In the 3rd quarter of January 2023 (August-October), the company's net sales decreased by 17% year-on-year to $5.931 billion. Non-GAAP adjusted EPS also decreased by 50% to $0.58. While net sales exceeded market expectations of $5.77 billion, adjusted EPS fell below market expectations of $0.69. Sales were impacted by GPU shipment constraints due to inventory adjustments, leading to a significant 51% decrease in the gaming division ($1.57 billion) impacting overall revenue. Also, the Professional Visualization division saw a 65% decrease in revenue ($0.2 billion) due to reduced sales from inventory adjustments. On the other hand, the Data Center division saw a 31% increase in revenue ($3.83 billion) reflecting strong performance from major U.S. cloud providers, and the AI self-driving solutions sales contributed to an 86% revenue increase for the autonomous driving division ($0.25 billion). Despite some offsetting from lower demand for data centers in China and warranty payments ($70 million), the gross margin decreased by 10.9 points due to inventory costs of $70.2 billion. Increased personnel and compensation costs from raises, as well as rising infrastructure costs in data centers, led to a 30% increase in adjusted operating expenses, resulting in a 55% decrease in adjusted operating profit ($1.536 billion). During the period, the company implemented a $3.75 billion shareholder return through share buybacks and cash dividends.

Translated

3

1

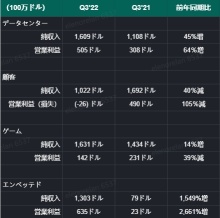

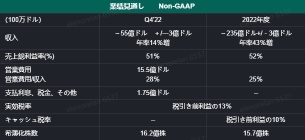

In the company's 2022 3Q (July-September) financial results, sales were 5.57 billion dollars, up 29% from the same period last year, and non-GAAP adjusted EPS fell 8% to 0.67 dollars. Both sales and EPS fell slightly below market expectations. In terms of sales, the data center division saw a 45% increase in sales (1.61 billion dollars), and while EPYC processors were doing well, it looks like the US market compensated for the decline in CPU demand for China. In the gaming division, sales increased 14% to 1.63 billion dollars, and chipsets for PS5 and the new Xbox performed well against the backdrop of special demand during the year-end sales season, covering the slump in PC GPUs. In the embedded (embedded semiconductor) division, sales increased 16.5 times to 1.3 billion dollars, and the Xilinx business acquisition contributed greatly. Meanwhile, the client division, which was the main force, fell 40% to 1.02 billion dollars, and the decline in shipments of CPUs for personal computers had a big impact.

In terms of profit and loss, the embedded division's operating profit was 635 million dollars, a major breakthrough from 23 million dollars in the same period last year. Data center operating profit increased 64% to 500 million dollars. The client division lost $26 million in operating income ($490 million in operating profit for the same period last year). game...

In terms of profit and loss, the embedded division's operating profit was 635 million dollars, a major breakthrough from 23 million dollars in the same period last year. Data center operating profit increased 64% to 500 million dollars. The client division lost $26 million in operating income ($490 million in operating profit for the same period last year). game...

Translated

8

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)