カロリーゼロ

liked

1. Non-farm payroll employment

∙ 250,000 increase from the previous month (significantly exceeding the expected 150,000 increase)

∙ The largest increase in 6 months

- The number of employees in the previous month has been revised upward to an increase of 0.15 million 9000 people (preliminary value: an increase of 0.14 million 2000 people).

- The total number of employees in July and August has been revised upward by 0.07 million 2000 people.

2. Unemployment Rate

- The unemployment rate in September decreased to 4.1%.

- Market expectations are at 4.2%.

- The previous month was at 4.2%.

3. Average Hourly Wage

- Increased by 4% compared to the same month last year (market expectation: an increase of 3.8%).

- In the previous month, there was a 3.9% increase.

- Month-on-month comparison shows a 0.4% increase (market estimate of 0.3% increase).

- In August, there was a 0.5% increase.

- Growth in wages for production and non-managerial positions slowed to 3.9%.

4. Trends in Employment by Major Industries

Industries that drove the increase in employment

- Entertainment and Hospitality

- Healthcare

・Government agencies

・Manufacturing industry saw a decrease in employment for the second consecutive month

・Employment diffusion index (DI) at a high level since January

・The possibility of a significant rate cut (0.5 points) at the November FOMC meeting has diminished

・In the interest rate swap market, the anticipation of a rate cut in November has retreated to 25 basis points

6. Special Factors

・Anticipated reflection of Boeing workers' strike in October statistics

...

∙ 250,000 increase from the previous month (significantly exceeding the expected 150,000 increase)

∙ The largest increase in 6 months

- The number of employees in the previous month has been revised upward to an increase of 0.15 million 9000 people (preliminary value: an increase of 0.14 million 2000 people).

- The total number of employees in July and August has been revised upward by 0.07 million 2000 people.

2. Unemployment Rate

- The unemployment rate in September decreased to 4.1%.

- Market expectations are at 4.2%.

- The previous month was at 4.2%.

3. Average Hourly Wage

- Increased by 4% compared to the same month last year (market expectation: an increase of 3.8%).

- In the previous month, there was a 3.9% increase.

- Month-on-month comparison shows a 0.4% increase (market estimate of 0.3% increase).

- In August, there was a 0.5% increase.

- Growth in wages for production and non-managerial positions slowed to 3.9%.

4. Trends in Employment by Major Industries

Industries that drove the increase in employment

- Entertainment and Hospitality

- Healthcare

・Government agencies

・Manufacturing industry saw a decrease in employment for the second consecutive month

・Employment diffusion index (DI) at a high level since January

・The possibility of a significant rate cut (0.5 points) at the November FOMC meeting has diminished

・In the interest rate swap market, the anticipation of a rate cut in November has retreated to 25 basis points

6. Special Factors

・Anticipated reflection of Boeing workers' strike in October statistics

...

Translated

13

カロリーゼロ

liked

This report introduces the market outlook for the first half of 2024 and the hot stocks (industries) of Japanese stocks. The examples of stocks mentioned in this report do not provide any recommendations or trading guidance. We hope you focus on the industries and reasons that may have an impact based on the possible situations in the 2024 market in Japan and the USA.

■ Outlook for the US Market

<Once Every Four Years Presidential Election That Causes Turbulence>

The trends in the US stock market will also have an impact on the Japanese stock market.

Of particular interest is the United States presidential election to be held on November 5th this year.

Especially in the S&P 500, there is data suggesting that stock prices tend to rise during US presidential election years.

Even in recent years, both during the election of President Trump in 2016 and the election of President Biden in 2020, there has been a significant increase in stock prices afterwards.

However, there have been fluctuations along the way.

In 2016, the unexpected shock of the United Kingdom's EU exit in June, and in 2020, the stock market experienced a major crash due to the new coronavirus pandemic in March.

Also, in the period from September to October just before the election, the stock market tends to become unstable due to risk aversion movements.

In 2024, the first half of the year will be dominated by geopolitical risks such as the presidential election in the United States and Japan's consumption tax increase.

■ Outlook for the US Market

<Once Every Four Years Presidential Election That Causes Turbulence>

The trends in the US stock market will also have an impact on the Japanese stock market.

