Will the Bank of Canada Cut Rates a Third Time Post Inflation Data?

"If inflation continues to ease broadly in line with our forecast, it is reasonable to expect further cuts in our policy interest rate," said the Bank of Canada (BOC) on July 24 when it lowered its key interest rate by 25 basis points to 4.50%.

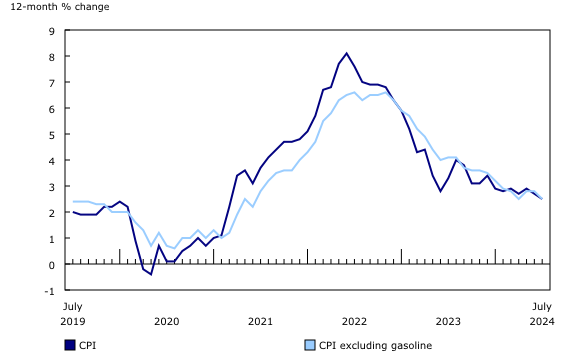

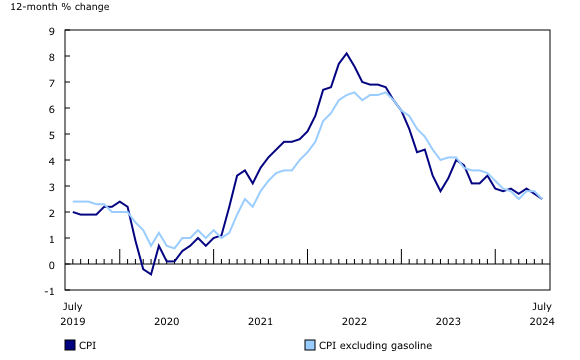

July's inflation report fits right into this scenario: Canada's 12-month inflation rate came down to 2.5% from 2.7% in June, the lowest level since March 2021.

The Consumer Price Index (CPI), excluding food and energy, was up 2.7% from a year earlier.

Canada 12-month CPI : All items and excluding gasoline

Source: Statistics Canada

On track to meet the BOC's Q3 inflation projections

The July inflation deceleration puts the overall rate at just 0.2 percentage points above the BOC's projection of a 2.3% average for the third quarter.

By the central bank's own measures of core inflation - the average of CPI-trim and CPI-median - the pace of price appreciation also moved closer to its projection of 2.5% in the third quarter. Both measures of inflation came down in July, averaging 2.6% year-over-year, down from 2.7% in June.

Actual CPI vs. Bank of Canada's projections

Broad-based improvement

Details of Statistics Canada's report were good news on many fronts for the Bank of Canada.

The slowdown from June was broad-based.

A broad-based slowdown

Services are still a sticky point

Services remain a sticky point, with an inflation rate of 4.4%, still twice as high as the 2% target, while the goods index was up just 0.3% from a year earlier.

Shelter, in particular, continues to drive prices higher, with three of the top five main contributors to the 12-month CPI gain being related to housing: mortgage interest cost was the top contributor with a 21.0% increase, rents, up 8.5%, were the second contributor, and property taxes and other special charges, up 4.9%, were the fifth largest contributors.

However, this is unlikely to hold back the BOC as it already acknowledged less than a month ago that while shelter and services could keep inflation above the 2% target for longer, the central bank "felt increasingly confident that the ingredients for price stability were in place."

Besides, shelter price increases eased to 5.7% year-over-year in July from 6.2% in June.

All in all, July inflation data keep the BOC on track for further easing, especially in an environment where expectations for a Federal Reserve rate cut have intensified, reducing the divergence risk for the BOC, with its potential impacts on the loonie.

USD/CAD exchange rate (08/20/2024)

Source: Yahoo Finance as of 08/20/2024

Kedep up to date with Canada's news by following Moomoo News Canada.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment