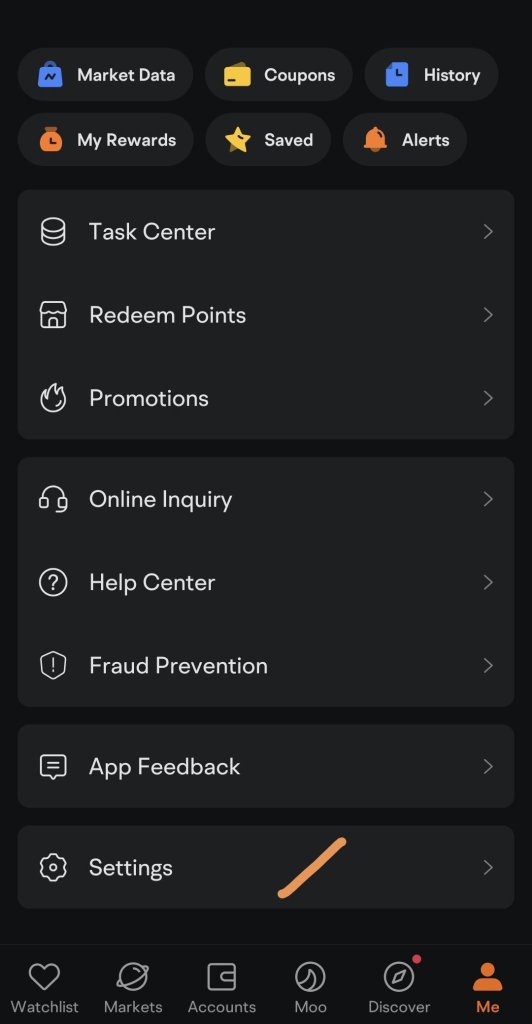

Recently, many Malaysian friends have started using moomoo.

Some people hear that Moomoo is margin acc, and they are a little worried that they might accidentally buy the wrong amount and then buy more than they deposit cash into their account.

Here, I'll explain how to turn off the margin function. I'm no longer afraid that my fingers are too fat; I'm entering more than the amount of cash in my account 😂

Please take a look at the graphic teaching, first let's go to me...

That's it, the margin function is turned off.

Some people hear that Moomoo is margin acc, and they are a little worried that they might accidentally buy the wrong amount and then buy more than they deposit cash into their account.

Here, I'll explain how to turn off the margin function. I'm no longer afraid that my fingers are too fat; I'm entering more than the amount of cash in my account 😂

Please take a look at the graphic teaching, first let's go to me...

That's it, the margin function is turned off.

Translated

+3

13

5

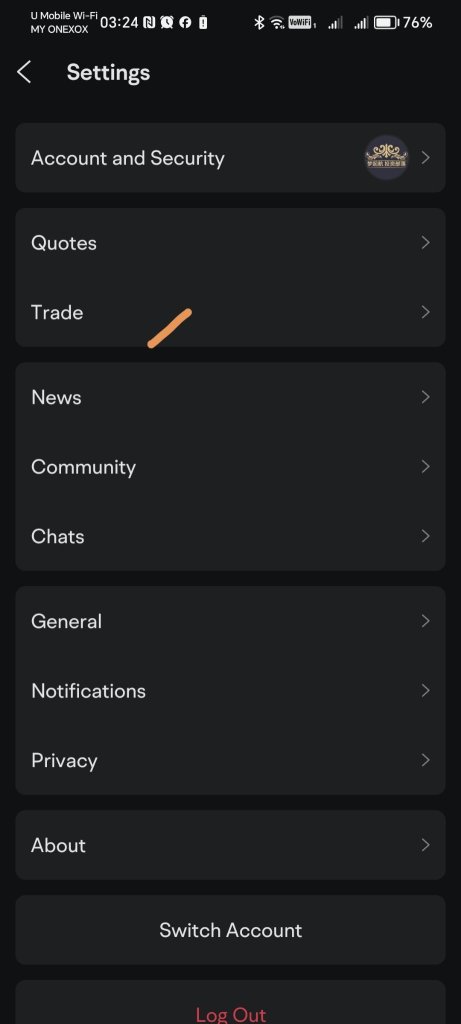

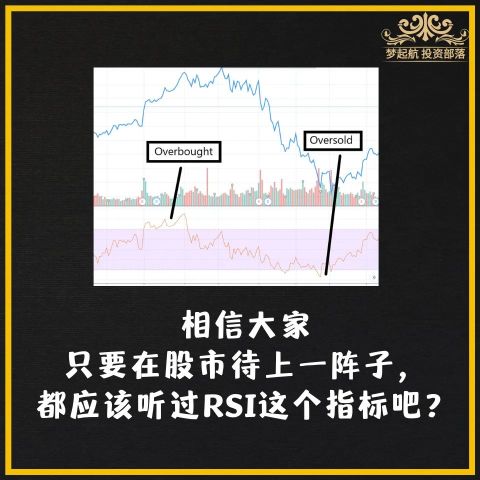

When you use a technical indicator, its inventor, doesn't use it anymore.

There's nothing scarier than this, right?

There's nothing scarier than this, right?

Translated

+37

21

1

Trading stocks is no easy task; there are so many tips. If you can identify “10 situations where you should not place an order”, then the investment report card will be much better~

Translated

+9

26

1

Today, let's talk about why the vast majority of investors are unable to buy skyrocketing stocks. 😅

Below is a stock chart.

At the current price, would you buy it? The answer for most people is absolutely no.![]()

Let's take a look at the next trend~

![]()

Such a strong stock has gone up so much; I believe many people in the market must notice it every day.

However, I can honestly say to you that there are very few investors who dare to buy it.![]()

Investors generally prefer to buy stocks that “rise from the bottom” rather than stocks that have formed an obvious “upward trend.”

They don't buy stocks with an upward trend. It's not that there is a bearish signal in technical analysis, but they seem to have gone up too much and are afraid it will plummet 📉.

Simply put, it's a fear of heights.![]()

So, think carefully. Is the real reason that dominates whether investors buy or not because of technical analysis or psychological factors?

Studying technical analysis is not difficult at all; however, seeing strong stocks, few people dare to catch up. 😅

The reason you choose stocks that rise and rise at the bottom is because they seem cheap, “the price is at the bottom, making you feel safe.”

Why are you afraid to buy stocks that are already rising? It's because you're afraid to “buy at the highest point.”

You've probably discovered a skyrocketing stock a long time ago, but the more it rises, the more afraid you become.

In the end, you chose to watch it go up all the way and miss out on making money.![]()

Actually, once a trend is formed, it won't change easily. We should be friends with trends....

Below is a stock chart.

At the current price, would you buy it? The answer for most people is absolutely no.

Let's take a look at the next trend~

Such a strong stock has gone up so much; I believe many people in the market must notice it every day.

However, I can honestly say to you that there are very few investors who dare to buy it.

Investors generally prefer to buy stocks that “rise from the bottom” rather than stocks that have formed an obvious “upward trend.”

They don't buy stocks with an upward trend. It's not that there is a bearish signal in technical analysis, but they seem to have gone up too much and are afraid it will plummet 📉.

Simply put, it's a fear of heights.

So, think carefully. Is the real reason that dominates whether investors buy or not because of technical analysis or psychological factors?

Studying technical analysis is not difficult at all; however, seeing strong stocks, few people dare to catch up. 😅

The reason you choose stocks that rise and rise at the bottom is because they seem cheap, “the price is at the bottom, making you feel safe.”

Why are you afraid to buy stocks that are already rising? It's because you're afraid to “buy at the highest point.”

You've probably discovered a skyrocketing stock a long time ago, but the more it rises, the more afraid you become.

In the end, you chose to watch it go up all the way and miss out on making money.

Actually, once a trend is formed, it won't change easily. We should be friends with trends....

Translated

19

1

2

Recently, the Federal Reserve has clearly softened its stance, and interest rate hikes have come to an end.

Powell now only uses “mouth to raise interest rates”, that is, simply be wary, and will raise interest rates again if necessary.

We can also see that the US inflation data is gradually slowing down, and everything is slowly moving on the right track.

Of course, this also explains why the US stock market recently strengthened ahead of schedule.

The stock market is always ahead of the economy.

Of course, there are quite a few people who are bearish. That's right.

After all, at the beginning of a wave of market activity, it is always the people who don't believe it, who slowly begin to believe it.

Back to our initial economic clock chart.

Currently, we can see that after the recession bottoms out, it will go through some processes.

What you can find is that bond prices are currently rising...

Of course, as market participants, the most important thing for us is to follow the market.

After all, as long as he is a human, his opinions will be wrong sometimes.

Hopefully, next year, the bull market will return to Malaysian stocks. Flying dragons are in the sky, aren't they?

Powell now only uses “mouth to raise interest rates”, that is, simply be wary, and will raise interest rates again if necessary.

We can also see that the US inflation data is gradually slowing down, and everything is slowly moving on the right track.

Of course, this also explains why the US stock market recently strengthened ahead of schedule.

The stock market is always ahead of the economy.

Of course, there are quite a few people who are bearish. That's right.

After all, at the beginning of a wave of market activity, it is always the people who don't believe it, who slowly begin to believe it.

Back to our initial economic clock chart.

Currently, we can see that after the recession bottoms out, it will go through some processes.

What you can find is that bond prices are currently rising...

Of course, as market participants, the most important thing for us is to follow the market.

After all, as long as he is a human, his opinions will be wrong sometimes.

Hopefully, next year, the bull market will return to Malaysian stocks. Flying dragons are in the sky, aren't they?

Translated

+2

17

1

![[Why is it easy for retail investors to lose money?]](https://sgsnsimg.moomoo.com/feed_image/104028525/a21da159e1b03133b42ac229e9f4c302.jpg/thumb)

![[Why is it easy for retail investors to lose money?]](https://sgsnsimg.moomoo.com/feed_image/104028525/828990e52b58365abb15e45152da5a10.jpg/thumb)

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)