Trump Trade Rises: Can 2016 Strategies Be Repeated?

The narrative driving global asset markets is shifting from "rate cut bets" to the "Trump trade" as the November election draws near.

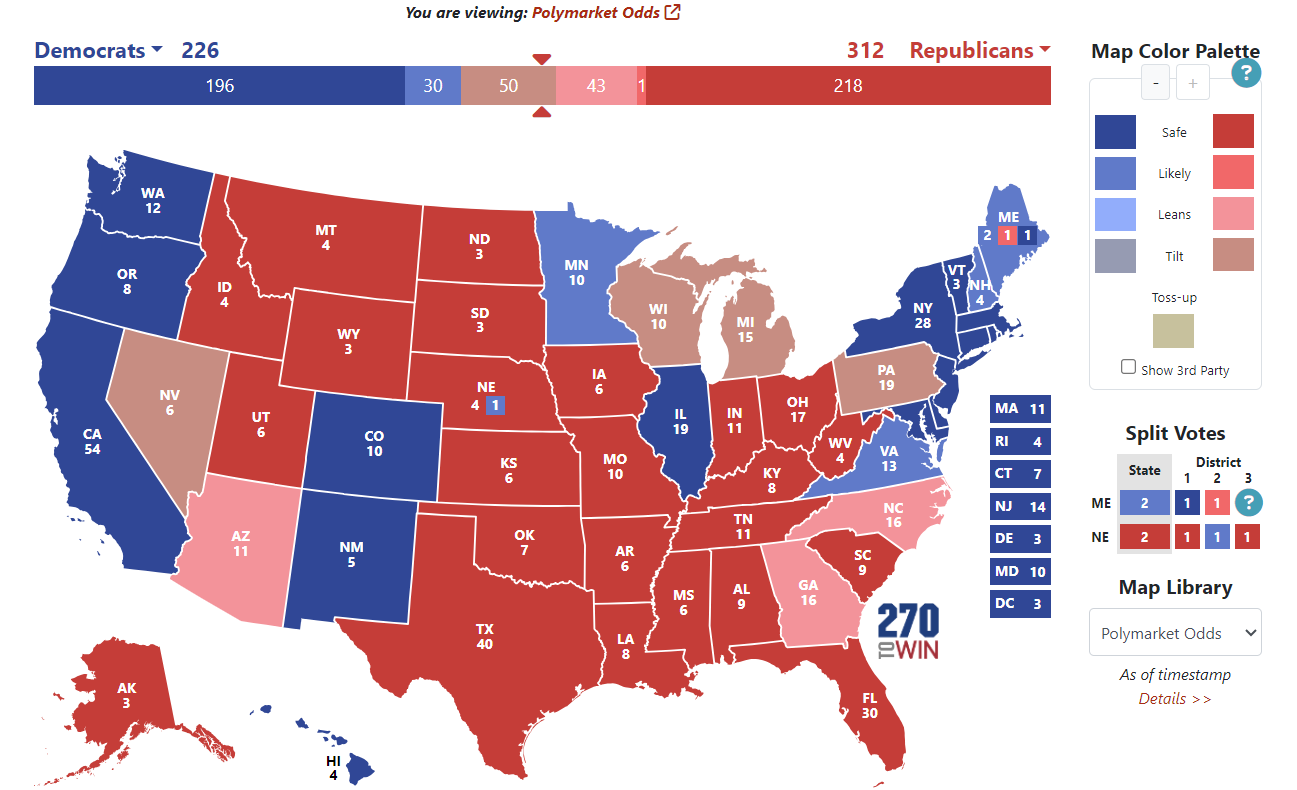

Platforms that allow users to bet on outcomes of events are pricing higher odds that former President Donald Trump could win the election. Polymarket data shows users are paying 61.70 cents per contract that will pay $1 if Trump wins, while contracts for Vice President Kamala Harris costs 38.30 cents each. Much like any betting platforms, the odds reflected in bets aren't necessarily a full reflection of the current political environment.

Real Clear Politics, which tracks more than 10 election surveys show a very tight presidential race, with 48.3% favoring Trump, and Harris 49.2%. The surveys are within the margin of error. Even the survey of Fox News, which has favored Trump, shows Republicans, which is the party of the former president, getting 219 electoral votes, while Democrats, which counts Harris as its standard-bearer, is seen with 226 electoral votes. A candidate needs 270 electoral votes to win.

