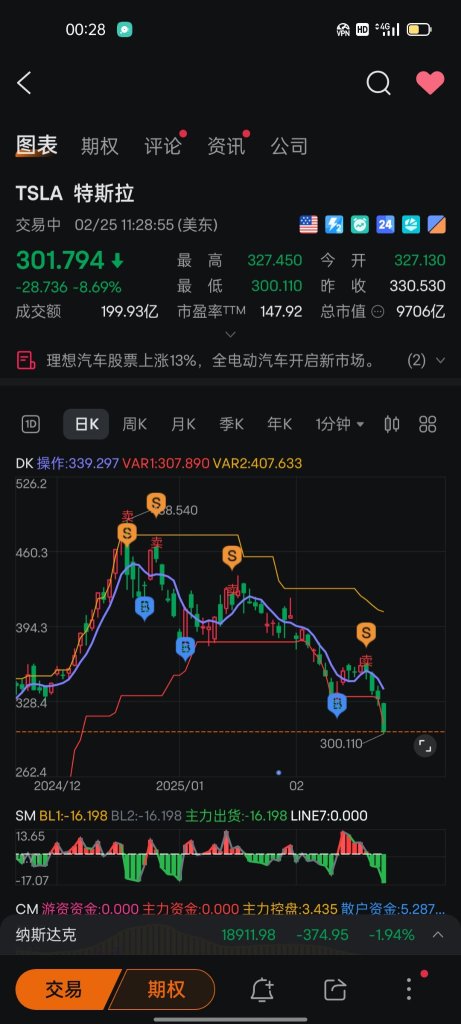

$Tesla (TSLA.US)$ Looking forward to bottom-fishing below 280.

You are invited to join the Server Eastern Panda | U.S. Stock Trading Group.

You are invited to join the Server Eastern Panda | U.S. Stock Trading Group.

Translated

1

Translated

From YouTube

1

4

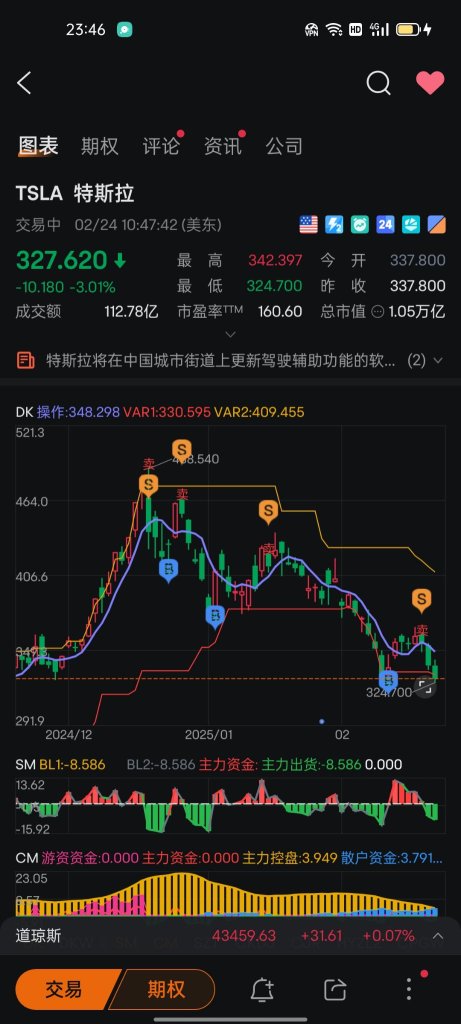

$Invesco QQQ Trust (QQQ.US)$ $NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$

Let's watch the market together and chat.

You are invited to join the Server Oriental Panda.

Let's watch the market together and chat.

You are invited to join the Server Oriental Panda.

Translated

2

$Invesco QQQ Trust (QQQ.US)$ $NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$ On the 24th, a signal for a downward trend has started; do not rush to buy the dip, patiently wait for the weak hands to sell.

You are invited to join the Server Oriental Panda.

You are invited to join the Server Oriental Panda.

Translated

From YouTube

2

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)