ドラッケンメラー

commented on

Are Japanese stocks doing well this week? Rice that is getting a lot of attention in the market $NVIDIA (NVDA.US)$Ahead of the announcement of financial results on the 22nd, the wait-and-see mood is likely to expand in the first half of the week. Triggered by financial statements, etc. showing the expansion of demand for artificial intelligence (AI), etc.There is a possibility that the impact will spread to related stocks around the worldThere is. Meanwhile, as observations of lower US interest rates increase, interest is also being drawn to trends in long-term US interest rates.

Currently, while the Dow Average and Nasdaq Index hit their highest values, the Nikkei Average has been in an adjustment phase for close to 2 months. Depending on NVIDIA's financial results, it is possible that the upward trend will intensify all at once. Since demand for generative AI is strong, market expectations for NVIDIA financial results are high. If financial results are good, semiconductor-related stocks will be bought, and the Nikkei Average is expected to test the 39,000 yen range. Conversely, it is possible that the trend will fall again. That positive content was evaluated in NVIDIA's financial results for February, and amid strong semiconductor stocks, the Nikkei AverageThe highest value was updated for the first time in 34 yearsI ran up to.

Multiple agencies have announced NVIDIA's first quarter financial results and second quarter guidance...

Translated

63

3

ドラッケンメラー

liked

I tried to consolidate most of it into NVIDIA.

In actual trading, it's gambling, right?

I will provide feedback.

I will continue like this until next weekend.

Additional note (0223) On March 1st, I want to return to normal, so on the 28th and 29th, I will change the portfolio.

In actual trading, it's gambling, right?

I will provide feedback.

I will continue like this until next weekend.

Additional note (0223) On March 1st, I want to return to normal, so on the 28th and 29th, I will change the portfolio.

Translated

6

1

ドラッケンメラー

commented on

$NVIDIA (NVDA.US)$

Hidden profits lurk within anxiety and fear.

Hidden profits lurk within anxiety and fear.

Translated

16

3

Mr. Takuro Morinaga is said to be a bubble.

Translated

ドラッケンメラー

commented on

I thought I was too early.![]() I thought I was too early, but the principle of leverage...

I thought I was too early, but the principle of leverage...![]()

$Arm Holdings (ARM.US)$

$Arm Holdings (ARM.US)$

Translated

9

6

ドラッケンメラー

commented on

This article uses automatic translation for some of its parts

![]() Investing in Japan was a gift from God “too easy” = Munger

Investing in Japan was a gift from God “too easy” = Munger

Right hand man of famous American investor Warren Buffett, $Berkshire Hathaway-A (BRK.A.US)$Charlie Munger (99), who served as the vice chairman of, touched on the judgment of Mr. Buffett, who invested billions of dollars in Japanese stocks,Investing in Japan was a gift from God “too easy”It showed that point of view.

Berkshire Hathaway decided the conditions for issuing yen denominated corporate bonds on November 17. While continued investment in Japanese stocks is expected, funds were raised in the yen bond market following April. This is Berkshire's second yen-denominated bond. According to Bloomberg's tally, Berkshire has issued most corporate bonds in yen since 2019/9, when it first appeared on the yen bond market.

![]() risks

risks

Japanese stocks have had a landslide victory over Chinese stocks this year, but some investors think that trend is about to change. The headwinds against Japanese stocks are getting stronger.Global growth worsensIn addition toMonetary policy tightening...

Right hand man of famous American investor Warren Buffett, $Berkshire Hathaway-A (BRK.A.US)$Charlie Munger (99), who served as the vice chairman of, touched on the judgment of Mr. Buffett, who invested billions of dollars in Japanese stocks,Investing in Japan was a gift from God “too easy”It showed that point of view.

Berkshire Hathaway decided the conditions for issuing yen denominated corporate bonds on November 17. While continued investment in Japanese stocks is expected, funds were raised in the yen bond market following April. This is Berkshire's second yen-denominated bond. According to Bloomberg's tally, Berkshire has issued most corporate bonds in yen since 2019/9, when it first appeared on the yen bond market.

