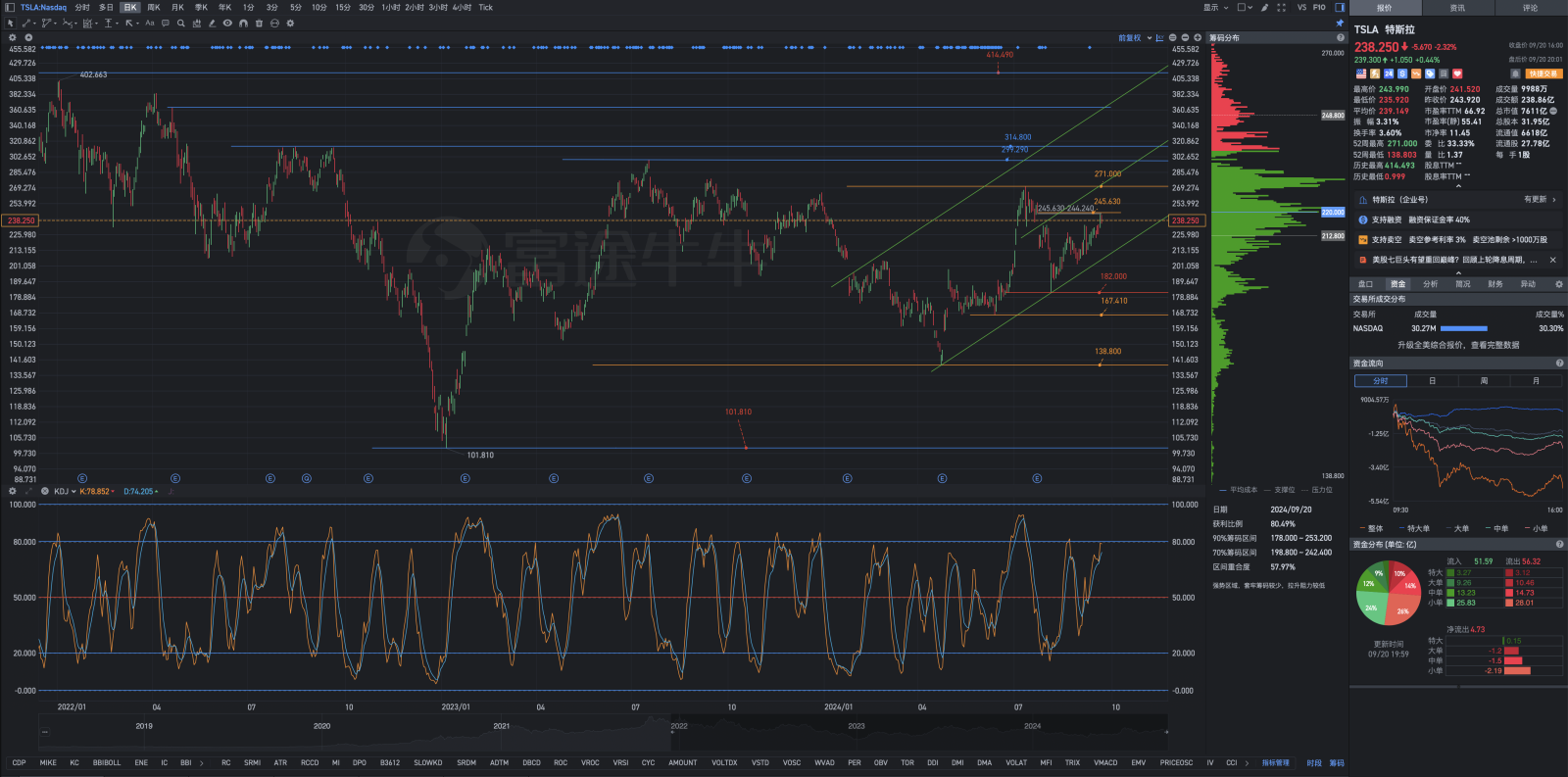

With the passing of James H. Simmons and his taking away of his own huge wealth, the influence of Renaissance Technology in the technology industry is gradually diminishing. As scientists, including mathematicians (primarily statisticians) and physicists, and computer software engineers, the members of the scientific team have very unique personalities, and it is difficult to find a leader who can hold the fort like James H. Simmons. During the lowest point of Tesla's stock price, Renaissance Technology should have top-level analysis and operational strategies.Planned and step-by-step, in batches, boldly and decisively, and with a large-scale layout, Renaissance Technology chose to reduce its stake in Tesla, contrary to the strategy of building positions when Tesla's stock price stabilizes and rises, and only started to increase its holdings and expand its shares after a significant increase in the stock price. This investment trading strategy is completely different from the tactics of large hedge funds known for their precise and aggressive styles, and it is not commendable.However, Renaissance Technology chose to reduce its stake in Tesla, which cannot be underestimated due to their past reputation. Wall Street's major institutions have no shortage of followers. When Tesla's stock price stabilized and began to rise significantly, Renaissance Technology's investment strategy of increasing holdings after such significant gains is very different from the aggressive style of the lion and tiger-class large hedge funds they were known for in the past, which is difficult to commend. Here, we can also see that it is extremely difficult to overcome the weaknesses of human nature such as trying to avoid greed, fear, and the desire for rising prices and falling prices. Without surpassing these constraints, it is difficult to achieve great success in the financial market.