Of particular interest is the United States presidential election to be held on November 5th this year.

Especially in the S&P 500, there is data suggesting that stock prices tend to rise during US presidential election years.

Even in recent years, both during the election of President Trump in 2016 and the election of President Biden in 2020, there has been a significant increase in stock prices afterwards.

However, there have been fluctuations along the way.

In 2016, the unexpected shock of the United Kingdom's EU exit in June, and in 2020, the stock market experienced a major crash due to the new coronavirus pandemic in March.

Also, in the period from September to October just before the election, the stock market tends to become unstable due to risk aversion movements.

In 2024, the first half of the year will be dominated by geopolitical risks such as the presidential election in the United States and Japan's consumption tax increase.

Translated

+5

35

カロリーゼロ

voted

Good evening, Moomoo users!![]() Here is the market sentiment for NY stocks tonight.

Here is the market sentiment for NY stocks tonight.![]()

Market Overview

Starting point for the USA market, Dow Jones Industrial Average, composed of high-quality stocks, started 116.09 points higher at 38,356.07. The technology-heavy Nasdaq Composite Index started 74.24 points higher at 15,525.55. The S&P 500, composed of 500 large-cap stocks, started 18.25 points higher at 5,028.85.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

Top News

The shift in the Fed's schedule and the Bank of Japan's acceleration are causing concern among investors regarding monetary policy fluctuations = Mr. Hidenari Kumano

There is strong adjustment pressure on both the Japanese and American stock prices. This is because the expected start of the Federal Reserve's (FRB) interest rate cut, which was originally anticipated for June, seems to be delayed.

The decline in US stocks is not over yet - Goldman's Rubner.

Prepare for further decline in US stocks, says Goldman Sachs Group Tactical Specialist...

Market Overview

Starting point for the USA market, Dow Jones Industrial Average, composed of high-quality stocks, started 116.09 points higher at 38,356.07. The technology-heavy Nasdaq Composite Index started 74.24 points higher at 15,525.55. The S&P 500, composed of 500 large-cap stocks, started 18.25 points higher at 5,028.85.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

Top News

The shift in the Fed's schedule and the Bank of Japan's acceleration are causing concern among investors regarding monetary policy fluctuations = Mr. Hidenari Kumano

There is strong adjustment pressure on both the Japanese and American stock prices. This is because the expected start of the Federal Reserve's (FRB) interest rate cut, which was originally anticipated for June, seems to be delayed.

The decline in US stocks is not over yet - Goldman's Rubner.

Prepare for further decline in US stocks, says Goldman Sachs Group Tactical Specialist...

Translated

30

カロリーゼロ

voted

Good evening to all Moomoo users!![]() Here is the NY stock market outlook for tonight.

Here is the NY stock market outlook for tonight.![]()

Market Overview

Starting in the USA market, the Dow Jones Industrial Average, composed of high-quality stocks, began at 38,523.26, up 61.75 points, while the tech stock-heavy Nasdaq Composite Index started at 16,236.20, up 65.84 points. The S&P 500, consisting of 500 of the largest US stocks, started at 5,172.95, up 12.31 points.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

Top News

【Indicator Flash Report】The US March Producer Price Index (PPI) increased by 0.2% compared to the previous month, falling below market expectations. The core index also increased by 0.2%.

Released by the US Department of Labor.Producer Price Index (PPI) in March. Rose 0.2% from the previous month.、Falls below the market's expected increase of 0.3%.Slowed down from the previous increase of 0.6% and reached the lowest level year-to-date.Compared to the previous year, it increased by 2.1%.The growth expanded from the previous 1.6% and once again exceeded the Federal Reserve Board's (FRB) target of 2% or more...

Market Overview

Starting in the USA market, the Dow Jones Industrial Average, composed of high-quality stocks, began at 38,523.26, up 61.75 points, while the tech stock-heavy Nasdaq Composite Index started at 16,236.20, up 65.84 points. The S&P 500, consisting of 500 of the largest US stocks, started at 5,172.95, up 12.31 points.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

Top News

【Indicator Flash Report】The US March Producer Price Index (PPI) increased by 0.2% compared to the previous month, falling below market expectations. The core index also increased by 0.2%.

Released by the US Department of Labor.Producer Price Index (PPI) in March. Rose 0.2% from the previous month.、Falls below the market's expected increase of 0.3%.Slowed down from the previous increase of 0.6% and reached the lowest level year-to-date.Compared to the previous year, it increased by 2.1%.The growth expanded from the previous 1.6% and once again exceeded the Federal Reserve Board's (FRB) target of 2% or more...

Translated

+2

23

カロリーゼロ

voted

Hello, Moomoo users! Good work on the market close.![]() Today's stock market summary is as follows. Thank you.

Today's stock market summary is as follows. Thank you.![]()

The Nikkei Stock Average ended at 40,369.44 yen, up 201.37 yen from the previous trading day.

Japanese stocks rebounded, buoyed by solid US economic indicators and buying in resource-related stocks.

The end of electricity and gas subsidies could push up Japan's prices - BOJ policy is complex.

In April, prices increased for 2,806 food items, including sausages, according to a private survey.

Kobayashi Pharmaceutical saw a sharp rise in the afternoon, with a press conference starting around 2 o'clock.

Hot Stocks: $Kobayashi Pharmaceutical (4967.JP)$, $Rohm (6963.JP)$etc.

moomoo News Japanese Stocks Zeber

Market Overview

The Nikkei stock average on the Tokyo stock market today closed at 40,369.44 yen, up 201.37 yen from the previous trading day, while the Tokyo Stock Price Index (TOPIX) closed at 2,768.62, up 17.81 points.

Top News

Japanese stocks rebounded on positive US economic indicators, with buying seen in resource-related stocks.

On the 29th, the Tokyo stock market rebounded. The revised value of US consumer sentiment raised to the highest level since July 2021, exceeding the market's median forecast.

The Nikkei Stock Average ended at 40,369.44 yen, up 201.37 yen from the previous trading day.

Japanese stocks rebounded, buoyed by solid US economic indicators and buying in resource-related stocks.

The end of electricity and gas subsidies could push up Japan's prices - BOJ policy is complex.

In April, prices increased for 2,806 food items, including sausages, according to a private survey.

Kobayashi Pharmaceutical saw a sharp rise in the afternoon, with a press conference starting around 2 o'clock.

Hot Stocks: $Kobayashi Pharmaceutical (4967.JP)$, $Rohm (6963.JP)$etc.

moomoo News Japanese Stocks Zeber

Market Overview

The Nikkei stock average on the Tokyo stock market today closed at 40,369.44 yen, up 201.37 yen from the previous trading day, while the Tokyo Stock Price Index (TOPIX) closed at 2,768.62, up 17.81 points.

Top News

Japanese stocks rebounded on positive US economic indicators, with buying seen in resource-related stocks.

On the 29th, the Tokyo stock market rebounded. The revised value of US consumer sentiment raised to the highest level since July 2021, exceeding the market's median forecast.

Translated

35

カロリーゼロ

voted

The speculation about the Bank of Japan's abolition of the negative interest rate policy was already announced last week.

The actual interest rate hike statement and the remarks of Governor Ueda at yesterday's press conference made it clear that the background of short-term large-scale monetary easing remains unchanged and that there will be no significant interest rate hike.

Due to the overall dovish remarks compared to market expectations, yesterday's Japanese government bond yields skyrocketed and the USD/JPY also surged.

Market expectations for a hawkish FOMC statement by Senior Advisor Bao tonight are gradually rising, and the dot plot to be released tonight is likely to show only 2 interest rate cuts for the year, instead of the market's expectation of 3. The interest rate spread between the US and Japan will not shrink significantly in the near future, and the continued strength of the US dollar and the yen depreciation are also pushing it.

Of course, there are other factors such as short-term manipulation in the foreign exchange market and exhaustion of shorts, but the two mentioned above are still the core logic of the feeling.![]() The logic that forms the basis of the feeling is still the two mentioned above.

The logic that forms the basis of the feeling is still the two mentioned above.

[Bank of Japan Decision Meeting Preview]Moomoo's news seems to have predicted it ahead of time. Amazing.![]()

$USD/JPY (USDJPY.FX)$

The actual interest rate hike statement and the remarks of Governor Ueda at yesterday's press conference made it clear that the background of short-term large-scale monetary easing remains unchanged and that there will be no significant interest rate hike.

Due to the overall dovish remarks compared to market expectations, yesterday's Japanese government bond yields skyrocketed and the USD/JPY also surged.

Market expectations for a hawkish FOMC statement by Senior Advisor Bao tonight are gradually rising, and the dot plot to be released tonight is likely to show only 2 interest rate cuts for the year, instead of the market's expectation of 3. The interest rate spread between the US and Japan will not shrink significantly in the near future, and the continued strength of the US dollar and the yen depreciation are also pushing it.

Of course, there are other factors such as short-term manipulation in the foreign exchange market and exhaustion of shorts, but the two mentioned above are still the core logic of the feeling.

[Bank of Japan Decision Meeting Preview]Moomoo's news seems to have predicted it ahead of time. Amazing.

$USD/JPY (USDJPY.FX)$

Translated

4

カロリーゼロ

liked

The depreciation of the yen progressed, and the dollar-yen exchange rate on the 29th hovered in the $1 = 146 yen range. The background is that the outlook that high interest rates in the US will continue for the time being spread based on Fed Chairman Powell's speech at the Jackson Hole meeting, and the interest rate difference between Japan and the US was once again aware.

According to Bloomberg, the Goldman Sachs Group predicts that “if the Bank of Japan maintains a dovish attitude, the yen will add 1 dollar = 155 yen in the next 6 months.” 1 dollar = 155 yen is equivalent to the depreciation level of the yen since 1990/6.

Export-related stocks will benefit from the depreciation of the yen progressing. Already in the first quarter financial results, the depreciation of the yen contributed to a rise in business performance for stocks with a high overseas sales ratio. It can also be seen from the financial results briefing materials of the 10 major companies with high overseas sales ratios that they have greatly benefited from exchange rates.

According to the Nihon Keizai Shimbun, out of 68 major companies that disclosed exchange rate effects of financial results for the fiscal year ending 2023/4/6, etc., 90% of companies benefited in the direction of profit increase, and the increase in profit due to exchange accounts for 50% of the overall operating profit increase.

The average exchange rate for financial results for the fiscal year ending 2023/4/6 is 1 dollar = 137 yen...

According to Bloomberg, the Goldman Sachs Group predicts that “if the Bank of Japan maintains a dovish attitude, the yen will add 1 dollar = 155 yen in the next 6 months.” 1 dollar = 155 yen is equivalent to the depreciation level of the yen since 1990/6.

Export-related stocks will benefit from the depreciation of the yen progressing. Already in the first quarter financial results, the depreciation of the yen contributed to a rise in business performance for stocks with a high overseas sales ratio. It can also be seen from the financial results briefing materials of the 10 major companies with high overseas sales ratios that they have greatly benefited from exchange rates.

According to the Nihon Keizai Shimbun, out of 68 major companies that disclosed exchange rate effects of financial results for the fiscal year ending 2023/4/6, etc., 90% of companies benefited in the direction of profit increase, and the increase in profit due to exchange accounts for 50% of the overall operating profit increase.

The average exchange rate for financial results for the fiscal year ending 2023/4/6 is 1 dollar = 137 yen...

Translated

26

1

カロリーゼロ

liked

To all moomoo users

Thank you for always using the moomoo app.![]()

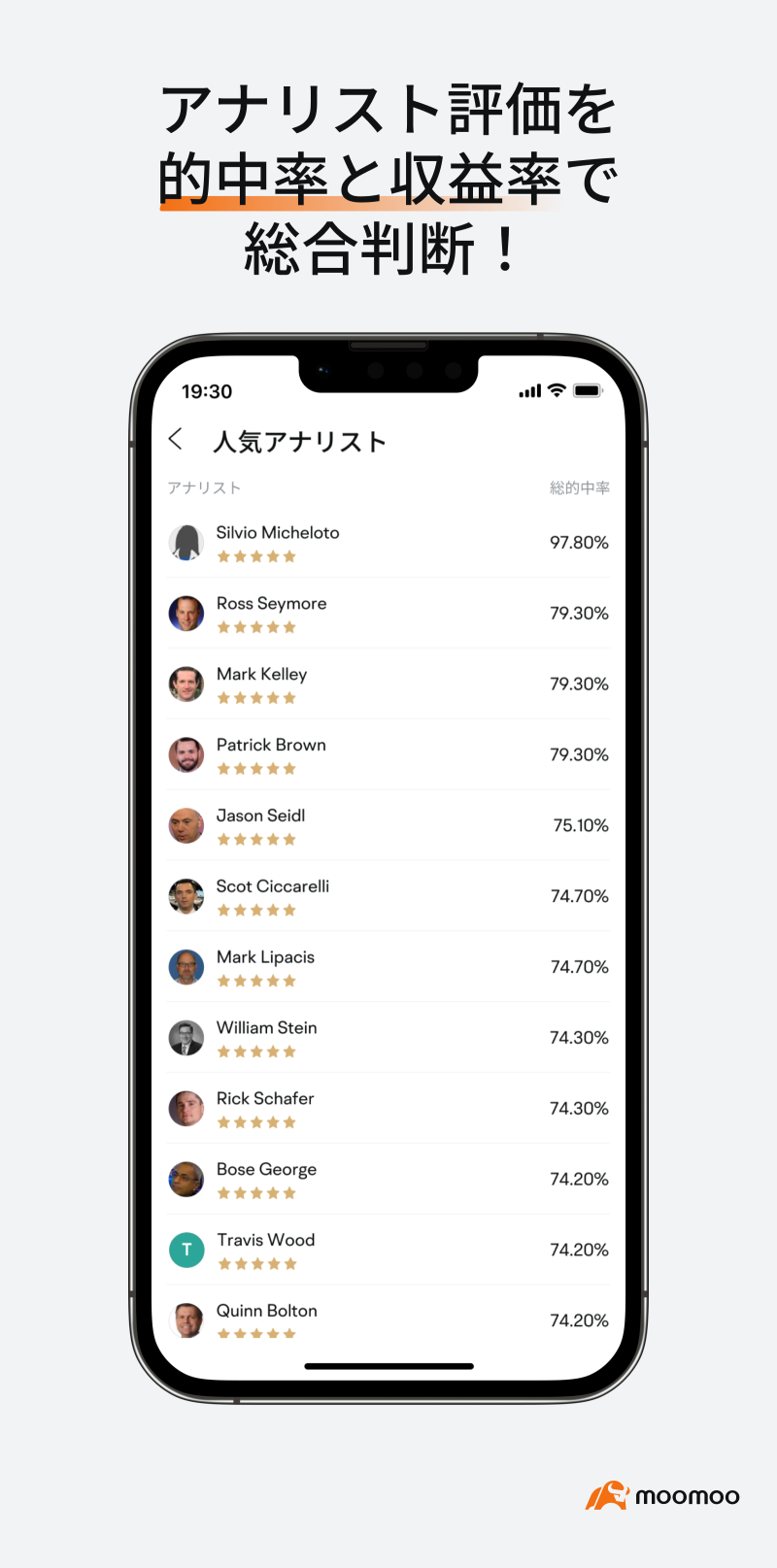

Are you having trouble gathering information on institutional investors' trading trends, analyst evaluations, etc.? This information is important data that determines investment strategies, and is essential for investors.

With this release, in addition to the overall evaluations of existing analyst evaluations and target stock price predictions,Institutional Investor/ Analyst Evaluation Datahas been added, and it is now possible to grasp it in more detail. Make the most of this powerful tool and explore investment opportunities.![]()

More detailed assessment data: check agencies/analysts' past evaluations at a glance

Newly added“Details”On the tab, Wall Street'sApproximately 250 financial institutionswithOver 4000 analystsEvaluation data contributed by is included. In addition, past evaluations can also be viewed, so you can check how accurate predictions have been made by specific institutional investors and analysts in the past.

Judge analysts' evaluations comprehensively based on hit rate and profit ratio

Of the analysts' pastThe median ratewithAverage rate of returnTo...

Thank you for always using the moomoo app.

