Why is it so difficult to make money from trading?

Why is it so difficult to make money from trading?

The main reasons are greed and fear:

One of the main factors contributing to the success of professional traders is that, in most cases, they do not trade with their own funds. It is easier to remain objective and follow your trading strategy when your capital is not at risk.

Most amateur traders have limited funds, making them more susceptible to the fear of losses, resulting in them not sticking to their trading plans. Or, after a series of losses, they start taking on more risk than their strategy allows.

When your money is at risk, it is a psychological state that is difficult to overcome. Remember, this is not the only reason, but it is the most significant one.

Why? You may ask, but first let me finish.

You may see many people on the internet praising their strategies as having a 90% accuracy rate. If you think trading is like that, stay away from trading. Most people enter trading with the mindset that once they find a strategy that brings them sustained profits, they will become like Ambani or Tata in a few weeks of trading. They believe trading is very simple, all you need to do is click the mouse and buttons. Buy when the stock price falls, sell when it rises. For them, trading is limited to this. They think trading is easy because it does not require specific college courses.

Returning to my main point, greed and fear are the most important aspects in trading. A day trader's personal desires and intentions can greatly influence the outcome of their efforts. A little success can lead to greedy behavior deviating from their established trading plan, ultimately putting all their money into one trade and losing it all (just like I did initially). This may include taking action too early, holding onto profits for too long, or not stopping losses in losing trades in time.

看看你的情绪如何影响你的交易!

Let me tell you a bit of my story, I was tempted by Telegram and YouTube channels to not accept real trading, having to invest a huge amount of money and time.

It took me a whole year trying to find the Holy Grail. An indicator that could print money, so I could just sit back and watch my bank account grow. If you are still trying to find it, let me tell you, that's not how the market operates. If such a thing existed, everyone would be making money, but we know that's not true.

So how many people actually profit from trading? The answer is very few. Why? You may ask.

Unfortunately, the market can only operate this way. Trading is a zero-sum game, which means one person's loss is another's profit.

To better explain, here is an example.

Imagine this, 5 people staying in a room, with a total net capital of 1000 rupees. You gamble with each other, creating something similar to an artificial market, where buying and selling transactions occur. That's how trading works. Each transaction only deducts taxes and brokerage fees. You may wonder, isn't trading just gambling? The answer is no. Do people make money in trading? Yes, people make money in trading, such as proprietary trading firms and institutional buyers.

You may see many people on the internet praising their strategies as having a 90% accuracy rate. If you think trading is like that, stay away from trading. Most people enter trading with the mindset that once they find a strategy that brings them sustained profits, they will become like Ambani or Tata in a few weeks of trading. They believe trading is very simple, all you need to do is click the mouse and buttons. Buy when the stock price falls, sell when it rises. For them, trading is limited to this. They think trading is easy because it does not require specific college courses.

Returning to my main point, greed and fear are the most important aspects in trading. A day trader's personal desires and intentions can greatly influence the outcome of their efforts. A little success can lead to greedy behavior deviating from their established trading plan, ultimately putting all their money into one trade and losing it all (just like I did initially). This may include taking action too early, holding onto profits for too long, or not stopping losses in losing trades in time.

看看你的情绪如何影响你的交易!

Let me tell you a bit of my story, I was tempted by Telegram and YouTube channels to not accept real trading, having to invest a huge amount of money and time.

It took me a whole year trying to find the Holy Grail. An indicator that could print money, so I could just sit back and watch my bank account grow. If you are still trying to find it, let me tell you, that's not how the market operates. If such a thing existed, everyone would be making money, but we know that's not true.

So how many people actually profit from trading? The answer is very few. Why? You may ask.

Unfortunately, the market can only operate this way. Trading is a zero-sum game, which means one person's loss is another's profit.

To better explain, here is an example.

Imagine this, 5 people staying in a room, with a total net capital of 1000 rupees. You gamble with each other, creating something similar to an artificial market, where buying and selling transactions occur. That's how trading works. Each transaction only deducts taxes and brokerage fees. You may wonder, isn't trading just gambling? The answer is no. Do people make money in trading? Yes, people make money in trading, such as proprietary trading firms and institutional buyers.

(Proprietary Trading Counter)

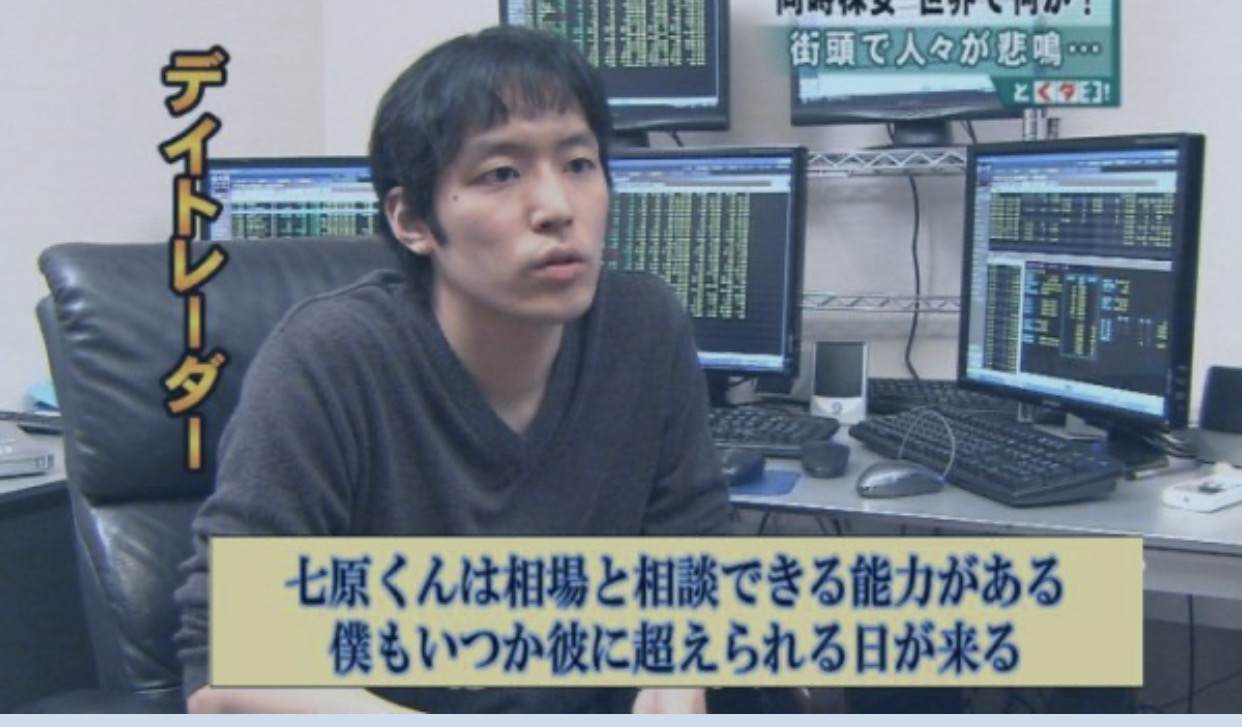

Can individual retail traders like us make money too? Yes, a famous individual retail trader is

29-year-old Japanese takashi kotegawa turned 0.013 million dollars into 0.153 billion dollars! Yes, you read that right.

Can individual retail traders like us make money too? Yes, a famous individual retail trader is

29-year-old Japanese takashi kotegawa turned 0.013 million dollars into 0.153 billion dollars! Yes, you read that right.

Yes, you can make money in trading, but it requires you to have an edge over others. Just like a casino owner. No matter how much you win, in the long run, you will always lose to the casino because they have the edge.

Another example

Imagine a roulette game with 49 black and 49 red slots, and two blank spots, where you have to bet on red or black. Regardless of your bet, the winning odds are 49/100. That's why no one gets rich from gambling. Just like in trading, you need to have a slight advantage, no matter how small, just a well-tested advantage through backtesting, which you can magnify through leverage.

Now, imagine having a good risk management setup, like 1:3, meaning for every 1 rupee of risk you take, you get 3 rupees. Now tell me, how many out of 10 trades do you need to win to make a minimum profit? The answer is only 3 trades. Total winning amount becomes 9 rupees, subtract 7 rupees from losses, total profit is 2 rupees. But finding the setups and knowing what they can achieve is also important. I have been trading with my own edge. It took me some time, but I am stable now.

What are the secrets to getting rich in the next decade?

The most feasible, practical, and effective strategy is to establish a position in Tesla, a listed company's stock, and hold it for the long term, steadfastly. Ronald Stephen Baron, the founder of Baron Capital (Duke Capital), the 12th largest institutional shareholder of Tesla, holds a total of over 6 million shares of Tesla stock (with a holding cost of only $42.88 per share), who is a wealthy Jewish American. Having already earned $6 billion on Tesla's stock, he is prepared to hold it for another ten years.What is your plan? Custom wave-level high-sell low-buy arbitrage? Custom intraday trading arbitrage?

1. Invest a lot in yourself, take good care of yourself, because you will always be with yourself. You are the best thing that happens to you.

2. Imagine the life you want.

Tell people not to look for the past you, you have actually changed.

Clearer - less confused.

Observe more, judge less.

Respond more, react less.

Inner calm, less chaos.

Do more, do less.

More trust, less fairness.

Improve your emotional intelligence to enhance your emotional body.

11. Change the plan but do not change the goal,

12. Make your goal to retire young and wealthy,

13. Your self-worth determines your net assets,

14. No more "I cannot", you can, and you will,

15. Calm down!!

15. Calm down!!

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment