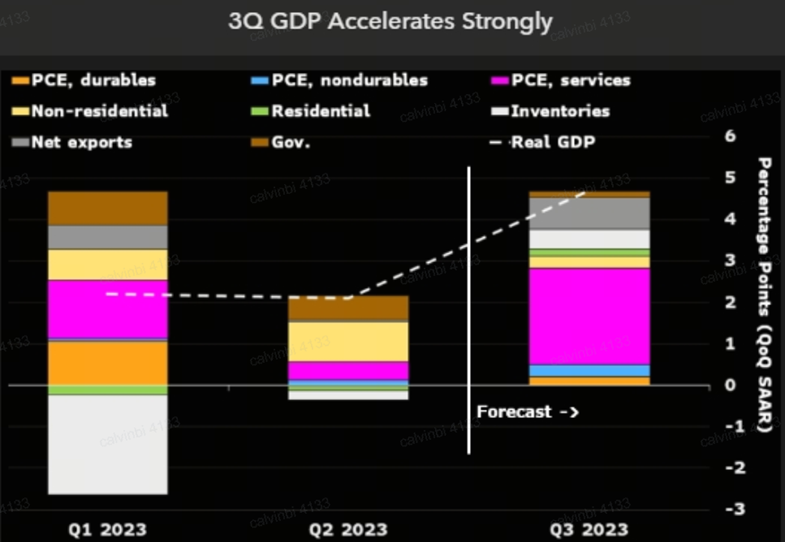

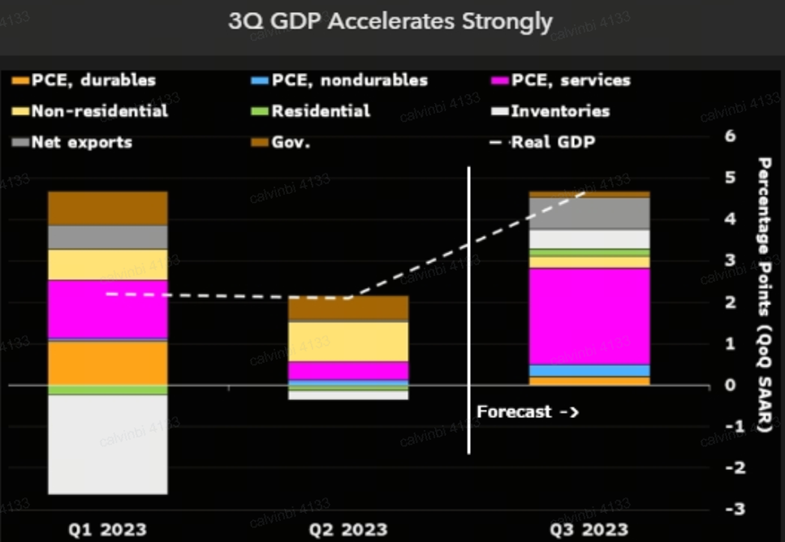

US GDP Preview: Resilient Consumption and Narrowing Trade Deficit to Drive Economic Reacceleration in Q3

The US economy has defied widespread predictions of a sharp slowdown. It's grown even faster.

Economists polled by Bloomberg predict 4.7% GDP in the third quarter. The analysts indicated the surge was driven by a frenzy of summer travel and entertainment.

■ Consumption

Among GDP components, consumption accounts for the largest proportion. US Census Bureau showed retail sales increased by 2.75%, 2.89%, and 3.75% respectively, from July to September. Food & drinking services and non-store retailers contributed major increases.

■ Investment

The investment includes housing sector investment, non-residential investment, and public investment. The Census Bureau releases data of construction spending every month. The latest data showed that although residential construction fell 3% in August, manufacturing investment grew by 65.9%, completely offsetting the drag of residential investment. In terms of public investment, under the influence of Bidenomics, public construction spending has experienced double-digit growth.

■ Trade balance

Since the decline in imports is greater than the decline in exports, the trade deficit will further reduce in the third quarter and therefore contribute to GDP growth.

Commodity prices have dropped significantly compared to last year, which means that the import and export of materials and grain have subsequently declined.

Due to the trend of nearshoring in recent years, US imports from China have declined further, and Mexico has filled the gap. Bloomberg forecasted a narrowing trade deficit and a modest build-up in inventories added 1.4% to the overall GDP growth.

■ Is economic boom sustainable?

Bloomberg Economist Eliza Winger said the economic pulse might be unsustainable and expected consumption to slow in 4Q, given elevated inflation, high interest rates, and the resumption of student loan repayments.

It has become a cliché that economists continue to predict the coming of a recession or slowdown, while economic data always show the opposite signal. The US economy may have formed a kind of inertia. When output increases and income increases, people invest more, thus forming a spiral.

As Powell has always pointed out, it takes time for the tightening cycle to hit the real economy. The economic boom is in sharp contrast to the hardship of ordinary people's lives, and this situation is likely to continue until the recession hits.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Winnerspayout : WInnerspayout It’s been hard I’ve feel like I’ve failed everyone . I am so cold as it snows an tired . I just want to thank you all for your good heart prosperity it’s the season to give in line I hope to be at the place where I get to revive my blessing .

nkAmerica : Ku

sister,

JMI MA

SpyderCall : This is a very good detailed breakdown. I appreciate the hard work for sure. You are making it easy for us