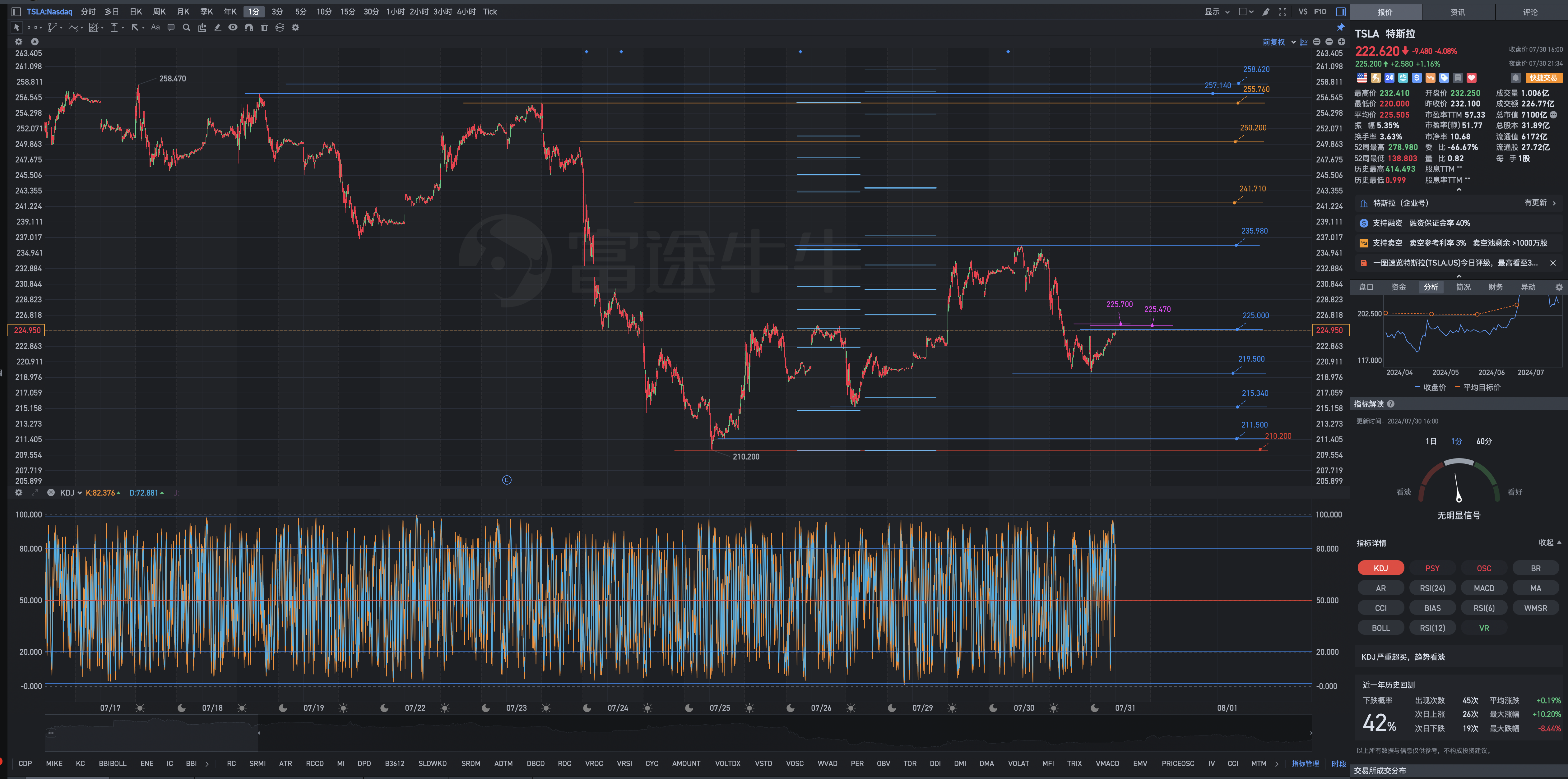

Analysis of the Tesla post-market review chart for Tuesday, July 30

Without seeing ghosts crying, Tesla's main trend and long-term trend haven't changed—forever ♾️ up 👆.

Too often in financial markets, imaginative and inertial thinking is a terrible thing.

There was already a rebound in the post-market period.

Investment guru Peter Lynch said, “In the history of over 70 years, there have been 40 stock market crashes. Even if I had predicted 39 of them in advance and sold all stocks before they plummeted, I would regret it immensely in the end. Because, even in the case of the biggest decline in the stock market, the stock price will eventually rise back, and it will rise even higher than before.”

Excellent companies will continue to reach record highs and can cross the bull and bear. For excellent companies, the bear market is only temporary; the bull market is eternal.

Excellent companies will continue to reach record highs and can cross the bull and bear. For excellent companies, the bear market is only temporary; the bull market is eternal.

Tesla's starting price of $1.13 per share on June 29, 2010, loss, no profit,... It has been hovering at low stock prices for a long time, and more than 90% of the original participants sold cheap Tesla shares with a sense of despondency and extreme frustration. It wasn't until August 26, 2018, that is, about 8 years later, that Tesla was able to soar to a peak of $371.

Is it difficult to hold shares for 6-8 years? (Do what you like or should do.)

That's almost a 33,000% increase...

Turn every $5,000 into $1.6 million. In the face of such results, it was enough to overshadow the average annual return of 71.8% for the Medallion Fund (Medallion Fund) world profit champion, led by the world's great mathematician, investor, and philanthropist James Harris Simons (James Harris Simons).

Is it difficult to hold shares for 6-8 years? (Do what you like or should do.)

That's almost a 33,000% increase...

Turn every $5,000 into $1.6 million. In the face of such results, it was enough to overshadow the average annual return of 71.8% for the Medallion Fund (Medallion Fund) world profit champion, led by the world's great mathematician, investor, and philanthropist James Harris Simons (James Harris Simons).

A truly top-level trading order that makes a lot of money is not only the absolute value at a relatively low price, but also quantity. The most important and core one is that in the midst of large fluctuations, especially in large downward fluctuations, they have overcome and transcended the pain of time and space with unwavering belief. This is how the rich and feudal Rothschild family and stock god Warren Buffett walked through. James Harris Simons, the world's top mathematician, philanthropist, and god of speculation worth over 23 billion dollars, has fully demonstrated the great value and power of mathematics and theoretical physics. Medallion Fund has almost taken them to the extreme.

How to Win Richland

So-called “empty messages” cannot stop the bull run, and even a world war, and vice versa. The only thing traders have to do is assess the potential.

A good trading strategy requires a space for tolerance; an accurate trading point also requires a space for tolerance.

No one of us knows where the bottom zone is; only God has this power. On the other hand, there are too many self-righteous people who are struggling to pursue such abilities, and are also acting recklessly and arrogant.

When you invest in stocks, what ultimately makes you make a lot of money depends on a firm belief in the midst of big fluctuations and a continuous belief in saving money in the snow, rather than icing on the cake. This statement is actually very, very important; making big money requires a firm belief.

Good top-level, high-value transaction orders cover time and space. They are not only absolute values at low prices, but also quantitative issues. The most important of these is that they cover the accumulation of time and time. Shock, courage, will, courage,...

Because you can't take advantage of avoiding all falls. You and I are neither Creator nor God. Only those who can master the fall can finally get those upward swings. This is very, very important, very, very worth the money.

Therefore, you have to endure some twists and turns that you yourself cannot imagine; this is really difficult and difficult to achieve. If you do it all, then you and I can also get those upward spins.

Stock speculation is much more than simply analyzing charts. The bearish movement in the bull market, the bearish movement at the end of the bear market, the bearish market decline during the bull transition period, and the persistence of the bullish momentum are crucial, and this is the main focus.

A sharp fall in the stock market means that gold falls from the sky, freaking you up and driving others away. It also requires excessive boldiness, which most people probably don't have. There are different ways to succeed; don't accept your uninertial approach.

So-called “empty messages” cannot stop the bull run, and even a world war, and vice versa. The only thing traders have to do is assess the potential.

A good trading strategy requires a space for tolerance; an accurate trading point also requires a space for tolerance.

No one of us knows where the bottom zone is; only God has this power. On the other hand, there are too many self-righteous people who are struggling to pursue such abilities, and are also acting recklessly and arrogant.

When you invest in stocks, what ultimately makes you make a lot of money depends on a firm belief in the midst of big fluctuations and a continuous belief in saving money in the snow, rather than icing on the cake. This statement is actually very, very important; making big money requires a firm belief.

Good top-level, high-value transaction orders cover time and space. They are not only absolute values at low prices, but also quantitative issues. The most important of these is that they cover the accumulation of time and time. Shock, courage, will, courage,...

Because you can't take advantage of avoiding all falls. You and I are neither Creator nor God. Only those who can master the fall can finally get those upward swings. This is very, very important, very, very worth the money.

Therefore, you have to endure some twists and turns that you yourself cannot imagine; this is really difficult and difficult to achieve. If you do it all, then you and I can also get those upward spins.

Stock speculation is much more than simply analyzing charts. The bearish movement in the bull market, the bearish movement at the end of the bear market, the bearish market decline during the bull transition period, and the persistence of the bullish momentum are crucial, and this is the main focus.

A sharp fall in the stock market means that gold falls from the sky, freaking you up and driving others away. It also requires excessive boldiness, which most people probably don't have. There are different ways to succeed; don't accept your uninertial approach.

If someone bought shares in Berkshire Hathaway (Berkshire Hathaway) in 1965 and kept them, they made an excellent investment—and their stockbrokers would starve to death. Most pension funds probably didn't buy Berkshire shares in 1965 and have held them ever since. If they actually did that, they would have far fewer problems today. Berkshire's stock price at the time was $22. Today, its share price is close to $0.133 million.

Elias=Jerome, if I tell you now, this opportunity has come again. What would you think? How to deal with it?

Elias=Jerome, if I tell you now, this opportunity has come again. What would you think? How to deal with it?

The eye's attention is only on Tesla's poor performance; profit margins have not improved. It simply focuses on secondary trends, short-term trends, and even short-term trends. It completely forgets or even downplays the main trends and long-term trends. It is bound to have no profit, let alone become a major financial enterprise.

Video playback link 🔗: - YouTube

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment