US Stocks Suffer Consecutive Drops: What Factors Are Weighing on Markets Apart from Middle East Tensions?

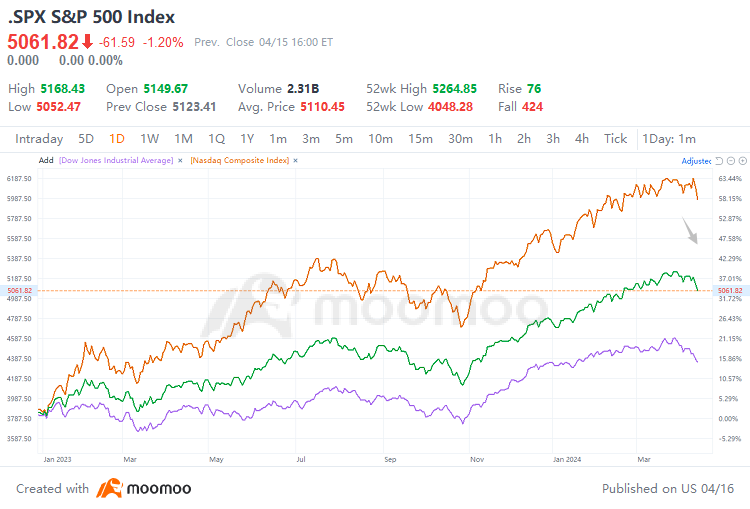

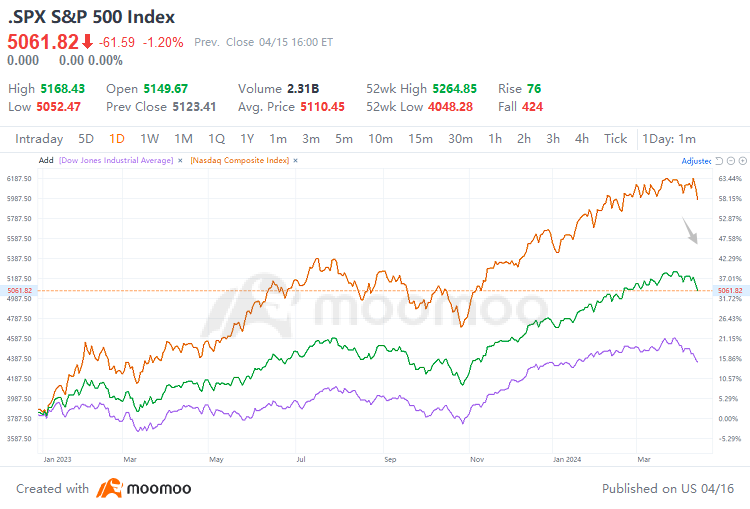

The escalating risk of geopolitical conflict in the Middle East has once again hit the market on Monday. US Treasury yields saw a sharp rise with the benchmark $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ touching its highest level in five months. Risk assets plummeted with the $Nasdaq Composite Index (.IXIC.US)$ falling sharply by 1.8%, marking its largest decline in two months. The $S&P 500 Index (.SPX.US)$ fell 2.64% over the past two trading days, marking its largest two-day drop since the collapse of Silicon Valley Bank. The $Dow Jones Industrial Average (.DJI.US)$ fell for six consecutive days. $Tesla (TSLA.US)$ fell 5.6% to an 11-month low, leading the decline of the "Magnificent Seven." Bitcoin took a dive and dropped below $63,000.

Kenny Polcari, the founder and CEO of Kace Capital Advisors said:

"All the geopolitical stuff is going to cause tension and anxiety in the market, the realization that rates are not going down anytime soon has got to be finally hitting home, that's what the bond market is telling you, that rates are going to go higher."

As investors focus on the increasingly intricate geopolitical landscape and the fading prospects of interest rate cuts, analysts point out that the headwinds facing the market may be more than just these factors.

