#US stock IPO

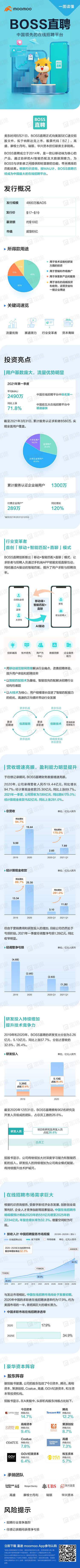

The largest online recruitment platform in China- $Kanzhun (BZ.US)$ Subscription has begun

🥇Leading market position: massive user base, significant traffic advantage;

📈 Huge potential: China's online recruitment market is still in its early stages of development, with considerable incremental space;

🐂 Excellent reputation: an industry innovator, pioneering the "mobile + smart matching + direct chat" model;

👍 Luxurious shareholder lineup: favored by investment institutions such as Capital Today, Tencent, GGV Capital, Source Code Capital, Coatue, etc.!

The largest online recruitment platform in China- $Kanzhun (BZ.US)$ Subscription has begun

🥇Leading market position: massive user base, significant traffic advantage;

📈 Huge potential: China's online recruitment market is still in its early stages of development, with considerable incremental space;

🐂 Excellent reputation: an industry innovator, pioneering the "mobile + smart matching + direct chat" model;

👍 Luxurious shareholder lineup: favored by investment institutions such as Capital Today, Tencent, GGV Capital, Source Code Capital, Coatue, etc.!

Translated

2

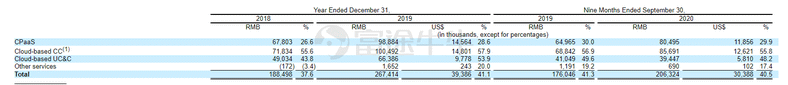

#USStockIPO# $Zhangmen Education (ZME.US)$ Subscription is now open!!!

🔥China's leading K12 personalized online education platform - Zhangmen Education has begun its IPO.

🥇Leading market position: Number one in the domestic online K12 one-on-one after-school tutoring service market share;

📈Huge potential: China has the world's largest online education market, with a broad runway;

🐂Excellent reputation: Over 50% of new customers signed up for one-on-one courses in 2020 were referred by existing clients;

👍Strong financial performance: Net income in 2020 was 4.018 billion yuan, with a year-on-year growth of over 50%.

🔥China's leading K12 personalized online education platform - Zhangmen Education has begun its IPO.

🥇Leading market position: Number one in the domestic online K12 one-on-one after-school tutoring service market share;

📈Huge potential: China has the world's largest online education market, with a broad runway;

🐂Excellent reputation: Over 50% of new customers signed up for one-on-one courses in 2020 were referred by existing clients;

👍Strong financial performance: Net income in 2020 was 4.018 billion yuan, with a year-on-year growth of over 50%.

Translated

#US Stock IPO#

🔥The largest independent insurance technology platform in China- $Waterdrop (WDH.US)$ Subscription has started

🥇Industry leader: Waterdrop Insurance is the largest independent insurance platform in China, Waterdrop Fundraising is the largest medical fundraising platform in China;

📈 Huge potential: China's insurance market is the second largest globally, with a broad track;

🐂 Strong shareholder lineup, including Tencent, Boyu Capital, Gaorong Capital, Swiss Reinsurance, etc.;

👍Compound annual revenue growth rate from 2018 to 2020 reached 256.6%.

🔥The largest independent insurance technology platform in China- $Waterdrop (WDH.US)$ Subscription has started

🥇Industry leader: Waterdrop Insurance is the largest independent insurance platform in China, Waterdrop Fundraising is the largest medical fundraising platform in China;

📈 Huge potential: China's insurance market is the second largest globally, with a broad track;

🐂 Strong shareholder lineup, including Tencent, Boyu Capital, Gaorong Capital, Swiss Reinsurance, etc.;

👍Compound annual revenue growth rate from 2018 to 2020 reached 256.6%.

