What Investors Need to Know Ahead of Broadcom's Upcoming Stock Split

$Broadcom (AVGO.US)$ shares have risen over 20% in the past month, significantly outperforming the $S&P 500 Index (.SPX.US)$'s 3.63% return. The stock has attracted considerable investor interest due to its expanding capabilities in the AI sector and a 10-for-1 stock split.

Broadcom is capitalizing on the increasing demand for AI infrastructure and generative AI deployment, with its solutions meeting the needs of growing AI workloads and fast networking in data centers. In the second quarter of fiscal 2024, Broadcom doubled its shipments of PCI Express switches and NICs for AI backend infrastructure. AI sales surged by 280% year-over-year and are projected to exceed $11 billion for fiscal 2024.

Broadcom's Stock Split on July 12: What to Expect

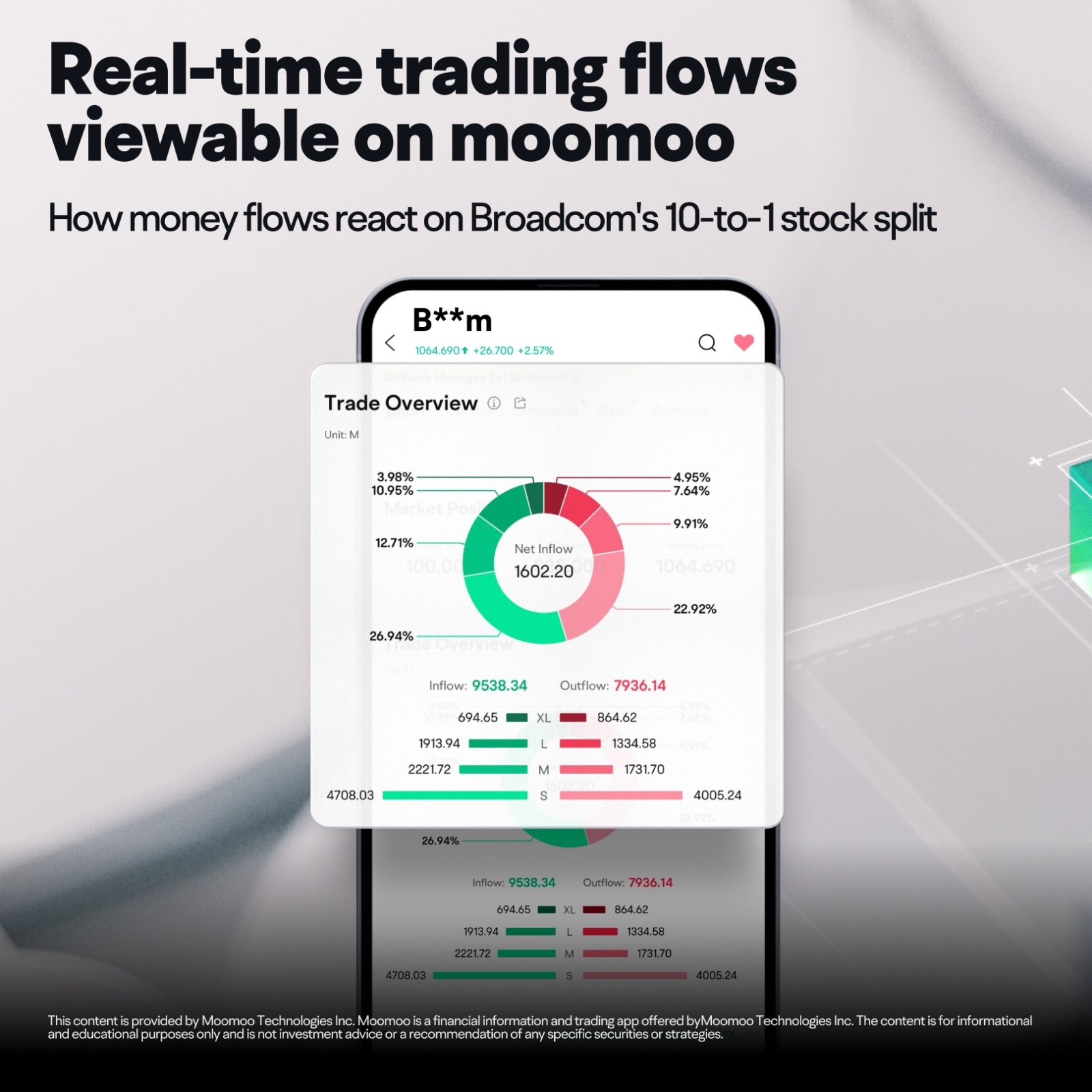

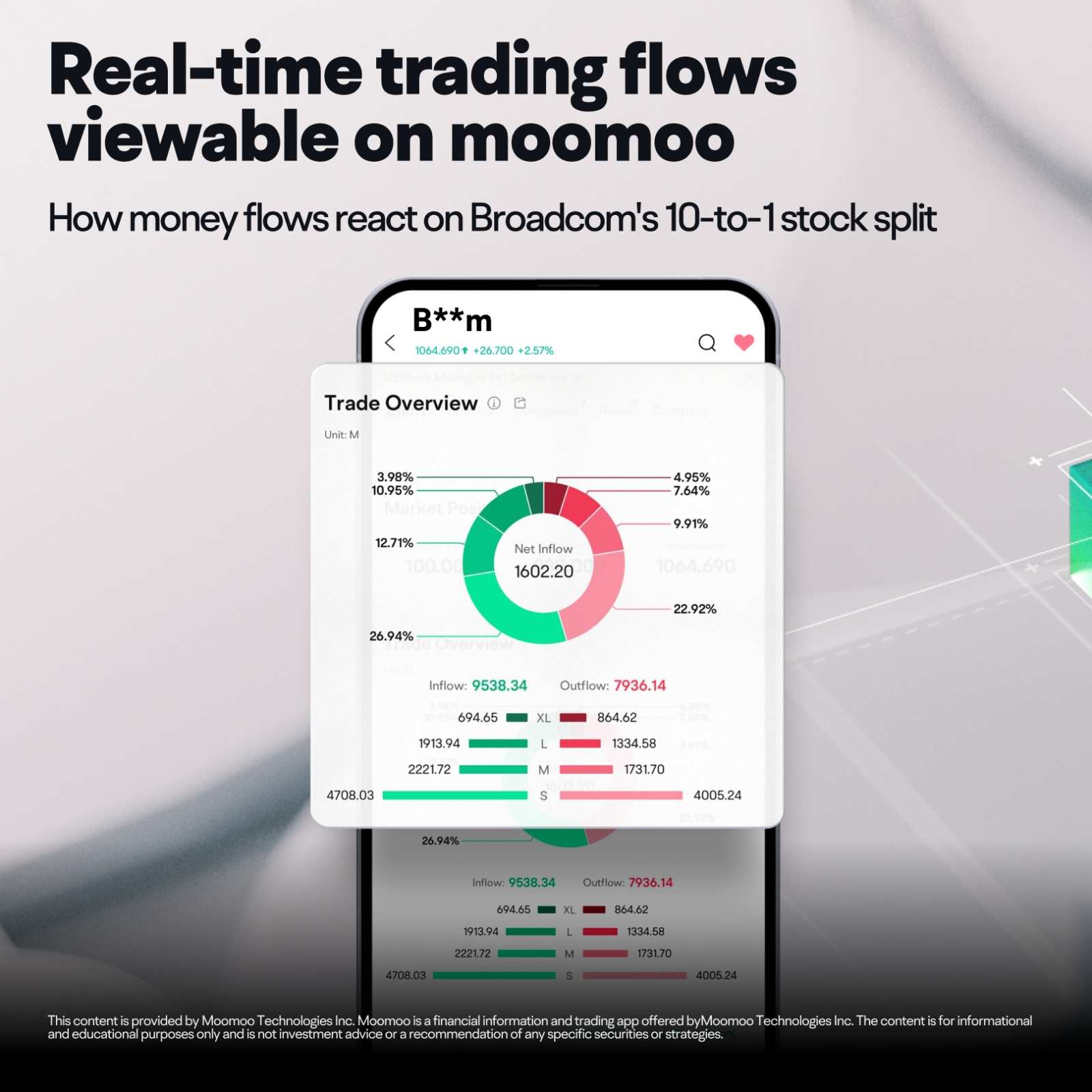

Broadcom's 10-for-1 stock split is set for later this week, following in the footsteps of $NVIDIA (NVDA.US)$ and $Chipotle Mexican Grill (CMG.US)$. The split aims to make shares more accessible by lowering individual share prices, which have soared about 500% over five years to over $1,700. This move is partially due to high demand from AI customers.

Stock splits generally occur after significant price increases to attract more investors by reducing the per-share price. Broadcom shareholders as of July 11 will receive nine additional shares for every one held, with the new shares issued after the market closes on July 12. The stock will begin trading at the post-split price, approximately $170, on July 15.

