What Should Investors Know Ahead of DBS's Earnings?

$DBS Group Holdings (D05.SG)$ will announce its financial results for the first half of the 2024 fiscal year (ending on June 30, 2024) during the midday trading break on August 7, 2024. This Singapore banking giant has seen its stock rise by approximately 12% year-to-date.

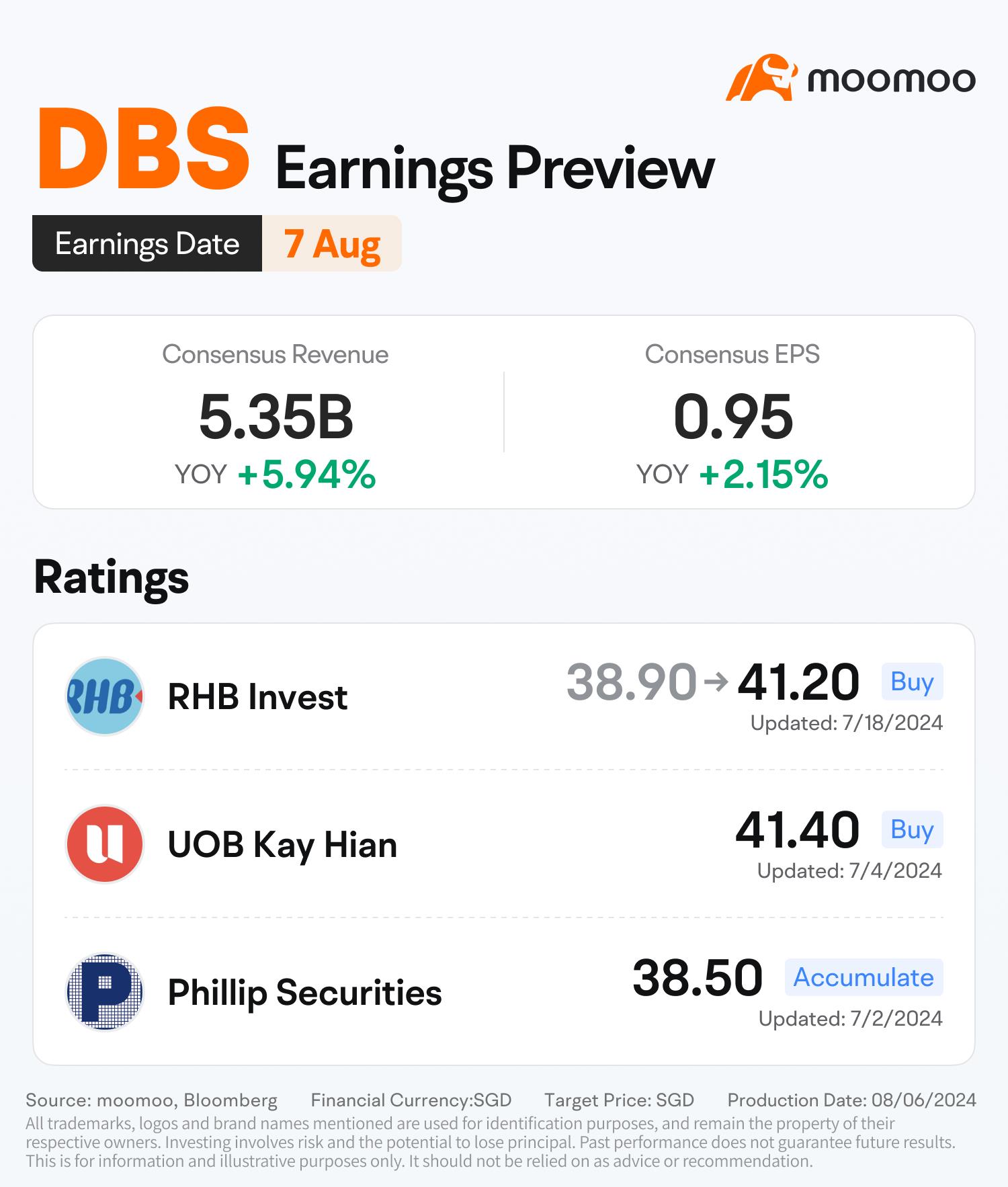

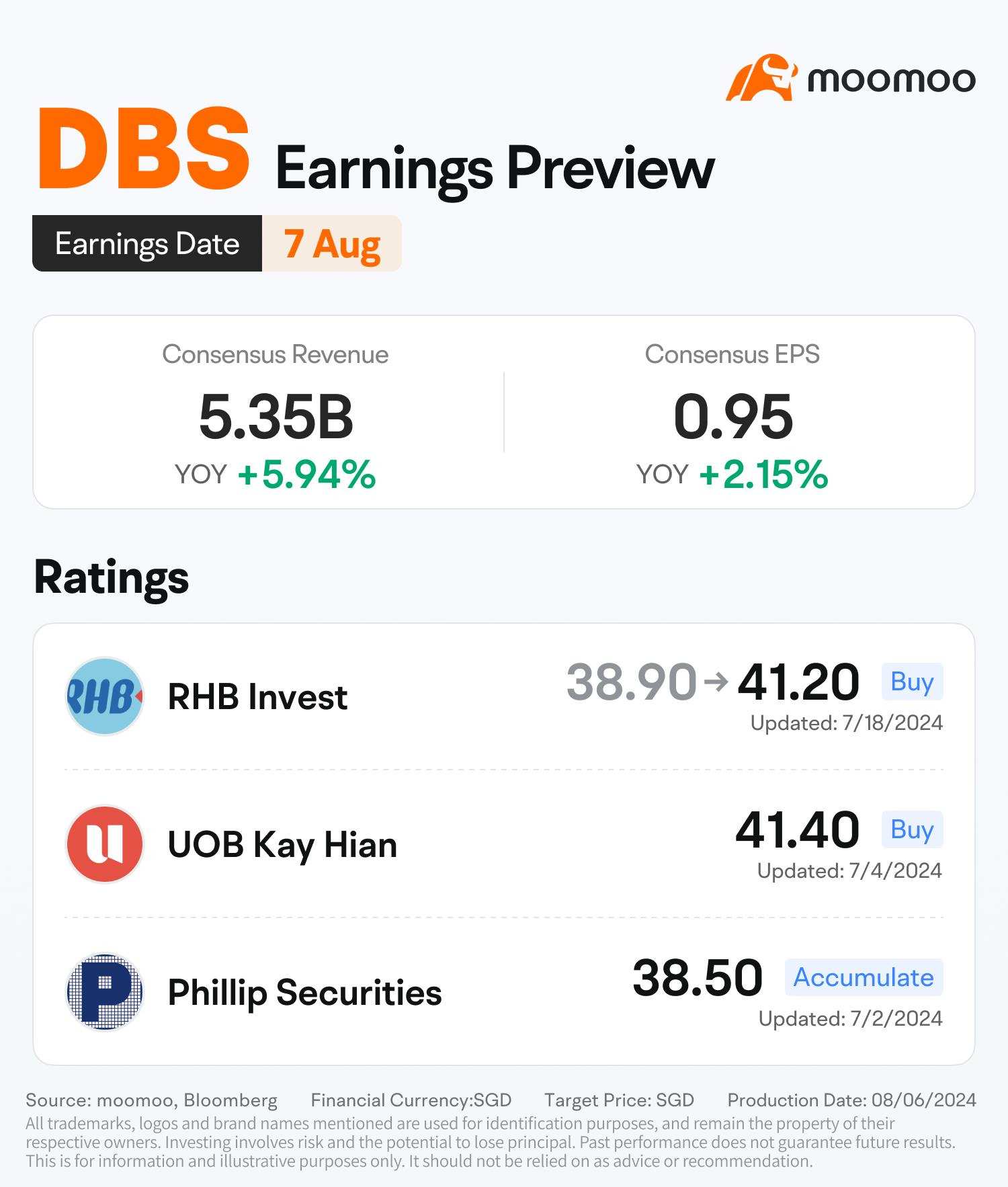

According to the latest analyst reports from 4 research institutions dated within the past 3 months, DBS's target price ranges from SGD 38.500 to SGD 41.400, with a median target price of SGD 40.035 and an average target price of S$ 39.993.

A Review of DBS's Q1 FY24 Earnings

DBS Group Holdings reported a stellar start to FY24 with a 15% rise in net profit to a new high of $2.95 billion, surpassing the $2.5 billion analysts' forecast. This growth was driven by a 23% increase in fee income, which included wealth management and card fees bolstered by the acquisition of Citi Taiwan. The bank also declared a record interim dividend of 54 cents per share and saw its shares push the company's market cap past the $100 billion mark.

DBS CEO Piyush Gupta highlighted strong business momentum with loan growth and record fee income, despite geopolitical challenges. He remained optimistic about the bank's performance, expecting better total income and earnings for the year. Net interest income increased by 8% to $3.65 billion, with a net interest margin of 2.77%, even as the industry braces for softer interest rates in 2024. While DBS's investment banking sector experienced a downturn this quarter, Gupta expects overall earnings and net interest income for 2024 to exceed the previous year's levels.

Key Things to Watch Out for Q2 FY24 Earnings

As we look forward to DBS's Q2 FY24 earnings report, several key factors are worth monitoring. Analysts From RHB Invest anticipate that dividends and capital returns will continue to be the primary attractions for investors. While a sequential easing in earnings is expected due to non-interest income (non-II) waning from a strong Q1, major negative surprises are not anticipated. The positive momentum in wealth management could provide support to fee income, although non-interest income lines might be softer compared to the previous quarter.

Loan growth in Q2 isn't expected to be as robust as in Q1, indicating that net interest income (NII) could also be muted. Nonetheless, asset quality is predicted to remain stable, with special provisions (SP) potentially trending below the provided guidance. An interim dividend per share (DPS) of 54 cents is expected, in line with Q1 but up from the previous year's adjusted figure.

Looking at the broader picture, the upcoming reporting quarter for DBS might be uneventful. However, investors will likely focus on forward guidance regarding the impact of potential rate cuts and any updates on capital management initiatives. Additionally, insights into asset quality and the wealth business will be closely watched. DBS's target price has been raised to S$41.20 from S$38.90, reflecting confidence in the bank's ability to provide an attractive yield, with forecasts suggesting a modest year-on-year earnings growth due to NIM pressures from anticipated rate cuts.

Analysts Perspectives Ahead of Earnings

RHB Invest maintains a buy rating and raises its target price for DBS from S$38.90 to S$41.20. The firm believes that DBS Bank's profit in the second quarter may decline compared to the previous quarter, as non-II class businesses gradually weaken from their strong performance in the first quarter of 2024, but they do not expect any significant negative surprises.

UOB Kay Hian maintains a hold rating due to the bank's strong execution and consistently good performance. They expect DBS to raise its quarterly dividend by 6 cents to 60 cents in the fourth quarter of 2024. The research company has increased its 2025 earnings forecast for DBS by 1.5% and predicts a narrowing of NIM by 8 basis points, with net interest income increasing by 0.8% in 2025.

Phillip Securities rates DBS as "Accumulate" rating, pointing out that there is potential for increased dividends as DBS has no cap on the dividend payout ratio (compared to OCBC/UOB at 50%). Stable NIMs, low single-digit loan growth, and double-digit growth in fee income are expected to sustain earnings momentum.

However, there are analysts with different views. Analysts led by Nick Lord at Morgan Stanley stated in a report after the financial results were released that the first quarter is usually a strong period for the bank, but performance may slow down subsequently.

Citi group research analyst Tan Yong Hong downgraded ratings for the three major banks in Singapore to "sell" as Citigroup economists expect the Federal Reserve to cut rates by 225 basis points within 10 months and view recent data as the first signs of a contraction in the US economy. In a report on August 5th, Tan downgraded ratings for DBS Group Holdings, OCBC, and UOB to "sell," suggesting investors "reduce their holdings." Tan stated that previous bullish sentiment was mainly supported by long-term high outlooks, capital management advantages, and a strong US dollar outlook.

Source: Business times, Bloomberg, Moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Paul Bin Anthony : very helpful thanks