Capitalizing on Investment Opportunities with Trump 2.0: A Trading Calendar

Since Donald Trump's election win on Nov. 6, the "Trump trade" has accelerated, driving U.S. $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ to 4.5%, the dollar index past 108, $Bitcoin (BTC.CC)$ near $100,000, and gold prices lower.

Analysts predict Trump's second-term policies could echo his first, but with a swifter pace and more assertive domestic and foreign agendas. Expectations are for a stronger application of the "America First" approach with stricter immigration and trade measures.

Pre-Inauguration (Now - Jan. 20, 2025): Key Appointments in Focus

Trump is moving faster than in 2016 to form his cabinet. On Friday, he named Scott Bessent as Treasury Secretary. Bessent, 62, founded the global macro hedge fund Key Square Group and is a former CIO at Soros Fund Management.

The Treasury Secretary, one of the "Big Four" cabinet roles, advises the President on economic and financial issues, manages the Financial Stability Oversight Council, implements sanctions, and oversees national debt. Trump's plans for tax cuts and a strong dollar hinge on Treasury's execution.

On Tuesday, Trump appointed Howard Lutnick as Commerce Secretary. Lutnick, CEO of Cantor Fitzgerald, has been a key economic adviser to Trump and heads his transition team. Trump said on Truth Social that Lutnick "will lead our tariff and trade agenda, with additional responsibility for the Office of the U.S. Trade Representative."

Federal Reserve Chair Jerome Powell's future is also under watch. Powell's term runs until May 2026, and he has stated he won't step down voluntarily, while Trump cannot legally remove him.

Post-Inauguration: Policy Rollout and Impact

1.Phase One (Jan. 20, 2025 - Q2 2025): Swift immigration and deregulation moves expected

Post-inauguration, focus shifts to the "First 100 Days" and possible policy and executive order announcements.

Immigration reforms can be enacted quickly due to the President's broad discretion. In February, Trump is likely to deliver his State of the Union address outlining legislative priorities. By March-April, the 2025 fiscal budget is expected, potentially detailing infrastructure and tax plans.

Prison operators like $The GEO Group Inc (GEO.US)$ and $CoreCivic, Inc. (CXW.US)$ may gain from strict immigration policies.

Deregulation could benefit sectors such as finance, energy, and cryptocurrencies.

During his campaign, Donald Trump endorsed Bitcoin, vowing to make the US the first nation to adopt it as a strategic reserve asset. He promised to replace the current SEC Chair, who is seen as unfriendly to the crypto sector, establish a Presidential Advisory Committee on Bitcoin and cryptocurrencies, and boost electricity supply for Bitcoin mining.

Following Trump's election, investors are expecting crypto-friendly legislation from his administration. Bloomberg reported Wednesday that Trump's team is considering creating a dedicated cryptocurrency policy role at the White House and is assessing candidates for the position.

