What You Need to Know Ahead of Apple's Earnings

Apple is set to release its Q4 FY'24 financial results on October 31, reporting on a quarter that witnessed the launch of the new iPhone 16 devices. Apple's stock has performed well this year, climbing approximately 23% since the beginning of January, and is currently trading near its all-time highs.

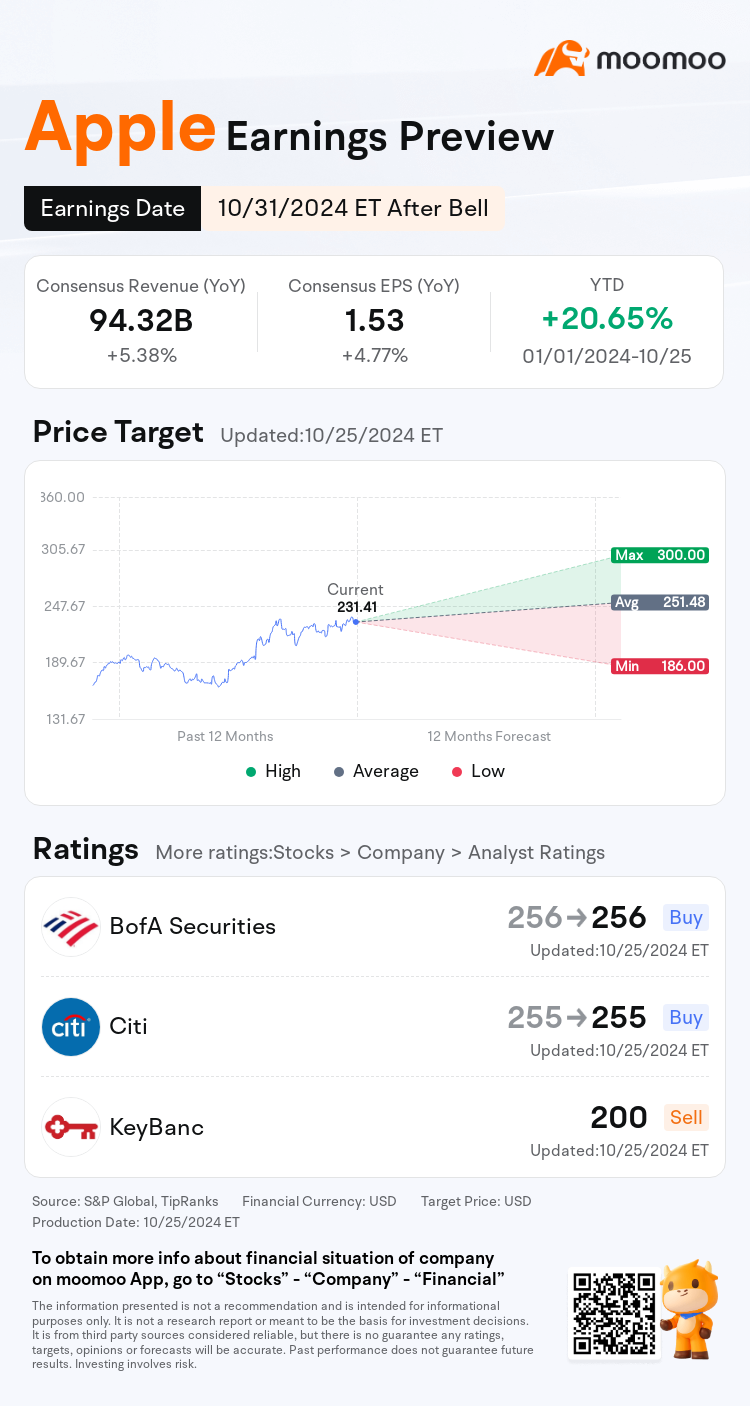

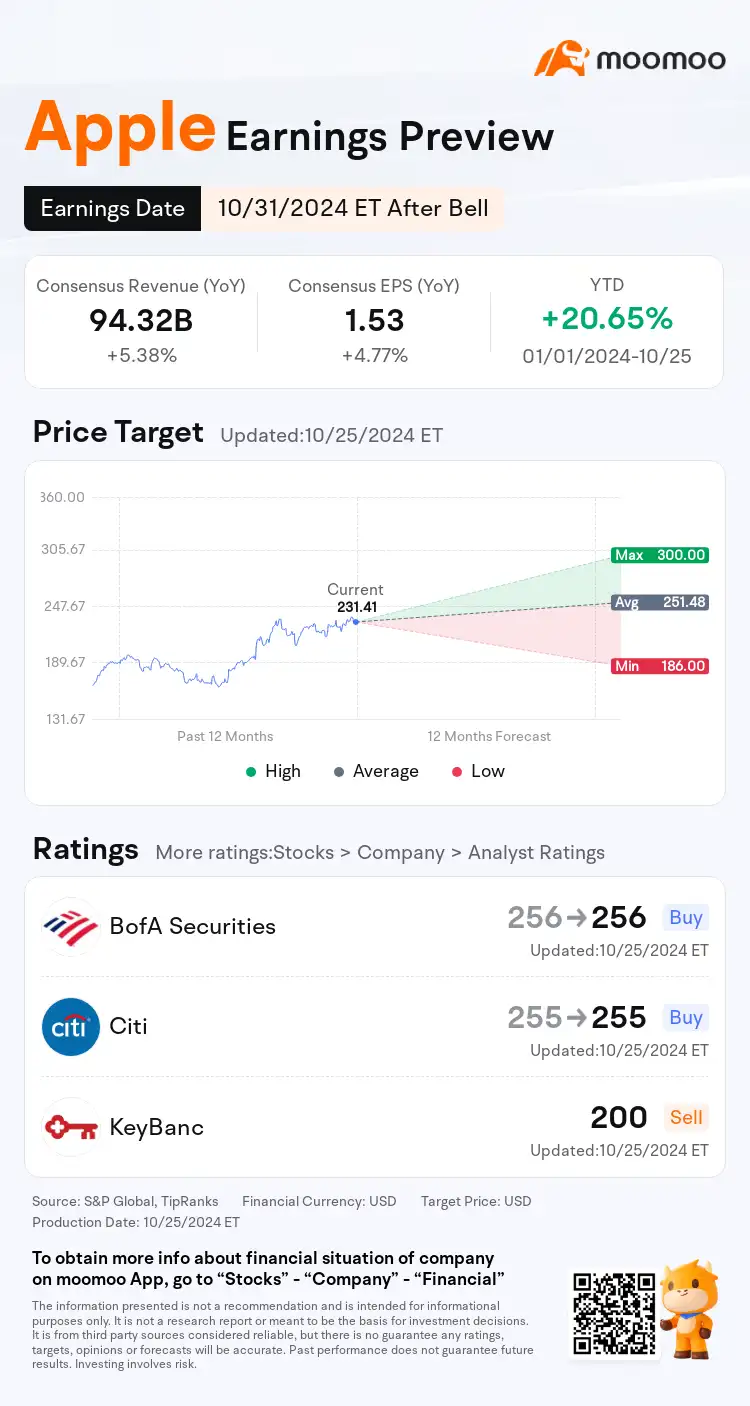

Analysts estimate Apple to post revenue of $94.32B for 2024 Q4, up 5.38% YOY; EPS is estimated to be $1.53, up 4.77% YOY. The company has consistently exceeded Wall Street's EPS predictions in its previous four quarterly reports. In the last quarter, its EPS of $1.40 beat the consensus estimate by 4.5%.

▶ Apple's iPhone sales are expected to grow slightly despite lowered expectations

Apple's iPhone division could experience some growth this quarter. IDC data suggests that Apple shipped 56 million iPhones in Q3 CY2024, a 3.5% increase from the previous year, even though its share of the overall smartphone market slightly decreased. The growth might be partially fueled by the recent launch of the iPhone 16 series, which hit the market about 10 days before the quarter ended. However, it's likely that the iPhone 15, with its significant promotional deals and the excitement around Apple's latest software updates, was the main contributor to sales. Despite this, the iPhone has encountered challenges in China, one of its biggest markets, where it faces stiff competition from companies like Huawei, which are making inroads into the high-end market segment. In the first nine months of the fiscal year, Apple's revenue from Greater China dropped nearly 10% compared to the same period last year.

The Mac is expected to generate revenue of $7.749 billion, up 1.77% year-over-year and 10.6% quarter-over-quarter; iPad revenue is projected at $7.084 billion, up 9.94% year-over-year but down 1% quarter-over-quarter; revenue from wearable devices, home products, and accessories is expected to be $9.159 billion, down 1.75% year-over-year but up 13.12% quarter-over-quarter.

