スパニッシュフライ

liked

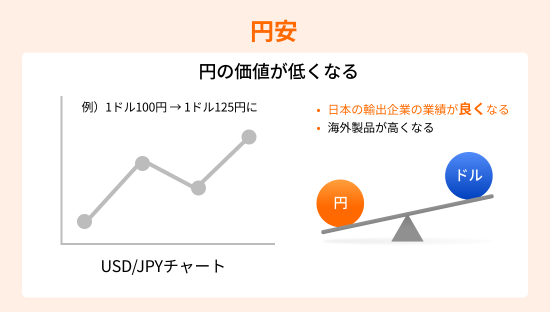

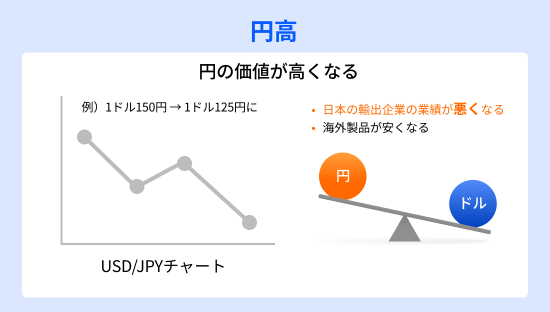

On 9/27, in response to the presidential election results, the appreciation of the yen progressed, and Nikkei Average futures temporarily recorded a drop of 2000 yen after closing. This time, I will explain what depreciation and appreciation of yen are, and why understanding exchange rates is important when investing in stocks.

Why you should keep a close eye on the dollar-yen exchange rate even when investing in Japanese stocks

1. The US dollar is the most widely used in the worldKey currencyIt plays a central role in international trade and financial transactions. Thus, the dollar-yen exchange rate affects various economic activities not only in Japan but also in the global economy.

2. The total market value of the US stock market accounts for about 50% of the total market value of the global stock market. Trends in the US dollar and US stocks will also have an impact on the Japanese stock market.

3. Trends in the dollar to yen exchange rate are closely related to earnings forecasts and stock price evaluations of Japanese companies.

For investors, the value of their currency against the dollar is a very important indicator. The euro is also the currency traded after the US dollar, but in terms of direct ties and influence with the Japanese economy, the dollar to yen rate tends to attract more attention. Therefore, in this article, yen against the US dollar...

Why you should keep a close eye on the dollar-yen exchange rate even when investing in Japanese stocks

1. The US dollar is the most widely used in the worldKey currencyIt plays a central role in international trade and financial transactions. Thus, the dollar-yen exchange rate affects various economic activities not only in Japan but also in the global economy.

2. The total market value of the US stock market accounts for about 50% of the total market value of the global stock market. Trends in the US dollar and US stocks will also have an impact on the Japanese stock market.

3. Trends in the dollar to yen exchange rate are closely related to earnings forecasts and stock price evaluations of Japanese companies.

For investors, the value of their currency against the dollar is a very important indicator. The euro is also the currency traded after the US dollar, but in terms of direct ties and influence with the Japanese economy, the dollar to yen rate tends to attract more attention. Therefore, in this article, yen against the US dollar...

Translated

+5

76

12

20

After-hours Ishiba shock, the reverse congratulatory market. Even now, it's chaotic, but let's wait for the real chaos until Monday morning when we are in a state of being strangled by cotton.

Translated

2

Today was a significant increase in an upward market. The RSI still has room for further upside, but it feels restrained by the 200-day moving average. As it's the end of the month, it seems like we might see a consolidation market from here. Hopefully, we can expect a breakthrough above 39,000 yen if the yen does not strengthen further!

Translated

2

スパニッシュフライ

liked

Japan at night rises only due to the weak yen.

Translated

2

スパニッシュフライ

liked

The Japanese stock market is affected by exchange rates. If the high stock prices in America are not accompanied by a weaker yen, I wonder if we can expect future growth.

Translated

7

I couldn't predict today's stock market rise. It's surprising that the Nikkei Average exceeded 37,000 yen so easily. It seems to be a risk-on atmosphere with plenty of material.

Translated

2

It's unusual for the stock market to rise and the yen to weaken before the FOMC. Is this some kind of reward?

Translated

3

The yen's strength caused the Nikkei 225 to fall. The direction is uncertain in the usa as well. We are waiting for events such as the FOMC.

Translated

8

#moomoo Securities

Translated

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)