星之所在

commented on

The Federal Reserve's interest rate meeting is about to take place on December 18th, Eastern Time. The current market consensus for this meeting is a 25 basis points rate cut, with a 95% probability. The market has already priced this in. The key is whether the changes in the interest rate path in next year's dot plot meet expectations. Stubborn core inflation and low unemployment rate are expected to significantly reduce the number of rate cuts by the Federal Reserve. I boldly speculate that there will only be one rate cut next year, and the 10-Year T-Note yield will surpass 4.5% again. Moreover, with the new administration taking office, there will be a substantial increase in federal debt, and high interest rates will pose a dilemma for the continuous government spending by the USA.

Conclusion: The current overvaluation of the US stock market running up to the upper limit of 6100 points forward-looking to FY25 is absolutely unsustainable, and a 5-10% index-level pullback is bound to occur. (After the Christmas market, positions from January to February need to be significantly increased for protection.) The index has risen by 27% this year. I can only wish good luck to those who are looking to chase the uptrend at this point.

Individual stocks:

AMD: Falling below $129, starting to approach the 25-year forward valuation lower limit of $118-124. I will start to establish positions and sell Put options at the end of March.

NVIDIA: Retracing to the strong support zone of $121-$128, friends without positions can start to build small positions. The super strong support zone of $112-$118 can be significantly increased to do the FY25 valuation mean reversion. If the index retraces as expected, this level is highly likely to be visible, so don't rush.

Tesla: This wave has already soared, I took profit halfway at $320 and sold, currently around $440 😭 I will buy Put options after January 5th...

Conclusion: The current overvaluation of the US stock market running up to the upper limit of 6100 points forward-looking to FY25 is absolutely unsustainable, and a 5-10% index-level pullback is bound to occur. (After the Christmas market, positions from January to February need to be significantly increased for protection.) The index has risen by 27% this year. I can only wish good luck to those who are looking to chase the uptrend at this point.

Individual stocks:

AMD: Falling below $129, starting to approach the 25-year forward valuation lower limit of $118-124. I will start to establish positions and sell Put options at the end of March.

NVIDIA: Retracing to the strong support zone of $121-$128, friends without positions can start to build small positions. The super strong support zone of $112-$118 can be significantly increased to do the FY25 valuation mean reversion. If the index retraces as expected, this level is highly likely to be visible, so don't rush.

Tesla: This wave has already soared, I took profit halfway at $320 and sold, currently around $440 😭 I will buy Put options after January 5th...

Translated

+2

22

10

7

星之所在

liked and commented on

$VCI Global (VCIG.US)$ What do dead short sellers do with stocks?

Translated

2

5

星之所在

voted

Mark your calendars, folks! Nvidia's Q3 earnings drop on November 20, and the market is buzzing with excitement. This could be the quarter that defines 2025 for the AI giant! 🌟

Here’s the setup:

- Nvidia is forecasting $32.5B revenue with a 75% gross margin—that’s insane efficiency for a company of this scale! 💎

- Analysts are even more bullish, predicting $32.94B revenue and $0.74 EPS, which would mean doubling last year’s Q3 revenue. Massive. 📈

O...

Here’s the setup:

- Nvidia is forecasting $32.5B revenue with a 75% gross margin—that’s insane efficiency for a company of this scale! 💎

- Analysts are even more bullish, predicting $32.94B revenue and $0.74 EPS, which would mean doubling last year’s Q3 revenue. Massive. 📈

O...

+1

9

3

星之所在

commented on

Translated

1

1

星之所在

voted

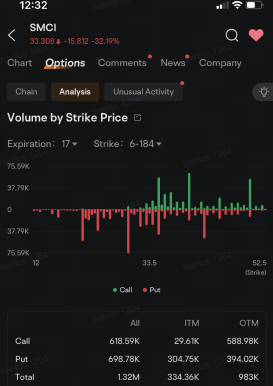

$Super Micro Computer (SMCI.US)$ pole-vaulted over $Tesla (TSLA.US)$ to become the second most active stock option amid increasing demand for protective put options that could shield the holder from further downside potential.

SMCI shares gapped down 30% to the lowest level since January after the IT solutions provider that sells liquid-cooling solutions to $NVIDIA (NVDA.US)$ said its auditor, Ernst & Young, ...

SMCI shares gapped down 30% to the lowest level since January after the IT solutions provider that sells liquid-cooling solutions to $NVIDIA (NVDA.US)$ said its auditor, Ernst & Young, ...

51

19

33

星之所在

voted

The market is buzzing today with an intriguing mix of gains and pullbacks across the Magnificent 7 stocks. Here’s a quick breakdown of the action:

• $Alphabet-A (GOOGL.US)$ : today’s big winner, surging +6.16%. Investors are responding positively to recent AI advancements, fueling strong buying interest. Google’s MACD indicates strong upward momentum, supporting its powerful performance.

• $Amazon (AMZN.US)$ : also shines, up +2.27%. The e-commerce ...

• $Alphabet-A (GOOGL.US)$ : today’s big winner, surging +6.16%. Investors are responding positively to recent AI advancements, fueling strong buying interest. Google’s MACD indicates strong upward momentum, supporting its powerful performance.

• $Amazon (AMZN.US)$ : also shines, up +2.27%. The e-commerce ...

28

1

星之所在

voted

Good morning, traders. Happy Monday, October 28th. The market is climbing, with just one S&P 500 sector in the red. It is the start of a massive earnings week, with every mag seven tech giant reporting besdies $Tesla (TSLA.US)$ who reported last week, and $NVIDIA (NVDA.US)$, set for a report November 21st.

$Alphabet-A (GOOGL.US)$ reports Tuesday alongside $Advanced Micro Devices (AMD.US)$, $Meta Platforms (META.US)$ a...

$Alphabet-A (GOOGL.US)$ reports Tuesday alongside $Advanced Micro Devices (AMD.US)$, $Meta Platforms (META.US)$ a...

43

7

11

星之所在

commented on

$ASML Holding (ASML.US)$ If it drops 500, I will sell my call. If you can't, then stop going up and down all the time.

Translated

2

2

星之所在

voted

$ASML Holding (ASML.US)$ continued slump signaled divergence among chipmakers, with those with the biggest exposure to artificial intelligence led by $NVIDIA (NVDA.US)$ showing greater resilience. As expected, that's also spilling over to the options market.

ASML's American depositary receipts (ADRs) tumbled Wednesday, taking its two-day loss to almost 21%, after the Dutch company reported a day earlier that its net bookings shr...

ASML's American depositary receipts (ADRs) tumbled Wednesday, taking its two-day loss to almost 21%, after the Dutch company reported a day earlier that its net bookings shr...

37

6

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

星之所在 : My opinion on Tesla is the same as yours, I am also ready to short the stock