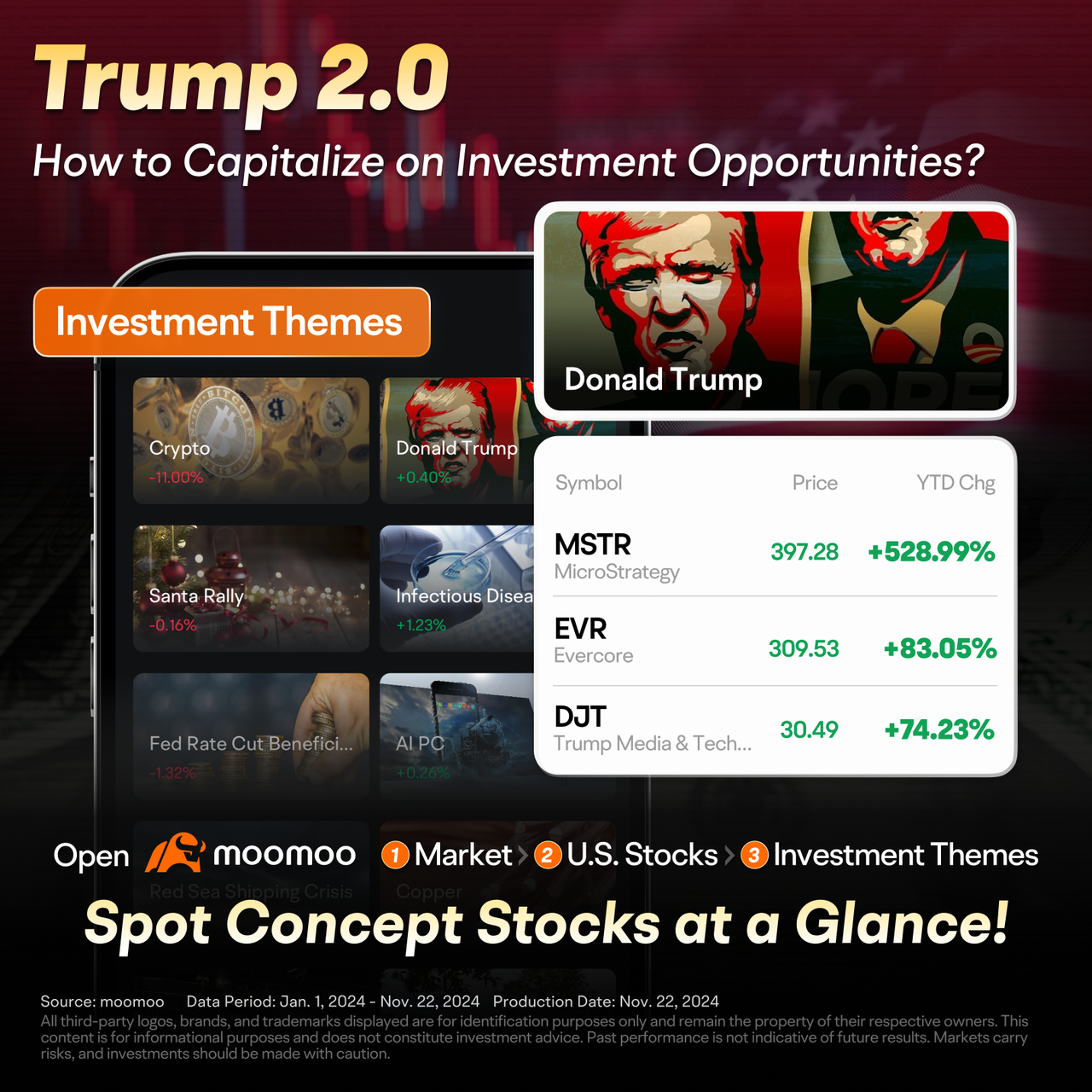

Related stocks include financial firms $JPMorgan (JPM.US)$, $Bank of America (BAC.US)$, $Wells Fargo & Co (WFC.US)$, $Lazard (LAZ.US)$, $Goldman Sachs (GS.US)$, $Morgan Stanley (MS.US)$, $Evercore (EVR.US)$; energy giants $Chevron (CVX.US)$, $Exxon Mobil (XOM.US)$, $ConocoPhillips (COP.US)$; and Bitcoin-holding firms like $MicroStrategy (MSTR.US)$ and miners $Riot Platforms (RIOT.US)$, $MARA Holdings (MARA.US)$.

2.Phase Two (Q2 2025 - End of 2026): Emphasis on tax cuts and tariffs.

Trump's economic agenda focuses on "tax cuts + tariffs." The tax cut bill is expected to pass in 2025, needing only a simple Senate majority (51 votes), while some tariff measures could be immediate.

– Tax Cuts

Trump aims to cut corporate tax rates from 21% to 15%, potentially boosting corporate profits and benefiting U.S. equities over the medium to long term.

Goldman Sachs suggests Trump's tax cuts could increase S&P 500 earnings by over 20% in the next two years.

– Tariffs

A central Trump 2.0 proposal is universal tariffs on all imports. Market concerns revolve around tariffs potentially driving inflation.

Goldman Sachs forecasts tariff hikes could raise the effective tariff rate by 3-4 percentage points. A 1% uptick in effective tariffs could raise the core PCE price index by 0.1%. A 10% universal tariff might push inflation slightly above 3%.

AllianceBernstein's Chief Market Strategist Orlando predicts the tax cut plan could drive the S&P 500 to 7,500 by 2026, noting that stock market benefits from tax cuts may take years to fully materialize.

Companies not producing physical goods, such as SaaS, internet, social media, digital tech, and communication firms, are less concerned about tariffs.

Clayton Gardner, Co-CEO of Titan, believes low-margin, smaller international footprint cyclical firms will gain most from Trump's policies, facing minimal tariff impact while enjoying lower corporate taxes. Relevant stocks include $The Kroger (KR.US)$, $Dollar General (DG.US)$, $Stanley Black & Decker (SWK.US)$, $Southwest Airlines (LUV.US)$, $Builders FirstSource (BLDR.US)$.

Notably, relying solely on Trump's 2024 campaign promises may be insufficient, as not all were fulfilled previously, with some inherently challenging. Even if Trump intends to deliver on these promises, the timing and actual impact of policy implementation remain uncertain.

Source: WSJ, Bloomberg, Investing, and The New York Times

by moomoo News Olivia

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment