人生如幻

commented on

UPDATE: 03/26 23:13 The big mouth is causing chaos again. This is not a fault of technical analysis, as technical analysis cannot prevent attacks from the big mouth. SOX breaks the daily MA20, stop loss and exit for coffee~ Going out now.. not playing with the big mouth anymore...

SOX: Stop loss and exit.

AMD:

Stop loss~

Looking down at the red dotted line or whether the daily MA20 can hold, this reminds me of the previous effort and care I put into the hand-drawn 18 white little sketches... haha..

The beginner draws a diagram at the end of this text.

The time for the 18-year-old novice's wild guesses has come again.

The playful novice is going out to have fun this Friday, so it's best to finish writing this part in one go, because this time the plan is to visit Yunnan, and expected to return in mid-April.

Without further ado, let's get to the main point:

Previously, we all guessed correctly at the bottom; after SOX broke above the descending red solid line on 3/12. The pullback backtest on 3/13 for SOX was a valid breakthrough, confirming this as a bottom reversal point. The breakthrough of the yellow solid line on 3/24 was only for testing the breakthrough, as there was pressure from the 4-hour MA50 above, making the trading day on 3/25 a preparation day for the pullback continuation. To make an analogy, just like a person preparing to jump high must first lower their center of gravity before exerting force to jump up. The position of the low point for this pullback continuation depends on the MM. Only the MM can decide how much to pull back. The book theory states that the pullback should not fill the gap below; however, novice traders believe that it should not fall below the 4-hour MA20 as a standard...

SOX: Stop loss and exit.

AMD:

Stop loss~

Looking down at the red dotted line or whether the daily MA20 can hold, this reminds me of the previous effort and care I put into the hand-drawn 18 white little sketches... haha..

The beginner draws a diagram at the end of this text.

The time for the 18-year-old novice's wild guesses has come again.

The playful novice is going out to have fun this Friday, so it's best to finish writing this part in one go, because this time the plan is to visit Yunnan, and expected to return in mid-April.

Without further ado, let's get to the main point:

Previously, we all guessed correctly at the bottom; after SOX broke above the descending red solid line on 3/12. The pullback backtest on 3/13 for SOX was a valid breakthrough, confirming this as a bottom reversal point. The breakthrough of the yellow solid line on 3/24 was only for testing the breakthrough, as there was pressure from the 4-hour MA50 above, making the trading day on 3/25 a preparation day for the pullback continuation. To make an analogy, just like a person preparing to jump high must first lower their center of gravity before exerting force to jump up. The position of the low point for this pullback continuation depends on the MM. Only the MM can decide how much to pull back. The book theory states that the pullback should not fill the gap below; however, novice traders believe that it should not fall below the 4-hour MA20 as a standard...

Translated

+3

11

8

人生如幻

commented on

$Advanced Micro Devices (AMD.US)$ Retail investors got scared for a moment and sold everything~~ Let's take a look. $NVIDIA (NVDA.US)$ $Advanced Micro Devices (AMD.US)$ $Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$ The probability of a rise on Friday is very high.

It seems that MM Institutions have been buying NVDA and AMD from start to finish. Many people do not understand why MM continues to accumulate shares, and why there was a drop after 12 o'clock. This is because the programs set by the Institutions are already established. As long as everyone collectively refrains from buying at a certain point in time, or reduces their purchase volume, the market will suddenly drop. For the remaining time, it is like closing the door and beating the dog, cooking it slowly over low heat... manipulating the ups and downs.

$PHLX Semiconductor Index (.SOX.US)$

It seems that MM Institutions have been buying NVDA and AMD from start to finish. Many people do not understand why MM continues to accumulate shares, and why there was a drop after 12 o'clock. This is because the programs set by the Institutions are already established. As long as everyone collectively refrains from buying at a certain point in time, or reduces their purchase volume, the market will suddenly drop. For the remaining time, it is like closing the door and beating the dog, cooking it slowly over low heat... manipulating the ups and downs.

$PHLX Semiconductor Index (.SOX.US)$

Translated

+1

3

6

人生如幻

commented on

Update: 03/20 01:23 EDT, just noticed that the VIX has dropped below 20, so we can expect that on Friday's quadruple witching day, the probability of a decline over the past two days has significantly decreased, and instead, the Institutions have lifted their short Insurance, making the probability of MM going long significantly increase.

Original text:

Last year, at the end of October, $Advanced Micro Devices (AMD.US)$ When it was still at 160, it was said that AMD was walking a tightrope and would continue to decline. During this time, AMD has consistently been suppressed by the red dashed line, and every time it rises to that line, it gets ruthlessly pushed back down. The previous post about AMD was hoped to help everyone, and those interested can check my previous articles. AMD's battle to protect the hundred-dollar mark.,

Yesterday, it rebounded to the red dotted line again. Will it be suppressed by the red dotted line like last time?

Answer: NO.

Because after the last hundred dollar defense, it is clear that AMD formed a bottoming pattern after touching the purple descending channel.

It is not ruled out that AMD may have the opportunity to form a cup pattern in the next month or two. (35%) If it is a cup pattern, AMD has a great chance to rebound to $136 over a period of time, but this $136 rebound is based on the cup trend.

If touching the green dashed line 116+, (refer to the trend of the yellow line below), during the pullback and consolidation (not breaking the daily MA5...

Original text:

Last year, at the end of October, $Advanced Micro Devices (AMD.US)$ When it was still at 160, it was said that AMD was walking a tightrope and would continue to decline. During this time, AMD has consistently been suppressed by the red dashed line, and every time it rises to that line, it gets ruthlessly pushed back down. The previous post about AMD was hoped to help everyone, and those interested can check my previous articles. AMD's battle to protect the hundred-dollar mark.,

Yesterday, it rebounded to the red dotted line again. Will it be suppressed by the red dotted line like last time?

Answer: NO.

Because after the last hundred dollar defense, it is clear that AMD formed a bottoming pattern after touching the purple descending channel.

It is not ruled out that AMD may have the opportunity to form a cup pattern in the next month or two. (35%) If it is a cup pattern, AMD has a great chance to rebound to $136 over a period of time, but this $136 rebound is based on the cup trend.

If touching the green dashed line 116+, (refer to the trend of the yellow line below), during the pullback and consolidation (not breaking the daily MA5...

Translated

+2

9

7

1

人生如幻

commented on

Can someone go and shut that big mouth up? Every time it's time to go up, that big mouth president comes out making a mess.... It's really been so long in the Stocks market without encountering this kind of situation, a president who is always going against the Large Cap. This is the second time; I went to bed after seeing a good market, and the next morning while drinking kopi-c, I almost spat it out....

Calling too many times, everyone will understand, it turns out that.. a dog that barks won't bite people. Clearly, it cannot collect others' taxes, yet it keeps barking...

SOX 4 hours, closing at 4453, which stabilizes the downward trend, standing on the 4-hour MA5 at 4450. The Technical Indicator trend looks bullish but not strong, with the 4-hour KDJ (933) & MACD continuously heading towards bullish. 03/13 is considered a consolidation pullback.

Almost every downturn will have a relief wave. This is because market makers also do not intend to keep selling and selling, selling stocks at the bottom area. When the timing is right, they will pull the stock price up a bit, and then sell again. Therefore, my view as a novice in this market is that SOX is expected to rebound 50%, around 4850. The power of this big mouth is too strong, so I originally saw 4950-5000, now revised down to the 50% rebound at 4850. (When reaching around 4850, I will look at the 30-minute trend and then decide whether to Hold until 4950-5000.)

But Friday is a peculiar day. If MM had previously shorted, ...

Calling too many times, everyone will understand, it turns out that.. a dog that barks won't bite people. Clearly, it cannot collect others' taxes, yet it keeps barking...

SOX 4 hours, closing at 4453, which stabilizes the downward trend, standing on the 4-hour MA5 at 4450. The Technical Indicator trend looks bullish but not strong, with the 4-hour KDJ (933) & MACD continuously heading towards bullish. 03/13 is considered a consolidation pullback.

Almost every downturn will have a relief wave. This is because market makers also do not intend to keep selling and selling, selling stocks at the bottom area. When the timing is right, they will pull the stock price up a bit, and then sell again. Therefore, my view as a novice in this market is that SOX is expected to rebound 50%, around 4850. The power of this big mouth is too strong, so I originally saw 4950-5000, now revised down to the 50% rebound at 4850. (When reaching around 4850, I will look at the 30-minute trend and then decide whether to Hold until 4950-5000.)

But Friday is a peculiar day. If MM had previously shorted, ...

Translated

12

16

1

$Advanced Micro Devices (AMD.US)$It really has come down this red line, it seems AMD is going to hit that red dashed line again, .... will it go down further?? It won't go down today, it will still go up a bit.

However:

There have been high points in these past two days. It's time to sell soon. Otherwise, there might be a hundred yuan defense battle by the end of February.

However:

There have been high points in these past two days. It's time to sell soon. Otherwise, there might be a hundred yuan defense battle by the end of February.

Translated

3

人生如幻

commented on

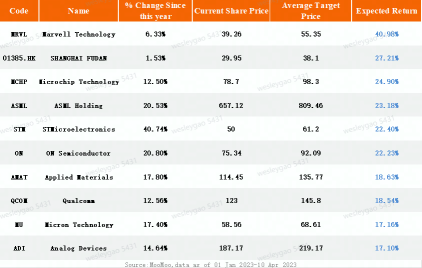

Trump's administration wants the AI chips made in domestically, this led to Intel's potential in the future 2025. Intel as a US company, already have serveral chip fab deployed in the US is beloved by the government and Trump. Trump promised to put Tariffs on Semiconductor mainly to focused on TSMC, giving TSMC three "Plan":

1. TSMC builds packaging plant in the US to reduce reliance on Asian supply chain

2. TSMC and Intel cooperate, TSMC provides technology and improves Intel

3. ...

1. TSMC builds packaging plant in the US to reduce reliance on Asian supply chain

2. TSMC and Intel cooperate, TSMC provides technology and improves Intel

3. ...

9

1

1

人生如幻

voted

🎢 Market Mayhem Alert! 🚨 September kicks off with a bang, but not the good kind. The $S&P 500 Index (.SPX.US)$ just dropped over 2%, hitting its lowest point since August 14, while the $Dow Jones Industrial Average (.DJI.US)$ lost 1.5%, slipping under 40k. And that’s not all— the $PHLX Semiconductor Index (.SOX.US)$ crashed by a whopping 7.8%! The “fear gauge” VIX shot up by more than 40%, inching close to 22.

But wait—who’s to bla...

But wait—who’s to bla...

26

2

4

人生如幻

voted

Columns Major Sell-Off Following Intel and Amazon Results, Labor Market in July Slowed | moovin Stonks

Good morning, traders. Happy Friday, August 2nd. The month started with a red day, and now for a second day in a row, equities in the U.S. are falling hard. Eight out of 11 S&P Global sectors are in the red today, led by Internet Content and Semiconductor companies. My name is Kevin Travers, it is a major pullback day; here are stories from the herd on Wall St today, here are moovin' stonks

Tech is lead...

Tech is lead...

54

5

14

人生如幻

voted

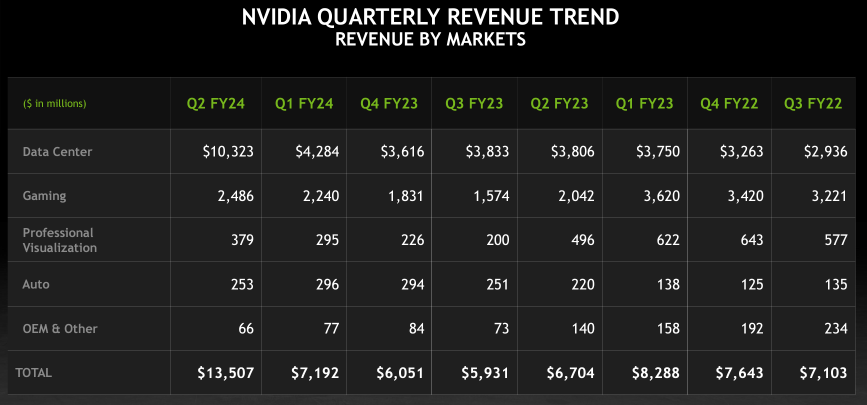

[Rewards] NVIDIA shares soar after Q2 earnings beat, driven by strong demand for AI chips

Claim your Earnings Season offer by winning Rewards Points and discovering Investment Opportunities!

KEY Figures:

● Q2 revenue was a record of $13.51 billion, up 88% QoQ (quarter-on-quarter) and up 101% YoY (year-on-year), beating the expectation of $11.22 billion by Refinitiv.

● NVIDIA got a record Data Center revenue of $10.32 billion, up 141% from Q1 and 171% YoY.

● Non-GAA...

Claim your Earnings Season offer by winning Rewards Points and discovering Investment Opportunities!

KEY Figures:

● Q2 revenue was a record of $13.51 billion, up 88% QoQ (quarter-on-quarter) and up 101% YoY (year-on-year), beating the expectation of $11.22 billion by Refinitiv.

● NVIDIA got a record Data Center revenue of $10.32 billion, up 141% from Q1 and 171% YoY.

● Non-GAA...

47

26

8

人生如幻

voted

In late November 2022, ChatGPT, a chatbot developed by OpenAI, was launched and quickly exploded around the world, with more than 100 million unique users worldwide in two months. Many believe that this large language model AI tool has put humanity at the crossroads of the productivity revolution once again. $NVIDIA (NVDA.US)$founderJensen Huang used the term "iPhone moment" to describe the development of AI.![]()

Stimulated by this good news, $Artificial Intelligence (LIST2136.US)$ such as �...

Stimulated by this good news, $Artificial Intelligence (LIST2136.US)$ such as �...

+2

18

1

15

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

人生如幻 OP 102205868 (Tay) : You mentioned NVDA? NVDA has potential.

人生如幻 OP 104609929 : Incorrect, it's 5000+50, thank you for informing me, in terms of Large Cap, $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$$E-mini S&P 500 Futures(JUN5) (ESmain.US)$, both are standing at the daily MA200, looking at ES, it is stronger than NQ. This week, if there are no big mouths causing chaos, I think in March, major Fund companies will be closing positions with a long strategy.

人生如幻 OP 102205868 (Tay) : Although AMD has made a strong rebound in recent days, the Technical Indicator indicates that it is already overheated, and the opportunity to surge directly to 125 is likely small. Consider setting a follow-up stop-loss order. During the U.S. stock trading session, after AMD rises to 116, prevent a rapid reversal during the session. Maintain a range of 116.5 ± 1 yuan.

人生如幻 OP 人生如幻 OP : AMD reached a high of 115.8.