出來看上帝

liked

$ProShares Ultra VIX Short-Term Futures ETF(UVXY.US$ If we want to increase our chances of profit in a volatile stock market, we still need to learn more about technology.

I'm lucky to learn with the master and seize what really is an opportunity!

I'm lucky to learn with the master and seize what really is an opportunity!

Translated

5

1

出來看上帝

liked

$NIO Inc(NIO.US$

On the first day of the Year of the Tiger, I wish the viewers who read this post a happy Lunar New Year.

Looking back at 2021, the world spent a second year in the midst of the pandemic. Countries closed down cities, people protested, businesses went out of business, and the economy became more and more difficult to understand...

However, there is another group whose wealth has doubled during the pandemic. The rich get richer, and the poor get poorer. This mysterious power affects everyone over and over again every day and year.

The reason behind it? It's actually pretty simple: poor cognition. The nature of wealth and the essence of business are actually all poorly understood.

People with a high cognitive limit see the world differently, the problems they see are not the same, and the opportunities they see are also different. However, the most difficult thing about “cognition” is that people often lack it and are not aware of it; they don't know enough about themselves; they think everything is beautiful. Until one day, my perception was crushed by outside forces.

Some people see the same K-line chart, just a bunch of unnecessary bar charts, and TMD is divided into red and green. Some people looked at it, and it was as if they saw a red/green bill waving at TA. These are the different results of different perceptions.

Here's the easiest question to ask yourself: Do you open trading software every day? If the answer is yes, then no matter what, you'll need to learn some more trading techniques. Trading techniques learned = gaining new knowledge. Its underlying logic is to push your cognitive limits.

...

On the first day of the Year of the Tiger, I wish the viewers who read this post a happy Lunar New Year.

Looking back at 2021, the world spent a second year in the midst of the pandemic. Countries closed down cities, people protested, businesses went out of business, and the economy became more and more difficult to understand...

However, there is another group whose wealth has doubled during the pandemic. The rich get richer, and the poor get poorer. This mysterious power affects everyone over and over again every day and year.

The reason behind it? It's actually pretty simple: poor cognition. The nature of wealth and the essence of business are actually all poorly understood.

People with a high cognitive limit see the world differently, the problems they see are not the same, and the opportunities they see are also different. However, the most difficult thing about “cognition” is that people often lack it and are not aware of it; they don't know enough about themselves; they think everything is beautiful. Until one day, my perception was crushed by outside forces.

Some people see the same K-line chart, just a bunch of unnecessary bar charts, and TMD is divided into red and green. Some people looked at it, and it was as if they saw a red/green bill waving at TA. These are the different results of different perceptions.

Here's the easiest question to ask yourself: Do you open trading software every day? If the answer is yes, then no matter what, you'll need to learn some more trading techniques. Trading techniques learned = gaining new knowledge. Its underlying logic is to push your cognitive limits.

...

Translated

1

出來看上帝

liked

出來看上帝

liked

$S&P 500 Index(.SPX.US$

Personally, I think the strongest support level of SPX has fallen below. Any surge must be treated as a rebound. It is likely that the rebound will fall under pressure when it reaches 4,560 to 4,570 points. Now I'm not imagining that the bull market is coming back because of a rebound in the market. It probably won't break through 4560 all of a sudden and go directly up; I'll wait until around 4,100 o'clock before trying to go long.

I had the privilege of continuing my studies with Langge's weekly quotes. I benefited greatly from the many stories. Stop it, sometimes a short position is also a method of operation.

Personally, I think the strongest support level of SPX has fallen below. Any surge must be treated as a rebound. It is likely that the rebound will fall under pressure when it reaches 4,560 to 4,570 points. Now I'm not imagining that the bull market is coming back because of a rebound in the market. It probably won't break through 4560 all of a sudden and go directly up; I'll wait until around 4,100 o'clock before trying to go long.

I had the privilege of continuing my studies with Langge's weekly quotes. I benefited greatly from the many stories. Stop it, sometimes a short position is also a method of operation.

Translated

2

出來看上帝

liked and commented on

$S&P 500 Index(.SPX.US$

On the first day of the Year of the Tiger, I wish the viewers who read this post a happy Lunar New Year.

Looking back at 2021, the world spent a second year in the midst of the pandemic. Countries closed down cities, people protested, businesses went out of business, and the economy became more and more difficult to understand...

However, there is another group whose wealth has doubled during the pandemic. The rich get richer, and the poor get poorer. This mysterious power affects everyone over and over again every day and year.

The reason behind it? It's actually pretty simple: poor cognition. The nature of wealth and the essence of business are actually all poorly understood.

