地表最强小花

liked

>>Follow Pre-IPO Buzz to get latest unicorn information

The epidemic has promoted the development of mobile banking services, and some online financial industries are growing rapidly.

Coinbase's revenue increased by 12 times, and Upstart Holdings' revenue increased by 11 times within a year. As the largest digital banking in the United States, Chime also has reported tremendous growth.

According to Chime's CEO Chris Brit...

The epidemic has promoted the development of mobile banking services, and some online financial industries are growing rapidly.

Coinbase's revenue increased by 12 times, and Upstart Holdings' revenue increased by 11 times within a year. As the largest digital banking in the United States, Chime also has reported tremendous growth.

According to Chime's CEO Chris Brit...

+6

16

2

地表最强小花

liked

>>Follow Pre-IPO Buzz to get latest unicorn information

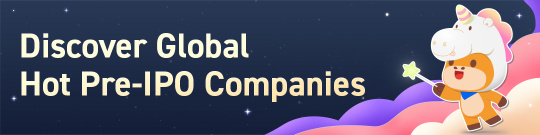

According to Reuters, Shein, the fast fashion e-retailer based in China, is rekindling plans for an initial public offering in New York later this year.

![]() Business Overview

Business Overview

Chinese ultra-fast fashion retailer Shein (styled as SHEIN, also referred to"SheIn") was founded in 2008 by Chris Xu, who started his entrepreneurial career selling wedding dresses. Th...

According to Reuters, Shein, the fast fashion e-retailer based in China, is rekindling plans for an initial public offering in New York later this year.

Chinese ultra-fast fashion retailer Shein (styled as SHEIN, also referred to"SheIn") was founded in 2008 by Chris Xu, who started his entrepreneurial career selling wedding dresses. Th...

+4

37

1

地表最强小花

liked

US yogurt brandChobani filed on November 17th with the SEC. It plans to list on the Nasdaq under the symbol CHO.

According to Renaissance Capital's estimation, the company could raise up to $1.5 billion. The joint bookrunners on the deal includes Goldman Sachs, BofA Securities, J.P. Morgan, Barclays,etc.

In July, the company confidentially filed for an IPO, and Reuters reported its valuation could exceed $10 billion.

Business Overview

Chobani, founded in 2005, is a leading Greek yogurt brand in the US. Since 2007, it has maintained its position as the #1 Greek yogurt brand. It also provides a portfolio of high-quality yogurt products.

Chobani's products come in single-serve, multi-serve, and/or multi-pack formats through approximately 95,000 retail locations in the US. Its key customers include Wal-Mart, Whole Foods, Amazon, Target, Kroger, Publix, Costco and Safeway/Albertsons. It also sells its products to various other national and regional retailers and has an international presence.

Chobani values innovation. Its trusted brand and expertise in the food value chain also helps it convert into new high-growth categories,including oat milk, coffee creamer, ready-to-drink coffee and plant-based probiotic beverage lines.

The U.S. oat milk market has experienced explosive growth in recent years and is the fastest growing segment within plant-based milk. In the 52 weeks ended October 16, 2021, it was a $376 million category, growing 79.6% year-over-year.

Chobani Oat entered the oat milk market in December 2019 and has grown to 15.1% of total Nielsen reported U.S. market share for the 13 weeks ended October 16, 2021, gaining share more quickly than it did in the yogurt category.

For the 13 weeks ended October 16, 2021, total Nielsen reported sales of Chobani Oat have grown 68% year-over year, ahead of the category and several incumbents.

Chobani's in-house production capabilities across its three plants with 1,900 dedicated people. It has a manufacturing facility in New Berlin, New York, a state-of-the-art multi-platform factory in Twin Falls, Idaho, and an additional facility in Melbourne, Australia.

It plans to add capacity to the Twin Falls, Idaho facility for yogurt, oat milk, creamer and coffee products due to increased demand for the products.

Financial Performance

Chobani's revenue grew 5.2% to $1.4 billion from 2019 to 2020. However, its net loss reached $58.7 million, as it invested back into its business.

For the nine months ended September 25, 2021, it generated net sales, net loss and Adjusted EBITDA of approximately $1,213.0 million, $24.0 million and $142.2 million, respectively.

It achieved year-over-year net sales growth of 13.8%, Adjusted EBITDA decrease of 6.2% and an increase in net loss of 12.1%.

Click to view the prospectus

$Chobani (CHO.US)$

According to Renaissance Capital's estimation, the company could raise up to $1.5 billion. The joint bookrunners on the deal includes Goldman Sachs, BofA Securities, J.P. Morgan, Barclays,etc.

In July, the company confidentially filed for an IPO, and Reuters reported its valuation could exceed $10 billion.

Business Overview

Chobani, founded in 2005, is a leading Greek yogurt brand in the US. Since 2007, it has maintained its position as the #1 Greek yogurt brand. It also provides a portfolio of high-quality yogurt products.

Chobani's products come in single-serve, multi-serve, and/or multi-pack formats through approximately 95,000 retail locations in the US. Its key customers include Wal-Mart, Whole Foods, Amazon, Target, Kroger, Publix, Costco and Safeway/Albertsons. It also sells its products to various other national and regional retailers and has an international presence.

Chobani values innovation. Its trusted brand and expertise in the food value chain also helps it convert into new high-growth categories,including oat milk, coffee creamer, ready-to-drink coffee and plant-based probiotic beverage lines.

The U.S. oat milk market has experienced explosive growth in recent years and is the fastest growing segment within plant-based milk. In the 52 weeks ended October 16, 2021, it was a $376 million category, growing 79.6% year-over-year.

Chobani Oat entered the oat milk market in December 2019 and has grown to 15.1% of total Nielsen reported U.S. market share for the 13 weeks ended October 16, 2021, gaining share more quickly than it did in the yogurt category.

For the 13 weeks ended October 16, 2021, total Nielsen reported sales of Chobani Oat have grown 68% year-over year, ahead of the category and several incumbents.

Chobani's in-house production capabilities across its three plants with 1,900 dedicated people. It has a manufacturing facility in New Berlin, New York, a state-of-the-art multi-platform factory in Twin Falls, Idaho, and an additional facility in Melbourne, Australia.

It plans to add capacity to the Twin Falls, Idaho facility for yogurt, oat milk, creamer and coffee products due to increased demand for the products.

Financial Performance

Chobani's revenue grew 5.2% to $1.4 billion from 2019 to 2020. However, its net loss reached $58.7 million, as it invested back into its business.

For the nine months ended September 25, 2021, it generated net sales, net loss and Adjusted EBITDA of approximately $1,213.0 million, $24.0 million and $142.2 million, respectively.

It achieved year-over-year net sales growth of 13.8%, Adjusted EBITDA decrease of 6.2% and an increase in net loss of 12.1%.

Click to view the prospectus

$Chobani (CHO.US)$

+3

60

6

地表最强小花

liked and commented on

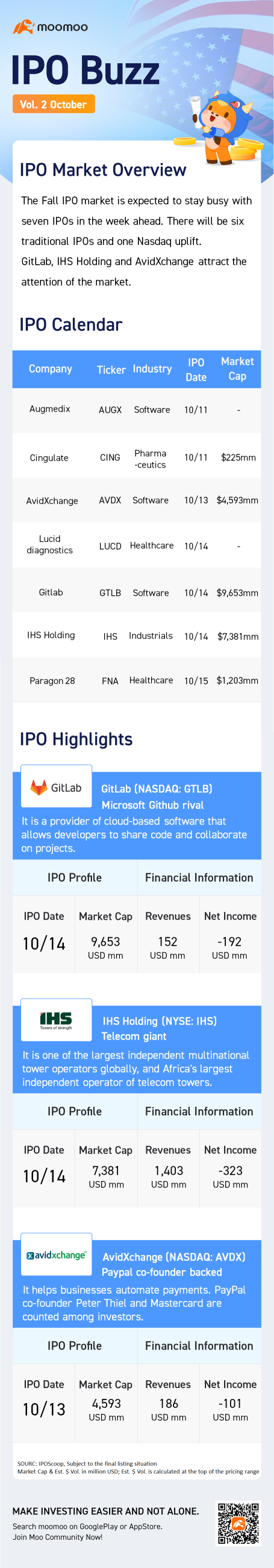

Related:

GitLab IPO: 5 things to know about the $8 billion valued all-remote software company

$Gitlab (GTLB.US)$ $AvidXchange (AVDX.US)$ $Augmedix (AUGX.US)$ $Cingulate (CING.US)$ $Lucid Diagnostics (LUCD.US)$ $IHS Holding (IHS.US)$ $Paragon 28 (FNA.US)$

GitLab IPO: 5 things to know about the $8 billion valued all-remote software company

$Gitlab (GTLB.US)$ $AvidXchange (AVDX.US)$ $Augmedix (AUGX.US)$ $Cingulate (CING.US)$ $Lucid Diagnostics (LUCD.US)$ $IHS Holding (IHS.US)$ $Paragon 28 (FNA.US)$

Expand

Expand 23

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)