吃鲸鱼的猫

liked

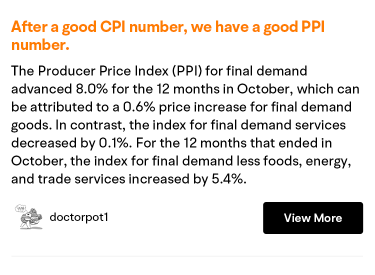

Reminder: CPI numbers are lagging indicators. So, let’s recap.

1. Used car prices have gone down

2. Food prices are moderating

3. Goods/merchandise pricing has gone down.

4. Real estate transactions are going down

5. Companies are clamping down on their reckless spending.

Even a slight improvement in inflation, could be a positive for markets. As for the fed, “moderation, data dependent” would also be taken as a Positive for markets.

Stay tuned!

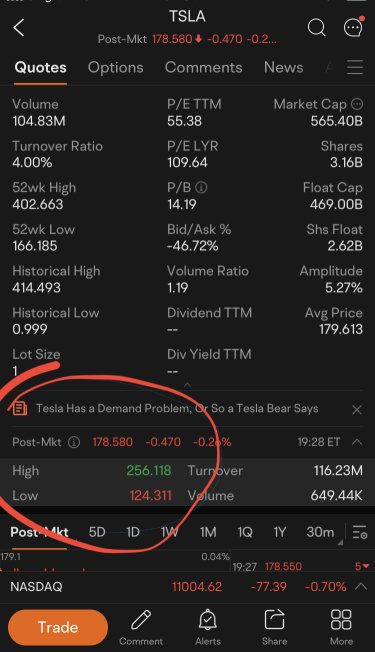

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $S&P 500 Index (.SPX.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$

1. Used car prices have gone down

2. Food prices are moderating

3. Goods/merchandise pricing has gone down.

4. Real estate transactions are going down

5. Companies are clamping down on their reckless spending.

Even a slight improvement in inflation, could be a positive for markets. As for the fed, “moderation, data dependent” would also be taken as a Positive for markets.

Stay tuned!

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $S&P 500 Index (.SPX.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$

5

1

吃鲸鱼的猫

liked

吃鲸鱼的猫

liked

$ProShares UltraShort Bloomberg Crude Oil ETF (SCO.US)$ Add positions, it's all about eating meat today $ProShares UltraShort Bloomberg Crude Oil ETF (SCO.US)$

Translated

2

$ProShares UltraShort Bloomberg Crude Oil ETF (SCO.US)$

The trend of today's US stock market is still bearish. Well-known analyst at Goldman Sachs is bearish again: The rebound of US stocks has ended, and today's main operation is to short crude oil. Double short oil with SCO and short Bloomberg crude oil, All countries jointly balance Russia to control oil prices at 65-70 US dollars per barrel. Therefore, it is certain that the short position of crude oil will have a large increase, which can be seen earlier. In addition, the SCO has been rising continuously. I will continue to share subsequent operations.

The trend of today's US stock market is still bearish. Well-known analyst at Goldman Sachs is bearish again: The rebound of US stocks has ended, and today's main operation is to short crude oil. Double short oil with SCO and short Bloomberg crude oil, All countries jointly balance Russia to control oil prices at 65-70 US dollars per barrel. Therefore, it is certain that the short position of crude oil will have a large increase, which can be seen earlier. In addition, the SCO has been rising continuously. I will continue to share subsequent operations.

Translated

$ProShares UltraShort Energy (DUG.US)$

The trend of the US stock market is still bearish today. The well-known analyst at Goldman Sachs is bearish again: the rebound of the US stock market has ended, the main operation today is to short crude oil, short SCO twice, short Bloomberg crude oil, various countries are united to balance Russia, and aim to control the oil price at $65-70 a barrel. Therefore, the short position of crude oil will definitely have a large increase. Being astute can see this beforehand, coupled with the continuous rise in SCO over these days.

The trend of the US stock market is still bearish today. The well-known analyst at Goldman Sachs is bearish again: the rebound of the US stock market has ended, the main operation today is to short crude oil, short SCO twice, short Bloomberg crude oil, various countries are united to balance Russia, and aim to control the oil price at $65-70 a barrel. Therefore, the short position of crude oil will definitely have a large increase. Being astute can see this beforehand, coupled with the continuous rise in SCO over these days.

Translated

吃鲸鱼的猫

liked

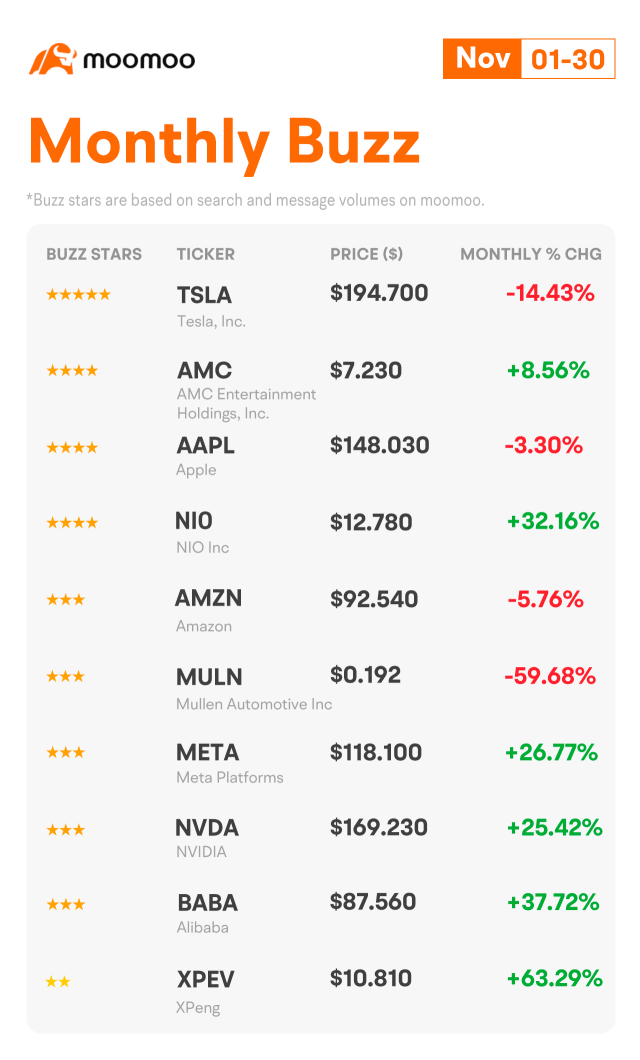

Inflation cooled much more than expected in October. Big tech companies have embarked on mass layoffs. Chinese stocks fly amid eased Covid measures. Trading is like surfing, let's see how mooers navigate the ups and downs.

Monthly Buzz

Traders' Insights

Earnings Roundup

Mooers' Stories

Chill Moments

Don't Miss Out!

Make Your Choice

Words of Wisdom

![]() How do you cope with market volatility?

How do you cope with market volatility?

Comment below to let us know.

![]() We...

We...

Monthly Buzz

Traders' Insights

Earnings Roundup

Mooers' Stories

Chill Moments

Don't Miss Out!

Make Your Choice

Words of Wisdom

Comment below to let us know.

+5

124

53

19

吃鲸鱼的猫

liked

Unlock commission-free* options trading to hedge your portfolio!

The US market continues to fluctuate as the Federal Reserve's interest rate hikes continues.

Is the year-end rally coming? You never know. But you can still take advantage of the volatile market by applying options strategies.

New to options trading? You may learn how to apply options strategies to hedge against the volatile stock market with our Options Starter Kit.

You ...

The US market continues to fluctuate as the Federal Reserve's interest rate hikes continues.

Is the year-end rally coming? You never know. But you can still take advantage of the volatile market by applying options strategies.

New to options trading? You may learn how to apply options strategies to hedge against the volatile stock market with our Options Starter Kit.

You ...

96

13

10

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)