$Under Armour-A (UAA.US)$ this is just an update I was list...

I was listening to a contrarian money manager and flat-out said look I don't deal in the tech world I don't deal in the AI world ideal in the world of tangible goods and services that's what I focus on.

he says I look for companies that are turnaround stories and that's what I try to find that's what I am paid to do is to find those companies that are turnaround plays where they have big revenue not a lot of profits and they're being ignored.

he says so here's a company with 6 billion in sales you may not be wearing their shirts their shoes their clothing but somebody's buying it.

they're not making money and what is the company doing they brought back the founder and he understands how to run the business so you eliminate items that are your losses and your product line you increase prices on what is selling and your margins will go up significantly generating profits.

and he says and that's what's happening now is you have a restructuring taking place within this company where their margins are improving they're going to continue to grow and the company will be reporting profits again.

the stock was trading very well and then all of a sudden they had for the first time in 6 years and investor conference you can see the results of that investor conference in the stock price

the founder and the new CEO was asked direct questions about the numbers of the company their margins their growth their profits very keyed in on certain product lines and he did not have those numbers available to answer and this is the CEO saying this I don't have those numbers.

the stock was abandoned companies downgraded it the stock sold off.

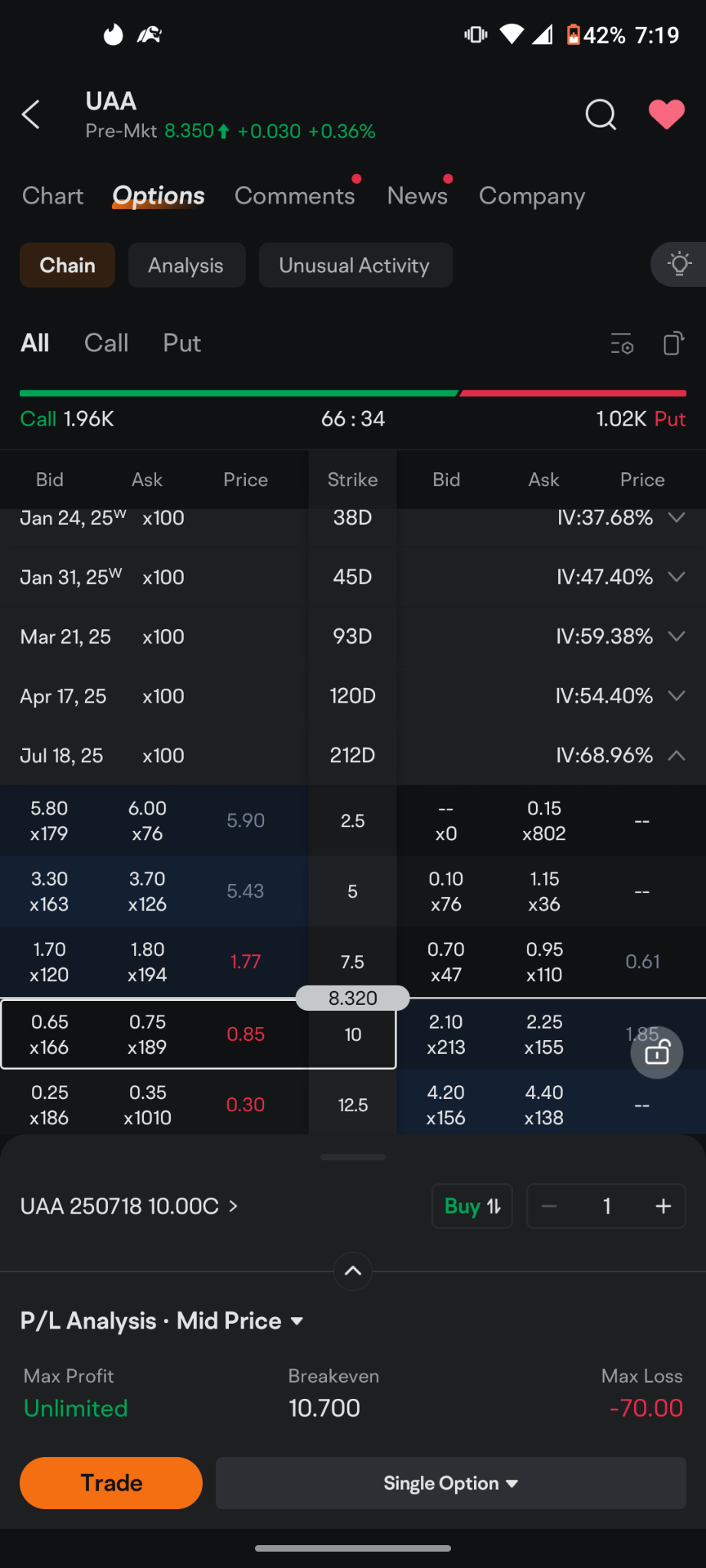

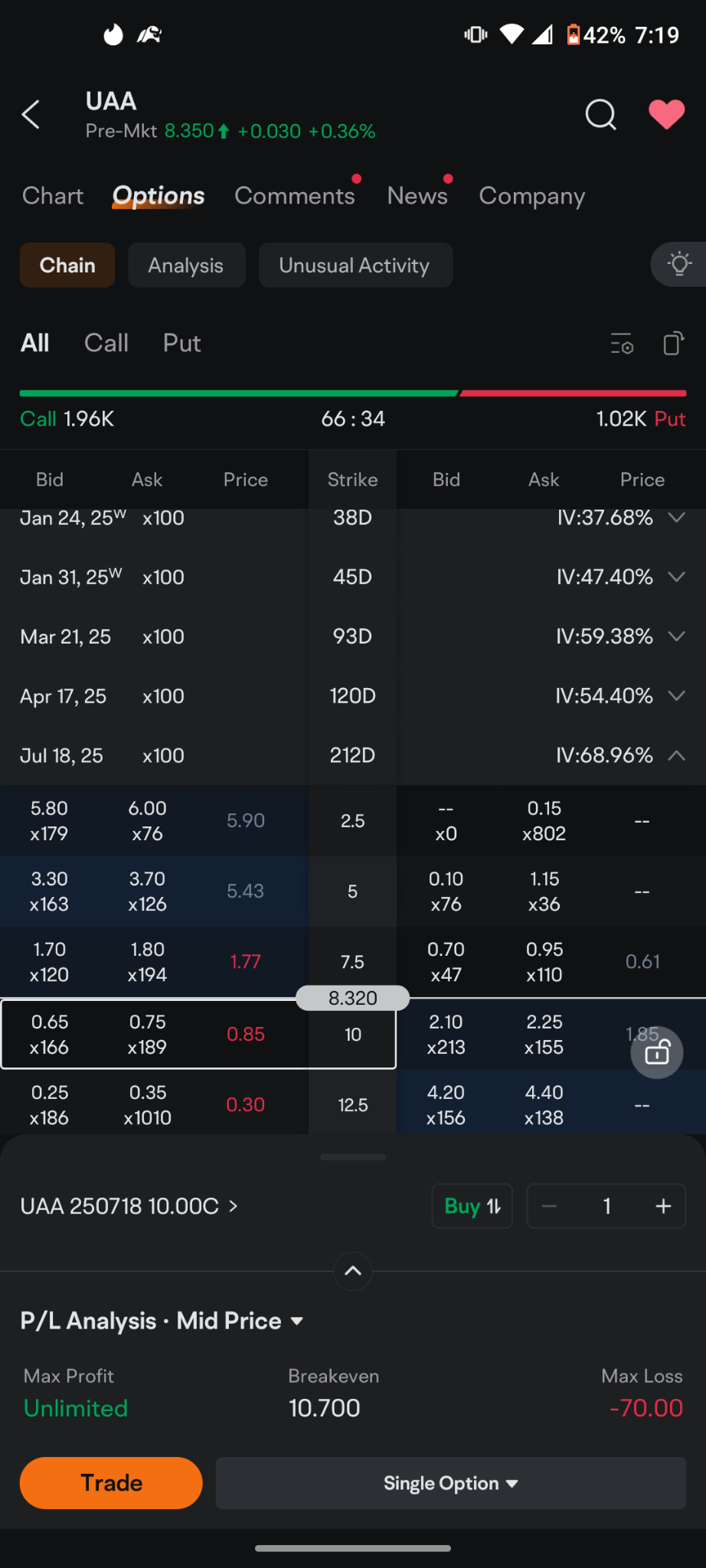

what I'm going to be looking at today is going out two quarters to July of next year and buying call options that are out of the money.

I'm going to be looking probably around the $10 strike and I'm going to be putting an order in and sitting on the bid, this is a fishing game at this point

you're not going to get your entire order filled in a day you might get a few contracts you might have to do the same order over a week to two week period of time frame in order to fill the number of contracts that you want to purchase.

however I like under armor products I like their shoes I like their clothing line their gym wear I'm one of the people that buys what they sell I don't buy Nike. I like the story that this analyst mentioned sell less charge more make money very simple to understand and this is going to be a story of are the margins increasing yes when will the company generate a profit so I'm going to go out 7 months to full quarters and roll the dice because if they generate a profit this stock is going to be a moon shot and will be back in favor again

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

10baggerbamm OP : filled 100 contracts July 12.50

.30

Hatt bosdike 10baggerbamm OP : Hey man, just wanted to ask u something bot related to this particular stock but the overall market. Today the Hindenburg Omen sell signal has triggered twice in a month which is very bearish signal. More than 50% of stocks in SPX break below 50EMA. Overall market breadth is getting weaker only the mag7 were holding it together from last few days. Do u see a correction in the market soon ? VIX has been creeping up too it broke above 15 today. What are your thoughts ? Please share thanks

10baggerbamm OP Hatt bosdike : well technically we've been having a correction 8 of the past 9 days the Dow has been down that goes back decades to find that many down days if you look at the mid cap and the Russell they've been headed down now for 3 weeks+-. so they're already is an underlying correction taking place and you can look at what they call the advanced decline there's more declines despite the NASDAQ hitting record highs than there are advances so all the people that say it's a broad-based rally in the market's broadening out they don't know what they're talking about. all the people that were pounding the table on mid cap small cap because interest rates are coming down they're getting their butts handed to them in the short term. do I think there's going to be a 1000 point down day like we experienced August 11th, it could happen because you don't really know what's going on in New Jersey and people posted if it's true might be fake I don't know but people posted paperwork from the nuclear regulatory commission saying that a vehicle that was transmitting nuclear waste had its cargo stolen. and this was in New Jersey about a week and a half ago. you got Joe kernan from CNBC yesterday morning saying is there a dirty bomb that's brought into this country is that what they're sniffing for radiation because that's one of the things drones can do is fly around and sniff and smell and find and locate. so God forbid something like that were to happen oh the market's going to get creamed will be down 5,000 to 10,000 points in the Dow..

Hatt bosdike 10baggerbamm OP : Hmm very interesting, thanks u bunch for your insight. Appreciate it.

10baggerbamm OP Hatt bosdike : so if you want to throw a dart at the worst case scenario if something's going to happen it's going to happen before January 20th so go out and buy a deep out of the money NASDAQ because that's where you're going to get the biggest correction put and go out 20% from where we are right now. it should be dirt cheap because everyone's bullish and make sure you cover through the inauguration of January 20th because if some evil person has something planned that's nefarious and really bad it's going to be prior to the 20th where Trump takes office. so buy a deep out of the money QQQ put at least 20% out of the money would be my suggestion

Hatt bosdike 10baggerbamm OP : Thank you

10baggerbamm OP Hatt bosdike : if there is a catastrophe and again this is a God forbid you don't want it to happen but if you wanted to roll the dice and throw a dart these are the contracts that I would buy.

I think the options contracts would be right around $25 maybe even a little bit more.. and this is a catastrophic worst case scenario

Hatt bosdike :

10baggerbamm OP Hatt bosdike : like I'm saying you don't want it to happen but if what Joe kernan was talking about that somebody brought in a dirty bomb into this country has really bad intentions and that's what these drones are sniffing for is radiation to try to find it the stock market will get decimated

Hatt bosdike : Yeah if its true than its very serious thing. I really hope these rumours are not true.