Unpacking Generative AI Adoption in Enterprises: Which Providers Are Best Positioned?

With the rapid ascent of generative artificial intelligence (Generative AI), AI technology continues to attract widespread and sustained market attention. Andreessen Horowitz (a16z), a venture capital firm renowned in the tech investment sphere, has recently published a study revealing how generative AI within enterprises is undergoing significant transformation.

The report, drawing on interviews with Fortune 500 companies and top business leaders, reveals a significant shift in their attitudes and investments towards GenAI over the past six months. Key transformations have been noted in resource allocation, modeling, and application scenarios.

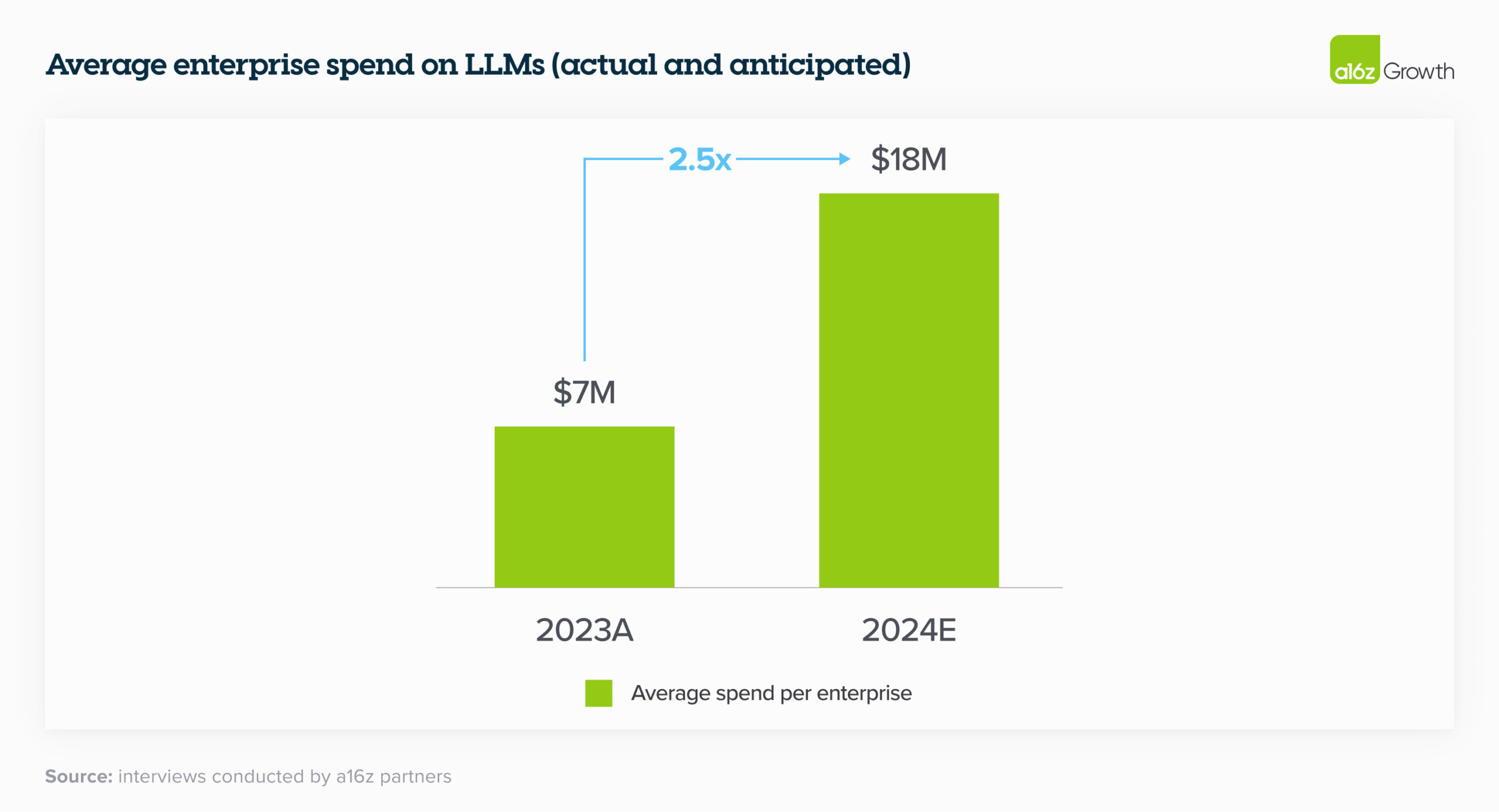

Surge in Budgets for Generative AI

Although company executives still have some concerns about using generative AI, they are increasing their budgets by almosttripled. In 2023, among the enterprises interviewed, the average expenditure on foundation model APIs, self-hosting, and fine-tuning models clocked in at $7 million. It is projected that by 2024, these enterprises will spend an average of $18 million on Large Language Models (LLMs), marking an approximate 2.5x increase, with some firms even quintupling their budgets.

