ℹ️ What exactly is the market expecting regarding tomorrow night's FOMC rate cut?

➡️ Stocks (and maybe bonds and FX) were energized late last week by various reports about the prospect that the FOMC would abandon its gradualism and begin an easing cycle with a -50 basis point cut to its policy rate target on Wednesday night, instead of demurring with a -25 basis point rate cut. (See WSJ article from last Friday here: The Fed's Interest-Rate Cut Debate: How Big Should it Be? - WSJ)

➡️ The hope for a -50 basis point cut from the Fed is still alive and well on Monday, with the implied probability of a -50 basis point cut having risen to more than 50% this morning, from 40% at the close on Friday.

➡️ Case for a -50 basis point rate cut: worsening labour-market conditions, decline in median income growth expectations over the next five years, manufacturing's leading indicators (such as new orders) are softening and tightening consumer credit

➡️ Case for a -25 basis point rate cut: a focus less on trends but actual levels/numbers. All the above-mentioned indicators have yet to reach a level historically association with recession.

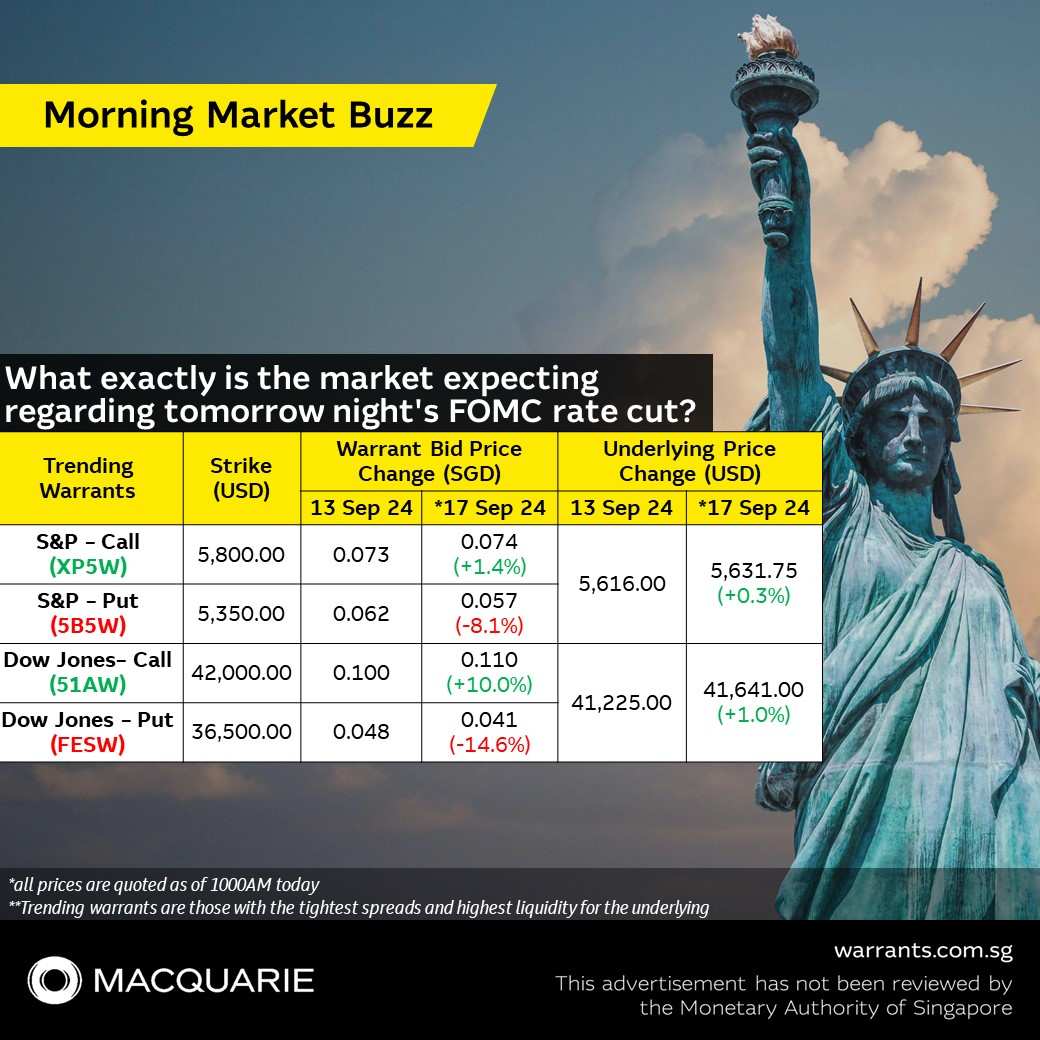

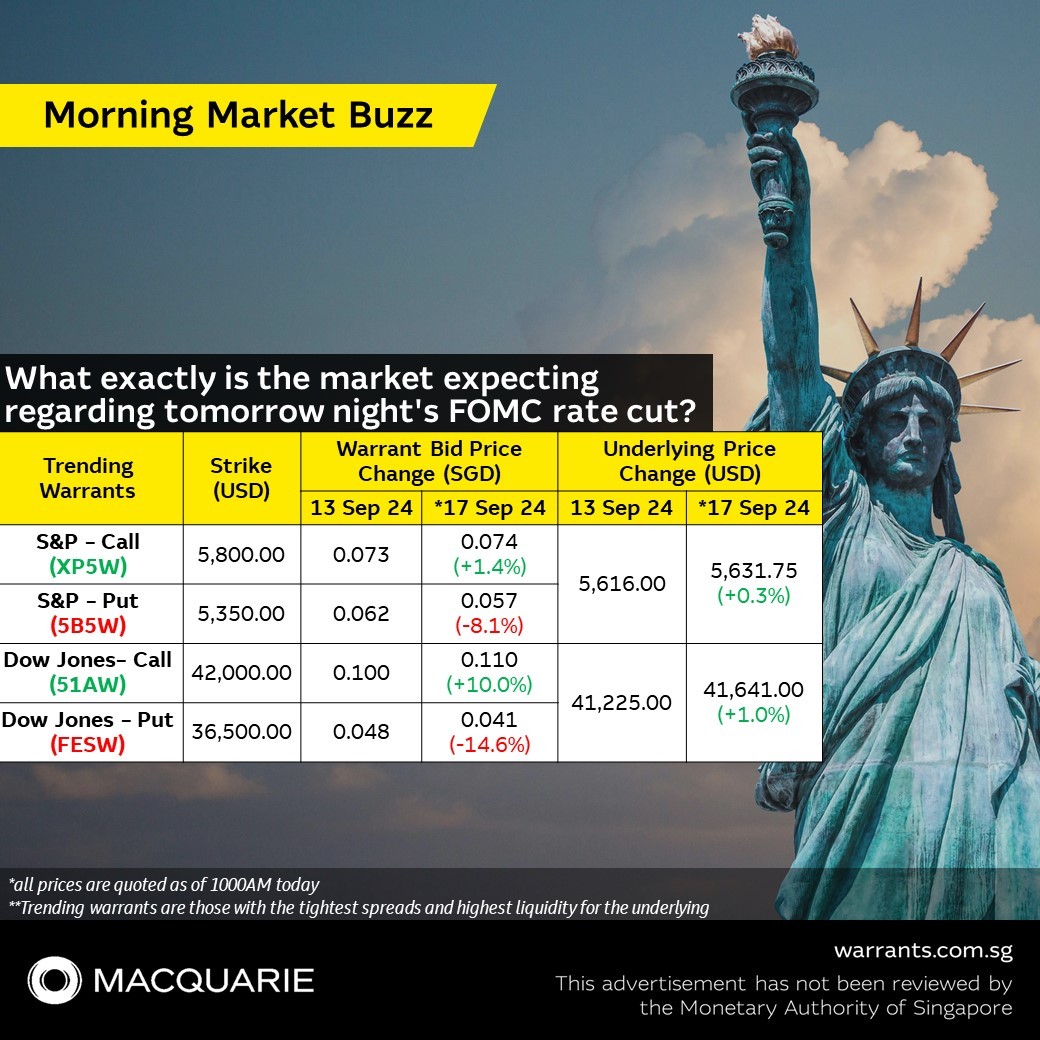

➡️ Investors who believe the US market may see a volatile move pre or post-Wednesday night's FOMC and wish to gain leveraged exposure may consider Macquarie's US index warrants - which cost no more than 15 cents and moves in greater percentages than the indices.

➡️ As an example, with the Dow Jones up 1% week to date to 41,641 (as of 10AM this morning), Macquarie's trending Dow Jones call warrant 51AW (https://warrants.com.sg/tools/warrantterms/51AW) is up 10% to SGD 0.110, while trending put warrant is down 14.6% to SGD 0.041

🔎 Read more: https://tinyurl.com/MMB17Sep24

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment