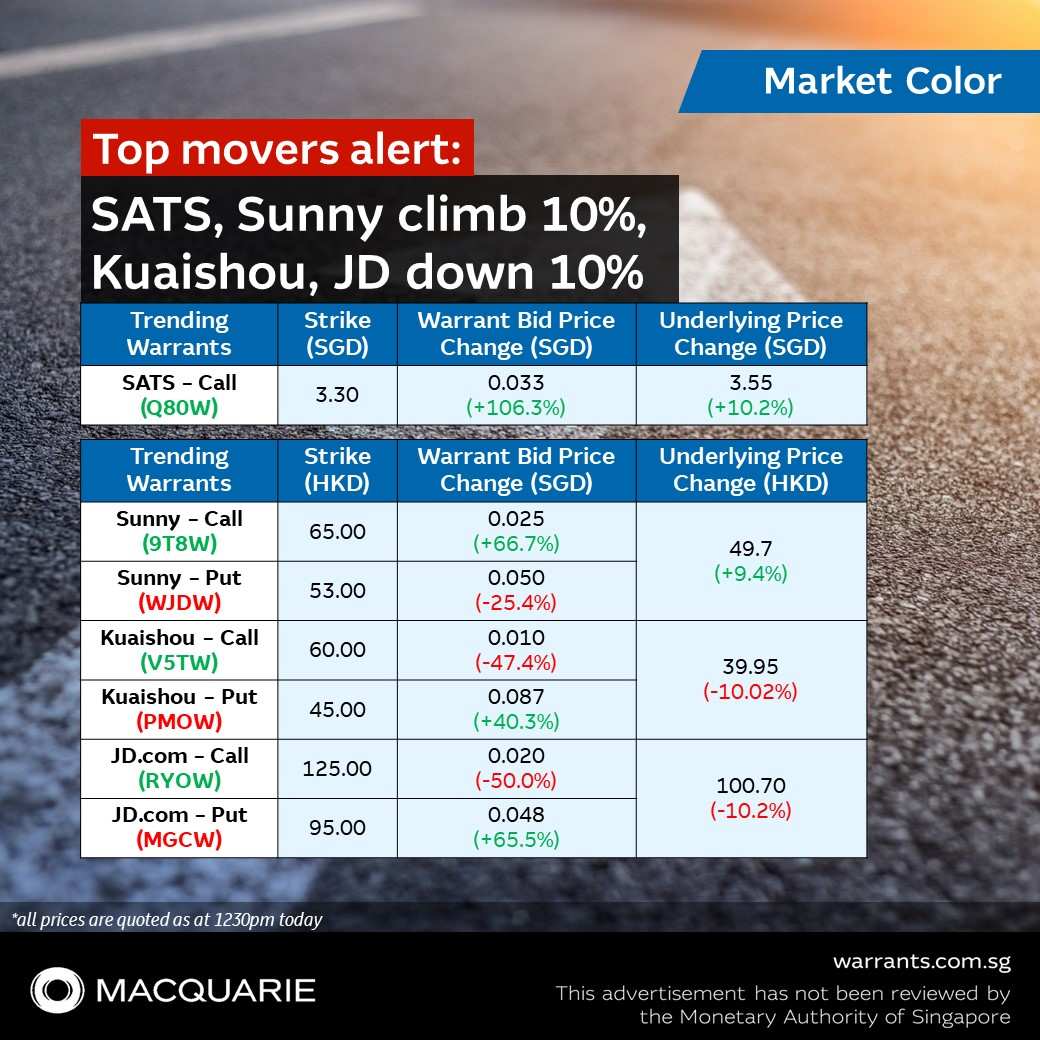

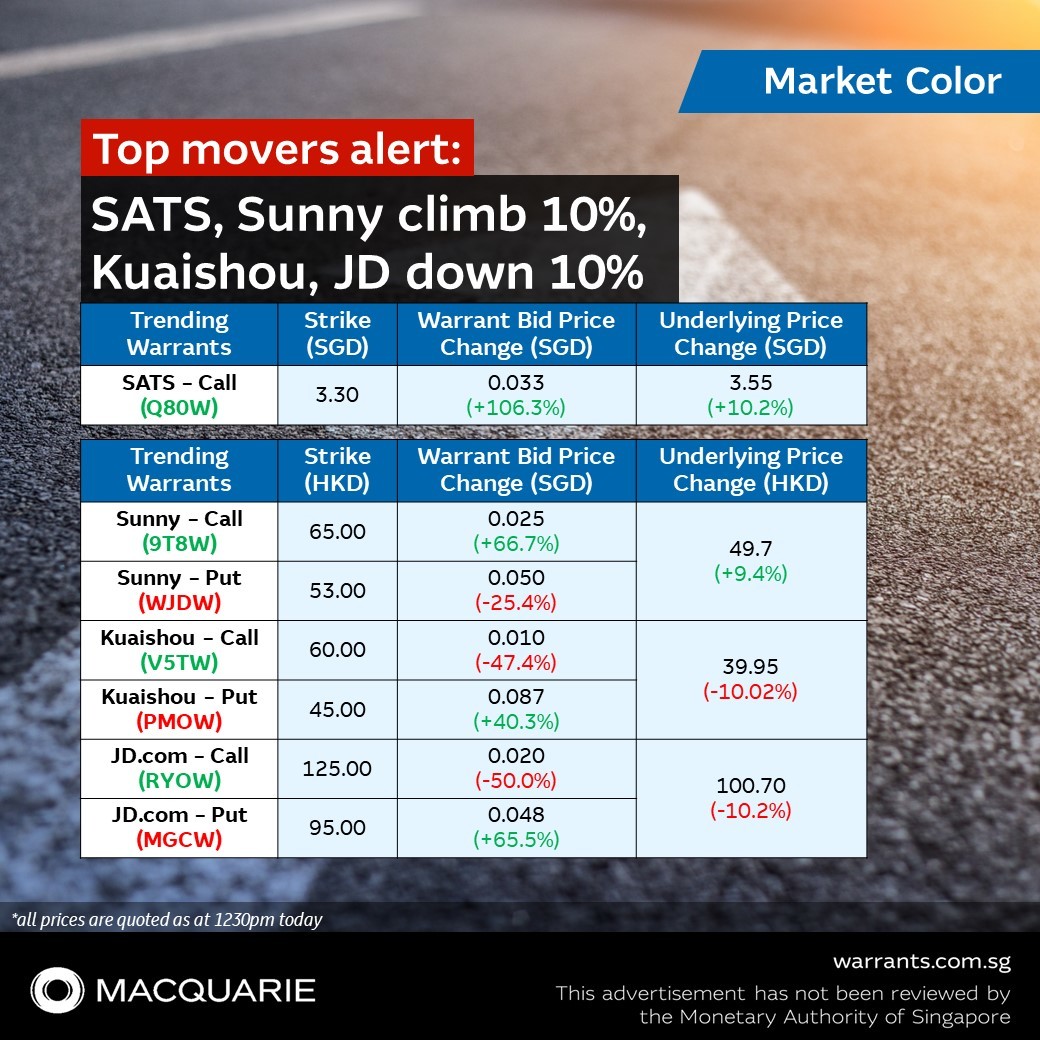

💥 📈 Top mover alert: SATS. Sunny climb 10%, Kuaishou, JD down 10%

➡️ Four stocks are making 10% moves today - two of them stocks we have been highlighting this week, the other two on the back of last night's earnings

✈️ SATS: We had highlighted the 4% climb of the stock yesterday morning. Today, SATS shares are up another 10.2% to $3.55 as of the AM session, while Macquarie's trending SATS call warrant 📌 (https://warrants.com.sg/tools/livematrix/Q80W) is up another 106.3% to $0.033 - taking its total weekly gain to 154% with SATS shares up 21.9% so far for the week. SATS shares are yet higher after announcing a net profit of $65 million for the first quarter ended June, compared to a net loss of $30 million during the same period a year ago. Revenue is also up 15.5% to S$1.37 billion from a year earlier, supported by significant growth in air cargo volumes and continuing travel recovery. SATS expects the positive momentum to sustain in the coming quarters with demand for air cargo services likely to be driven by factors including the increase of e-commerce.

👟 JD: We had noted JD's +12% share price move in the two days on the back of its most profitable quarterly earnings in this week's telegram posts. However, the stock is down 10.2% to HKD 100.70 as of the AM session, after Walnut sold its USD 3.6 billion stake in JD. Subsequently, trending JD call RYOW 📌(https://warrants.com.sg/tools/livematrix/RYOW) is down 50% to SGD 0.020 while trending put 📌MGCW (https://warrants.com.sg/tools/livematrix/MGCW) is up 65.5% to SGD 0.048.

