What's Behind Dow Jones Hitting 46-Year Record With Nine-Day Losing Streak

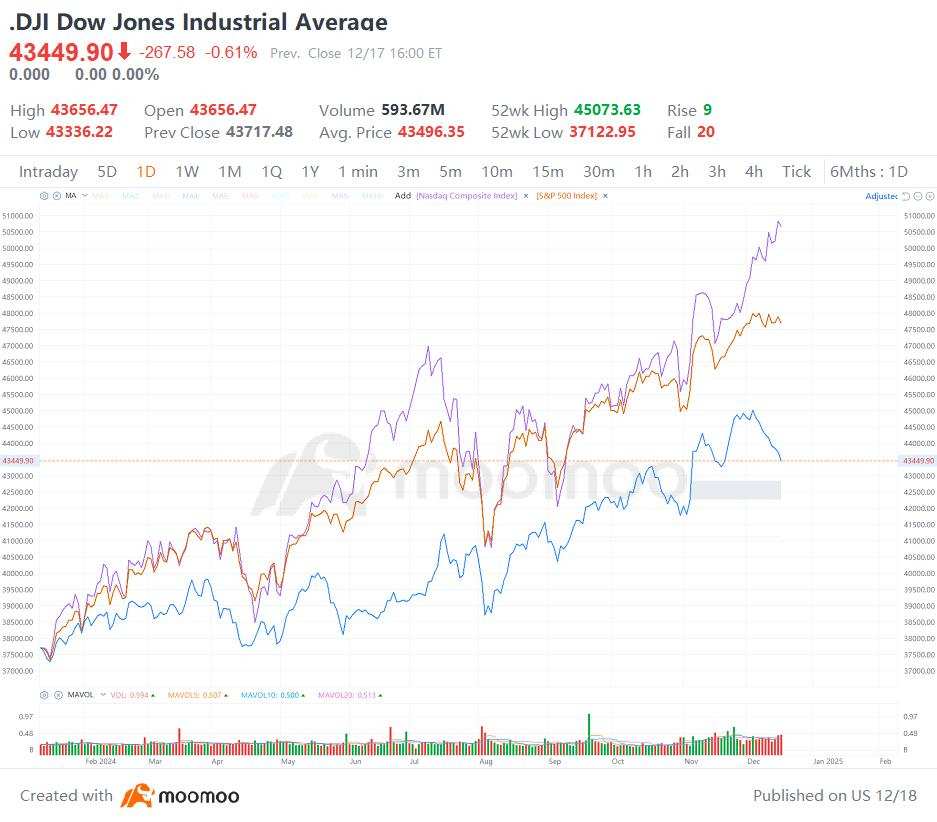

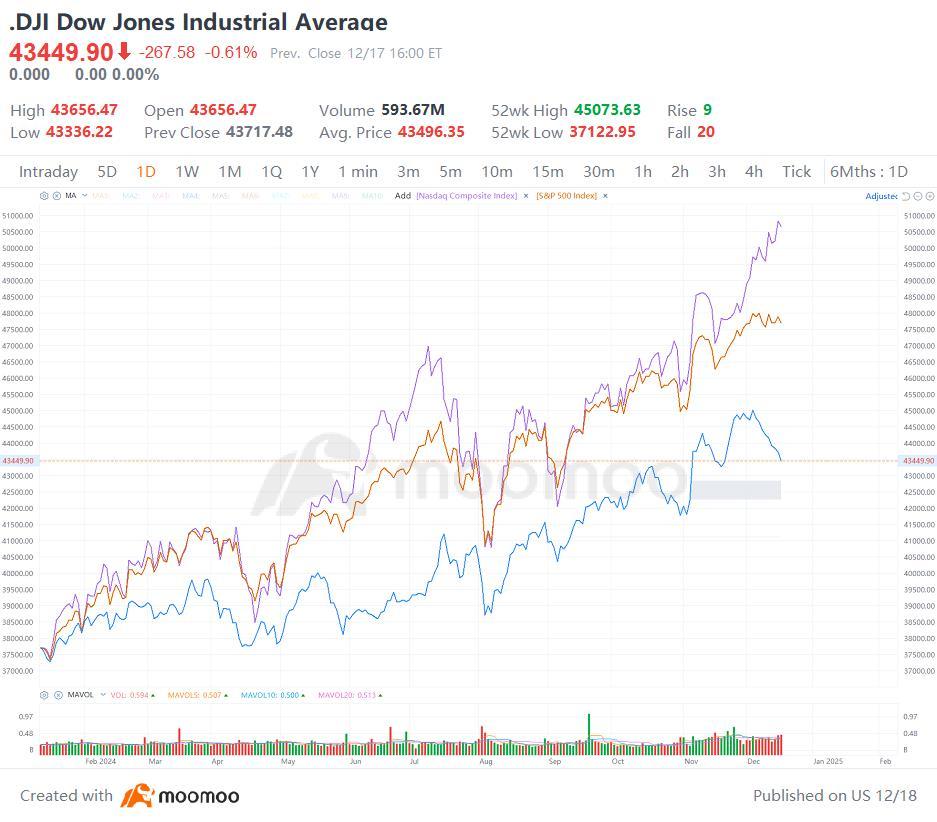

The U.S. stock market has shown clear signs of divergence. The $Dow Jones Industrial Average (.DJI.US)$ has fallen for nine consecutive trading days, marking its longest losing streak in over 40 years, with a total decline of nearly 4%. In stark contrast, the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ are nearing historic highs, driven by strong performance in the technology sector.

Key Drivers Behind the Dow's Decline

The Dow's losing streak can largely be attributed to the drag from $UnitedHealth (UNH.US)$. Its stock has plummeted over 20% since early December, significantly impacting the index. Concerns about the company grew after the CEO's death and policy uncertainties, including former President Trump's threats to crack down on pharmaceutical middlemen.

UnitedHealth alone has contributed to about half of the Dow's losses (804 points). Additionally, cyclical stocks like $Caterpillar (CAT.US)$, $Sherwin-Williams (SHW.US)$, and $Goldman Sachs (GS.US)$ have also retreated from their November highs, adding further pressure.

Another factor behind the Dow's underperformance is its price-weighted nature, making it particularly sensitive to movements in high-priced stocks. For example, changes in UnitedHealth, Apple, and Microsoft have an outsized impact on the index. Meanwhile, the Dow's lower weighting in technology stocks has limited its ability to benefit from the ongoing AI boom.

Adding to the Dow's woes, newly included index member Nvidia has fallen more than 10% recently. Analysts at Mizuho suggest that market concerns over companies like Meta and Alphabet potentially shifting to ASIC chips over GPUs in generative AI applications have contributed to Nvidia's decline.

Diverging Market Trends

In contrast to the Dow, the S&P 500 and Nasdaq Composite have been driven higher by a narrow group of technology stocks, collectively referred to as the "Magnificent Seven" (Mag7). These AI-focused companies have gained over 76% year-to-date, setting multiple record highs recently.

Investors continue to pour money into these stocks, creating trades driven by momentum. However, this concentration in tech stocks comes with risks. For instance, the S&P 500 has seen more declining than advancing stocks for 12 consecutive days—a near-century record—indicating deteriorating market breadth.

Deutsche Bank has cautioned that this heavy concentration in AI stocks could lead to the bursting of a "super AI bubble" or even trigger a market downturn. While tech giants like Amazon, Microsoft, and Apple are performing well, their contribution to the Dow remains limited. The one-sided capital flow also raises concerns about increased market volatility and liquidity risks.

Uncertainty From Policy Shifts

UnitedHealth CEO Andrew Witty emphasized that healthcare is highly personal and complex, and the reasons behind insurance coverage decisions are not always clear. Insurance companies are also working hard to negotiate with doctors and hospitals to reduce rising costs, especially for expensive prescription drugs and medical equipment.

Trump's nomination of Robert F. Kennedy as Secretary of Health and Human Services suggests that the Trump administration may take an unconventional approach to healthcare reform. Possible changes could include breaking up big healthcare companies like UnitedHealth, $CVS Health (CVS.US)$, and $Cigna Group (CI.US)$, stronger rules to limit drug prices, and stricter control over Medicare Advantage plans.

If UnitedHealth continues its decline, it could pose risks to both the healthcare sector and the Dow Jones. Additionally, cooling economic recovery expectations are weighing on cyclical stocks. The pullback in industrial names like Caterpillar reflects investor concerns about slowing global growth, contrasting sharply with the resilience of tech stocks.

Strategists' Views and Outlook

Despite the apparent divergence, some strategists believe the Dow's losing streak does not necessarily signal broader market trouble. Keith Lerner of Truist Advisory Services notes that while the strength in tech stocks could exacerbate concentration risks, it doesn't represent the full economic picture.

Mitchell Goldberg of ClientFirst Strategies argues that the Dow's performance reflects investor sentiment more than underlying economic fundamentals.

Meanwhile, Ameriprise's chief strategist suggests that the Dow's decline is likely due to short-term profit-taking, rather than signaling systemic issues.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment