康庄大道

voted

Hi, mooers. Welcome back to Mooers' Stories, where we present mooers' insights and experiences from our community. 🎤

We're thrilled to bring you a special post on options trading with @大学生的百万梦 today. This time, he will share his journey as a very young trader, delve into strategies, and offer advice for beginners.

![]() Please share your background, including age, location, profession, hobbies, and any other personal characteristics you'd like to highlig...

Please share your background, including age, location, profession, hobbies, and any other personal characteristics you'd like to highlig...

We're thrilled to bring you a special post on options trading with @大学生的百万梦 today. This time, he will share his journey as a very young trader, delve into strategies, and offer advice for beginners.

+1

352

187

61

康庄大道

voted

Hi, mooers! 👋

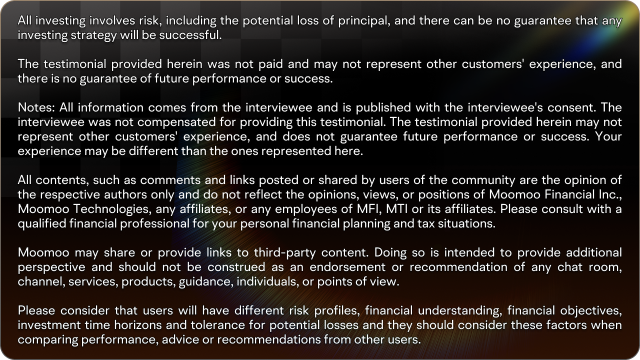

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

645

1022

40

Have good health![]() , financial luck

, financial luck![]() , good luck

, good luck![]() , what do you all want?

, what do you all want?

![]() Some people want “good luck”, hoping for the snake to bring good fortune

Some people want “good luck”, hoping for the snake to bring good fortune![]()

![]() Some people also want 'financial luck', to have a continuous flow of wealth, buying snakes and doing anything with snakes can make money.

Some people also want 'financial luck', to have a continuous flow of wealth, buying snakes and doing anything with snakes can make money.![]()

![]() But without a 'healthy' body, how to earn wealth, and then go to places for eating, drinking, and having fun without any problems, after all, health is the greatest wealth.

But without a 'healthy' body, how to earn wealth, and then go to places for eating, drinking, and having fun without any problems, after all, health is the greatest wealth.![]()

#I want all three, what about snakes~ have snakes~ after all, only children can make choices.![]()

![]()

![]()

#I want all three, what about snakes~ have snakes~ after all, only children can make choices.

Translated

2

康庄大道

Set a live reminder

Ken, MBA and Head of Dealing at Moomoo, will join Jia Wei, Master Trainer from 21 Days Investment Education Platform, for a cross-interview to discuss how options trading has transformed their investment strategies and impacted their lives.

Options Unlocked: An Investor's Journey To Financial Mastery

Dec 5 20:00

155

60

21

康庄大道

commented on

Stock market runs faster than the economy by about 6 months, unless it is a sudden event like a "black swan" incident.

Here are some signs of a storm:

![]() The 10-year US Treasury bond yield exceeds 3%, higher than the weekly interest rate of listed companies.

The 10-year US Treasury bond yield exceeds 3%, higher than the weekly interest rate of listed companies.

![]() The 10-year US Treasury bond yield is lower than the 2-year US Treasury bond yield, resulting in an inverted yield curve.

The 10-year US Treasury bond yield is lower than the 2-year US Treasury bond yield, resulting in an inverted yield curve.

![]() The average PE ratio of the stock market exceeds 40 times, indicating that many stocks are overvalued.

The average PE ratio of the stock market exceeds 40 times, indicating that many stocks are overvalued.

![]() The stock market trading volume is increasing.

The stock market trading volume is increasing.

![]() Everyone is all smiles, showing off how easy it is to make money in the stock market, a major correction is not far away.

Everyone is all smiles, showing off how easy it is to make money in the stock market, a major correction is not far away.

![]() The index keeps hitting new highs, with many stocks taking turns to stage fireworks, constantly introducing different themes, causing stocks within the sector to rise.

The index keeps hitting new highs, with many stocks taking turns to stage fireworks, constantly introducing different themes, causing stocks within the sector to rise.

When several of the above signs appear, it is important to consider storing provisions for a rainy day, waiting for the arrival of a bear market, and being greedy when others are in panic.

Based on the analysis of historical data, the stock market cycle is approximately around 10 years.

When newly built houses remain unsold and a large number of auctioned houses emerge in the market, this phenomenon indicates that ordinary people cannot afford loans, hinting that an economic recession is approaching. If the economy falters, the stock market will also be negatively impacted.

Here are some signs of a storm:

When several of the above signs appear, it is important to consider storing provisions for a rainy day, waiting for the arrival of a bear market, and being greedy when others are in panic.

Based on the analysis of historical data, the stock market cycle is approximately around 10 years.

When newly built houses remain unsold and a large number of auctioned houses emerge in the market, this phenomenon indicates that ordinary people cannot afford loans, hinting that an economic recession is approaching. If the economy falters, the stock market will also be negatively impacted.

Translated

9

4

4

康庄大道

voted

Gold prices hit new milestones last week, reaching a fresh record high of $2,600 on Friday. Expectations of further interest rate cuts bolstered the appeal of bullion, but that is not the only reason.

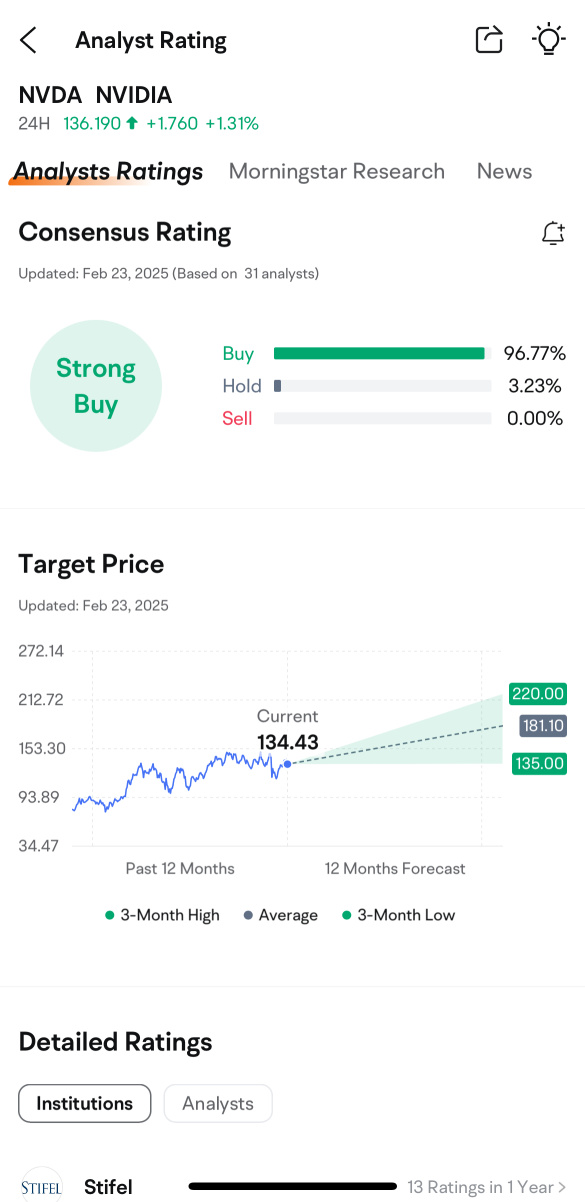

The rising deficit rate in the U.S. is one of the key forces driving gold prices. Historically, Gold prices and the US deficit rate have shown good synchronicity historically:

1. From 1984 to 2000, the US deficit ra...

The rising deficit rate in the U.S. is one of the key forces driving gold prices. Historically, Gold prices and the US deficit rate have shown good synchronicity historically:

