小公映

reacted to

$Getaround (GETR.US)$ = GETReady to pop

2

小公映

voted

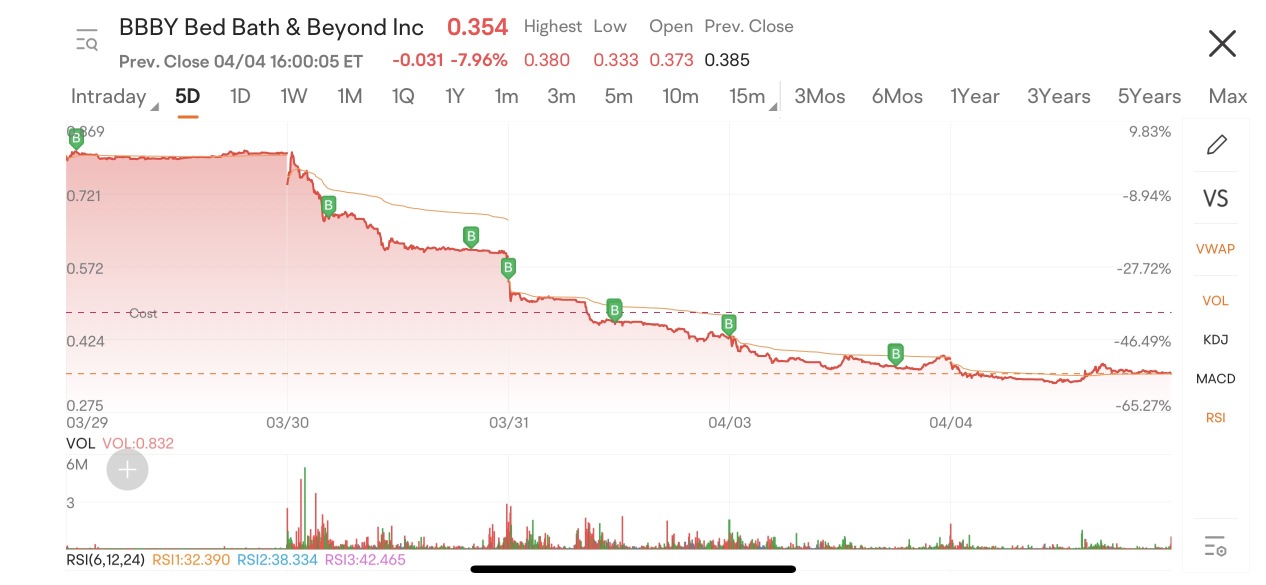

$Bed Bath & Beyond Inc (BBBY.US)$ is a stock in trouble.

No doubt there could be some near-term upswings due to the stock being oversold, but it would take a miracle for the stock to rally for the mid to long term.

Here's why

1. Shrinking revenue and increasing losses

Revenue growth was a problem for BBBY even before its current fiasco. Topline has been flattish for a few consecutive years.

Then when the topline starts to dwindle, the company fell into losses....

No doubt there could be some near-term upswings due to the stock being oversold, but it would take a miracle for the stock to rally for the mid to long term.

Here's why

1. Shrinking revenue and increasing losses

Revenue growth was a problem for BBBY even before its current fiasco. Topline has been flattish for a few consecutive years.

Then when the topline starts to dwindle, the company fell into losses....

+1

3

小公映

reacted to

$Bed Bath & Beyond Inc (BBBY.US)$ Same thing gonna happen again , pre market spikes up and then creates a new low during the session.

2

8

小公映

reacted to

$Bed Bath & Beyond Inc (BBBY.US)$ there we go

1

3

小公映

liked

$Bed Bath & Beyond Inc (BBBY.US)$

thinking about buying more bags are fully packed ready for blast off LFG

thinking about buying more bags are fully packed ready for blast off LFG

7

1

小公映

reacted to

$Bed Bath & Beyond Inc (BBBY.US)$ now average 0.65. will continue to buy till the reversal

6

3

小公映

liked

MACRO

Fed May Take Comfort With US Jobs Seen Showing Moderating Wages

The pace of US hiring in March likely continued to show firm yet moderating labor demand, just as an anticipated slowdown in wage growth may offer some comfort to Federal Reserve officials in their inflation battle.

The March jobs report will be the last before Fed policymakers gather May 2-3 to decide whether to keep raising their benchmark int...

Fed May Take Comfort With US Jobs Seen Showing Moderating Wages

The pace of US hiring in March likely continued to show firm yet moderating labor demand, just as an anticipated slowdown in wage growth may offer some comfort to Federal Reserve officials in their inflation battle.

The March jobs report will be the last before Fed policymakers gather May 2-3 to decide whether to keep raising their benchmark int...

11

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)