Which Major Assets Performed Best in the Last Three Rate Cuts?

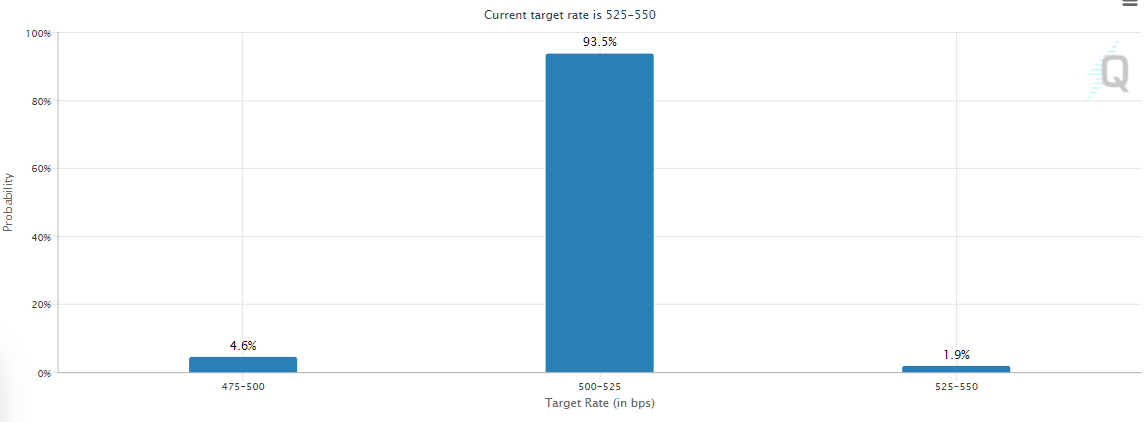

Investor expectations for a September rate cut remain strong after Fed Chair Jerome Powell indicated that the U.S. is "no longer an overheated economy," suggesting a stronger case for easing monetary policy. This optimism supports a bullish stance despite potential challenges from upcoming corporate earnings and political uncertainty.

Rate cuts are anticipated to benefit small-cap companies facing higher financing costs. The $S&P 500 Index(.SPX.US$ has risen about 18.8% year-to-date, driven by rate cut expectations, strong earnings, and excitement over artificial intelligence. Investors believe clearer guidance from the Fed on rate cuts could stabilize stocks amid market turbulence. Powell highlighted improved inflation data, which, if sustained, could justify rate cuts. A key test will be the release of U.S. consumer price data for June.

Check Out Which Assets Benefited the Most During Past Rate-Cutting Cycles:

From the most recent rate-cutting cycle, Bitcoin performed the best, nearly tripling in value throughout the cycle. The U.S. stock market also fared well, with the Nasdaq rising by as much as 64%. Among commodities, copper and crude oil performed the best.

Matt Miskin from John Hancock Investment Management notes that lower rates could aid small-cap companies, which are more sensitive to interest rates due to their reliance on financing. However, rate cuts are not always a sign of smooth sailing, as they can signal a deteriorating economy. A Wells Fargo Investment Institute study found the S&P 500 has historically fallen by an average of 20% in the 250 days following the first rate cut of a cycle. Stocks may perform well if the Fed cuts rates due to falling inflation, but aggressive cuts in response to economic or market disruptions could hurt stock performance.

Source: Bloomberg, CME, REUTERS

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

方展博 一博 : good

Elaine Ford : you want me to do all this work you want to do all this work withouta coach and them you tell time ticking you want to much

stabilorrr : Yeay all green for bonds!

103809741RahimiRamly : thanks