ふぁいとB

liked

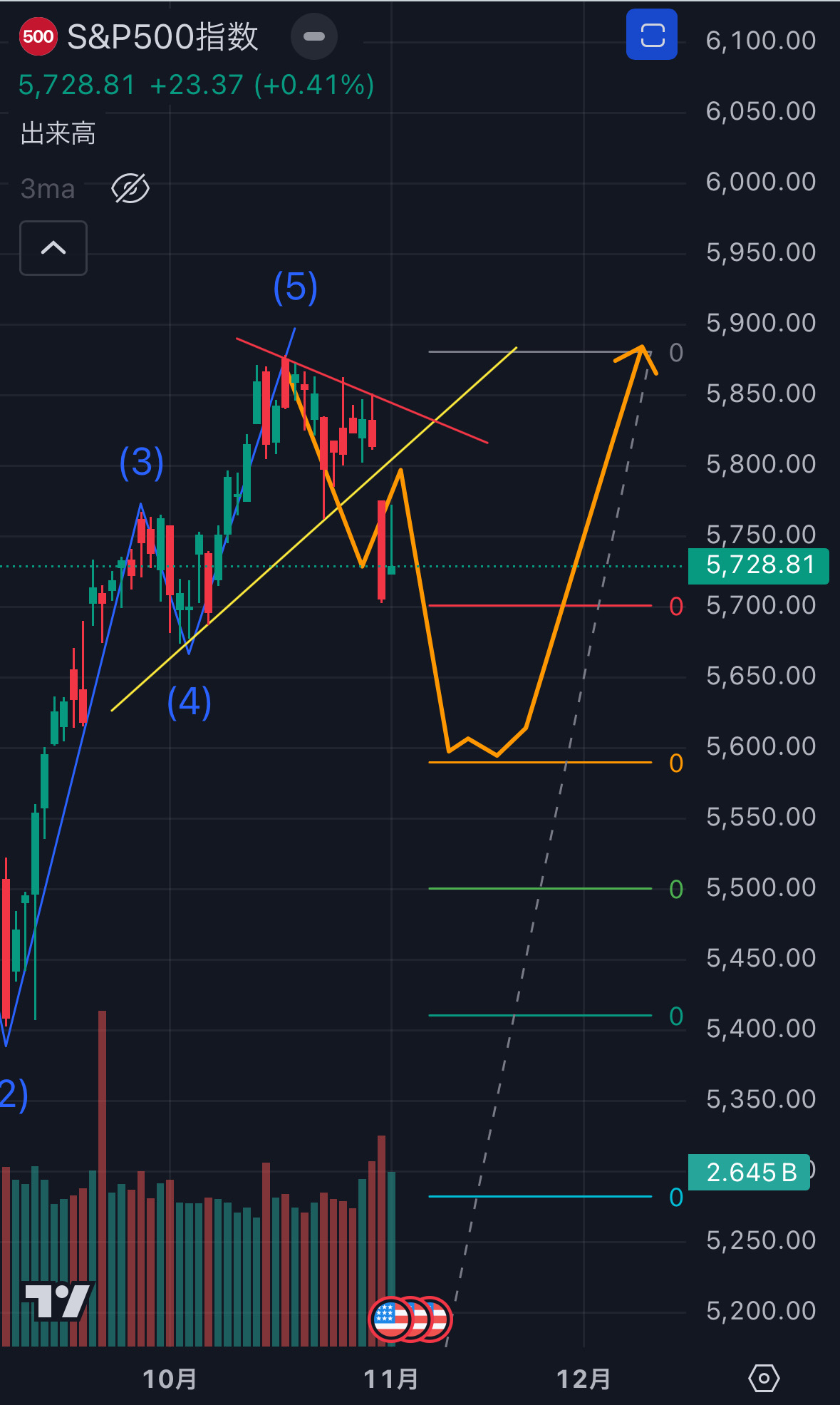

$S&P 500 Index (.SPX.US)$

First, there were two scenarios in my financial estimates for the end of last weekend below ↓

And the results below ↓

Hmm, I feel like the financial estimates of the orange line are close, so I have eliminated the scenario of the green line

I really didn't expect such a drop on Thursday... 💦 Being supported at 0.236 level by resistance on Friday, with the employment statistics coming out, it's more of an autonomous rebound, I think

What concerns me is that even though FEDWATCH is leaning towards a rate cut, the interest rate has risen to the mid-4.3s

I wonder if the bond market is breaking due to the uncertainty about the future... When bond investors are sending a signal of 'not knowing which way it will go' overall, it really is best not to know...

However, there are still remnants of the upbeat mood from the first half of this week, so there may be a light rebound on Monday, with actual selling and cautious profit-taking starting around the 5th... It seems like the upside will be heavy until the FOMC and next week from Tuesday.

However, if asked whether it will drop to the financial estimates (C) level, I have shifted my thinking to not dropping that much now, possibly rising to around (B) at most, with a bottom around 5600...

First, there were two scenarios in my financial estimates for the end of last weekend below ↓

And the results below ↓

Hmm, I feel like the financial estimates of the orange line are close, so I have eliminated the scenario of the green line

I really didn't expect such a drop on Thursday... 💦 Being supported at 0.236 level by resistance on Friday, with the employment statistics coming out, it's more of an autonomous rebound, I think

What concerns me is that even though FEDWATCH is leaning towards a rate cut, the interest rate has risen to the mid-4.3s

I wonder if the bond market is breaking due to the uncertainty about the future... When bond investors are sending a signal of 'not knowing which way it will go' overall, it really is best not to know...

However, there are still remnants of the upbeat mood from the first half of this week, so there may be a light rebound on Monday, with actual selling and cautious profit-taking starting around the 5th... It seems like the upside will be heavy until the FOMC and next week from Tuesday.

However, if asked whether it will drop to the financial estimates (C) level, I have shifted my thinking to not dropping that much now, possibly rising to around (B) at most, with a bottom around 5600...

Translated

7

ふぁいとB

commented on

$OSE Nikkei 225 Futures(DEC4) (NK225main.JP)$ Ew, I feel sick. This is probably a Piranha Plant.

Translated

1

ふぁいとB

liked

I bought it for $40 and it's at a paper loss, so I hope the presidential election wins. ˚ ‧ º · (´ฅдฅ`) ‧ º · ˚.

$Trump Media & Technology (DJT.US)$

$Trump Media & Technology (DJT.US)$

Translated

12

5

ふぁいとB

reacted to

ふぁいとB

Set a live reminder

$NVIDIA (NVDA.US)$ The earnings call for the second quarter of the fiscal year 2025 is scheduled to be held at 6:00 AM on Thursday, August 29, 2024 Japan time. This briefing It will be delivered in subtitle translation format.If you wish to watch it, "Reservation"button.

◆Precautions

The content of this live stream is provided with the subtitle translation service for the convenience of our customers. The subtitles are generated using Microsoft Azure and Amazon Translate. No explicit or implicit guarantees are made regarding the accuracy, reliability, or precision of machine translation from English to Japanese. We are not responsible for any damages resulting from the translation content. Please keep this in mind when viewing.

◆Precautions

The content of this live stream is provided with the subtitle translation service for the convenience of our customers. The subtitles are generated using Microsoft Azure and Amazon Translate. No explicit or implicit guarantees are made regarding the accuracy, reliability, or precision of machine translation from English to Japanese. We are not responsible for any damages resulting from the translation content. Please keep this in mind when viewing.

Translated

Nvidia Q2 Earnings Call for Fiscal Year 2025 (subtitled translation)

Aug 28 16:00

136

12

ふぁいとB

liked

$NVIDIA (NVDA.US)$

I won't sell even if it goes down.![]()

Those who have been holding since last year don't need to sell.

It would be scary if it became one-third like Netflix, but it won't fall that much anyway.

If you sell based on emotions, you'll be a stepping stone for institutional investors after the holidays.

I'm sorry, but I can't do that.![]()

I won't sell even if it goes down.

Those who have been holding since last year don't need to sell.

It would be scary if it became one-third like Netflix, but it won't fall that much anyway.

If you sell based on emotions, you'll be a stepping stone for institutional investors after the holidays.

I'm sorry, but I can't do that.

Translated

24

ふぁいとB

reacted to

$Nikkei 225 (.N225.JP)$

Regarding the significant fluctuations in stock prices this time, a tone of 'let's make a calm judgment' stands out. It seems that the belief is 'stocks will eventually rise'. Is that really the case?

After the bubble burst, the Nikkei Stock Average dropped from the 0.03 million yen range to the 7,000 yen range over a decade. At that time, I bought stocks hoping to invest, but ended up losing money. Eventually, I realized that short selling was more profitable. From such a rock bottom situation, over another decade, the Nikkei Stock Average reached the 0.04 million yen range. I think it was largely thanks to monetary easing.

I'm not assuming that this stock market crash will be the same as after the bubble burst, but watching central banks so eager for interest rate hikes, it's hard to believe that 'stocks will eventually rise'.

It's not a matter of being against interest rate hikes at all. After outlining the path of the discussion, I would like an explanation of to what extent and over what period of time interest rates will be raised. Otherwise, I can't buy. To put it more bluntly, it seems like I would turn to selling as in the old days. It's absurd to base it on real interest rates. If you base it on real interest rates, you might as well raise interest rates as much as you want...

Regarding the significant fluctuations in stock prices this time, a tone of 'let's make a calm judgment' stands out. It seems that the belief is 'stocks will eventually rise'. Is that really the case?

After the bubble burst, the Nikkei Stock Average dropped from the 0.03 million yen range to the 7,000 yen range over a decade. At that time, I bought stocks hoping to invest, but ended up losing money. Eventually, I realized that short selling was more profitable. From such a rock bottom situation, over another decade, the Nikkei Stock Average reached the 0.04 million yen range. I think it was largely thanks to monetary easing.

I'm not assuming that this stock market crash will be the same as after the bubble burst, but watching central banks so eager for interest rate hikes, it's hard to believe that 'stocks will eventually rise'.

It's not a matter of being against interest rate hikes at all. After outlining the path of the discussion, I would like an explanation of to what extent and over what period of time interest rates will be raised. Otherwise, I can't buy. To put it more bluntly, it seems like I would turn to selling as in the old days. It's absurd to base it on real interest rates. If you base it on real interest rates, you might as well raise interest rates as much as you want...

Translated

8

ふぁいとB

liked

then why not raise interest rates? I wonder if that's enough, the government that skipped money, sorry, that's enough!

Translated

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)