Previously, a forecast report from IDC showed that enterprises would invest approximately $19.4 billion in GenAI by 2023. Thisfigure is expected to double by 2024 and reach $151.1 billion in 2027, with a compound annual growth rate (CAGR) of 86.1% over the forecast period of 2023-2027.

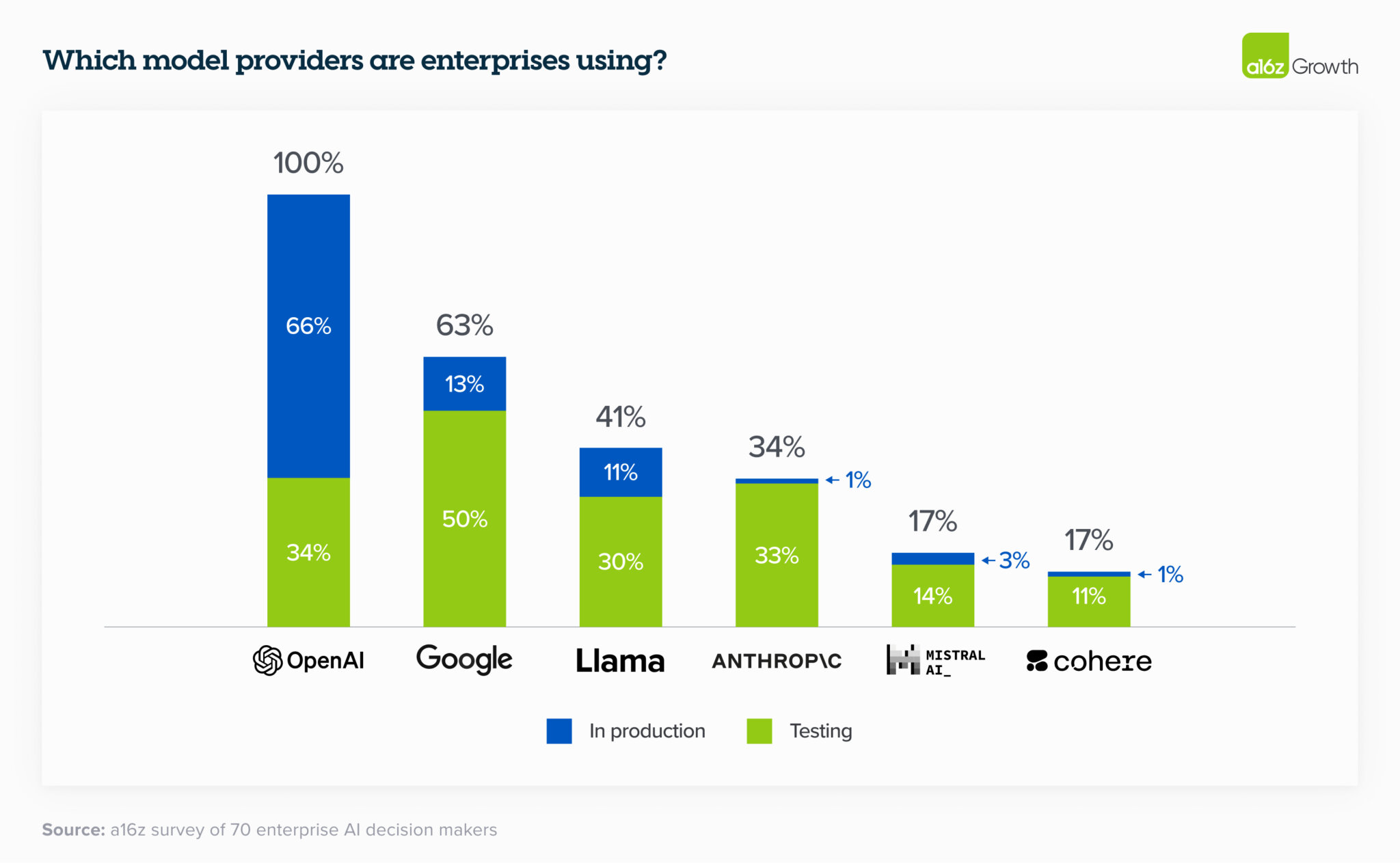

Embrace a Multi-Model Future with OpenAI Leading the Way

Six months ago, the majority of enterprises were only experimenting with a single model, often OpenAI's, or at most two. However, according to interviews conducted by a16z with enterprise leaders, they are now testing and in some cases using multiple models in production. This approach allows them to 1) customize to specific use cases based on performance, size, and cost, 2) avoid vendor lock-in and 3) quickly incorporate advancements in a rapidly evolving field.

Survey data indicates that the three most utilized models among enterprises currently hail from OpenAI, $Alphabet-C (GOOG.US)$, and LLaMA. OpenAI continues to dominate the market, while Google's large models are under testing by the highest number of companies—approximately 50%—suggesting a strong potential for future growth.

Cloud Continues to Drive Model Procurement Decisions

In 2023, many enterprises opted to procure models through their existing cloud service providers (CSPs), prioritizing security. Leaders expressed greater concern over the mishandling of their data by closed-source models than by their CSPs, while also seeking to bypass lengthy procurement processes. This trend persists to the present day, indicating a significant correlation between CSPs and preferred models.

Survey data reveals that of the 72% of enterprises accessing their model via an API, more than half employ the model hosted by their CSP. Thus, market players that offer both large language models and cloud services are poised to enjoy enhanced customer loyalty in the future. As noted in the report, users of $Microsoft (MSFT.US)$ Azure tend to favor OpenAI, while $Amazon (AMZN.US)$ and $Alphabet-C (GOOG.US)$ are poised to steer their investments toward large language models like Anthropic through their proprietary cloud service platforms.

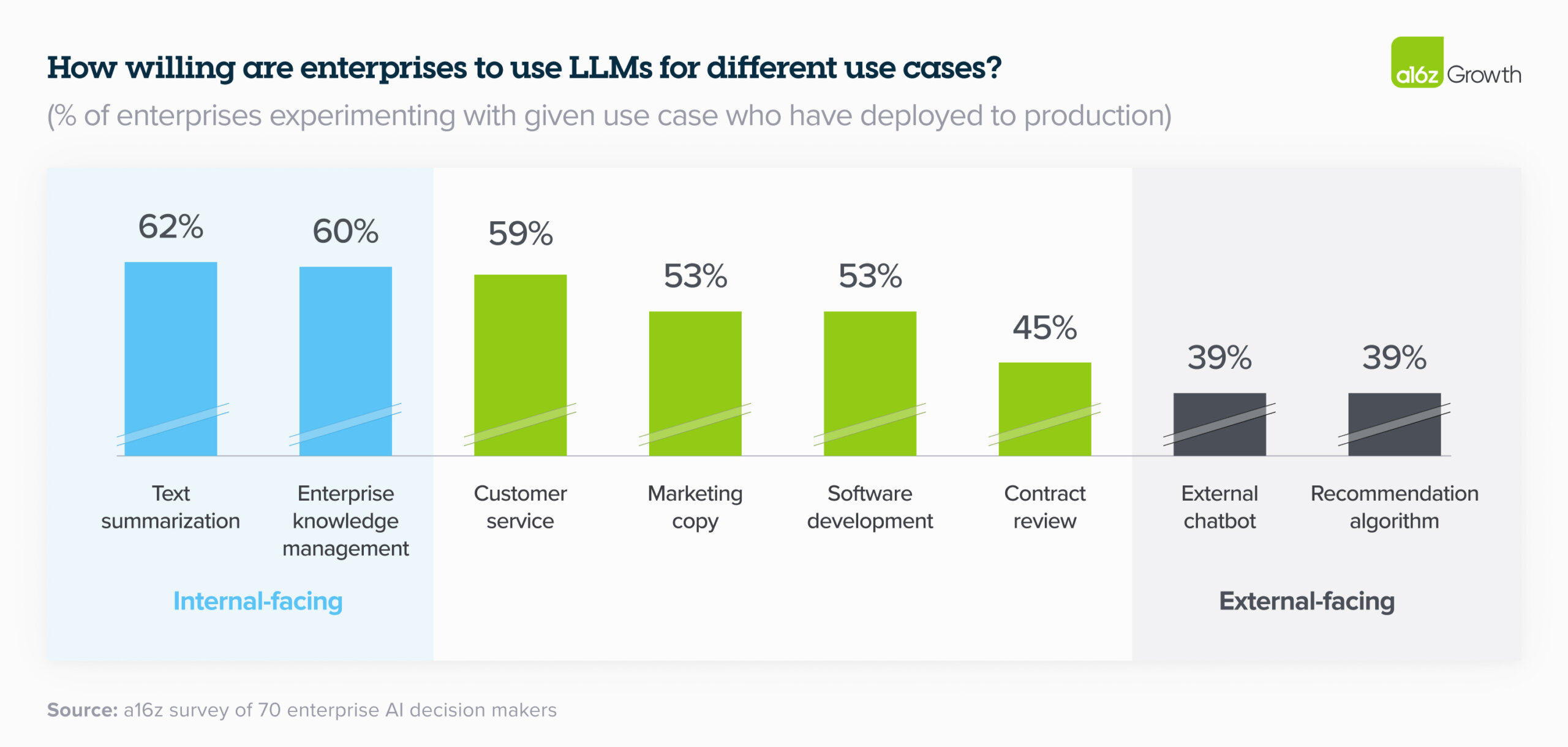

Firms Favor AI Internally, Cautious Externally

Beyond the aforementioned trends, when it comes to enterprise applications, businesses are showing enthusiasm for internal use cases, yet they approach external applications with greater caution. Last year's most common use cases centered around enhancing internal productivity or involved human interactions before reaching the customer, such as coding copilots, customer support, and marketing. These use cases continue to be prevalent in the enterprise sector in 2024.

Source: a16z, IDC

By Moomoo News Marina

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

tinybird :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)