1. From 1984 to 2000, the US deficit ra...

+2

218

101

64

康庄大道

voted

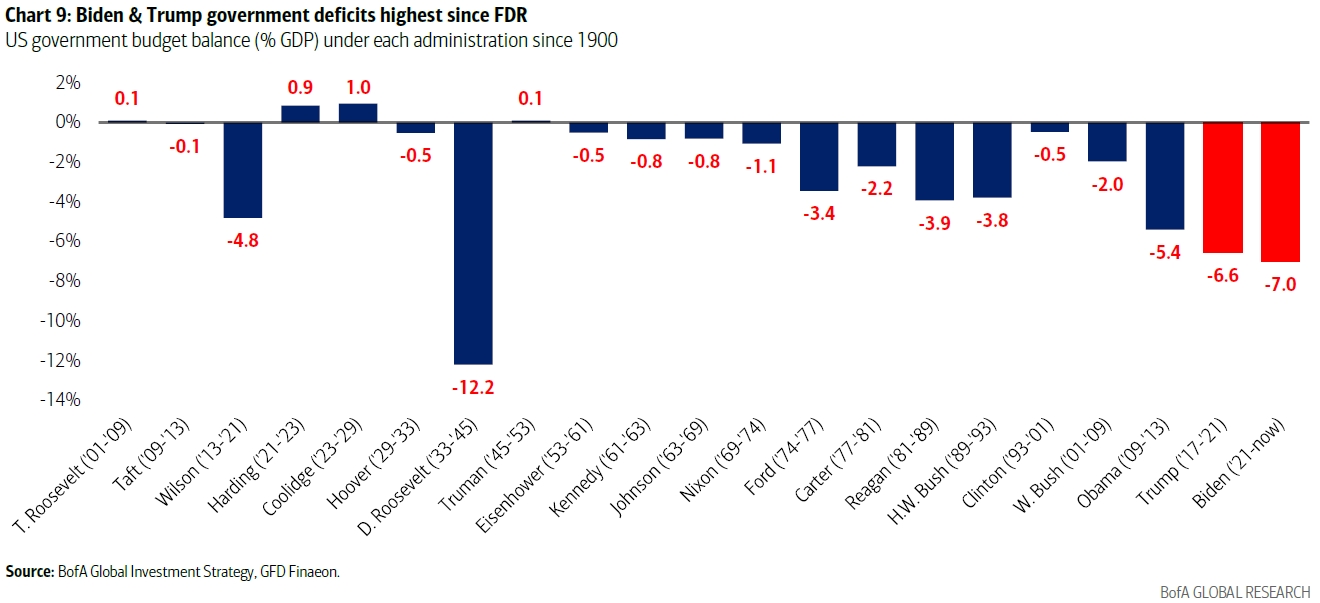

The much-anticipated rate cut decision has finally arrived, with the Federal Reserve announcing a 50 basis point rate cut! At this pivotal moment, investors need to have a deeper understanding of the background and impact of rate cuts.

Since March 2022, in a bid to curb inflation, the Fed has hiked rates 11 times, bringing it to the current range of 5.25%-5.50%. Now that inflation is under control, the calls for a rate cut are growin...

Since March 2022, in a bid to curb inflation, the Fed has hiked rates 11 times, bringing it to the current range of 5.25%-5.50%. Now that inflation is under control, the calls for a rate cut are growin...

+4

401

177

123

康庄大道

Set a live reminder

Missed the live? Watch the replay now and join Justin, Michael and Jessica as they dives deep into US rate cuts!

704

1017

29

康庄大道

Set a live reminder

Dear Mooers,

Are you ready to take your investment knowledge to the next level? We’re excited to invite you to our upcoming live stream event: “Understanding and Investing in ETFs Listed on Bursa Malaysia”.

Participate in this live stream, you will have a chance to receive 88 moomoo points!

In this comprehensive live stream, we’ll guide you through everything you need to know about Exchange Traded Funds (ETFs) and how you can leverage them...

Are you ready to take your investment knowledge to the next level? We’re excited to invite you to our upcoming live stream event: “Understanding and Investing in ETFs Listed on Bursa Malaysia”.

Participate in this live stream, you will have a chance to receive 88 moomoo points!

In this comprehensive live stream, we’ll guide you through everything you need to know about Exchange Traded Funds (ETFs) and how you can leverage them...

Unlock the Secrets of ETFs with Our Upcoming Live Stream!

Sep 4 20:00

289

103

16

Free Cash Flow is more important than EPS.

Avoid companies with one-time contracts unless they can obtain repeat orders from the same customers.

🤩 Growth stocks in their teenage years generally come from rapidly growing small and medium-sized enterprises, but these companies usually pay less dividends.

Stable companies in middle age, transitioning from rapid growth to stable profitability, typically distribute high dividends as blue chip stocks.

Buy/Sell stocks

Buy

🎯准备>找出值得投资的5⭐企业

🎯忍受>耐心等待想要买的股票跌至最点位

🎯狠心>当调整到接近低点时,要快,分5批在不同的价位买入

Sell

🎯 Preparation > During the approaching peak of the bull market, or when the stock price exceeds its intrinsic value.

🎯 Endurance > Patience to wait for the best selling time.

🎯 Ruthlessness > When the bull market approaches its peak, act quickly and sell all the stocks in batches at different price levels.

Avoid companies with one-time contracts unless they can obtain repeat orders from the same customers.

🤩 Growth stocks in their teenage years generally come from rapidly growing small and medium-sized enterprises, but these companies usually pay less dividends.

Stable companies in middle age, transitioning from rapid growth to stable profitability, typically distribute high dividends as blue chip stocks.

Buy/Sell stocks

Buy

🎯准备>找出值得投资的5⭐企业

🎯忍受>耐心等待想要买的股票跌至最点位

🎯狠心>当调整到接近低点时,要快,分5批在不同的价位买入

Sell

🎯 Preparation > During the approaching peak of the bull market, or when the stock price exceeds its intrinsic value.

🎯 Endurance > Patience to wait for the best selling time.

🎯 Ruthlessness > When the bull market approaches its peak, act quickly and sell all the stocks in batches at different price levels.

Translated

8

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)