People with a high cognitive limit see the world differently, the problems they see are not the same, and the opportunities they see are also different. However, the most difficult thing about “cognition” is that people often lack it and are not aware of it; they don't know enough about themselves; they think everything is beautiful. Until one day, my perception was crushed by outside forces.

Some people see the same K-line chart, just a bunch of unnecessary bar charts, and TMD is divided into red and green. Some people looked at it, and it was as if they saw a red/green bill waving at TA. These are the different results of different perceptions.

Here's the easiest question to ask yourself: do you open trading software every day? If the answer is yes, then no matter what, you need to learn more about trading techniques. Learned trading techniques = gained new understanding. Its underlying logic is to break through your...

On the first day of the Year of the Tiger, I wish the viewers who read this post a happy Lunar New Year.

Looking back at 2021, the world spent a second year in the midst of the pandemic. Countries closed down cities, people protested, businesses went out of business, and the economy became more and more difficult to understand...

However, there is another group whose wealth has doubled during the pandemic. The rich get richer, and the poor get poorer. This mysterious power affects everyone over and over again every day and year.

The reason behind it? It's actually pretty simple: poor cognition. The nature of wealth and the essence of business are actually all poorly understood.

People with a high cognitive limit see the world differently, the problems they see are not the same, and the opportunities they see are also different. However, the most difficult thing about “cognition” is that people often lack it and are not aware of it; they don't know enough about themselves; they think everything is beautiful. Until one day, my perception was crushed by outside forces.

Some people see the same K-line chart, just a bunch of unnecessary bar charts, and TMD is divided into red and green. Some people looked at it, and it was as if they saw a red/green bill waving at TA. These are the different results of different perceptions.

Here's the easiest question to ask yourself: do you open trading software every day? If the answer is yes, then no matter what, you need to learn more about trading techniques. Learned trading techniques = gained new understanding. Its underlying logic is to break through your...

Translated

6

5

出來看上帝

liked and commented on

$Netflix(NFLX.US$

I'm sure anyone entering the stock market has heard the above two terms. But how many people are seriously thinking about how to use these two sentences in our investment process?

To figure out how to apply these two sentences, this goes back to what I've been emphasizing recently. First, we need to understand our role in the stock market. Investor or trader?

As a trader, my current crude understanding is that not setting a stop loss and buying more as you fall is an outright leek act. Buying more and more when it falls can actually lower your holding costs. However, if you buy the same number of stocks or the same amount of money each time, then you will inevitably experience a passivation effect. In other words, as you buy more and more, the cost reduction effect of each purchase becomes less and less. Your costs will only drop significantly if you buy much more each time than you currently hold. But ask yourself how much money you have in the stock market for you to use. No matter how many digits it is, it's not infinite. And who can always buy more and more at a lower price? The reality is that after we bought it a few times, we just had to wait and see because our funds were exhausted. If you have a good mentality, you can still hold it; if you don't have a good mentality, you can just cut meat.

Having experienced the above, it is entirely what I learned after teaching tuition fees. I believe everyone has experienced this. If not, it means you're really new to the market, and congrats on reading this post at this point.

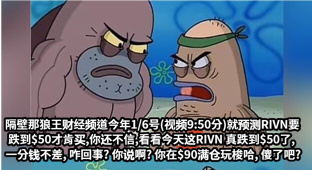

After watching the Wolf King video, with my current...

I'm sure anyone entering the stock market has heard the above two terms. But how many people are seriously thinking about how to use these two sentences in our investment process?

To figure out how to apply these two sentences, this goes back to what I've been emphasizing recently. First, we need to understand our role in the stock market. Investor or trader?

As a trader, my current crude understanding is that not setting a stop loss and buying more as you fall is an outright leek act. Buying more and more when it falls can actually lower your holding costs. However, if you buy the same number of stocks or the same amount of money each time, then you will inevitably experience a passivation effect. In other words, as you buy more and more, the cost reduction effect of each purchase becomes less and less. Your costs will only drop significantly if you buy much more each time than you currently hold. But ask yourself how much money you have in the stock market for you to use. No matter how many digits it is, it's not infinite. And who can always buy more and more at a lower price? The reality is that after we bought it a few times, we just had to wait and see because our funds were exhausted. If you have a good mentality, you can still hold it; if you don't have a good mentality, you can just cut meat.

Having experienced the above, it is entirely what I learned after teaching tuition fees. I believe everyone has experienced this. If not, it means you're really new to the market, and congrats on reading this post at this point.

After watching the Wolf King video, with my current...

Translated

1

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)