Easy to use

Translated

夜天星辰

liked

Hi, mooers! ![]()

The final Federal Open Market Committee (FOMC) meeting of 2023 is approaching. In previous meetings, the Fed raised interest rates 11 times after inflation soared to levels not seen since the early 1980s. The policy rate reached its highest level in 22 years, with a target range between 5.25%–5.5%.

Many investors believe that the Federal Reserve's rate hike cycle is nearing its end. "The Fed is on hold for now...

The final Federal Open Market Committee (FOMC) meeting of 2023 is approaching. In previous meetings, the Fed raised interest rates 11 times after inflation soared to levels not seen since the early 1980s. The policy rate reached its highest level in 22 years, with a target range between 5.25%–5.5%.

Many investors believe that the Federal Reserve's rate hike cycle is nearing its end. "The Fed is on hold for now...

259

123

夜天星辰

voted

Spoiler:

![]() At the end of this post, there is a chance for you to win points!

At the end of this post, there is a chance for you to win points!

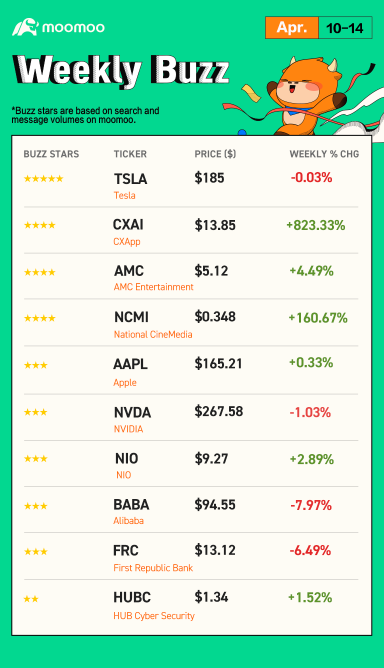

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Make Your Choices

Buzzing Stocks List & Mooers Comments

US stock markets experienced a rollercoaster ride last week. ...

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Make Your Choices

Buzzing Stocks List & Mooers Comments

US stock markets experienced a rollercoaster ride last week. ...

+6

27

30

夜天星辰

commented on

The smallest me has big dreams!![]()

In 2021, I officially joined moomoo.![]()

![]()

![]()

Confused and clueless, I tried to make my first pot of gold in the stock market. Through ups and downs, falling and rising again, constantly trying and making efforts to learn new knowledge, looking forward to achieving a better self!![]()

![]()

![]()

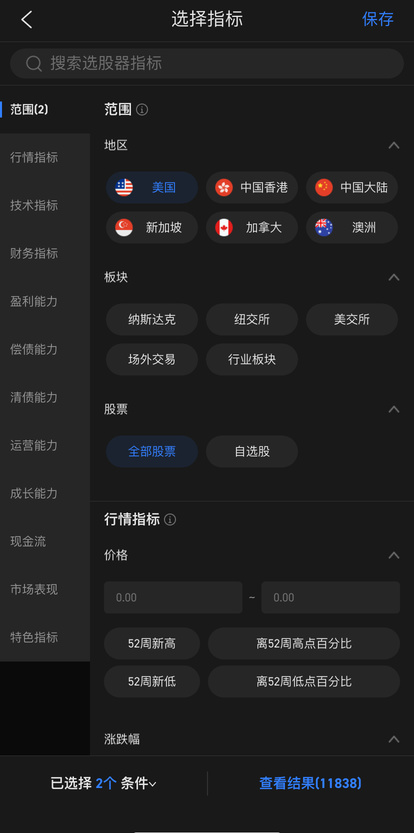

👉moomoo is a great software:

1. Through it, I have learned a lot of very useful new knowledge about stock trading, thank you. @moomoo Courses

2. Often organizing different activities and competitions, sharing different knowledge and enabling us to continuously grow. By participating in activities, I have gained many surprises, improved myself, and have the chance to win rewards, thank you. @moomoo Event @moomoo Rewards @PaperTradingOfficial @Popular on moomoo @Meta Moo @Moomoo Breakfast @Moomoo Recap @Investing with moomoo @In One Chart @Movers and Shakers @moo_Live @The Boxing Ring

3. There are many great tools, through continuous exploration and familiarization with moomoo functions, trading can become very simple.

👉Holdings statistics

Amazing trading volume of super retail investors!![]()

![]()

![]()

Currently, I hold over 150 stocks and have traded over 200 times (with multiple positions added in between). Because I didn't have much initial capital, I started by buying small amounts of multiple low-priced stocks. Inexperienced, I mistakenly thought that as long as I bought low-priced stocks (near their yearly lows) and waited for a rebound, I would definitely make a big profit. However, the reality is not so. Using the DCA strategy, diversifying the investment methods seems to have had no effect (actually, it was a wrong method 🙅♂️), but instead caused my funds to be continuously trapped, and most of the stocks I bought are still falling. Fortunately, a few trades have made profits and exited.

👉 What have I learned from trading![]()

1. Wrong choices![]()

Avoid trading in Chinese concept stocks. I learned a painful lesson from investing in Chinese concept stocks. The China-US trade war has made Chinese concept stocks quite fragile in the US stock market. The withdrawal of Chinese ride-hailing giant Didi Chuxing from the US and its listing in Hong Kong has disrupted the market, and the wave of delistings of Chinese concept stocks is on the rise amid the struggle between China and the US regulators. Chinese concept stocks that have access to large-scale consumer data also face delisting risks in the future. At the same time, Didi's delisting move has also convinced the market that China's industry regulation of technology stocks is still ongoing, and the return of leading internet companies listed in the US is the trend. Chinese concept stocks face increasing regulatory challenges from both the US and Chinese authorities. For most companies, it's like walking on eggshells and trying to please both sides. Delisting will only make things simpler. In the future, I will no longer consider trading Chinese concept stocks.

$DouYu (DOYU.US)$

$Energy Monster (EM.US)$

$Pop Culture (CPOP.US)$

$Tian Ruixiang (TIRX.US)$

$DiDi Global (Delisted) (DIDI.US)$

How to choose individual stocks![]()

Because I don't have much initial capital, I mostly trade low-priced stocks, ignoring the fundamentals of stocks, such as market cap, profit and loss, etc. In the future, I will focus more on other aspects when choosing stocks.

This is a post I previously published:

https://www.moomoo.com/hans/community/feed/107420373680134?lang_code=0

Trading guidelines/strategies

👍 In the future, I tend to trade individual stocks more than index trading![]()

Continuously try and learn from it, looking for feasible solutions to establish their own trading portfolio, I consider learning from the stock god Buffett. Based on previous experience, I found that stocks that do not rise or even fall when the index rises, and when the market rebounds after a decline, they not only do not rebound but also fall even more. On the contrary, stocks that perform better than the market when the index rises tend to show relatively better resilience when the market corrects. Choose stocks with strong fundamentals, they tend to fall less in the face of severe market volatility, and they quickly recover when they rise.

$Apple (AAPL.US)$A good example.![]()

https://www.moomoo.com/hans/news/post/6932418?src=3&report_type=market&report_id=568409&is_recommendation=0&is_recommend_pos=0&futusource=news_headline_list&skintype=3&main_broker=WwogIDEwMDgKXQ==&level=1&data_ticket=1638329773905485

3. Diversify your investment portfolio.

In the future, consider buying ETFs and learning investment concepts from some investment institutions. Here are some posts I've previously shared:https://www.moomoo.com/hans/community/feed/107426476982278?lang_code=0

4. Reviewing stock trades.

To be honest, when it comes to reviewing stock trades, it is not only limited to experts, but also a necessary practice for anyone who wants to be a successful investor. The biggest advantage of reviewing trades is that it allows us to continuously gain experience, which enables us to make better decisions in the constantly changing stock market.

5. Only invest the amount of risk you can afford, and I only invest funds within my personal acceptable range.

When investing, you must be mentally prepared and have a plan for the best and worst outcomes. Making money is definitely a happy thing, but when you experience losses, you have to bear immense inner pressure, which is not easy at all.

Control and understand how much risk you can afford. If your investment unexpectedly fails, you won't undergo too much change. Of course, making money is the best!

👉Looking ahead to the future![]()

I will gradually close out profitable positions and do thorough research before buying the next stock. There is so much to learn, and I will learn from my mistakes, continuously trying. I hope to end the loss and start making a profit next year. I don't expect to get rich overnight, I just hope for steady success.