Consensus data from surveys tracked by Real Clear Politics show Republicans winning 51 seats in the Senate and against 48 seats for the Democrats. In the House of Representatives, 206 seats were seen going to the Republicans and 204 to Democrats. Still, many surveys are showing it's too close to call which party will take control of either the House or the Senate. It's a different picture in the betting platforms with Polymarket users paying 43 cents for contracts betting on a Republican sweep of the presidency, the Senate and the House. That's up for 28 cents at the start of the month.

The last time Republicans swept the elections was when Donald Trump was elected president in 2016.

What Happened in 2016?

According to the latest report from Bank of America, the top-performing assets in the month following the 2016 election were regional banks, crude oil, and small-cap stocks, with gains of 24.5%, 14.8%, and 14.4%, respectively. Copper and industrial sectors also saw increases of over 10%, while the S&P 500 and the dollar posted single-digit gains.

On the downside, clean energy, gold, and 30-year U.S. Treasury bonds were the worst performers, declining by 5.2%, 8.2%, and 8.7%, respectively.

Bank of America strategists noted in the report that investors have begun to preemptively invest in assets such as banks, small-cap stocks, and the dollar, which led the rally in 2016.

Over the past two weeks, $Banks - Regional (LIST2456.US)$ have risen 3.9%, the $Russell 2000 Index (.RUT.US)$ has climbed 2.85%, and the $USD (USDindex.FX)$ has continued to ascend.

Will This Time Be the Same?

In terms of policy, immigration and trade policy are largely subject to presidential discretion, while the House of Representatives has more influence over fiscal and tax policy. Both parties support infrastructure development and the advancement of AI, but they diverge on energy policy.

If the election results in a Republican sweep, with both chambers of Congress under Republican control, that political scenario could facilitate the advancement of Trump's policy agenda, especially fiscal measures such as tax cuts.

A Republican sweep could lead to significant demand-side tax cuts, boosting U.S. economic growth, though higher tariffs and immigration restrictions may introduce supply-side inflation risks.

Thus, Trump's policy proposals remain similar to those of 2016, with banks, fossil fuels, small-cap stocks, and industrials as potential beneficiaries. The dollar could strengthen, while long-term bonds might be sold off as the market adopts a steepener trade to hedge against inflation risks, potentially repeating past patterns.

Notably, recent gold prices have surged to historical highs, while oil remains sluggish, contrasting with post-2016 election trends when gold fell, and oil rose.

Gold prices have repeatedly hit new highs, currently at $2,720, driven by escalating Middle East tensions and a tight U.S. election race boosting demand for safe havens. Gold is one of the best-performing commodities of 2024, up over 30% year-to-date. The Federal Reserve’s recent rate cut cycle and continued central bank gold purchases have been key factors supporting this gold rally.

Bank of America commodities analyst Michael Widmer forecasts that gold prices will reach $3,000 per ounce in the first half of the year, citing macroeconomic uncertainty, rising debt levels, and central bank purchases as factors making gold the "Ultimate Perceived Safe Haven."

A crucial factor enhancing the bullish outlook for gold is the U.S.'s fiscal trajectory. Government projections indicate that national debt is set to hit a record high as a share of the U.S. economy within three years.

Widmer noted that "whoever wins the 2024 presidential election will face an unprecedented fiscal situation upon taking office. Neither Kamala Harris nor Donald Trump seems to prioritize fiscal consolidation."

In contrast to gold, current oil prices are around $70, significantly below previous peaks, with historical highs in 2022 at $124 per barrel.

Oil prices fell over 7% last week due to concerns about demand from China, the world's largest oil importer, and easing fears of potential supply disruptions in the Middle East.

JPMorgan's commodities research division suggests that Brent crude prices may average $80 per barrel in the fourth quarter of 2024, $75 per barrel in 2025, and dip to just over $60 by the end of 2025.

Asset investment is influenced by multiple factors, with the US election being just one element. Given the differing international and macroeconomic landscape from 2016, investing based on historical experience requires a more comprehensive approach.

Source: Bloomberg, JPMorgan, CICC, Yahoo Finance, Reuters

by moomoo News Olivia

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

A Humble Mooer : You can think Polymarket is neutral OR Musk asked his cultists to boost Trump and they are doing it.

wingk sol : Nice use of the Polymarket graphs. Polymark data is being integrated into the Bloomberg terminal.

wingk sol A Humble Mooer : Do you think the NYtimes is neutral OR Harris asked her lib cultists to boost her poll #s in that news outlet?

Adrianlim90 : 1

joemamaa : nice