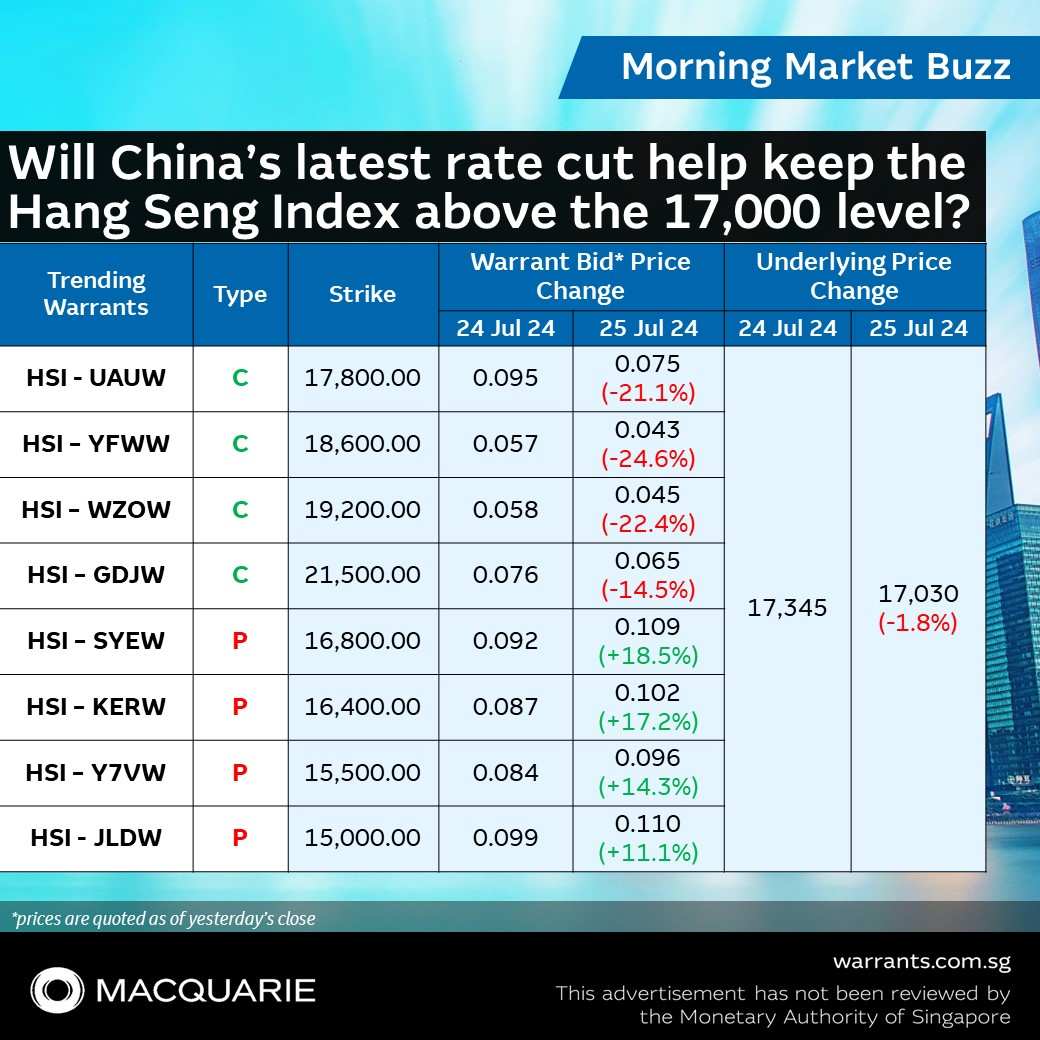

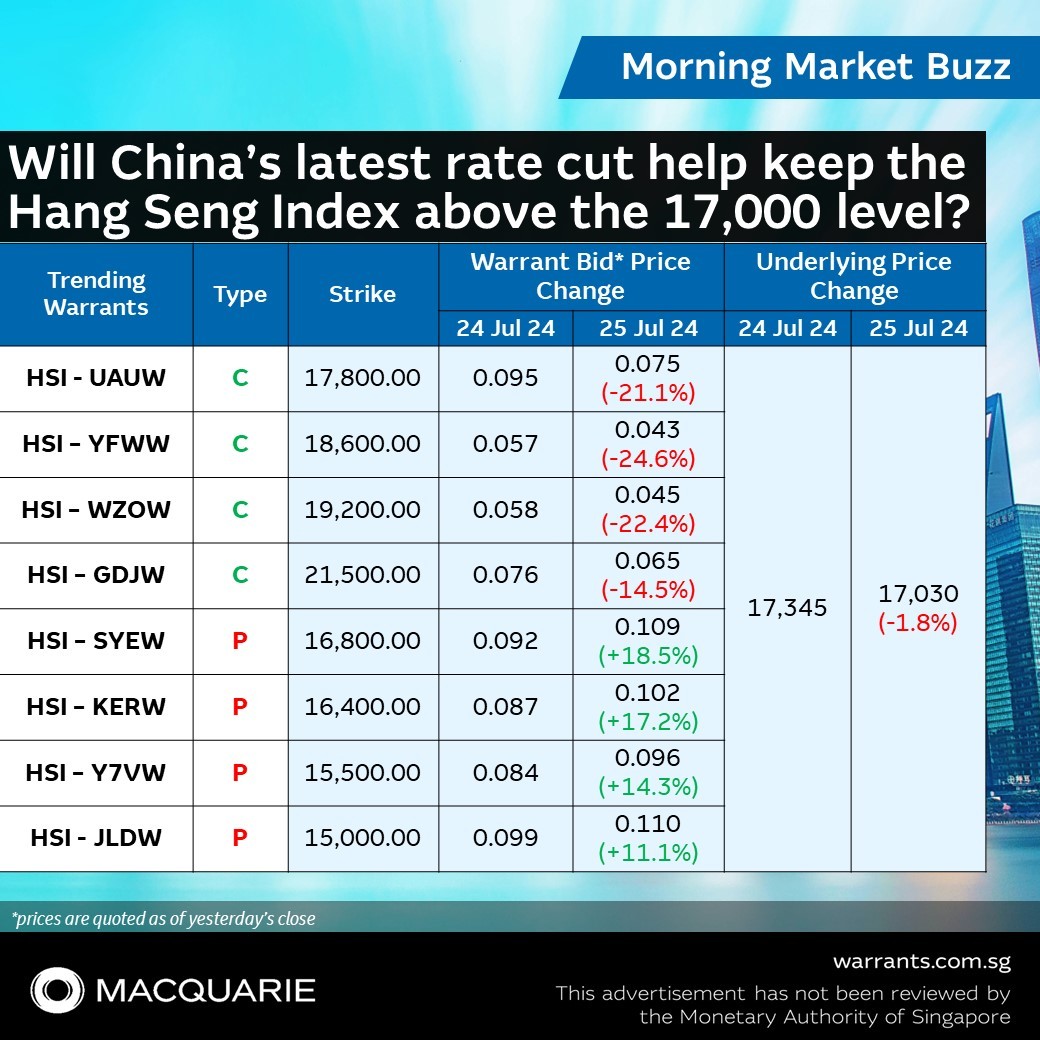

Will China’s latest rate cut help keep the Hang Seng Index above the 17,000 level?

In an after-market announcements yesterday, the People’s Bank of China unexpectedly lowered the cost of its one-year policy loans by the most since April 2020, four days after trimming the seven-day reverse repo.

The two rate cuts this week signals China’s growing urgency to ease monetary policy to support growth which has come in worse than expected in the second quarter.

Chinese stocks have been weighed down by poor sentiment in the past two weeks after China’s second quarter GDP grew less than the expected 5% target while retail sales grew at the slowest pace since December 2022.

The benchmark Hang Seng Index traded below the 17,000 level yesterday for the first time in three months after falling more than 1,200 points, or 7.4% since 12 July 2024 – the day before China released their GDP figures. Will the latest news help keep the HSI afloat the key 17,000 level?

Read more: Singapore Warrants | Trading Stocks and Index Warrants | Macquarie

The two rate cuts this week signals China’s growing urgency to ease monetary policy to support growth which has come in worse than expected in the second quarter.

Chinese stocks have been weighed down by poor sentiment in the past two weeks after China’s second quarter GDP grew less than the expected 5% target while retail sales grew at the slowest pace since December 2022.

The benchmark Hang Seng Index traded below the 17,000 level yesterday for the first time in three months after falling more than 1,200 points, or 7.4% since 12 July 2024 – the day before China released their GDP figures. Will the latest news help keep the HSI afloat the key 17,000 level?

Read more: Singapore Warrants | Trading Stocks and Index Warrants | Macquarie

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment