投资小子4896

liked

Good morning mooers! Here are things you need to know about today's Singapore:

●Singapore shares opened lower on Monday; STI down 1.01%

●Commodities face tough week as Fed angst builds

●Stocks and REITs to watch: Singtel, SPH Reit, Aspen

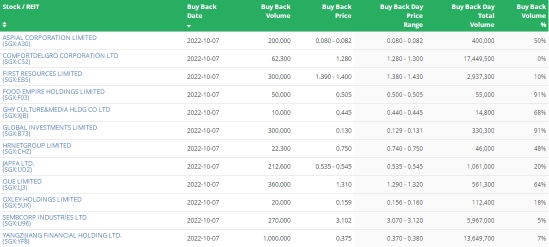

●Latest share buy back transactions

-moomoo News SG

Market Trend

Singapore shares opened lower on Monday. The $FTSE Singapore Straits Time Index (.STI.SG)$ decreased 1.01 per cent to 3,114.16 ...

●Singapore shares opened lower on Monday; STI down 1.01%

●Commodities face tough week as Fed angst builds

●Stocks and REITs to watch: Singtel, SPH Reit, Aspen

●Latest share buy back transactions

-moomoo News SG

Market Trend

Singapore shares opened lower on Monday. The $FTSE Singapore Straits Time Index (.STI.SG)$ decreased 1.01 per cent to 3,114.16 ...

1447

1387

189

投资小子4896

voted

Columns Moo Picks in July

Hey mooers,

Inflation is still hot, but July's CPI may not tell the whole story for investors. Did anyone catch a ride of the rocketing inflation? Let's find out here. Don't panic, and we're going to get through this!

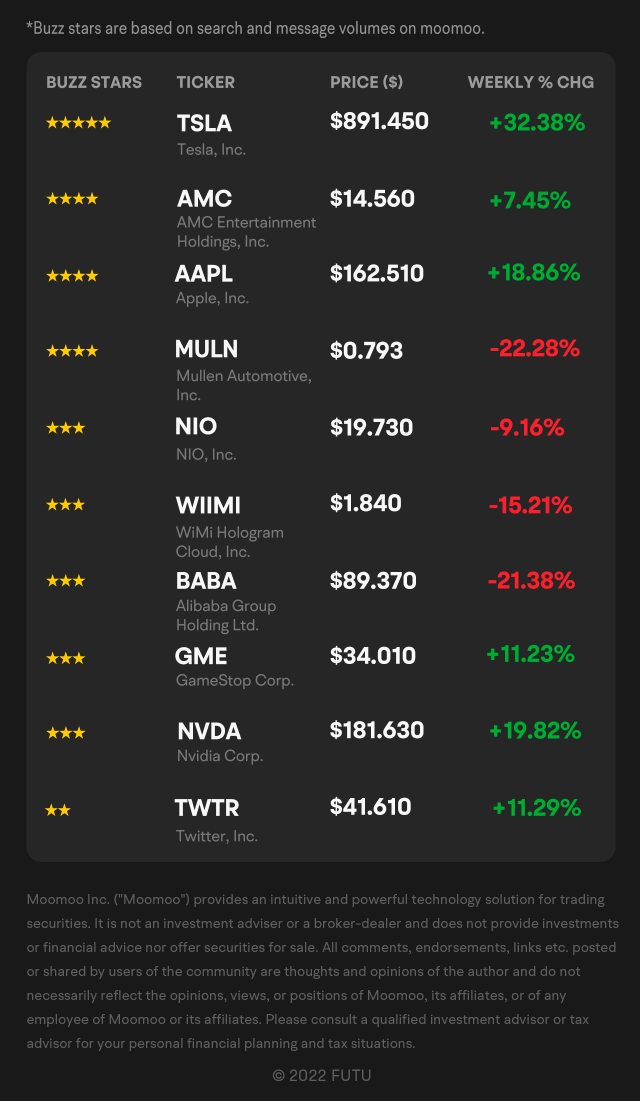

Monthly Buzz

Did you read the breaking news about the stocks in which you invest? Is there any company on the list that you didn't follow? Check out the buzzing stocks you may have missed out on!

Buzzing Stocks List

July Picks

@iamiam

Stop trying to calm the storm...

Inflation is still hot, but July's CPI may not tell the whole story for investors. Did anyone catch a ride of the rocketing inflation? Let's find out here. Don't panic, and we're going to get through this!

Monthly Buzz

Did you read the breaking news about the stocks in which you invest? Is there any company on the list that you didn't follow? Check out the buzzing stocks you may have missed out on!

Buzzing Stocks List

July Picks

@iamiam

Stop trying to calm the storm...

+1

195

74

23

投资小子4896

liked

Singapore real estate investment trusts can benefit from their safe-haven status during a time of market volatility as the U.S. Fed raises interest rates, analysts from DBS say in a research note.

The Fed's clarity on its rate-rise trajectory will likely lead to more price stability for Singapore REITs, they say.

What are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are funds that invest in a port...

The Fed's clarity on its rate-rise trajectory will likely lead to more price stability for Singapore REITs, they say.

What are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are funds that invest in a port...

1537

1277

382

投资小子4896

voted

Yooooo mooers,

Successful entrepreneurs build great companies and inspire people to become enduring legends. They create fortunes with their talent, wisdom, and diligence. To build wealth ourselves, we should try to figure out how they make money, what are their asset management skills, and why they can continue to achieve great success. Getting to know the great minds and their stories may lead us to the ladder of wealth. Now, let...

Successful entrepreneurs build great companies and inspire people to become enduring legends. They create fortunes with their talent, wisdom, and diligence. To build wealth ourselves, we should try to figure out how they make money, what are their asset management skills, and why they can continue to achieve great success. Getting to know the great minds and their stories may lead us to the ladder of wealth. Now, let...

145

693

22

投资小子4896

liked

First thing first!

Team moomoo wish all mooers a merry Christmas!!![]()

![]()

![]()

Thank you all for your company in the past year! And we wish we will always be by your side on your investing journey.

And now, we sincerely invite all mooers join us in writing about #My Christmas Wishlist for 2022, speak out your wishes about what NEW FEATURES or SERVICES that you expect the most from moomoo in upcoming 2022, which might bring your post more impressions and even earn the rewards for you!! All we want is to keep improving ourselves and offer better experience to mooers! We do value your voice!![]()

![]()

![]()

Santa Moo Can't Wait to Read Your Wishlists!![]()

![]()

Team moomoo wish all mooers a merry Christmas!!

Thank you all for your company in the past year! And we wish we will always be by your side on your investing journey.

And now, we sincerely invite all mooers join us in writing about #My Christmas Wishlist for 2022, speak out your wishes about what NEW FEATURES or SERVICES that you expect the most from moomoo in upcoming 2022, which might bring your post more impressions and even earn the rewards for you!! All we want is to keep improving ourselves and offer better experience to mooers! We do value your voice!

Santa Moo Can't Wait to Read Your Wishlists!

137

16

4

投资小子4896

liked

The biggest lesson is that despite setting stop-loss and take-profit, the lack of self-control and the mentality of luck led to not strictly implementing stop-loss and take-profit.

Translated

1

投资小子4896

liked

Big mistakes most of us will have is “Greed” most frequently heard phrase we all have heard and seen “ To the Moon” , hahaha of cos who doesn’t want a Moon in the stock markets whereby we already invested and longing for the Moon. Yes it’s all a believe where we seek info and news read up to see a stock growing and believe in to reach its peak. But have you ever wonder where it’s peak is? Have you ever seen beyond the mountains or have a sight of its highest point. That’s right we can only read up news, from its company we determined it’s future but no one will ever know when it’s peak before it hits. For Greed I had missed the opportunity to release at its very top and looking back to yearn for another peak but it never happens. But seeing from Coca Cola, Intel, Tesla, Apple, yes there’s a peak way long before and down again but after many years of up and downs we see it have hit many new heights. So it’s the thought that have bring the company together with its investors so far with ~ Believe. Nothing can be achieved if you don’t put a thought to it, and nothing can be done if you don’t believe in it.

Apes 🦍

And I do believe one day just one day we all shall see the Moon we believe to be![]()

![]()

![]()

![]()

hit a like button below if you are just like me a believer and hopefully our shares and stocks rises in 2022/2023

Merry Xmas to everyone![]()

![]()

![]()

thanks MooMoo app appreciate the app and people in MooMoo which makes it such a wonderful journey together. Cheers 🥂

Apes 🦍

And I do believe one day just one day we all shall see the Moon we believe to be

hit a like button below if you are just like me a believer and hopefully our shares and stocks rises in 2022/2023

Merry Xmas to everyone

thanks MooMoo app appreciate the app and people in MooMoo which makes it such a wonderful journey together. Cheers 🥂

3

1

投资小子4896

liked

$Taiwan Semiconductor (TSM.US)$

Intel hopes to book a separate production line from Taiwan Semiconductor for the production of their CPUs and GPUs, just like the cooperation between Taiwan Semiconductor and Apple.

The cost of setting up a separate production line is high.Therefore, Taiwan Semiconductor hopes that Intel will pay a prepayment for the 3nm process production line, but this is not the desired outcome for Intel's discussions.

Intel hopes to book a separate production line from Taiwan Semiconductor for the production of their CPUs and GPUs, just like the cooperation between Taiwan Semiconductor and Apple.

The cost of setting up a separate production line is high.Therefore, Taiwan Semiconductor hopes that Intel will pay a prepayment for the 3nm process production line, but this is not the desired outcome for Intel's discussions.

