必胜1

liked

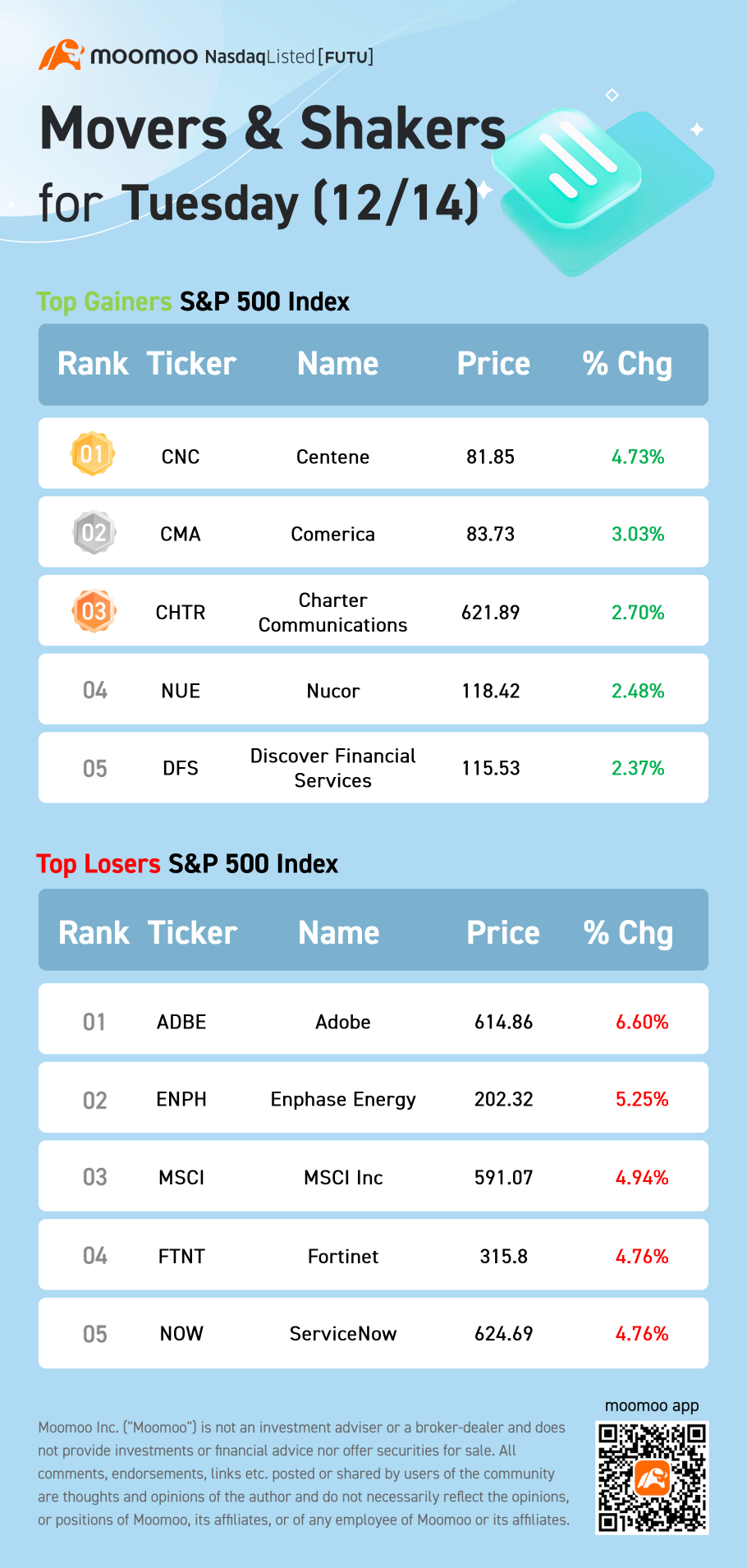

Singapore real estate investment trusts can benefit from their safe-haven status during a time of market volatility as the U.S. Fed raises interest rates, analysts from DBS say in a research note.

The Fed's clarity on its rate-rise trajectory will likely lead to more price stability for Singapore REITs, they say.

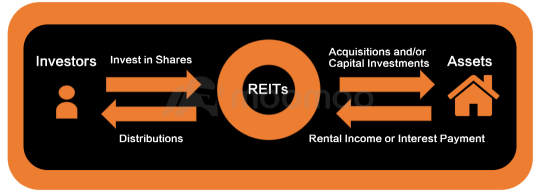

What are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are funds that invest in a port...

The Fed's clarity on its rate-rise trajectory will likely lead to more price stability for Singapore REITs, they say.

What are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are funds that invest in a port...

1537

1277

必胜1

liked

Ever heard of the wisdom: buy the rumors trade the news?

The reason is simple. Rumors generate hype and momentum for the stock, even if nothing fundamental is happening in the company.

However, once there is confirmation of the news, be it earnings or official announcements, the price will always drop.

Take a look at the Joe Biden's infrastructure plan which made $Tesla (TSLA.US)$ hit its first trillion dollar milestone. Ever since then, $Tesla (TSLA.US)$ has been falling, eve...

The reason is simple. Rumors generate hype and momentum for the stock, even if nothing fundamental is happening in the company.

However, once there is confirmation of the news, be it earnings or official announcements, the price will always drop.

Take a look at the Joe Biden's infrastructure plan which made $Tesla (TSLA.US)$ hit its first trillion dollar milestone. Ever since then, $Tesla (TSLA.US)$ has been falling, eve...

13

1

必胜1

commented on

Dear mooers,

We are coming to the end of a very unusual year full of uncertainty. Whether good or bad, we all witnessed the history.

Before you want to see what you can expect in 2022, let's have a little break and take a guess of the closing price of the S&P 500.

A happy ending or a tragedy? Go big or go home? Place your bet NOW!

Win Reward:

Place your bet on the closing price of the $S&P 500 Index (.SPX.US)$ (i.e.4800.11) on Friday...

We are coming to the end of a very unusual year full of uncertainty. Whether good or bad, we all witnessed the history.

Before you want to see what you can expect in 2022, let's have a little break and take a guess of the closing price of the S&P 500.

A happy ending or a tragedy? Go big or go home? Place your bet NOW!

Win Reward:

Place your bet on the closing price of the $S&P 500 Index (.SPX.US)$ (i.e.4800.11) on Friday...

452

1070

必胜1

liked

$Singtel (Z74.SG)$ you took its dividend, it took your capital

9

3

必胜1

liked

$Globalstar (GSAT.US)$ buying time!

11

必胜1

liked

$NIO Inc (NIO.US)$

It's normal for the stock market to go up and down

1. Tesla didn't break the market cap, which is the most important price anchor point

2. Do you think niO will get better and better in the future? If so, don't be afraid

3. Most of the comments were written by people who had not experienced the sharp drop at the end of the past year or the beginning of the year, so the fluctuations of these days are small scenes

It's normal for the stock market to go up and down

1. Tesla didn't break the market cap, which is the most important price anchor point

2. Do you think niO will get better and better in the future? If so, don't be afraid

3. Most of the comments were written by people who had not experienced the sharp drop at the end of the past year or the beginning of the year, so the fluctuations of these days are small scenes

12

3

必胜1

liked

Time to add more🤔?

11

必胜1

liked

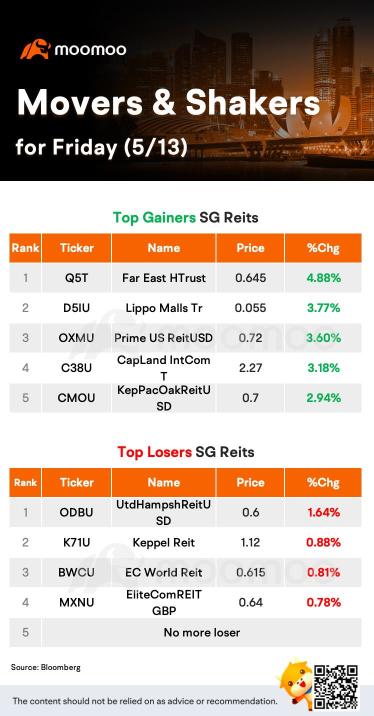

U.S. stock futures were steady in overnight trading on Tuesday as investors readied for Wednesday's highly anticipated Federal Reserve decision.

On Tuesday, the major averages slipped, exacerbated by selling in software names like $Microsoft (MSFT.US)$ and $Adobe (ADBE.US)$. The $Dow Jones Industrial Average (.DJI.US)$ lost 106 points. The $S&P 500 Index (.SPX.US)$ fell 0.75%.

$Centene (CNC.US)$ $Adobe (ADBE.US)$ $Discover Financial Services (DFS.US)$ $Enphase Energy (ENPH.US)$

On Tuesday, the major averages slipped, exacerbated by selling in software names like $Microsoft (MSFT.US)$ and $Adobe (ADBE.US)$. The $Dow Jones Industrial Average (.DJI.US)$ lost 106 points. The $S&P 500 Index (.SPX.US)$ fell 0.75%.

$Centene (CNC.US)$ $Adobe (ADBE.US)$ $Discover Financial Services (DFS.US)$ $Enphase Energy (ENPH.US)$

18

必胜1

liked

$NVIDIA (NVDA.US)$ takes the top spot on the list. CTRU is currently holding 96 shares of the company, making up 1.51% of the fund.

$MaxLinear (MXL.US)$ comes in second, with 410 shares accounting for a 1.46% weight.

$Enphase Energy (ENPH.US)$ is No. 3 on the list. The 134 shares of the solar energy company account for 1.45% of the ETF.

American automation company $Teradyne (TER.US)$ is fourth, with 184 shares making up 1.42%

$Cloudflare (NET.US)$ is also present on the list, with 178 shares accounting for 1.35%.

$Bloom Energy (BE.US)$ comes in at the No. 5 spot. The CTRU ETF contains 1,080 shares of the company, also for 1.35% weight.

$HP Inc (HPQ.US)$ is also a big player for the Transparency ETF, with 740 shares worth 1.34%

Little needs to be said of industry titan Tesla. The EV maker is good for 26 shares, making up 1.33%.

The first clothing company on the list, $Buckle Inc (BKE.US)$ , is present for 514 shares worth 1.25% of the ETF.

Rounding out the list is $Intuit (INTU.US)$ The Transparency ETF holds 38 shares of INTU stock, accounting for 1.24% of the fund.

$MaxLinear (MXL.US)$ comes in second, with 410 shares accounting for a 1.46% weight.

$Enphase Energy (ENPH.US)$ is No. 3 on the list. The 134 shares of the solar energy company account for 1.45% of the ETF.

American automation company $Teradyne (TER.US)$ is fourth, with 184 shares making up 1.42%

$Cloudflare (NET.US)$ is also present on the list, with 178 shares accounting for 1.35%.

$Bloom Energy (BE.US)$ comes in at the No. 5 spot. The CTRU ETF contains 1,080 shares of the company, also for 1.35% weight.

$HP Inc (HPQ.US)$ is also a big player for the Transparency ETF, with 740 shares worth 1.34%

Little needs to be said of industry titan Tesla. The EV maker is good for 26 shares, making up 1.33%.

The first clothing company on the list, $Buckle Inc (BKE.US)$ , is present for 514 shares worth 1.25% of the ETF.

Rounding out the list is $Intuit (INTU.US)$ The Transparency ETF holds 38 shares of INTU stock, accounting for 1.24% of the fund.

15

2

必胜1

liked

13F filings are filed if an institutional investment manager that uses the U.S. mail (or other means or instrumentality of interstate commerce) in the course of its business, and exercises investment discretion over $100 million or more in Section 13(f)securities (explained below) must report its holdings quarterly on Form 13F with the Securities and Exchange Commission (SEC).

Now lets start with the disadvantages of the 13F. The first thing to note is that these filings can be up to 45 days old, which is a little late for an advantage. The second thing is these filings only tell you what they bought. Not how they are using them. They could have bought the shares to use them to short sell the stock. The third thing is they also file 13F’s to sell their stock. Any information the SEC gives out for free is going to be one of two things: difficult to understand or of no use to you.

The only advantage of 13F filings is that the more you know the better.

Now a Walk Street Broker knows the way to tell what stocks some of the hedges or institutions are buying or selling. All the big institutions have as a crucial part of their investment strategy a group that they rely on for sound investment advice-stock analyst. They have in-depth knowledge of all accounts they are responsible for and every week they turn in a report that list each of those stocks with a rating of strong buy, buy, hold, or sell. And these reports are released in the news sections. 90% of the time this is what they are buying or selling or short selling. You also have to remember that just because they are buying doesnt mean others arent selling it. Plus when they buy a stock its going to be held for more than week.

Now lets start with the disadvantages of the 13F. The first thing to note is that these filings can be up to 45 days old, which is a little late for an advantage. The second thing is these filings only tell you what they bought. Not how they are using them. They could have bought the shares to use them to short sell the stock. The third thing is they also file 13F’s to sell their stock. Any information the SEC gives out for free is going to be one of two things: difficult to understand or of no use to you.

The only advantage of 13F filings is that the more you know the better.

Now a Walk Street Broker knows the way to tell what stocks some of the hedges or institutions are buying or selling. All the big institutions have as a crucial part of their investment strategy a group that they rely on for sound investment advice-stock analyst. They have in-depth knowledge of all accounts they are responsible for and every week they turn in a report that list each of those stocks with a rating of strong buy, buy, hold, or sell. And these reports are released in the news sections. 90% of the time this is what they are buying or selling or short selling. You also have to remember that just because they are buying doesnt mean others arent selling it. Plus when they buy a stock its going to be held for more than week.

27

11

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)