Broadcom announced the split on June 12, and its stock has since gained about 15%. However, stock splits don't change a company's fundamentals, such as valuation or market value. Broadcom's recent stock performance is tied to its growth and future prospects, including a 43% revenue increase in the recent quarter and expected full-year revenue growth of 42%. The stock split is a positive move but won't inherently make Broadcom a buy or sell. It's important for investors to focus on the company's underlying growth and prospects rather than the mechanical operation of the split itself.

What Powers AVGO Stock

Broadcom's robust portfolio includes foundational technologies and advanced packaging capabilities for custom AI accelerators, expanding its presence in next-gen AI infrastructure. Key offerings include the Bailly 51.2 Tbps co-packaged optics Ethernet switch, integrating cutting-edge silicon photonics with the StrataXGS Tomahawk 5 switch chip, providing significant performance boosts for AI and machine learning infrastructure.

Broadcom also offers high-speed interconnect technologies like VCSEL, EML, and CW laser, and the industry's first end-to-end PCIe connectivity portfolio with PCIe Gen5/Gen6 retimers and PEX series switches. Its Sian BCM85822 800G PAM-4 DSP PHY solution and Jericho3-AI fabric address large-scale AI workload demands, while the 400G PCIe Gen 5.0 Ethernet adapters, utilizing 5 nm process technology, enhance data center connectivity and efficiency.

The increasing demand for higher data transfer speeds in AI networks is met by Broadcom's third-generation RoCE pipeline, low-latency congestion control, and innovative telemetry features, making these adapters ideal for high-bandwidth AI environments. This portfolio supports the massive data processing needs of training large language models and scalable, high-bandwidth connectivity for larger server clusters.

Broadcom's expanding clientele, including $Alphabet-A (GOOGL.US)$ and $Meta Platforms (META.US)$, highlights its strong partner base. Alphabet uses Broadcom's ASICs for AI and machine learning, while Meta employs them for Metaverse hardware development. In fiscal Q2 2024, sales of Broadcom's PAM-5 and Jericho 3, developed with partners like Arista Networks, Dell, Juniper, and Supermicro, doubled year-over-year.

Source: Yahoo Finance, Nasdaq, The Motley Fool

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

1000proof : Ready to collect my extra shares and buy more on July 15th. Thank you very much

103824191 1000proof : https://www.moomoo.com/my/promotion/referee?inviter=103824191&global_content=%7B%22promote_id%22%3A15066%2C%22sub_promote_id%22%3A3%7D

105114306 103824191 : hi

Thomas Seymour : something

Wolverines :

Paul Purcell : Good to know

Cowlamity Jane :

edamera :

Zspurr : Always been a great buy and hold

Steve Gonzalez838 : great company

View more comments...