$Futu Holdings Ltd (FUTU.US)$ $Alibaba (BABA.US)$ $Alibaba (BABA.US)$ $JD.com (JD.US)$ $PDD Holdings (PDD.US)$ $UP Fintech (TIGR.US)$

CN Stocks are all jumping up together.

For details, please refer to the article above, as the length cannot be accommodated here.

CN Stocks are all jumping up together.

For details, please refer to the article above, as the length cannot be accommodated here.

Translated

2

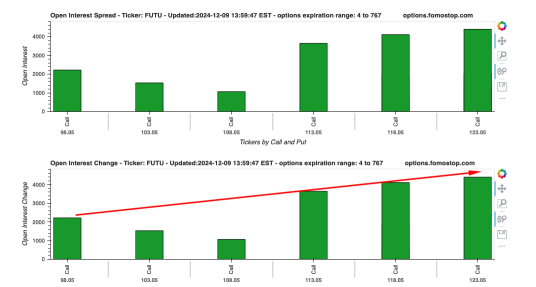

$Futu Holdings Ltd (FUTU.US)$Currently, there is a pulling force formation in the 113 to 123 position of the data, so it can be temporarily assumed that this wave of rise has not ended. There has been a gap-up situation before, but at that time the data immediately reduced its shareholding, which can be checked to see the difference.

Translated

2

$Archer Aviation (ACHR.US)$

The data in recent weeks has been consistently bullish, with the stock price doubling in sync over the past four weeks. It is currently at a technical support level, suitable for short-term arbitrage, following the breakthrough and pullback without falling below.

The data in recent weeks has been consistently bullish, with the stock price doubling in sync over the past four weeks. It is currently at a technical support level, suitable for short-term arbitrage, following the breakthrough and pullback without falling below.

Translated

$Coinbase (COIN.US)$

Last time we entered near 160, the data looked like this, but the pattern was different. After this type of data came out, the stock price experienced nearly three weeks of decline, but the data continued to increase Buyer CALL, so this market maker's price behavior is like this. Each stock has its own market maker behavior, and only by studying the behavior carefully can we perfectly utilize the data.

Last time we entered near 160, the data looked like this, but the pattern was different. After this type of data came out, the stock price experienced nearly three weeks of decline, but the data continued to increase Buyer CALL, so this market maker's price behavior is like this. Each stock has its own market maker behavior, and only by studying the behavior carefully can we perfectly utilize the data.

Translated

3

$Advanced Micro Devices (AMD.US)$

AMD

Incremental positions are obvious, total CALL and PUT continue to confront each other, the stock price has been falling for quite some time, the first target position of the increment has been taken down today at 140, Initiator at position 146 is still a Seller, it is worth paying attention to the breakthrough.

AMD

Incremental positions are obvious, total CALL and PUT continue to confront each other, the stock price has been falling for quite some time, the first target position of the increment has been taken down today at 140, Initiator at position 146 is still a Seller, it is worth paying attention to the breakthrough.

Translated

1

7

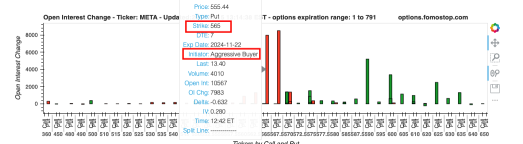

$Meta Platforms (META.US)$Since becoming the CEO, META has been under pressure, and the FS data from yesterday and today are clearly pointing to 565, already below the target price, perfect for Friday.

Translated

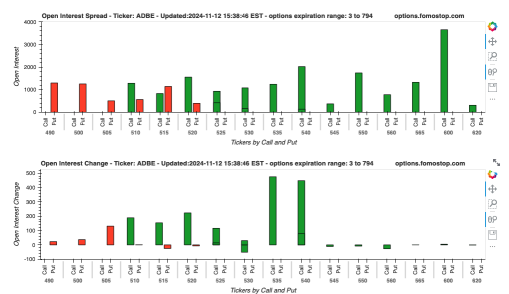

$Adobe (ADBE.US)$The resistance at the 535-540 position still has space, and the strong upward trend from today is still ongoing.

Translated

2

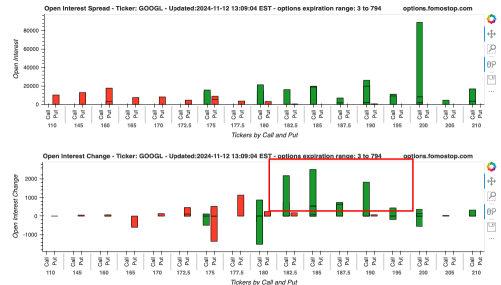

$Alphabet-A (GOOGL.US)$FS data shows a significant increase in open call options for Google at $195 and $200, following an upward trend.

Translated

3

1

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)