📱 Kuaishou: Its share price dropped 10% to HKD 39.95 as of the AM session, after reporting mixed second quarter results last night with live-streaming revenues coming in ahead of consensus but gross merchandise volume growth below expectations. The results have led to some analysts to lower their target price on the stock. The share is now trading close to its January lows. Trending Kuaishou call warrant V5TW 📌 (https://warrants.com.sg/tools/livematrix/V5TW) is down 47.4% to SGD 0.010 on the back of today's share price move, while trending Kuaishou put warrant PMOW 📌 (https://warrants.com.sg/tools/livematrix/PMOW) is up 40.3% to SGD 0.087.

💿 Sunny Optical: One of the rare outperformers today, with a +9.4% gain to HKD 49.70 as of the AM session. Its first half net income of 1.08 billion RMB beat estimates of 944 million RMB, while revenue jumped 32% from the same period last year. Consequently, Macquarie's trending Sunny call warrant 9T8W 📌 (https://warrants.com.sg/tools/livematrix/9T8W) is up 66.7% to SGD 0.025 while trending put warrant WJDW 📌 (https://warrants.com.sg/tools/livematrix/WJDW) is down 25.4% to SGD 0.050.

💡 Investors would note from the above examples that both call and put warrants tracking the shares have moved between 2.5 times to 10 times more than the shares, providing a geared exposure to the underlyings whilst costing below SGD 0.100. Put warrants move in an opposite direction to the underlying, as seen by the puts moving higher where share prices have declined, offering protection for shareholders who worry about short-term pullback in the share prices as a result of earnings/news events.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment