永恆

reacted to

Once again the year flew by in a blink of the eyes![]()

![]()

Looking back at 2024 there have been many rewarding moments in moomoo![]()

$Fullerton SGD Cash Fund (SG9999005961.MF)$ is my favorite money market fund![]()

Combined it with moomoo's % yield coupons my daily returns have been greatly boosted![]()

2024 has been good to me and I hope to continue this track record for next year!![]()

Unfortunately this year we didn't get the fishing game but here are jus...

Looking back at 2024 there have been many rewarding moments in moomoo

$Fullerton SGD Cash Fund (SG9999005961.MF)$ is my favorite money market fund

Combined it with moomoo's % yield coupons my daily returns have been greatly boosted

2024 has been good to me and I hope to continue this track record for next year!

Unfortunately this year we didn't get the fishing game but here are jus...

+6

72

25

1

永恆

commented on

A special, final Q&A for 2024, focusing on the US Federal Reserve's interest rate decision. Feel free to ask your questions below. For each question you post, moomoo will reward you with points. moomoo Australia's market strategist covers investing, trading and all market matters - live. Ask questions, comment, and share your view, as the markets trade.

Ask a strategist - Fed rate decision

Dec 17 08:00

Book

Book 159

170

7

永恆

voted

Happy weekend investors! Welcome back to Weekly Buzz where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

The market finished the week with all-time records for tech stocks, yet again. Prices were muted until CPI numbers came out Wednesday, high enough above expectations to secure hope for further rate cuts at the FOMC meet...

Make Your Choice

Weekly Buzz

The market finished the week with all-time records for tech stocks, yet again. Prices were muted until CPI numbers came out Wednesday, high enough above expectations to secure hope for further rate cuts at the FOMC meet...

+9

38

16

13

永恆

voted

China stocks are back in action! 🚀 After a big political meeting, next year’s game plan is clear: more fiscal spending and easier monetary policy. Sounds big, right? The last time we saw this kind of "double easing" was 2008—feels like déjà vu! 🕰️Today’s market was a mixed bag though—so where’s the momentum heading next? 🤔

Here’s the gist:

1️⃣ Boost consumer spending (yes, they’re serious about it)

2️⃣ Push tech innovation and industrial upgrad...

Here’s the gist:

1️⃣ Boost consumer spending (yes, they’re serious about it)

2️⃣ Push tech innovation and industrial upgrad...

+1

5

3

永恆

voted

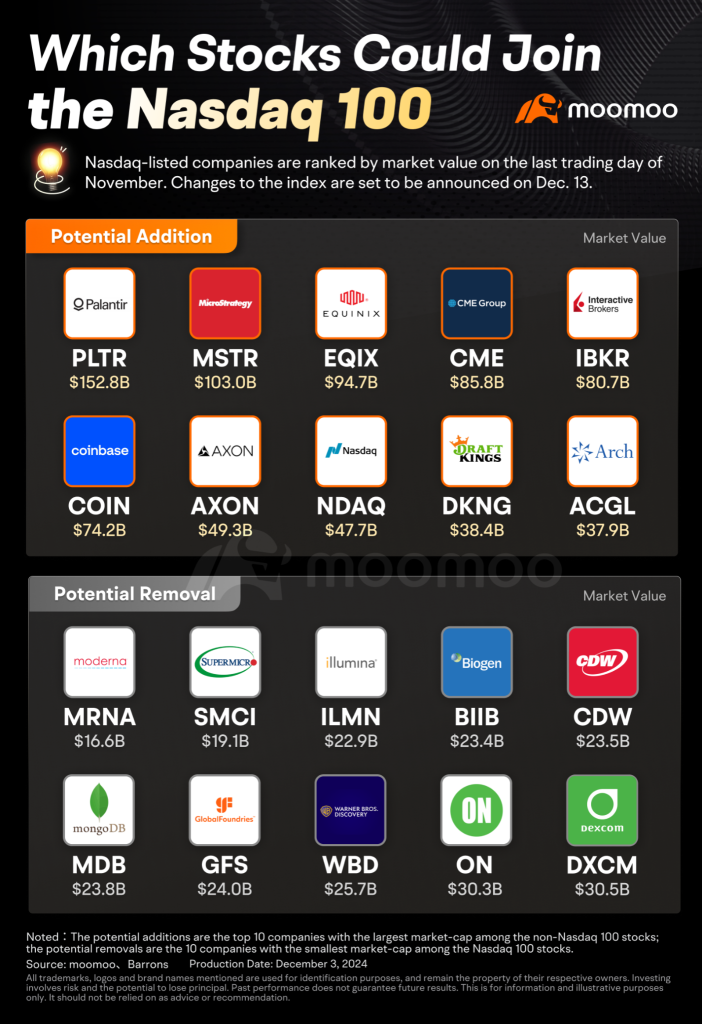

The Nasdaq 100 is up to its tricks again, transforming itself every December! 🎄 And guess what? Some major players might just join the $26 trillion club! 💰 $Palantir (PLTR.US)$ is leading the pack, with $MicroStrategy (MSTR.US)$ 💻, $Equinix Inc (EQIX.US)$ 🌐, $CME Group (CME.US)$ 📊, $Interactive Brokers (IBKR.US)$ 📈, and $Coinbase (COIN.US)$ hot on its trail. They're all in line to potentially become $NASDAQ 100 Index (.NDX.US)$ members d...

+3

5

2

1

永恆

voted

Woohoo $Tesla (TSLA.US)$ ![]() soars past 400 today.

soars past 400 today. ![]() $S&P 500 Index (.SPX.US)$ remains above 6080 looking choppy today.

$S&P 500 Index (.SPX.US)$ remains above 6080 looking choppy today.

$NVIDIA (NVDA.US)$fell with China anti competition charges. More of a political move or something underfoot?![]() China Market Regulator: Opens Investigation I - moomoo

China Market Regulator: Opens Investigation I - moomoo

$NVIDIA (NVDA.US)$fell with China anti competition charges. More of a political move or something underfoot?

2

1

1

永恆

voted

Happy weekend investors! Welcome back to Weekly Buzz where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

The market finished the week with a climb to fresh highs after unemployment data came in with an expected rise, leading to hopes that interest rates will come down again in December. It was the fourth day for records this week for th...

Make Your Choice

Weekly Buzz

The market finished the week with a climb to fresh highs after unemployment data came in with an expected rise, leading to hopes that interest rates will come down again in December. It was the fourth day for records this week for th...

+10

54

29

4

永恆

voted

Hi mooers! Hope you're doing well.![]()

We recently witnessed $Bitcoin (BTC.CC)$ surpass the 100K milestone on 12/04 at 21:33 ET.

*Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

Following the breakout, many mooers from various markets shared their impressive P/L (profit and loss) images within community. The surge in prices impacted several crypto-related stoc...

We recently witnessed $Bitcoin (BTC.CC)$ surpass the 100K milestone on 12/04 at 21:33 ET.

*Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

Following the breakout, many mooers from various markets shared their impressive P/L (profit and loss) images within community. The surge in prices impacted several crypto-related stoc...

+5

27

21

3

永恆

voted

$S&P 500 Index (.SPX.US)$at above 6060 showing good post election gains.

Another All time high $Amazon (AMZN.US)$ propeling stock price with Apple's shift to its Graviton and Inferentia2 chips has yielded efficiency gains of over 40% in some of its machine learning services. CNBC also cited Dupin as saying Apple is in "early stages" of evaluating AWS' Trainium2 chips.

$Microsoft (MSFT.US)$recovered some of its recent dips at 417. Hoping it will hold its gains with Christmas effect...

Another All time high $Amazon (AMZN.US)$ propeling stock price with Apple's shift to its Graviton and Inferentia2 chips has yielded efficiency gains of over 40% in some of its machine learning services. CNBC also cited Dupin as saying Apple is in "early stages" of evaluating AWS' Trainium2 chips.

$Microsoft (MSFT.US)$recovered some of its recent dips at 417. Hoping it will hold its gains with Christmas effect...

1

1

1

永恆

voted

Hey mooers! Max here, wrapping up our exciting journey through the world of stock selection. ![]()

Can you believe how far we've come? Let's take a quick trip down memory lane:

1. We started by peeking into the portfolios of big institutions with the Institutional Tracker.

2. Then we hunted for passive income with the High Dividend Yield screener.

3. We got a bird's-eye view of the market with the Heat Map.

4. We explored entire industri...

Can you believe how far we've come? Let's take a quick trip down memory lane:

1. We started by peeking into the portfolios of big institutions with the Institutional Tracker.

2. Then we hunted for passive income with the High Dividend Yield screener.

3. We got a bird's-eye view of the market with the Heat Map.

4. We explored entire industri...

112

38

23

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)