Are you having trouble gathering information on institutional investors' trading trends, analyst evaluations, etc.? This information is important data that determines investment strategies, and is essential for investors.

With this release, in addition to the overall evaluations of existing analyst evaluations and target stock price predictions,Institutional Investor/ Analyst Evaluation Datahas been added, and it is now possible to grasp it in more detail. Make the most of this powerful tool and explore investment opportunities.

More detailed assessment data: check agencies/analysts' past evaluations at a glance

Newly added“Details”On the tab, Wall Street'sApproximately 250 financial institutionswithOver 4000 analystsEvaluation data contributed by is included. In addition, past evaluations can also be viewed, so you can check how accurate predictions have been made by specific institutional investors and analysts in the past.

Judge analysts' evaluations comprehensively based on hit rate and profit ratio

Of the analysts' pastThe median ratewithAverage rate of returnTo...

Translated

+2

112

2

Translated

2

カロリーゼロ

liked

$Astellas Pharma (4503.JP)$

Since the stock price of Astellas Pharma is coming down nicely, I am watching to see if it's a good time to buy 🌱

【Shopping Criteria】

Stock Price: Around 2000 yen

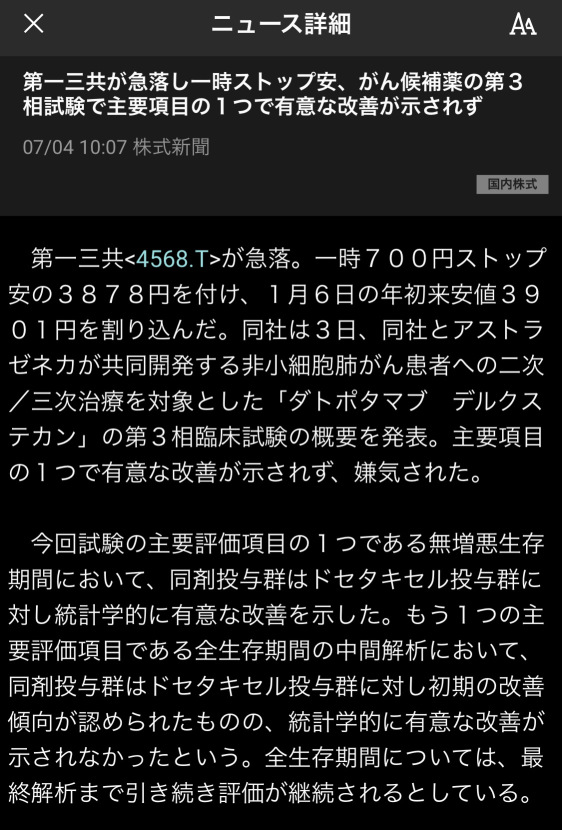

The reason for this decline is the news from Daiichi Sankyo Pharmaceutical.

Astellas Pharma also experienced a decline as a result.

So, personally, I think this is a chance, and I want to carefully time my entry.

The concern is the pharmaceutical industry, so there is a risk of price fluctuations due to reliance on new drugs. However, it is also an industry with a high company value, so I definitely want to include it in my portfolio. 😆

↑ This happened with Daiichi Sankyo this time, but please be careful as it could happen with Astellas Pharma as well. 📝

Please feel free to use it as a reference. 🌱

$Astellas Pharma (4503.JP)$

$Daiichi Sankyo (4568.JP)$

Since the stock price of Astellas Pharma is coming down nicely, I am watching to see if it's a good time to buy 🌱

【Shopping Criteria】

Stock Price: Around 2000 yen

The reason for this decline is the news from Daiichi Sankyo Pharmaceutical.

Astellas Pharma also experienced a decline as a result.

So, personally, I think this is a chance, and I want to carefully time my entry.

The concern is the pharmaceutical industry, so there is a risk of price fluctuations due to reliance on new drugs. However, it is also an industry with a high company value, so I definitely want to include it in my portfolio. 😆

↑ This happened with Daiichi Sankyo this time, but please be careful as it could happen with Astellas Pharma as well. 📝

Please feel free to use it as a reference. 🌱

$Astellas Pharma (4503.JP)$

$Daiichi Sankyo (4568.JP)$

Translated

19

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)