广阔的格吉尔

voted

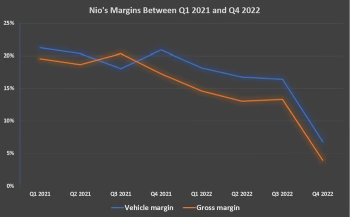

[Rewards] NIO Q4 sales were up, while gross margin contracted and losses widening

Claim your Earnings Season offer by winning Rewards Points and discovering Investment Opportunities!

KEY Figures:

● NIO Q4 total revenues were $2,329.0 million, representing an increase of 62.2% YoY (year-over-year).

● The vehicle deliveries were 40,052 in Q4, up 60% YoY. The total deliveries were 122,486 in 2022, representing an increase of 34.0% from 2021.

● Excluding share-based ...

Claim your Earnings Season offer by winning Rewards Points and discovering Investment Opportunities!

KEY Figures:

● NIO Q4 total revenues were $2,329.0 million, representing an increase of 62.2% YoY (year-over-year).

● The vehicle deliveries were 40,052 in Q4, up 60% YoY. The total deliveries were 122,486 in 2022, representing an increase of 34.0% from 2021.

● Excluding share-based ...

45

42

3

广阔的格吉尔

liked

$AMC Entertainment (AMC.US)$ I dont think all the Apes remained dumb money! The options market is NOT being played by institutions only! Dumb money isnt dumb anymore and is making tendies whether the price is going up or down.

1

1

广阔的格吉尔

liked

$Amazon (AMZN.US)$

Amazon has blasted right through resistance of 3570 and is now heading to retest 3773 all time highs!

I mentioned 2 to 3 weeks ago as amazon was sitting on critical support that it is looking bullish as it did not break past the support for 3 days. Right on the same day It rebounded off the critical support and now it is on track to break a new high.

Amazon is still looking bullish and now has a strong support at 3530 level. Which is also the 5EMA which is sloping upwards.

Once we have broken past 3773 resistance, our next take profit zone will be at 3935 and 4019.

As always, trade safe & invest wise!

Amazon has blasted right through resistance of 3570 and is now heading to retest 3773 all time highs!

I mentioned 2 to 3 weeks ago as amazon was sitting on critical support that it is looking bullish as it did not break past the support for 3 days. Right on the same day It rebounded off the critical support and now it is on track to break a new high.

Amazon is still looking bullish and now has a strong support at 3530 level. Which is also the 5EMA which is sloping upwards.

Once we have broken past 3773 resistance, our next take profit zone will be at 3935 and 4019.

As always, trade safe & invest wise!

1

广阔的格吉尔

liked

$Ocugen (OCGN.US)$ Now we will see the MM set tge algorithm control dials to maybe a decline of $.10 rvery 19 min. estimated closing price 8.80

3

3

广阔的格吉尔

liked

$Affirm Holdings (AFRM.US)$ The market did not stand firm at 14500. Despite the good news, they held on to their profits and sold

OK, let's wait for the general market to recover

OK, let's wait for the general market to recover

Translated

4

3

广阔的格吉尔

reacted to

$Palantir (PLTR.US)$ Get on the bus, quickly, confirm the back step.

Translated

4

广阔的格吉尔

liked

$Aterian (ATER.US)$

RSI is on the rise.

TTM Squeeze indicator is approaching fire line.

volume has been eclipsing that of the run up to $49.

Short interest is high.

We've been on the FTD list for weeks.

#1 on Fintel squeeze list for days

Catalyst news about Amazon deal

Top 10 popularity on Webull

Top 10 most active on StockTwits

and we are out of September!

RSI is on the rise.

TTM Squeeze indicator is approaching fire line.

volume has been eclipsing that of the run up to $49.

Short interest is high.

We've been on the FTD list for weeks.

#1 on Fintel squeeze list for days

Catalyst news about Amazon deal

Top 10 popularity on Webull

Top 10 most active on StockTwits

and we are out of September!

1

广阔的格吉尔

liked

thank you @The money makerfor the solid technical analysis.

bought PROG at 1.8 and sold at 2.3 for day trade

bought PALT at 11.45 and sold at 12.80 for day trade

$Biora Therapeutics (PROG.US)$

$Paltalk (PALT.US)$

bought PROG at 1.8 and sold at 2.3 for day trade

bought PALT at 11.45 and sold at 12.80 for day trade

$Biora Therapeutics (PROG.US)$

$Paltalk (PALT.US)$

4

1

广阔的格吉尔

liked

There are many super bull stocks in the U.S. market, I missed the opportunity to buy before it broke out due to inexperience.![]() Eventually, I saw the wonderful performance of big bull stocks in the news and information, I was secretly regretting that I didn't buy them in time.

Eventually, I saw the wonderful performance of big bull stocks in the news and information, I was secretly regretting that I didn't buy them in time.![]() Since then, I have been paying attention to stock selection indicators.

Since then, I have been paying attention to stock selection indicators.![]()

I usually use moo stock selection tool to select the super big stocks that are temporarily unknown among stocks. Now, I use the tool to show you.

We need to set the following screening conditions in the stock screener:

1. Higher net profit growth rate (≥30%)

Higher net profit growth rate is more attractive to investment capital.

2. Higher price-to-earnings ratio (≥60)

The high price-earnings ratio shows that many professional investment institutions on the market have greater confidence in its rapid growth prospects.

3. Fewer shares outstanding (≤1billion)

It is best not to have too many shares in circulation, so that institutional investors holding positions will be more likely to raise the stock price.

At this time, we can see the results from the filter, such as $Switch (SWCH.US)$ $Netflix (NFLX.US)$ $Zoom Communications (ZM.US)$

After sharing my stock selection strategy, now I will talk about my red flags while deciding on a stock:

1. Stock trading volume

I think that stocks with daily trading volume of less than 100 million dollars should not be participated. Due to the existence of short selling in US stocks, it’s very likely that some stocks will be manipulated.

2. Plunged stocks

When a stock plummets, there is a high probability that the company’s fundamentals have undergone tremendous changes. At this time, you must be cautious and not buy it at the bottom. For example, $New Oriental (EDU.US)$ $TAL Education (TAL.US)$ .You can earn less, but you can't put yourself in a dangerous place because of temporary greed.

Finally, I want to share some of my own experience. There are thousands of stocks in the U.S. stock market. Why is there a large amount of funds that continue to pursue $Tesla (TSLA.US)$ ? Because Tesla's products, models, and appeal are constantly proving itself. Stock selection is simple, but it is very difficult to operate.

If you like and agree with my point of view, welcome to interact with me and follow me![]()

![]()

![]()

I usually use moo stock selection tool to select the super big stocks that are temporarily unknown among stocks. Now, I use the tool to show you.

We need to set the following screening conditions in the stock screener:

1. Higher net profit growth rate (≥30%)

Higher net profit growth rate is more attractive to investment capital.

2. Higher price-to-earnings ratio (≥60)

The high price-earnings ratio shows that many professional investment institutions on the market have greater confidence in its rapid growth prospects.

3. Fewer shares outstanding (≤1billion)

It is best not to have too many shares in circulation, so that institutional investors holding positions will be more likely to raise the stock price.

At this time, we can see the results from the filter, such as $Switch (SWCH.US)$ $Netflix (NFLX.US)$ $Zoom Communications (ZM.US)$

After sharing my stock selection strategy, now I will talk about my red flags while deciding on a stock:

1. Stock trading volume

I think that stocks with daily trading volume of less than 100 million dollars should not be participated. Due to the existence of short selling in US stocks, it’s very likely that some stocks will be manipulated.

2. Plunged stocks

When a stock plummets, there is a high probability that the company’s fundamentals have undergone tremendous changes. At this time, you must be cautious and not buy it at the bottom. For example, $New Oriental (EDU.US)$ $TAL Education (TAL.US)$ .You can earn less, but you can't put yourself in a dangerous place because of temporary greed.

Finally, I want to share some of my own experience. There are thousands of stocks in the U.S. stock market. Why is there a large amount of funds that continue to pursue $Tesla (TSLA.US)$ ? Because Tesla's products, models, and appeal are constantly proving itself. Stock selection is simple, but it is very difficult to operate.

If you like and agree with my point of view, welcome to interact with me and follow me

75

23

25

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)