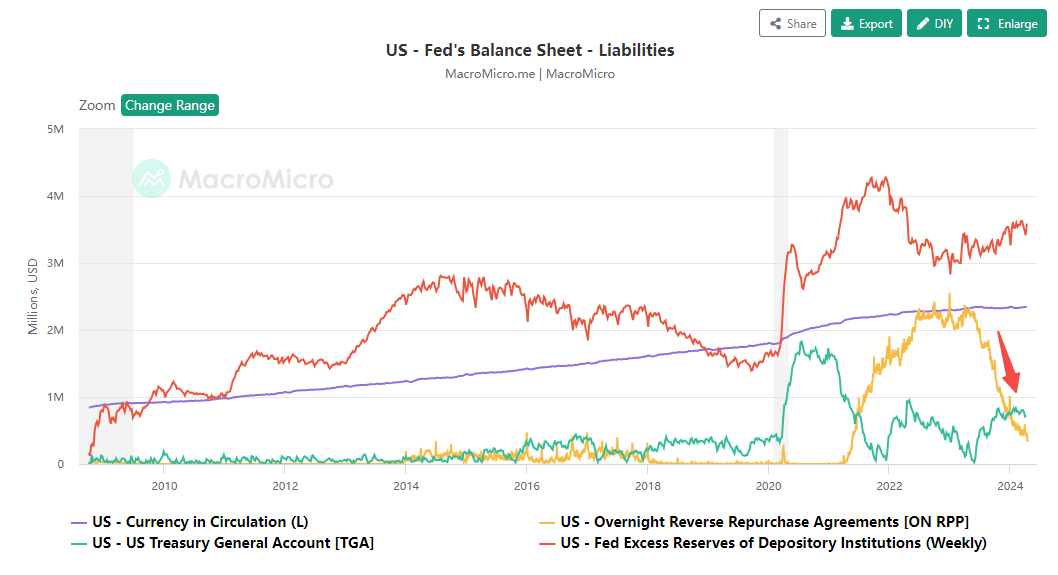

The Federal Reserve's reverse repo (RRP) facility has been deemed a gauge for excess liquidity, and its rapid decrease has offset the pressure from the Fed to shrink its balance sheet in 2023, releasing liquidity and providing strong support for the US stock market's rise at that time.

Now, the market liquidity barometer is flashing warning signs. According to the Fed's latest data, RRP usage plummeted from $407 billion to $327 billion from the previous trading day, marking the first time since May 2021 that the RRP usage has fallen below the $400 billion threshold, triggering discussions of a liquidity crisis. Some are concerned about a repeat of the "liquidity crunch" seen in September 2019, where the Fed miscalculated the necessary bank reserves to maintain system liquidity, leading to chaos in the short-term financing market and a spike in funding rates to 10%.

It should be noted that this time appears to be different, as the Fed has been acutely aware of these liquidity risks and has clearly stated its intention to slow down its QT.The market is awaiting more details on the Fed's slowdown plan for QT at the May FOMC meeting. In addition, the Standing Repo Facility (SRF) and the Fed's Foreign and International Monetary Authorities (FIMA) repo facility will also act as backstops to prevent any sudden liquidity shock.

Bank of America analyst Benjamin Bowler has issued a warning in his latest research, indicating that the US stock market is very close to triggering stop-losses among the commodity trading advisor (CTA). According to his monitoring model, the S&P 500 index is only 90 basis points away from the stop-loss level of CTA strategies. If stock prices continue to fall, CTAs will be forced to sell stocks to cut losses, which will further exacerbate market panic and create a vicious cycle.

Even if CTA does not reach the stop-loss level, recent days of consecutive declines and significant volatility in the stock market may also prompt Equity Vol Control strategy to dramatically reduce equity exposure, and the potential for leveraged ETFs and inverse ETFs to make significant adjustments will further release selling pressure. Data shows that the $CBOE Volatility S&P 500 Index (.VIX.US)$, known as the fear gauge, has surged to nearly 20, skyrocketing nearly 60% in less than a month.

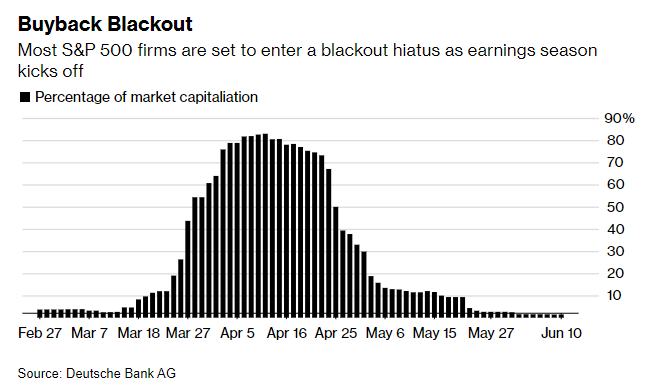

In general, companies can support their stock prices through stock buybacks. However, this important support is currently being put on hold due to pre-earnings blackouts. According to Deutsche Bank, over 80% of the S&P 500 index components are in a blackout period this week for stock buybacks. This lack of stable buying sources may exacerbate market volatility.

In addition to companies themselves, buyers who enter the market on dips are also filled with uncertainty. Recent market declines may cause this group to lack confidence in the market and hesitate to enter, or even trigger a new wave of selling.

The steadfast belief in AI had strongly supported the market's strong performance throughout the year 2023 and the first quarter of this year. However, this excitement is now cooling down. In general, a stock that falls more than 10% from its high is considered to enter a correction phase. After $Tesla (TSLA.US)$ and $Apple (AAPL.US)$ both entered correction phases, last week the AI darling, $NVIDIA (NVDA.US)$ also followed suit. At the same time, as the US Department of Justice and the European Union launched antitrust investigations into large tech stocks, including Apple, Google, and Meta, potential regulatory risks have also made investors cautious.

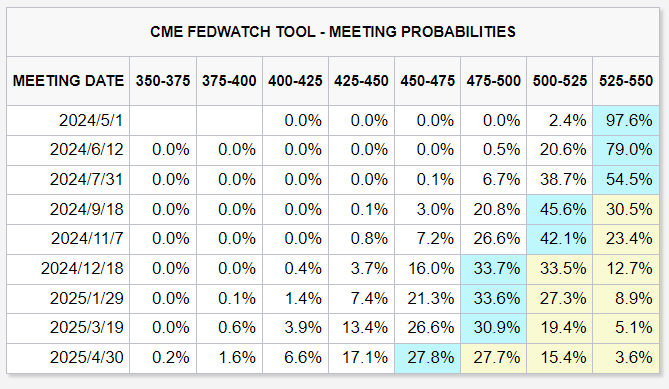

The US retail sales figures for March, released on Monday, showed a monthly increase of 0.7%, once again exceeding market expectations of 0.4%, and the previous month's value was also revised up from 0.6% to 0.9%. The strong retail sales data indicates that consumer spending remains resilient, further weakening investors' confidence in the Federal Reserve's decision to cut interest rates this year.The market is pricing in the expectation of a later interest rate cut. The CME FedWatch tool shows that futures traders now expect the earliest possible rate cut to occur in September, with only about a 70% chance of a 25bp cut at least.

Wall Street is even discussing the risk of a rate hike. According to the latest analysis by Jonathan Pingle and Bhanu Baweja of Credit Suisse, if the US economy continues to expand with resilience and inflation remains stagnant at 2.5% or higher, the federal funds rate could reach 6.5% by mid-next year.

Considering the ongoing disturbances caused by a series of unfavorable factors, including geopolitical risks, uncertainty in Federal Reserve monetary policy, and intensified market selling pressure, the performance of this earnings season will be crucial for the market rebound. This week, top banks such as Goldman Sachs, Morgan Stanley, and Bank of America, as well as tech giants such as ASML, TSMC, and Netflix, will release their earnings reports. Investors are eagerly anticipating seeing robust company profitability inject confidence into the market.

Source: Bloomberg, Financial Times, Alliance Bernstein, Reuters, moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

wiseone : Good bye any remote chance of a base rate drop of any size.

KnightRider : and that's pretty

KnightRider : I'm getting my stuff together I'm very sorry but I will log in