Translated

3

1

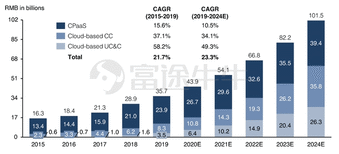

The leading cloud communications provider in China $Cloopen (RAAS.US)$Has submitted an application to the SEC and plans to list on the NYSE with the stock code RAAS.

The Chinese version of 'Twilio' supported by institutions, with multiple rounds of investment from Sequoia Capital China.

Since its launch in 2013, Ronglian Yun has achieved rapid growth and has become the largest cloud communications service provider in China. Its high-potential track record and first-mover advantage have attracted institutional investors who are bullish on its prospects, including multiple rounds of investment from Sequoia Capital China.

Before the IPO in the USA, Ronglian Yun completed a Series F financing of 125 million USD in November 2020, with China's State-owned Capital Venture Capital Fund (referred to as the 'National Venture Capital Fund') as the lead investor, followed by New Oriental Industrial Fund and other institutions. Tencent also participated in this round of financing through its investment entity Image Frame Investment (HK) Limited.

The US stock market has a certain understanding of SaaS, with many comparable companies, and the SaaS sector was highly sought after in the market last year. Ronglian Yun can be comparable to the target. $Twilio (TWLO.US)$Also saw an astonishing increase last year. Twilio is the world's largest cloud communications service provider, founded by former Amazon Cloud Product Manager Jeff Lawson, with the original intention of allowing developers to pay for telecommunications services on demand.

Although Twilio has not yet achieved profitability, its success validates the potential of the track and the feasibility of the business model. In summary...

The Chinese version of 'Twilio' supported by institutions, with multiple rounds of investment from Sequoia Capital China.

Since its launch in 2013, Ronglian Yun has achieved rapid growth and has become the largest cloud communications service provider in China. Its high-potential track record and first-mover advantage have attracted institutional investors who are bullish on its prospects, including multiple rounds of investment from Sequoia Capital China.

Before the IPO in the USA, Ronglian Yun completed a Series F financing of 125 million USD in November 2020, with China's State-owned Capital Venture Capital Fund (referred to as the 'National Venture Capital Fund') as the lead investor, followed by New Oriental Industrial Fund and other institutions. Tencent also participated in this round of financing through its investment entity Image Frame Investment (HK) Limited.

The US stock market has a certain understanding of SaaS, with many comparable companies, and the SaaS sector was highly sought after in the market last year. Ronglian Yun can be comparable to the target. $Twilio (TWLO.US)$Also saw an astonishing increase last year. Twilio is the world's largest cloud communications service provider, founded by former Amazon Cloud Product Manager Jeff Lawson, with the original intention of allowing developers to pay for telecommunications services on demand.

Although Twilio has not yet achieved profitability, its success validates the potential of the track and the feasibility of the business model. In summary...

Translated

1

$17 Education & Technology (YQ.US)$Moomoo has now started a hot subscription. It is expected to be officially listed on December 4, and is expected to become the largest education concept stock on NASDAQ. The underwriters for this IPO include Morgan Stanley, Goldman Sachs, Bank of America Securities, and Huaxing Capital.

According to the latest prospectus, Education Technology's current IPO price range is 9.5 to 11.5 US dollars/ADS, and it plans to issue a total of 27.4 million ADS shares (excluding over-allotment rights). Based on this calculation, the corresponding financing range is 0.26 billion to 0.315 billion US dollars.

Established in 2011, Together Education Technology (formerly Allied Work) is a well-known K12 online job platform in China. It is also an intelligent education company that provides “Internet +” solutions for basic education. Currently, the company's brand business includes: elementary school together, middle school together, study together, and learn online school together.

The total number of users exceeds 0.1 billion, and the advantages of segmentation are obvious

According to the prospectus, a brand under Education Technology works together to provide services to more than 0.9 million teachers, 54.3 million students, and 45.2 million parents across the country, covering one-third of the country's public primary and secondary schools.