Translated

5

投资小子4896

liked

Hey mooers![]()

Happy Friday! Weekly Sectors Fund Flow Board is here~

From this chart, you will be able to find out what sector ETFs have most fund inflow. Fund inflow is often considered as a bullish sign of the sector and related ETFs!

^Weekly Sectors Fund Flow Board: a sector ranking based on sector ETFs aggregate 3-month fund flows.

^3-month fund flows: a metric that can be used to gaugethe perceived popularity amongst investors of different sectors.

^The board includes the following information: change of rankings, 3-month fund flows, how many ETFs are in the sectors, and the related ETFs.

For this week, I covered the top two sector-realted ETFs with the highest total assets! Now, let's take a look at the board~You may find something to diversify your porfolio

* Follow me to know what is hot on the market

Sectors Update in Premarket on Friday :

*Tech

Technology stocks were declining as the $The Technology Select Sector SPDR® Fund (XLK.US)$ dropped 1.3% and the $iShares Semiconductor ETF (SOXX.US)$ was off by 1.2%.

$Bottomline Technologies (EPAY.US)$ advanced more than 15% after it agreed to be bought by software investment firm Thoma Bravo for $2.6 billion in an all-cash go-private deal.

*Financial

Financial stocks were retreating as the $Financial Select Sector SPDR Fund (XLF.US)$ was 0.3% lower in recent trading.

The $Direxion Daily Financial Bull 3X Shares ETF (FAS.US)$ declined 1% and its bearish counterpart $Direxion Daily Financial Bear 3X Shares ETF (FAZ.US)$ were up 1.5%.

*Consumer

Consumer stocks were mixed ahead of the opening bell on Friday as the $Consumer Staples Select Sector SPDR Fund (XLP.US)$ was 0.2% higher while the $Consumer Discretionary Select Sector SPDR Fund (XLY.US)$ was recently down 0.8%.

$Rivian Automotive (RIVN.US)$ dropped 8% after the electric automaker posted a wider loss in its most recent reporting quarter. The company also unveiled plans to invest $5 billion on a second production facility in Georgia.

*Energy

Energy stocks were declining premarket Friday as the $Energy Select Sector SPDR Fund (XLE.US)$ dipped 0.6%.

The $United States Oil Fund LP (USO.US)$ was off 0.8% and the $United States Natural Gas (UNG.US)$ dropped 1.5%.

Source: MT Newswires

Happy Friday! Weekly Sectors Fund Flow Board is here~

From this chart, you will be able to find out what sector ETFs have most fund inflow. Fund inflow is often considered as a bullish sign of the sector and related ETFs!

^Weekly Sectors Fund Flow Board: a sector ranking based on sector ETFs aggregate 3-month fund flows.

^3-month fund flows: a metric that can be used to gaugethe perceived popularity amongst investors of different sectors.

^The board includes the following information: change of rankings, 3-month fund flows, how many ETFs are in the sectors, and the related ETFs.

For this week, I covered the top two sector-realted ETFs with the highest total assets! Now, let's take a look at the board~You may find something to diversify your porfolio

* Follow me to know what is hot on the market

Sectors Update in Premarket on Friday :

*Tech

Technology stocks were declining as the $The Technology Select Sector SPDR® Fund (XLK.US)$ dropped 1.3% and the $iShares Semiconductor ETF (SOXX.US)$ was off by 1.2%.

$Bottomline Technologies (EPAY.US)$ advanced more than 15% after it agreed to be bought by software investment firm Thoma Bravo for $2.6 billion in an all-cash go-private deal.

*Financial

Financial stocks were retreating as the $Financial Select Sector SPDR Fund (XLF.US)$ was 0.3% lower in recent trading.

The $Direxion Daily Financial Bull 3X Shares ETF (FAS.US)$ declined 1% and its bearish counterpart $Direxion Daily Financial Bear 3X Shares ETF (FAZ.US)$ were up 1.5%.

*Consumer

Consumer stocks were mixed ahead of the opening bell on Friday as the $Consumer Staples Select Sector SPDR Fund (XLP.US)$ was 0.2% higher while the $Consumer Discretionary Select Sector SPDR Fund (XLY.US)$ was recently down 0.8%.

$Rivian Automotive (RIVN.US)$ dropped 8% after the electric automaker posted a wider loss in its most recent reporting quarter. The company also unveiled plans to invest $5 billion on a second production facility in Georgia.

*Energy

Energy stocks were declining premarket Friday as the $Energy Select Sector SPDR Fund (XLE.US)$ dipped 0.6%.

The $United States Oil Fund LP (USO.US)$ was off 0.8% and the $United States Natural Gas (UNG.US)$ dropped 1.5%.

Source: MT Newswires

95

13

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)