I also plan to invest in some of Warren Buffett's projects: $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Warren Buffett Portfolio (LIST2999.US)$ $Apple (AAPL.US)$ $Bank of America (BAC.US)$ $American Express (AXP.US)$ $Coca-Cola (KO.US)$ $The Kraft Heinz (KHC.US)$ $Royalty Pharma (RPRX.US)$ $Floor & Decor (FND.US)$ $Chevron (CVX.US)$ $General Motors (GM.US)$ $Teva Pharmaceutical Industries (TEVA.US)$

👉https://www.moomoo.com/hans/news/post/7182898?src=3&report_type=market&report_id=570621&is_recommendation=0&is_recommend_pos=0&futusource=news_headline_list&skintype=3&main_broker=WwogIDEwMDgKXQ==&level=1&data_ticket=1639926069628354

👉https://news.futunn.com/post/11206454?level=1&data_ticket=b2da89f3174162804021fdbcb7d2d452

Haha, please give a like if you've managed to read through this long article!

One thumbs up, one blessing, many thumbs up, many blessings.![]()

![]()

![]()

Wishing everyone a happy investment.![]()

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$ $iShares Russell 2000 ETF (IWM.US)$

In 2021, I officially joined moomoo.

Confused and clueless, I tried to make my first pot of gold in the stock market. Through ups and downs, falling and rising again, constantly trying and making efforts to learn new knowledge, looking forward to achieving a better self!

👉moomoo is a great software:

1. Through it, I have learned a lot of very useful new knowledge about stock trading, thank you. @moomoo Courses

2. Often organizing different activities and competitions, sharing different knowledge and enabling us to continuously grow. By participating in activities, I have gained many surprises, improved myself, and have the chance to win rewards, thank you. @moomoo Event @moomoo Rewards @PaperTradingOfficial @Popular on moomoo @Meta Moo @Moomoo Breakfast @Moomoo Recap @Investing with moomoo @In One Chart @Movers and Shakers @moo_Live @The Boxing Ring

3. There are many great tools, through continuous exploration and familiarization with moomoo functions, trading can become very simple.

👉Holdings statistics

Amazing trading volume of super retail investors!

Currently, I hold over 150 stocks and have traded over 200 times (with multiple positions added in between). Because I didn't have much initial capital, I started by buying small amounts of multiple low-priced stocks. Inexperienced, I mistakenly thought that as long as I bought low-priced stocks (near their yearly lows) and waited for a rebound, I would definitely make a big profit. However, the reality is not so. Using the DCA strategy, diversifying the investment methods seems to have had no effect (actually, it was a wrong method 🙅♂️), but instead caused my funds to be continuously trapped, and most of the stocks I bought are still falling. Fortunately, a few trades have made profits and exited.

👉 What have I learned from trading

1. Wrong choices

Avoid trading in Chinese concept stocks. I learned a painful lesson from investing in Chinese concept stocks. The China-US trade war has made Chinese concept stocks quite fragile in the US stock market. The withdrawal of Chinese ride-hailing giant Didi Chuxing from the US and its listing in Hong Kong has disrupted the market, and the wave of delistings of Chinese concept stocks is on the rise amid the struggle between China and the US regulators. Chinese concept stocks that have access to large-scale consumer data also face delisting risks in the future. At the same time, Didi's delisting move has also convinced the market that China's industry regulation of technology stocks is still ongoing, and the return of leading internet companies listed in the US is the trend. Chinese concept stocks face increasing regulatory challenges from both the US and Chinese authorities. For most companies, it's like walking on eggshells and trying to please both sides. Delisting will only make things simpler. In the future, I will no longer consider trading Chinese concept stocks.

$DouYu (DOYU.US)$

$Energy Monster (EM.US)$

$Pop Culture (CPOP.US)$

$Tian Ruixiang (TIRX.US)$

$DiDi Global (Delisted) (DIDI.US)$

How to choose individual stocks

Because I don't have much initial capital, I mostly trade low-priced stocks, ignoring the fundamentals of stocks, such as market cap, profit and loss, etc. In the future, I will focus more on other aspects when choosing stocks.

This is a post I previously published:

https://www.moomoo.com/hans/community/feed/107420373680134?lang_code=0

Trading guidelines/strategies

👍 In the future, I tend to trade individual stocks more than index trading

Continuously try and learn from it, looking for feasible solutions to establish their own trading portfolio, I consider learning from the stock god Buffett. Based on previous experience, I found that stocks that do not rise or even fall when the index rises, and when the market rebounds after a decline, they not only do not rebound but also fall even more. On the contrary, stocks that perform better than the market when the index rises tend to show relatively better resilience when the market corrects. Choose stocks with strong fundamentals, they tend to fall less in the face of severe market volatility, and they quickly recover when they rise.

$Apple (AAPL.US)$A good example.

https://www.moomoo.com/hans/news/post/6932418?src=3&report_type=market&report_id=568409&is_recommendation=0&is_recommend_pos=0&futusource=news_headline_list&skintype=3&main_broker=WwogIDEwMDgKXQ==&level=1&data_ticket=1638329773905485

3. Diversify your investment portfolio.

In the future, consider buying ETFs and learning investment concepts from some investment institutions. Here are some posts I've previously shared:https://www.moomoo.com/hans/community/feed/107426476982278?lang_code=0

4. Reviewing stock trades.

To be honest, when it comes to reviewing stock trades, it is not only limited to experts, but also a necessary practice for anyone who wants to be a successful investor. The biggest advantage of reviewing trades is that it allows us to continuously gain experience, which enables us to make better decisions in the constantly changing stock market.

5. Only invest the amount of risk you can afford, and I only invest funds within my personal acceptable range.

When investing, you must be mentally prepared and have a plan for the best and worst outcomes. Making money is definitely a happy thing, but when you experience losses, you have to bear immense inner pressure, which is not easy at all.

Control and understand how much risk you can afford. If your investment unexpectedly fails, you won't undergo too much change. Of course, making money is the best!

👉Looking ahead to the future

I will gradually close out profitable positions and do thorough research before buying the next stock. There is so much to learn, and I will learn from my mistakes, continuously trying. I hope to end the loss and start making a profit next year. I don't expect to get rich overnight, I just hope for steady success.

I also plan to invest in some of Warren Buffett's projects: $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Warren Buffett Portfolio (LIST2999.US)$ $Apple (AAPL.US)$ $Bank of America (BAC.US)$ $American Express (AXP.US)$ $Coca-Cola (KO.US)$ $The Kraft Heinz (KHC.US)$ $Royalty Pharma (RPRX.US)$ $Floor & Decor (FND.US)$ $Chevron (CVX.US)$ $General Motors (GM.US)$ $Teva Pharmaceutical Industries (TEVA.US)$

👉https://www.moomoo.com/hans/news/post/7182898?src=3&report_type=market&report_id=570621&is_recommendation=0&is_recommend_pos=0&futusource=news_headline_list&skintype=3&main_broker=WwogIDEwMDgKXQ==&level=1&data_ticket=1639926069628354

👉https://news.futunn.com/post/11206454?level=1&data_ticket=b2da89f3174162804021fdbcb7d2d452

Haha, please give a like if you've managed to read through this long article!

One thumbs up, one blessing, many thumbs up, many blessings.

Wishing everyone a happy investment.

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$ $iShares Russell 2000 ETF (IWM.US)$

Translated

+14

23

15

夜天星辰

commented on

1

4

夜天星辰

liked

$StoneCo (STNE.US)$Is this stock worth saving? I bought it at $14. 😂😂

Translated

1

2

夜天星辰

commented on

夜天星辰

voted

Right after praising $Dogecoin (DOGE.CC)$ , Elon Musk soon tweeted to announce that Tesla will accept some payments in the digital token on Tuesday.

Dogecoin skyrocketed as much as 23% on Tuesday. Its price soared as much as 40% compared with Monday's level at 5 p.m. ET.

Being one of the most volatile among cryptocurrencies, it had surged over 15,500% in 2021 at its peak in May and is still up over 3,000% for the year.

Dogecoin was initially started as a joke, and now it may become a real currency that used for car purchasing.

Are you surprised by that?Or you knew this was coming?

Source:

Dogecoin Soars After Elon Musk Says Tesla Will Accept It as Payment for Merchandise

Dogecoin skyrocketed as much as 23% on Tuesday. Its price soared as much as 40% compared with Monday's level at 5 p.m. ET.

Being one of the most volatile among cryptocurrencies, it had surged over 15,500% in 2021 at its peak in May and is still up over 3,000% for the year.

Dogecoin was initially started as a joke, and now it may become a real currency that used for car purchasing.

Are you surprised by that?Or you knew this was coming?

Source:

Dogecoin Soars After Elon Musk Says Tesla Will Accept It as Payment for Merchandise

53

3

夜天星辰

commented on

Thursday, August 12, 2021

By Mia

![]() You found me! Today's password is :"Smart trading anytime, anywhere!"

You found me! Today's password is :"Smart trading anytime, anywhere!"

By Mia

+1

59

423

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)