Japanese stocks have had a landslide victory over Chinese stocks this year, but some investors think that trend is about to change. The headwinds against Japanese stocks are getting stronger.Global growth worsensIn addition toMonetary policy tightening...

Translated

Expand

Expand 26

2

ドラッケンメラー

commented on

Moomooユーザーの皆様、こんばんは!![]() 今晩のNY株の読み筋です。

今晩のNY株の読み筋です。![]()

Market Overview

US market opened with the Dow Industrial Average, which consists of high-quality stocks, starting at 33,852.44 dollars, an increase of 18.83 dollars. The Nasdaq Composite Index, which has a high proportion of high-tech stocks, started at 13,312.39, up 73.87 points. The S&P 500 Index, which consists of stocks from 500 large US companies, rose 10.95 points to 4,304.88.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

Top News

The Federal Reserve is expected to pause interest rate hikes in June and maintain them until December, according to economists' predictions.

A majority of economists surveyed by Bloomberg expect the Federal Reserve to pause its current rate hike campaign, which began in March last year, at next week's meeting of the Federal Open Market Committee (FOMC) for the first time in one year and three months.

The market is bracing for the impact of the issuance of 1 trillion dollars of US Treasury bonds.

���������...

Market Overview

US market opened with the Dow Industrial Average, which consists of high-quality stocks, starting at 33,852.44 dollars, an increase of 18.83 dollars. The Nasdaq Composite Index, which has a high proportion of high-tech stocks, started at 13,312.39, up 73.87 points. The S&P 500 Index, which consists of stocks from 500 large US companies, rose 10.95 points to 4,304.88.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

Top News

The Federal Reserve is expected to pause interest rate hikes in June and maintain them until December, according to economists' predictions.

A majority of economists surveyed by Bloomberg expect the Federal Reserve to pause its current rate hike campaign, which began in March last year, at next week's meeting of the Federal Open Market Committee (FOMC) for the first time in one year and three months.

The market is bracing for the impact of the issuance of 1 trillion dollars of US Treasury bonds.

���������...

Translated

10

2

ドラッケンメラー

commented on

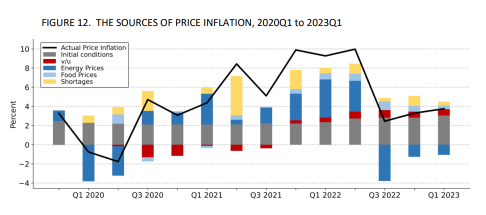

Ben Bernanke, a former US Federal Reserve (Fed) chairman and senior researcher at the Brookings Institution, presented a paper with PIIE senior researcher and economist Olivier Blanchard on the causes of US inflation during the pandemic period.

This paper breaks down the sources of inflation during the pandemic period and obtained the conclusion that “labor market tensions did not contribute much to inflation in the early stages.” With this conclusion, it is possible to explain that inflation skyrocketed under a situation where the Phillips curve is flat. Early stage inflation is mainly in the goods market, and it is a sharp rise in the prices of some commodities and commodity prices in industries where supply is restricted. Then, as commodity market prices stabilize and supply chains normalize, it is said that the importance of the goods market will decline among the components of inflation, and there is a possibility that the labor market will become more dominant.

According to this paper, it is anticipated that inflation will rise moderately in the future since the slump in the labor market is below a sustainable level. The Fed is...

This paper breaks down the sources of inflation during the pandemic period and obtained the conclusion that “labor market tensions did not contribute much to inflation in the early stages.” With this conclusion, it is possible to explain that inflation skyrocketed under a situation where the Phillips curve is flat. Early stage inflation is mainly in the goods market, and it is a sharp rise in the prices of some commodities and commodity prices in industries where supply is restricted. Then, as commodity market prices stabilize and supply chains normalize, it is said that the importance of the goods market will decline among the components of inflation, and there is a possibility that the labor market will become more dominant.

According to this paper, it is anticipated that inflation will rise moderately in the future since the slump in the labor market is below a sustainable level. The Fed is...

Translated

5

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)