$OSE Nikkei 225 mini Futures(MAR5) (NK225Mmain.JP)$

Although general optimism prevails in the market, it strangely smells bad.

As it seems like a prelude to sharp movements in declines or surges, I plan to temporarily withdraw from the market until I grasp the initial wave, and try to buy Bull and Bear Commodities.

I wonder if the negative success experience left by Kanda will undermine the credibility of the Bank of Japan.

Although general optimism prevails in the market, it strangely smells bad.

As it seems like a prelude to sharp movements in declines or surges, I plan to temporarily withdraw from the market until I grasp the initial wave, and try to buy Bull and Bear Commodities.

I wonder if the negative success experience left by Kanda will undermine the credibility of the Bank of Japan.

Translated

$OSE Nikkei 225 mini Futures(MAR5) (NK225Mmain.JP)$

The price movements from the Ueda Shock until today are similar to the movements from October last year until today.

The price movements from the Ueda Shock until today are similar to the movements from October last year until today.

Translated

2

$OSE Nikkei 225 mini Futures(MAR5) (NK225Mmain.JP)$

It was expected to be a trend change around 20:00 today at 38,980.

It was expected to be a trend change around 20:00 today at 38,980.

Translated

2

$OSE Nikkei 225 mini Futures(MAR5) (NK225Mmain.JP)$

Yesterday broke out of the narrow range of the expected upper range, and since the close of yesterday, it has caused a collapse in prices. In other words, there are two possible scenarios to consider from here.

It is either a high-volatility range of 38,500-40,500 or a medium-term range of 39,500-40,500.

When dealing with the initial movement, it is best to be cautious as it is easy to get caught in the slot as a falling knife.

Yesterday broke out of the narrow range of the expected upper range, and since the close of yesterday, it has caused a collapse in prices. In other words, there are two possible scenarios to consider from here.

It is either a high-volatility range of 38,500-40,500 or a medium-term range of 39,500-40,500.

When dealing with the initial movement, it is best to be cautious as it is easy to get caught in the slot as a falling knife.

Translated

$OSE Nikkei 225 mini Futures(MAR5) (NK225Mmain.JP)$

This time, the SQ is expected to be a short-term small range (descending wedge) triangular consolidation pattern until the closing auction, so the trust will be temporarily sold today.

Furthermore, I want to conduct short-term analysis without risking money by identifying the volume distribution from the range of Pitchfan's value range where the consolidation can be extracted early, and breaking from the trades with high distribution to the opposite.

This time, the SQ is expected to be a short-term small range (descending wedge) triangular consolidation pattern until the closing auction, so the trust will be temporarily sold today.

Furthermore, I want to conduct short-term analysis without risking money by identifying the volume distribution from the range of Pitchfan's value range where the consolidation can be extracted early, and breaking from the trades with high distribution to the opposite.

Translated

$OSE Nikkei 225 mini Futures(MAR5) (NK225Mmain.JP)$

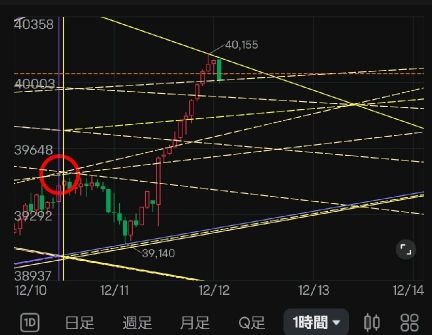

Selling pressure after the breakout on 12/10, followed by a triangular consolidation during the day on 12/11, leading to a sudden purchase (upward push) of the lagging part.

Therefore, considering 40,500 on 12/27 as the upper limit of this market, I believe there will be 1-2 range formations.

Selling pressure after the breakout on 12/10, followed by a triangular consolidation during the day on 12/11, leading to a sudden purchase (upward push) of the lagging part.

Therefore, considering 40,500 on 12/27 as the upper limit of this market, I believe there will be 1-2 range formations.

Translated

2

$OSE Nikkei 225 mini Futures(MAR5) (NK225Mmain.JP)$

Today was a market where Ad Test lost by a point, but when we look at the recovery of after-hours futures, it seems like Ad Test is also regaining ground.

Today was a market where Ad Test lost by a point, but when we look at the recovery of after-hours futures, it seems like Ad Test is also regaining ground.

Translated

2

$OSE Nikkei 225 mini Futures(MAR5) (NK225Mmain.JP)$

Negotiations leading up to SQ are continuing.

In this way, it seems that more stop-loss sell orders have been triggered than expected, leading to a situation where it is not possible to buy back, feeling the pressure to make profits after spending time, and as it drops a bit, it is pushed up further in pursuit of gains...

Rather, I think the hedge fund's expectation is to hit 38,500 traps to SQ.

Negotiations leading up to SQ are continuing.

In this way, it seems that more stop-loss sell orders have been triggered than expected, leading to a situation where it is not possible to buy back, feeling the pressure to make profits after spending time, and as it drops a bit, it is pushed up further in pursuit of gains...

Rather, I think the hedge fund's expectation is to hit 38,500 traps to SQ.

Translated

7

According to Reuters, it seems that TikTok has been used for illegal election activities by a pro-Russian Slavic far-right party in Romania, and a data retention order has been issued.

Countries such as Russia, Germany, Belgium, Spain, China, Japan, France, South Korea, and Romania are each initiating campaigns to support extremist candidates mainly targeting younger and older voters with relatively low accountability through social media. I was eager to buy the currency of the country if identified, but...

It's a strange story, but it seems that the instigators of the US-UK-Japan New Order (Pacific Order) and BRICS (Atlantic Order) both seem to originate from the United States.

Austria and the Netherlands have historically been countries that have made efforts to establish order, so I want to investigate why information is not coming out unnaturally this time.

Countries such as Russia, Germany, Belgium, Spain, China, Japan, France, South Korea, and Romania are each initiating campaigns to support extremist candidates mainly targeting younger and older voters with relatively low accountability through social media. I was eager to buy the currency of the country if identified, but...

It's a strange story, but it seems that the instigators of the US-UK-Japan New Order (Pacific Order) and BRICS (Atlantic Order) both seem to originate from the United States.

Austria and the Netherlands have historically been countries that have made efforts to establish order, so I want to investigate why information is not coming out unnaturally this time.

Translated

4

$OSE Nikkei 225 mini Futures(MAR5) (NK225Mmain.JP)$

Set the range to 39,800-39,250, determine that scalping centered on 39,500 is effective until the opening of SQ.

As a trust player, once the profit from the price difference with yesterday's closing price is secured, reduce the amount and repurchase.

If the pre-market closing price tomorrow falls below 39,500, the decision is to carry over until the beginning of the week.

Set the range to 39,800-39,250, determine that scalping centered on 39,500 is effective until the opening of SQ.

As a trust player, once the profit from the price difference with yesterday's closing price is secured, reduce the amount and repurchase.

If the pre-market closing price tomorrow falls below 39,500, the decision is to carry over until the beginning of the week.

Translated

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)