Status of Shares

Total Issuable Common Shares - 3,000,000 shares

Class 5 Preferred Shares - 167,000 shares

Class 7 Preferred Shares - 167,000 shares

Class 8 Preferred Shares - 115,000 shares

Class 9 Preferred Shares - 115,000 shares

Total Issued Common Shares - 1,373,171,556 shares

Number of common shareholders - 327,658

Total Issuable Common Shares - 3,000,000 shares

Class 5 Preferred Shares - 167,000 shares

Class 7 Preferred Shares - 167,000 shares

Class 8 Preferred Shares - 115,000 shares

Class 9 Preferred Shares - 115,000 shares

Total Issued Common Shares - 1,373,171,556 shares

Number of common shareholders - 327,658

Translated

Sumitomo Mitsui Financial Group (SMBC Group)'s “V Points” and Culture Convenience Club (CCC)'s “T Points” have begun moving toward integration (detailed article). It is attracting attention as a common point on a scale exceeding Rakuten points, d points, Ponta points, and PayPay points promoted by the 4 mobile phone carriers, but what are “V” and “T” in the first place?

First, T points started in 2003/10. The common point where multiple companies participate is now common, but T point was the forerunner of that. So what does that “T” mean?

CCC, which operates T Points, is also known for operating TSUTAYA and Tsutaya Bookstore. So when it comes to TSUTAYA's T, it's different. It is said that CCC founder Masuda Muneaki answered a TV interview, “T” has a beautiful design for T points, so intuition (decided) that 'T' would be good” (from Wikipedia) (from Wikipedia).

According to CCC Public Relations, “T stands for Top Share Alliance.” Common points Initially, T points were adopted in multiple industries...

First, T points started in 2003/10. The common point where multiple companies participate is now common, but T point was the forerunner of that. So what does that “T” mean?

CCC, which operates T Points, is also known for operating TSUTAYA and Tsutaya Bookstore. So when it comes to TSUTAYA's T, it's different. It is said that CCC founder Masuda Muneaki answered a TV interview, “T” has a beautiful design for T points, so intuition (decided) that 'T' would be good” (from Wikipedia) (from Wikipedia).

According to CCC Public Relations, “T stands for Top Share Alliance.” Common points Initially, T points were adopted in multiple industries...

Translated

Why can Mitsubishi UFJFG and Sumitomo Mitsui Financial Group maintain an “annual income of 10 million yen” even at ultra-low interest rates, and is it safe even when the yen is super weak?

The banking industry has suffered from a low interest rate environment for many years

However, Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group still continue to receive high treatment

The average annual income of both companies is 10 million yen or more, and the benefits are generous.

The banking industry has suffered from a low interest rate environment for many years

However, Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group still continue to receive high treatment

The average annual income of both companies is 10 million yen or more, and the benefits are generous.

Translated

1. NASDAQ ( $Nasdaq Composite Index (.IXIC.US)$ ) is the world's largest stock market for start-ups in the United States

2. Many information and communication related stocks with global technology and services are listed on the NASDAQ

3. The NASDAQ100 index has a better performance record than the Dow average and the S&P 500

$Invesco QQQ Trust (QQQ.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ $ProShares UltraPro QQQ ETF (TQQQ.US)$ $Global X Nasdaq 100 Covered Call ETF (QYLD.US)$

2. Many information and communication related stocks with global technology and services are listed on the NASDAQ

3. The NASDAQ100 index has a better performance record than the Dow average and the S&P 500

$Invesco QQQ Trust (QQQ.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ $ProShares UltraPro QQQ ETF (TQQQ.US)$ $Global X Nasdaq 100 Covered Call ETF (QYLD.US)$

Translated

2

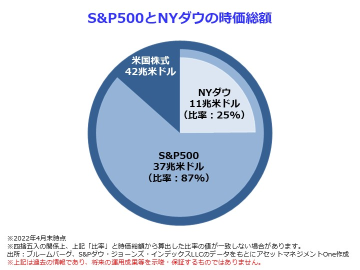

$S&P 500 Index (.SPX.US)$ S&P500, formally known as the "Standard & Poor's 500 Stock Index", is published by S&P Dow Jones Indices LLC. It aims to cover major companies in the main industries of the United States. It selects approximately 500 stocks listed on the New York Stock Exchange and NASDAQ based on market size, liquidity, industry, and other factors. The index is calculated as a weighted average by market capitalization. As of April 2022, it covers about 87% of the total market capitalization of US stocks.

On the other hand, NY Dow (officially known as Dow Jones Industrial Average) is also published by S&P Dow Jones Indices LLC. It is characterized by having a very small number of 30 constituent stocks. Unlike S&P500, it calculates the index by averaging the prices of the stocks rather than by market capitalization. As of April 2022, it covers about 25% of the total market capitalization of US stocks. $Vanguard Total Stock Market ETF (VTI.US)$ $iShares Core S&P 500 ETF (IVV.US)$

���������...

On the other hand, NY Dow (officially known as Dow Jones Industrial Average) is also published by S&P Dow Jones Indices LLC. It is characterized by having a very small number of 30 constituent stocks. Unlike S&P500, it calculates the index by averaging the prices of the stocks rather than by market capitalization. As of April 2022, it covers about 25% of the total market capitalization of US stocks. $Vanguard Total Stock Market ETF (VTI.US)$ $iShares Core S&P 500 ETF (IVV.US)$

���������...

Translated

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)