▶ Services segment is expected to become a significant source of profit growth

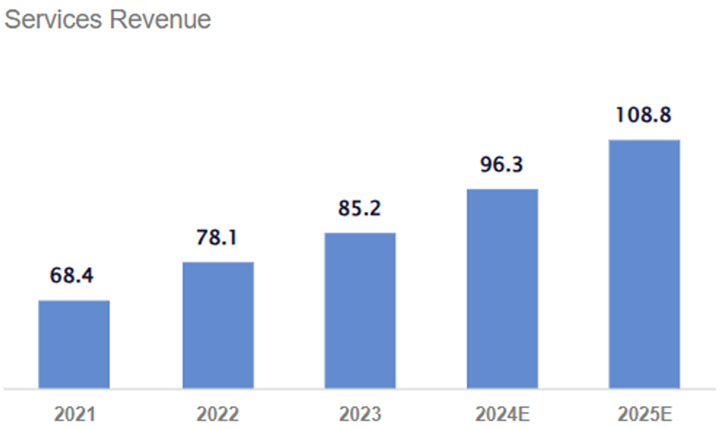

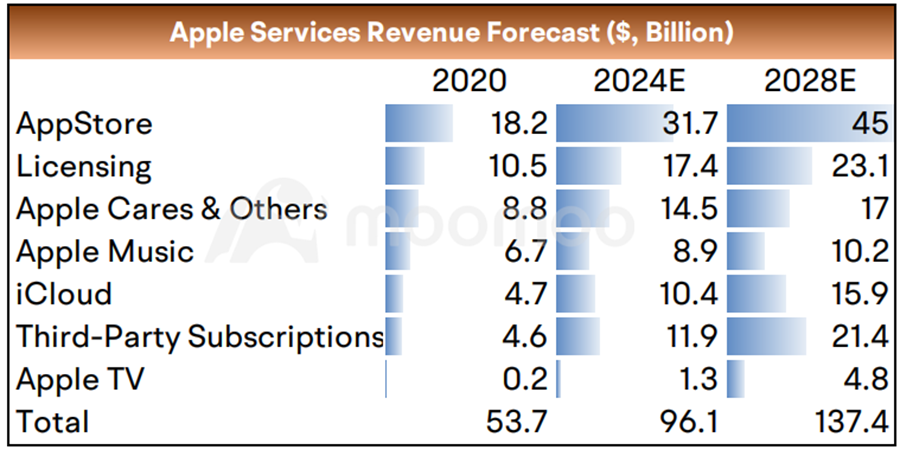

Apple's services business is its second-largest segment, contributing approximately 22% of the company's revenue in fiscal year 2023. This sector boasts a gross margin of 71%, significantly surpassing the approximately 36% margins achieved by the hardware division. The division is expected to perform strongly, supported by robust AppStore sales and growing engagement with other subscription offerings.

During the previous earnings period, sales from services increased by 14% to $24.2 billion. For the upcoming release, the segment is expected to achieve revenue of $25.269 billion, a year-over-year increase of 13.24% and a quarter-over-quarter increase of 4.4%.

▶ Apple will gradually roll out AI features

Despite the continuous delays in the launch plans for Apple Intelligence, Apple will gradually introduce more advanced AI features in English-speaking countries as the fourth quarter approaches. Mark Gurman from Bloomberg expects that the image, expression generation, and ChatGPT functions will be launched in some English-speaking countries in December. This could potentially serve as a catalyst for boosting Apple's stock price in the future.

▶ Is there a buying opportunity for Apple?

The main cause of market skepticism towards Apple currently is its valuation. Although this premium is justified by the company's top-tier business quality, Apple's heavy dependence on the iPhone, which accounted for more than 50% of its total revenue last year, remains a concern.

Apple's current forward P/E ratio stands at 35x, which is notably higher than its five-year average of about 24x. Even when adjusted for growth, with an anticipated compound annual growth rate (CAGR) of 9.4% over the next three to five years, the PEG ratio reaches 3.7x. This is nearly 50% above its historical norm and almost triple that of Nvidia, making it increasingly challenging to justify such a high multiple.

While long-term investors might not be overly concerned due to Apple's robust cash generation and strong returns on capital, this high valuation might lead to short-term market volatility.

Historical stock price reaction to earnings shows that shares of Apple have generally risen following earnings announcements, increasing after 8 out of the last 12 reports. On average, the stock has gained 1.8% on the first trading day after the earnings release.

Currently, Apple's implied earnings move is ±3.7%, indicating that the options market is betting on a post-earnings single-day price fluctuation of 3.7%. In comparison, Apple's average post-earnings stock price movement over the previous four quarters was ±2%, suggesting that the market expects increased volatility in its stock price this time.

Looking at the skewness of options volatility, the market sentiment towards Apple is slightly bearish.

Source: Trefis, Market Chameleon

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

学习中的小白(傑哥) : w

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

102414347 : wow