Wall Street Is Cautious on Gold Prices. Is the Gold Rally Over?

Deutsche Bank analyst Michael Hsueh released a report stating that two indicators in the gold market - China's SGE premium and spot premium relative to fair value - may have peaked, indicating that gold will experience a period of oscillation in the future, providing investors with opportunities for range trading.

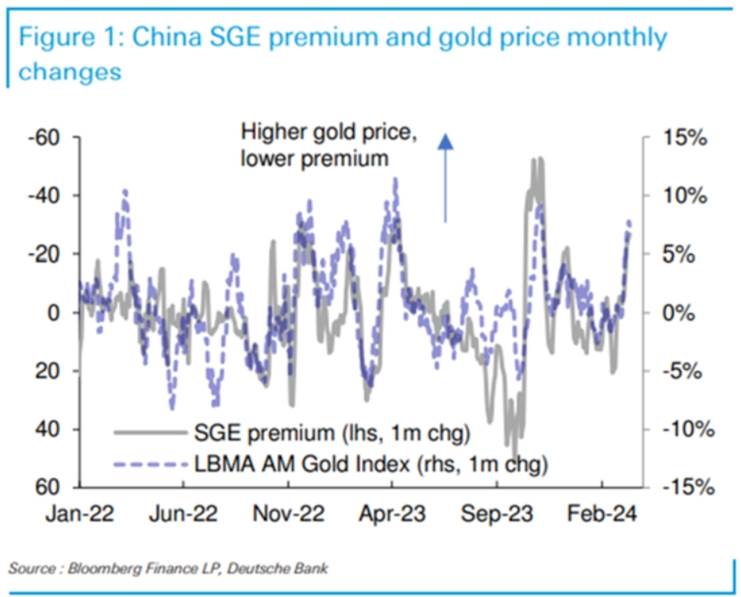

■ The China SGE indicator shows demand for physical gold weakening

Firstly, there is the China SGE (Shanghai Gold Exchange) premium, which has dropped from $68 per ounce (5-day average) last month to the current $27. 30-day Average in February has also dropped by $27 MoM.

The China SGE premium indicator reflects the strength of demand for gold in the Chinese market. The premium refers to the difference between the gold price of China SGE and the international market price. When the premium is high, it usually means that Chinese buyers are willing to pay higher prices for gold, which is usually associated with strong gold demand. When the premium falls, it typically indicates that Chinese buyers are not inclined to pay higher prices for gold, which is often associated with weak gold demand.

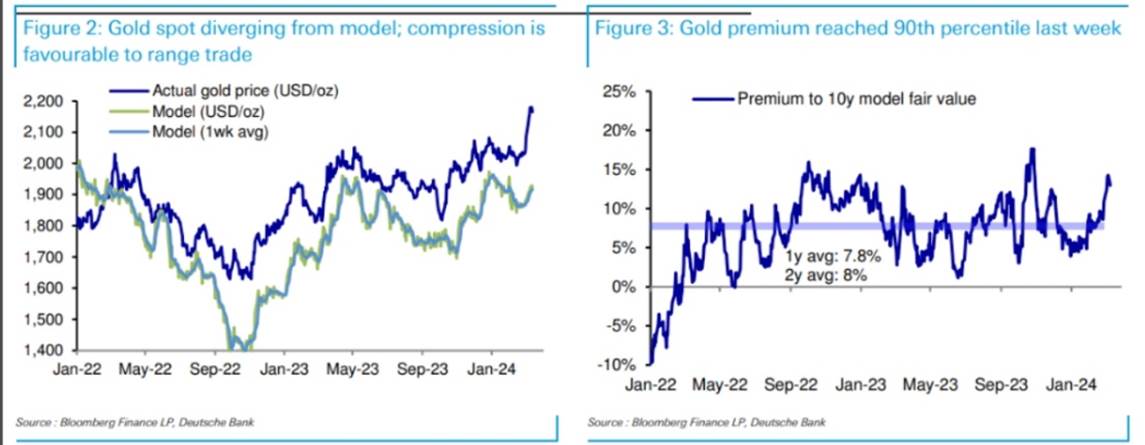

■ Fair value model shows gold is more expensive

The second is the premium indicator of gold spot relative to fair value. This indicator measures the gap between the spot price of gold and the fair value estimated by the model. When the spot price is higher than the fair value estimated by the model, it indicates that the market may be overheated and investors may be too optimistic.

According to Deutsche Bank's report, the spot gold price has deviated upward from the model fair value, and the gap between the two reached 90 percentiles. This means that statistically, only 10% of the time will this gap be as large as it is now. This high premium may indicate that the market's expectations for future gold prices are too optimistic, which may cause prices to fall back.

■ The persistence of inflation and rising bond rates may put pressure on gold prices

Several pieces of economic data last week showed that the economy is still overheating. Both CPI and PPI were higher than market expectations. Subsequently, yields on U.S. government bonds surged to their highest in over a week, with the 10-year note reaching 4.29%, as the inflation indicators dampened expectations for Federal Reserve rate cuts. Concerns over inflation were reignited by climbing oil prices, leading to an increase in intermediate- and long-term bond yields by up to 10 basis points.

The rise in bond rates offers investors a competing source of returns, making bonds more attractive and potentially diverting interest away from gold as an investment.

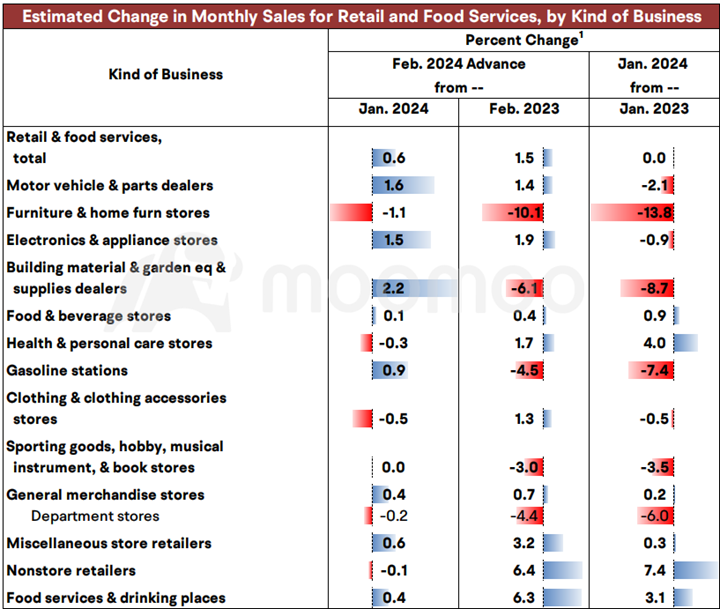

Meanwhile, retail sales rose 0.6% in February from the previous month, according to Census Bureau data. Building materials and garden equipment led the gains by category, rising 2.2%. Sales gained 1.6% at motor vehicle and parts dealers, while electronics and appliance stores added 1.5%.

■ How will the dot plots of the March FOMC meeting affect gold prices?

Investors will closely monitor the forthcoming dot plot update from the Federal Open Market Committee (FOMC) meeting, along with any insights on the timing of interest rate cuts that Fed Chair Jerome Powell might offer. The forthcoming Summary of Economic Projections could reveal that a number of FOMC members may increase their estimates of the neutral interest rate, a topic that at least five participants addressed in the period between meetings.

A Financial Times survey of academic economists indicates that the Federal Reserve may need to maintain elevated interest rates for a more extended period than both markets and central bankers currently expect. According to the poll, over two-thirds of the respondents believe that the Fed will enact two or fewer rate reductions this year as it aims to conquer the final stages of its fight against inflation. Opinions on when the first rate cut will occur were evenly divided, with July and September being the most predicted months.

Certain members of the rate-setting committee, such as Raphael Bostic, the president of the Federal Reserve Bank of Atlanta, have expressed a preference for fewer rate cuts than the widely anticipated three reductions.

If the number of interest rate cuts by the Federal Reserve this year falls below expectations, it could exert downward pressure on gold prices. Investors often look to gold as a safe haven asset during times of economic uncertainty and when they expect monetary policy to be very accommodative, which often involves low-interest rates. Therefore, a deviation from expected monetary easing could lead to a reassessment of gold's role in investment portfolios, potentially leading to a sell-off in the gold market and a decrease in its price.

Source: Financial Times, US Census Bureau

By Moomoo US Calvin

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

101504720 : Funny![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

70603379 : 1015

Chase Carlin : Turn off notification

Johnny Tradewell : Hi all, I am of opinion that Gold is never out dated. Histroy says everything. China Russia India stocking up on Gold. Check the US reserves portfolio. You will find your answers.