According to the Frost & Sullivan report, in the first half of 2020, the average MAU (monthly active users) of Assignment (a brand owned by Education Technology) was number one in the field of online homework for primary and secondary schools, larger than the sum of the next four companies...

According to the latest prospectus, Education Technology's current IPO price range is 9.5 to 11.5 US dollars/ADS, and it plans to issue a total of 27.4 million ADS shares (excluding over-allotment rights). Based on this calculation, the corresponding financing range is 0.26 billion to 0.315 billion US dollars.

Established in 2011, Together Education Technology (formerly Allied Work) is a well-known K12 online job platform in China. It is also an intelligent education company that provides “Internet +” solutions for basic education. Currently, the company's brand business includes: elementary school together, middle school together, study together, and learn online school together.

The total number of users exceeds 0.1 billion, and the advantages of segmentation are obvious

According to the prospectus, a brand under Education Technology works together to provide services to more than 0.9 million teachers, 54.3 million students, and 45.2 million parents across the country, covering one-third of the country's public primary and secondary schools.

According to the Frost & Sullivan report, in the first half of 2020, the average MAU (monthly active users) of Assignment (a brand owned by Education Technology) was number one in the field of online homework for primary and secondary schools, larger than the sum of the next four companies...

Translated

![[IPO Broadcast] Together Education Technology, China's leading K12 online job platform](https://snsimg.futunn.com/16069813251997-77777005-web-d259ea1d16ee1ac8.png/thumb)

November 16, Perfect Diary parent company $Yatsen (YSG.US)$Subscriptions are popular. As of 5:00 p.m. on November 16, the number of Futu subscribers exceeded 17,000, and the subscription amount exceeded 770 million US dollars. It is expected that subscriptions will end at 6:00 EST on November 18, and will be officially listed on the New York Stock Exchange on the same day.

Scan the QR code in the picture to enter Moomoo's new Yixian e-commerce portal:

According to the latest prospectus, Yixian E-Commerce plans to issue 58.75 million American Depositary Shares (ADS) in this IPO. Each ADS share is equivalent to 4 Class A common shares, with an issuance range of $8.5 to $10.5 per ADS share. Based on this calculation, the corresponding financing range is between US$499 million and US$619 million.

Yixian E-commerce was founded in 2016. According to the Insight Consulting Report, the company achieved total sales of 3.5 billion yuan in 2019, ranking first among domestic makeup companies. Perfect Diary, which it incubates, has become the number one online makeup brand in China.

Currently, Yixian E-Commerce owns four high-growth makeup and skincare brands, PerfectDiary (PerfectDiary), Little Ondine (Little Ondine), Abby's Choice (Abby's Choice), and Galenic.

In recent years, the company has achieved diversified channel expansion and adopted a combination of online and offline methods to further promote customer and brand building...

Scan the QR code in the picture to enter Moomoo's new Yixian e-commerce portal:

According to the latest prospectus, Yixian E-Commerce plans to issue 58.75 million American Depositary Shares (ADS) in this IPO. Each ADS share is equivalent to 4 Class A common shares, with an issuance range of $8.5 to $10.5 per ADS share. Based on this calculation, the corresponding financing range is between US$499 million and US$619 million.

Yixian E-commerce was founded in 2016. According to the Insight Consulting Report, the company achieved total sales of 3.5 billion yuan in 2019, ranking first among domestic makeup companies. Perfect Diary, which it incubates, has become the number one online makeup brand in China.

Currently, Yixian E-Commerce owns four high-growth makeup and skincare brands, PerfectDiary (PerfectDiary), Little Ondine (Little Ondine), Abby's Choice (Abby's Choice), and Galenic.

In recent years, the company has achieved diversified channel expansion and adopted a combination of online and offline methods to further promote customer and brand building...

Translated

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)